- Home

- »

- Clinical Diagnostics

- »

-

Canada Nuclear Medicine Market Size & Share Report, 2030GVR Report cover

![Canada Nuclear Medicine Market Size, Share & Trends Report]()

Canada Nuclear Medicine Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Diagnostic, Therapeutic), By Application (Oncology, Bone Metastasis, Neurology, Cardiology), By End-use (Hospitals & Clinics, Diagnostic Centers), By Province, And Segment Forecasts

- Report ID: GVR-4-68040-167-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

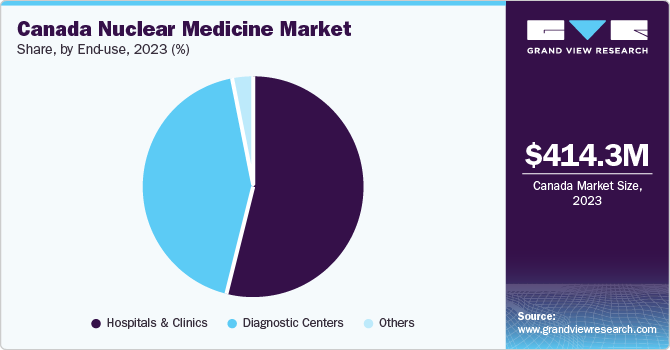

The Canada nuclear medicine market size was valued at USD 414.31 million in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 15.16% from 2024 to 2030. The growth of Canada’s nuclear medicine market is attributed to the increasing demand for early & accurate diagnosis of diseases and enhanced therapies. Furthermore, growing demand for radioisotopes in therapeutic & diagnostic applications in the healthcare industry has improved the entry of numerous players developing and producing such radioisotopes in the country.

Cancer and heart diseases are the most common causes of death in Canada. Heart diseases account for 18.5% of all annual deaths in the country. The increasing prevalence and mortality rates in terms of cancer and cardiovascular diseases contribute to radiopharmaceuticals market growth in Canada. According to data published by the Canadian Institute for Health Information (CIHI) in July 2022, about 2.4 million people have heart disease in the nation.

Moreover, the Canadian Institute for Health Information (CIHI) has collaborated with the Canadian Cardiovascular Society (CCS) to improve health service quality of cardiac care across the country. Supportive initiatives undertaken by government bodies and increasing incidence of targeted diseases, coupled with high mortality rates, are expected to increase the demand for novel & effective diagnostic and therapeutic products in the coming years.

Currently, radiopharmaceuticals are widely used in the fields of cardiology and oncology. Ongoing research & studies demonstrating positive results are expanding the application of radioisotopes in the diagnosis & treatment of cancer, thyroid-related diseases, respiratory diseases, bone diseases, and digestive tract conditions.

For instance, in May 2023, a research team led by UBC received USD 23 million in funding to develop precise radiopharmaceutical products to improve cancer treatment in Canada. Canadian researchers are committed to developing a new generation of radiation therapy solutions and aim to bring multiple drug candidates into future clinical trials in the coming years. Such initiatives are expected to increase the penetration of nuclear medicines and radiopharmaceuticals in different medical applications.

End-use Insights

Hospitals & clinics accounted for the largest revenue share in Canada’s nuclear medicine market in 2023. These facilities are increasingly leveraging nuclear medicine’s potential to diagnose and treat various medical conditions. Nuclear medicine plays a crucial role in providing valuable insights into the functioning of organs and tissues at a molecular level. Radiopharmaceuticals, such as Technetium-99m (Tc-99m) and Gallium-68 (Ga-68), are administered to patients to aid in imaging and targeted therapies.

Furthermore, these advanced techniques are employed in the early detection of diseases such as cancer, assessment of cardiac health, and the evaluation of bone & neurological disorders. With the growing demand for precision medicine, Canada’s healthcare sector is continually advancing its nuclear medicine capabilities. Moreover, health institutions across the country are collaborating with research organizations and industry leaders to expand access to state-of-the-art radiopharmaceuticals, thus improving patient care and outcomes.

Product Insights

The diagnostic products segment emerged dominant with a revenue share of 76.26% in Canada’s nuclear medicine market in 2023. This segment’s high share can be attributed to the strong demand for diagnostic products that utilize radioactive tracers, rising cases of cancer & cardiovascular diseases, and advancements in imaging technologies. Radiopharmaceuticals are crucial in non-invasive diagnosis, making them essential in modern healthcare systems.

The market is expected to witness further steady growth due to innovations in radiopharmaceuticals and diagnostic tools at the forefront of healthcare advancements.In February 2023, a groundbreaking achievement was experienced by BWXT Medical Ltd. and Laurentis Energy Partners, through successful installation and commissioning of an innovative isotope system at Ontario Power Generation’s (OPG) Darlington Nuclear Generating Station.

However, the therapeutics segment is expected to advance at a higher CAGR through 2030, as solutions such as alpha emitters, beta emitters, and brachytherapy are being widely employed in radiopharmaceutical therapeutic procedures. Ongoing studies to evaluate the efficacy & safety of RIT and subsequent approval of these agents are poised to drive market expansion. In February 2023, Canadian Nuclear Laboratories (CNL) and Jubilant Radiopharma announced a collaboration to develop novel alpha radiopharmaceuticals. This partnership is part of CNL’s Canadian Nuclear Research Initiative-Health (CNRI-H) program.

Application Insights

Oncology segment held a dominant revenue share in the Canada nuclear medicine market in 2023. Cancer is a leading global cause of death, and factors such as an unhealthy diet, smoking, and lack of exercise contribute to its rising prevalence. Moreover, rising investments in R&D of novel nuclear medicines for cancer treatment may contribute to segment growth.Traditional radiation therapies have been effective but limited in their application, often relying on external energy beams.

Meanwhile, the endocrine tumor segment is expected to witness fastest growth through 2030. A rapid emergence of specialized radiopharmaceutical therapies, including Lutathera, is helping address specific needs of patients afflicted with these tumors, driving market expansion. These innovative therapies offer precision in targeting and treating neuroendocrine tumors, making them a critical component of market growth, as they help enhance patient care and outcomes in Canada.

Province Insights

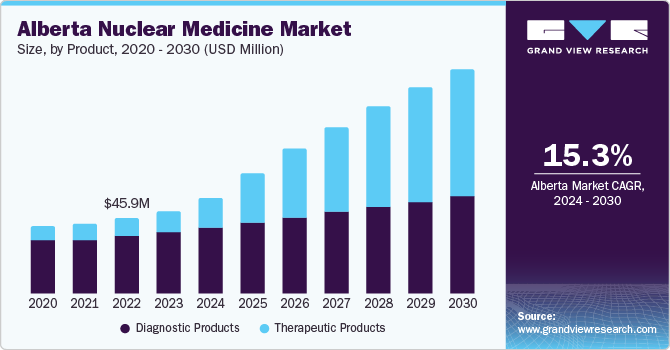

Alberta dominated the nuclear medicine market in Canada in 2023. The medical isotope production, imaging biomarkers, and radiotherapy program at the University of Alberta (UofA) and Cross Cancer Institute (CCI) has emerged as a leader in nuclear medicine research & patient care in the country since its inception. Notably, it has become a valuable research resource, offering support to patients with various diseases apart from cancer.Furthermore, the development of Calgary's first cyclotron and a new radiopharmaceutical facility is poised to enhance access to crucial diagnostic tests & treatment for various medical conditions, including cancer, cardiac disorders, and neurological ailments.

Manitoba is estimated to expand at a lucrative CAGR over the forecast period. The Department of Radiology at the University of Manitoba is the exclusive academic radiology department in Manitoba, encompassing diagnostic radiology, pediatric radiology, nuclear medicine, radiation oncology, and medical physics. This multidisciplinary department plays a crucial role within the province, particularly its Radiation Oncology faculty, which is seamlessly integrated into the clinical oncology program of CancerCare Manitoba.Faculty members provide clinical services not only to Winnipeg's two tertiary hospitals, Health Sciences Centre and St. Boniface Hospital, but also to Winnipeg community hospitals and the Pan Am Clinic.

Key Companies And Market Share Insights

Key companies operating in Canada’s nuclear medicine market are attempting to enhance their product portfolio by upgrading their products and exploring acquisitions and government authorizations to increase their client base and obtain a larger market share.

-

In September 2023, GE HealthCare entered into a strategic collaboration with Mayo Clinic to make advancements in innovation in areas including theranostics and medical imaging

-

In June 2023, GE HealthCare entered into a collaboration with several Canadian healthcare institutions, including Lawson Health Research Institute and St. Josephʼs Health Care London, for developing a Theranostics Center of Excellence

-

In March 2023, Isologic Innovative Radiopharmaceuticals introduced a prostate cancer imaging agent, Illuccix, in Canada for prostate cancer diagnosis

Key Canada Nuclear Medicine Companies:

- GE Healthcare

- Nordion (Canada), Inc.

- Lantheus Medical Imaging, Inc.

- Cardinal Health

- Jubilant Life Sciences Ltd.

- Isologic Innovative Radiopharmaceuticals

- Curium Pharma

- adMare BioInnovations

Canada Nuclear Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 480.50 million

Revenue forecast in 2030

USD 1.12 billion

Growth rate

CAGR of 15.16% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, province

Province scope

Alberta; Saskatchewan; Manitoba; Rest of Canada

Key companies profiled

GE Healthcare; Nordion (Canada), Inc.; Lantheus Medical Imaging, Inc.; Cardinal Health; Jubilant Life Sciences Ltd.; Isologic Innovative Radiopharmaceuticals; Curium Pharma; adMare BioInnovations

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Nuclear Medicine Market Report Segmentation

This report forecasts regional and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Canada nuclear medicine market report based on product, application, end-use, and province:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Products

-

SPECT

-

TC-99m

-

TL-201

-

GA-67

-

I-123

-

Other SPECT products

-

-

PET

-

F-18

-

SR-82/RB-82

-

Other PET products

-

-

-

Therapeutic Products

-

Alpha Emitters

-

RA-223

-

Others

-

-

Beta Emitters

-

I-131

-

Y-90

-

SM-153

-

Re-186

-

Lu-117

-

Other Beta Emitters

-

-

Brachytherapy

-

Cesium-131

-

Iodine-125

-

Palladium-103

-

Iridium-192

-

Other Brachytherapy Products

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Neurology

-

Oncology

-

Thyroid

-

Lymphoma

-

Bone Metastasis

-

Endocrine Tumor

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Centers

-

Others

-

-

Province Outlook (Revenue, USD Million, 2018 - 2030)

-

Alberta

-

Saskatchewan

-

Manitoba

-

Rest of Canada

-

Frequently Asked Questions About This Report

b. The Canada nuclear medicine market size was estimated at USD 414.31 million in 2023 and is expected to reach USD 480.50 million in 2024.

b. The Canada nuclear medicine market is expected to grow at a compound annual growth rate of 15.16% from 2024 to 2030 to reach USD 1.12 billion by 2030.

b. Oncology dominated the Canada nuclear medicine market with a share of 43.67% in 2023. This is attributable to the rising prevalence of cancer and growing investment in R&D of novel nuclear medicines for the treatment of cancer

b. Some key players operating in the Canada nuclear medicine market include GE Healthcare, Nordion (Canada), Inc., Lantheus Medical Imaging, Inc, Cardinal Health, Jubilant Life Sciences Ltd, Isologic Innovative Radiopharmaceuticals, CURIUM, adMare Bionnovations.

b. Key factors that are driving the market growth include increasing demand for early & accurate diagnosis of diseases and enhanced therapies and growing demand for radioisotopes in therapeutic & diagnostic applications in the healthcare industry

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.