- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Canada Liquid Dietary Supplements Market Size Report, 2030GVR Report cover

![Canada Liquid Dietary Supplements Market Size, Share & Trends Report]()

Canada Liquid Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals, Proteins & Amino Acids), By Type, By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-660-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

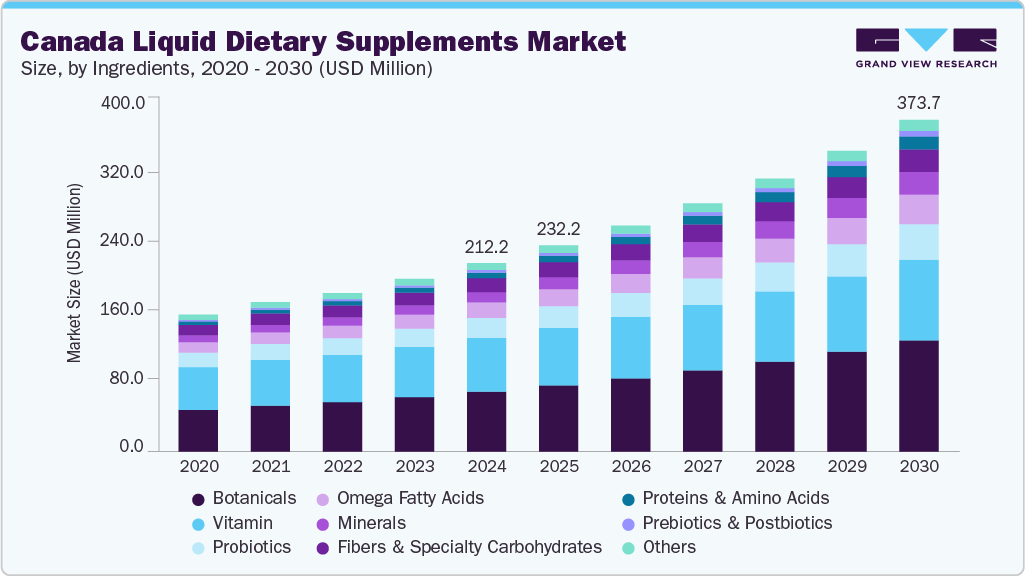

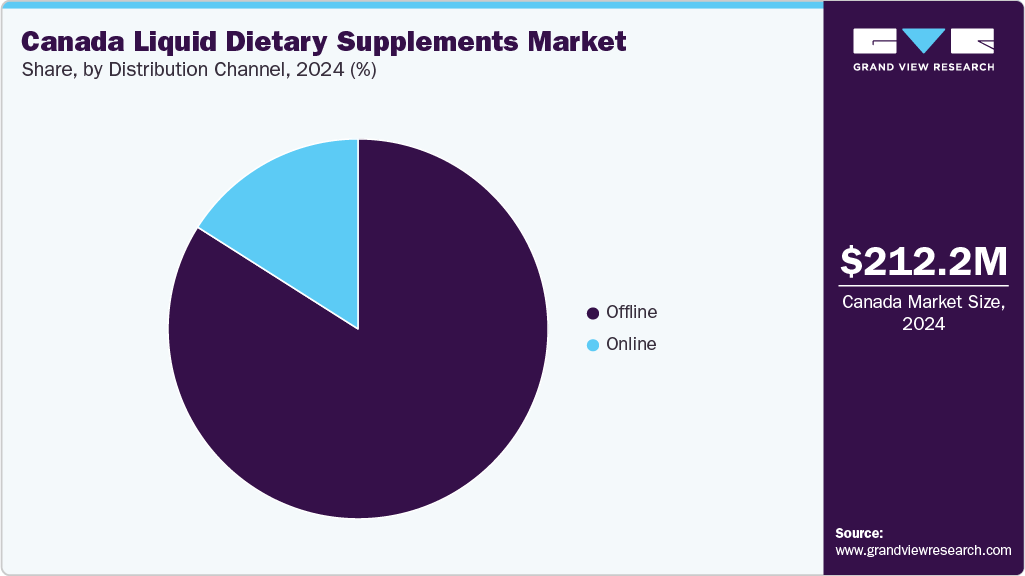

The Canada liquid dietary supplements market was estimated at USD 212.2 million in 2024 and is projected to grow at a CAGR of 10.0% from 2025 to 2030. The market's growth is driven by growing health consciousness among the population, many older adults seeking solutions for healthy aging and changing consumer preference toward convenient and easily digestible liquid formats of dietary supplements. In addition, the strong trend towards preventive healthcare and increased accessibility through various distribution channels, especially online platforms, drives the market’s continued expansion.

Canadian consumers are actively seeking proactive health management solutions, leading to a greater demand for dietary supplements that support overall well-being and preventive care. This raised awareness is evident in the growing consumers’ interest in products that can boost immunity, enhance energy levels, and address specific nutritional gaps. Furthermore, the increasing accessibility of these products through online retail and the rising demand for plant-based and clean-label alternatives are significantly contributing to the expansion of the Canada liquid dietary supplements industry.

Furthermore, the rising consumer preference for convenient and easily digestible liquid formats is a vital factor driving the market's growth. Liquid supplements offer various advantages, such as quicker absorption and ease of consumption, particularly appealing to a wider demographic, including those who face difficulties with pills or prefer ready-to-drink options. For instance, in February 2025, New Chapter vitamin and supplement company introduced its liquid-based multivitamin. This new product, "Liquid Multivitamin," contains 22 essential vitamins and minerals, providing comprehensive wellness support. Liquid Multivitamin is formulated to cater to the entire family, offering age-appropriate dosages for both adults and children aged two and above from a single bottle. The company’s products are available in Canada through various retailers and dealer partnerships.

Consumer Insights

Consumers are increasingly proactive in managing their health, driven by a heightened awareness of nutrition's role in overall well-being, particularly in the wake of global health events. This is reflected in a preference for products that offer targeted health benefits, such as immune support, digestive health, and cognitive function, alongside general nutritional supplementation. The ease of consumption, improved absorption, and variety of appealing flavors are significant drivers for adopting liquid formats, making them particularly attractive to demographics such as older adults and children who may face difficulties with traditional pill or powder forms.

Consumer Demographics

Furthermore, consumer insights reveal a growing preference for liquid supplements due to their inherent convenience, portability, and pleasant consumption experience. Busy lifestyles and the need for efficient, on-the-go nutritional solutions drive this shift away from traditional pills and powders.

In June 2025, BioSteel, a Canadian sports nutrition brand, launched its first Ready-to-Drink protein beverage, providing 30 grams of clean protein per 330 mL bottle, free from sugar, lactose, and preservatives. This launch is expected to enhance consumer demand for clean-label options in Canada liquid dietary supplements industry.

Ingredient Insights

The botanicals segment dominated the Canada liquid dietary supplements market and accounted for revenue share of 31.7% in 2024. This prominence is driven by increasing consumer preference for natural and plant-derived health solutions. Botanicals offer various perceived health benefits, from immune support and stress management to improved digestion and general wellness. In January 2024, dsm-firmenich collaborated with Italy-based Indena to launch science-backed botanical ingredient solutions addressing consumer demand for natural, effective health products. This strategic alliance combined expertise to deliver innovative formulations targeting immunity, brain health, and more, marking a new era in nutraceutical innovation. It enables dsm-firmenich to enhance liquid supplement offerings with high-potency, great-tasting botanical solutions tailored to modern consumer preferences. dsm-firmenich has a strong presence in Canada, offering a variety of its products in the country.

The proteins & amino acids segment is expected the fastest growth in Canada's liquid dietary supplements industry during the forecast period. This growth is fueled by increasing consumer interest in muscle health, active lifestyles, and healthy aging. The demand among fitness enthusiasts is rising for convenient, ready-to-drink products that provide high-quality protein sources and functional amino acids to support muscle recovery, endurance, and overall performance. In May 2024, Lactalis Canada launched Enjoy!, a high-protein plant-based beverage line. Featuring oat, almond, and hazelnut variants with 8g of pea protein per serving, the line addressed the rising demand for nutritious, unsweetened, dairy-free options with clean labels and sustainable packaging. Such launches are expected to strengthen the plant-based protein segment, offering consumers more functional beverage choices and driving innovation in Canada liquid dietary supplements industry.

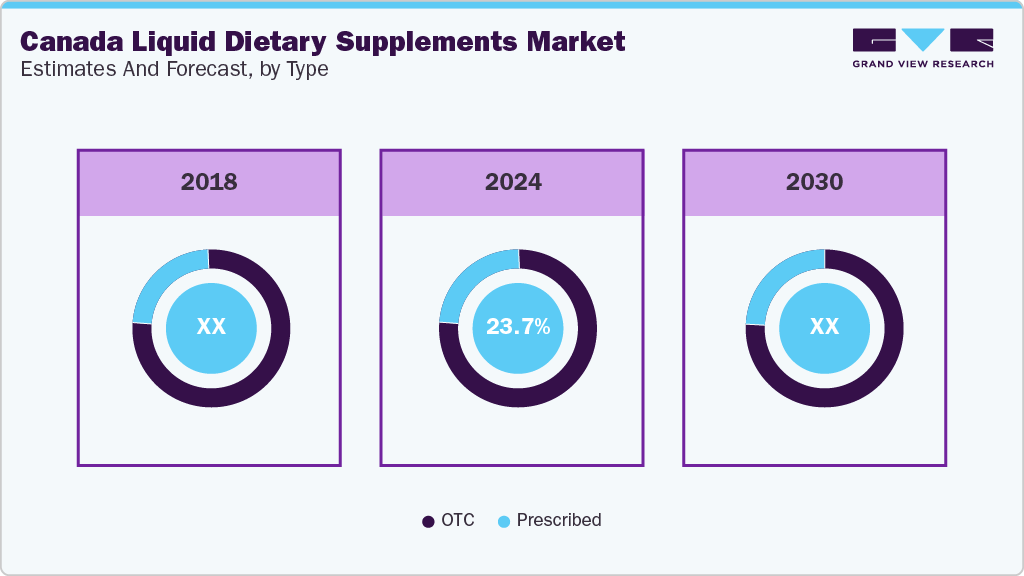

Type Insights

In 2024, the OTC segment accounted for the largest revenue share of the market. This segment's prevalence is attributed to the widespread consumer preference for easily accessible, non-prescription products that support general health and wellness. OTC liquid supplements, such as multivitamin blends, botanical extracts, and protein-based drinks, are commonly available in pharmacies, health food stores, and online platforms. These make them convenient for consumers seeking to address health concerns such as immunity, digestive health, and energy levels. In January 2024, Abbott launched its PROTALITY high-protein nutrition shake in North America, targeting adults pursuing weight loss and muscle preservation. This strategic introduction expands Abbott's presence in the over-the-counter liquid dietary supplement market, potentially impacting the competitive landscape in Canada through increased consumer awareness and demand for similar products in retail and online channels.

The prescribed liquid dietary supplements market is expected to grow at the fastest CAGR from 2025 to 2030. This growth is driven by an increasing recognition of the need for specialized nutritional support in managing chronic conditions and age-related health issues. Healthcare professionals typically recommend these supplements to address specific deficiencies or health concerns, offering higher concentrations of active ingredients tailored to individual needs.

Application Insights

The bone & joint health segment dominated the Canada liquid dietary supplements industry in 2024. This prominence is driven by an aging demographic and increasing consumer awareness regarding musculoskeletal well-being. The rising prevalence of osteoporosis, a condition characterized by weakened bones, also contributes to the demand for liquid calcium supplements. According to Osteoporosis Canada, during 2022-2023, 2.3 million Canadians were living with osteoporosis. The increasing incidence of bone-related disorders will continue driving the demand for liquid calcium supplements.

Based on application, the prenatal health segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by a high degree of awareness for maternal nutrition and the importance of supplementation during pregnancy. Products such as DHA and folic acid-enriched liquid supplements are gaining popularity among expectant mothers seeking convenient and effective ways to support fetal development and maternal health.

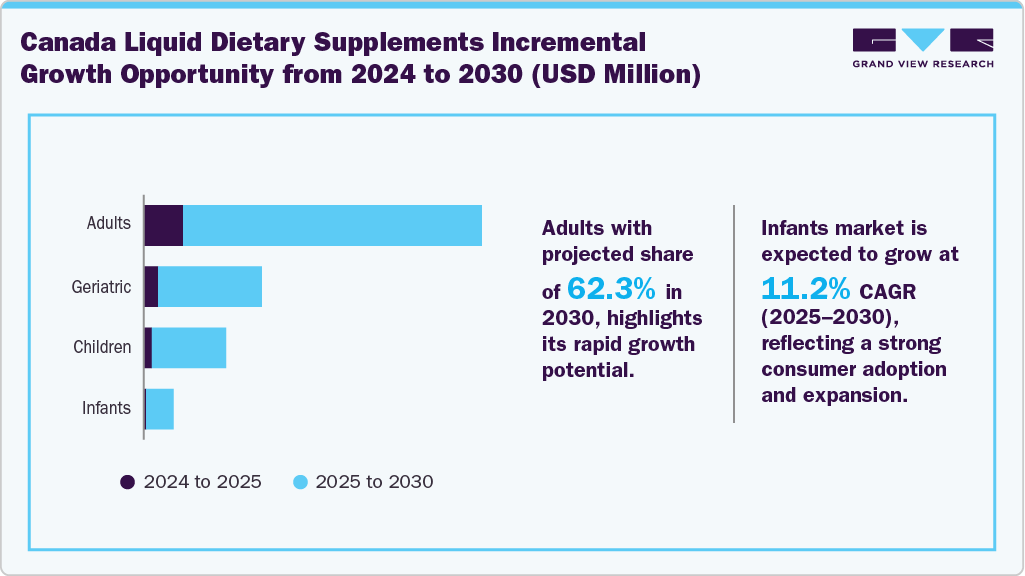

End Use Insights

The adult segment accounted for the largest market share in 2024. This demand reflects the widespread engagement of adult consumers in managing their general health, supporting active lifestyles, and addressing age-related nutritional needs. This segment benefits from various product offerings, including liquid multivitamins for comprehensive wellness, protein-based drinks for muscle support, and specialized formulations targeting cognitive function and immunity.

The infant segment is anticipated to grow at the fastest CAGR during the forecast period. According to Statistics Canada, approximately 3.5 lakh children are born every year in Canada. This consistent demographic inflow heightened parental awareness of crucial early-life nutrients, and strong healthcare recommendations for infant supplementation create sustained market demand. This convergence of factors underpins the segment's impressive expansion.

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the market in 2024. The offline distribution channel remains the dominant sub-segment due to the well-established presence of pharmacies, health stores, and supermarkets nationwide. Shoppers Drug Mart Inc. is one of the leading pharmacy retailers, with over 1300 stores in Canada and approximately 18 million registered customers across Canada. The extensive network and high foot traffic of such major retailers provide unparalleled convenience and immediate product availability, fostering a strong consumer preference for in-person purchases and contributing significantly to the continued strength of the offline segment.

The online distribution segment will experience the fastest CAGR from 2025 to 2030. The increasing consumer inclination towards e-commerce for convenience, wider product variety, and home delivery options has accelerated growth in this channel. New product developments and digital-first launches are increasingly targeted at online platforms to capture tech-savvy and health-conscious consumers. Additionally, digital marketing initiatives and subscription-based models are helping brands build strong consumer engagement and loyalty through online channels, driving significant growth in this segment.

Key Canada Liquid Dietary Supplements Company Insights

Some of the key companies operating in Canada liquid dietary supplements industry include Amway, Nestle, Herbalife Ltd. and others.

-

Nestle is a global food & beverage company offering extensive products and services to consumer markets. Nestle is known for its wide range of consumer goods, including coffee, confectionery, and pet foods. Its specialized division, Nestle Health Science, also includes health and wellness.

-

Herbalife Ltd. is a nutrition company that develops and sells science-backed products focused on weight management, targeted nutrition, energy, sports, fitness, and outer nutrition. They operate through a network of independent distributors and also have retail stores and online platforms.

Key Canada Liquid Dietary Supplements Companies:

- Amway

- Nestle

- Herbalife Ltd.

- Abbott

- DUOLIFE S.A.

- Pfizer Canada

- BASF

- Bayer AG

- Nutralab Canada Corp.

- Land Art

Recent Developments

-

In April 2023, Herbalife Ltd. launched 106 product SKUs across 95 global markets in quarter one. The company introduced a high-protein Iced Coffee in Caramel Macchiato flavor, containing 15g of protein, low fat, up to 2g of sugar, and no artificial colors. This launch may strengthen the liquid dietary supplement market by offering a healthier, protein-rich alternative to sugary coffee drinks.

-

In March 2023, Nestle introduced a new plant-based beverage combining oats and fava beans, offering 5g of complete protein per serving. Available in Original and Unsweetened under the Natural Bliss brand, it supports health-conscious consumers. This launch may influence Canada's liquid dietary supplement market by increasing demand for high-protein plant-based options.

-

In November 2022, Cymbiotika launched Creatine+, a ready-to-consume liquid supplement featuring Creabrev creatine and L-Glutamine for improved energy, strength, and recovery. The product uses liposomal technology for better absorption. This launch will boost innovation and consumer interest in Canada’s liquid dietary supplement market.

Canada Liquid Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 232.2 million

Revenue forecast in 2030

USD 373.7 million

Growth rate

CAGR of 10.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, type, application, end use, and distribution channel

Key companies profiled

Amway; Nestlé; Herbalife Ltd.; Abbott;DUOLIFE S.A.; Pfizer Canada; BASF; Bayer AG; Nutralab Canada Corp.; Land Art

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Liquid Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Canada liquid dietary supplements market report based on ingredients, type, application, end use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.