- Home

- »

- Homecare & Decor

- »

-

Canada Serviced Apartment Market, Industry Report, 2033GVR Report cover

![Canada Serviced Apartment Market Size, Share & Trends Report]()

Canada Serviced Apartment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Long-term, Short-term), By End-use (Corporate/ Business Traveler, Leisure Travelers), By Booking Mode, And Segment Forecasts

- Report ID: GVR-4-68040-719-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada Serviced Apartment Market Trends

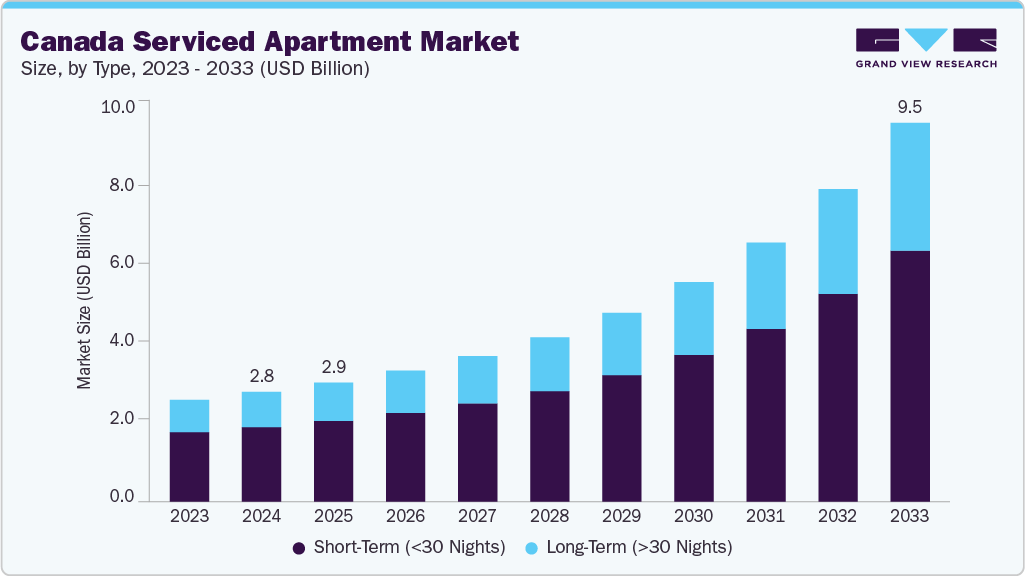

The Canada serviced apartment market size was estimated at USD 2.76 billion in 2024 and is projected to reach USD 9.52 billion by 2033, growing at a CAGR of 15.6% from 2025 to 2033. In Canada, demand for serviced apartments is fueled by the need for flexible long-stay options among business travelers, expatriates, and relocating families, alongside the rise of remote work and digital nomads seeking home-like spaces with productivity features. Rapid urbanization and housing shortages further reinforce this trend, making serviced apartments an attractive alternative to traditional rentals.

A growing trend in the Canada serviced apartment industry is the integration of hybrid workspaces, where properties either include dedicated co-working areas or collaborate with external workspace providers. This caters to remote workers, digital nomads, and business travelers who require professional environments within or near their accommodation, combining the comfort of extended stays with the functionality of modern offices.

Serviced apartment operators increasingly prioritize personalized guest experiences by offering tailored welcome packages, customized service plans, and loyalty programs. These efforts aim to build stronger connections with guests, enhance satisfaction, and encourage repeat stays by making each visit feel unique and thoughtfully designed around individual preferences.

Sustainability has become a key focus in the serviced apartment industry, with operators adopting eco-friendly practices such as using energy-efficient appliances, installing smart energy systems, and incorporating sustainable building materials. These initiatives reduce environmental impact and appeal to a growing segment of environmentally conscious travelers who prefer accommodations that align with their values, enhancing brand image and guest loyalty.

Consumer Insights

Canadian serviced apartment consumers value accommodations within the service industry that combine the home-like comfort of flats with the reliability and services of hotels, catering to professional and personal needs. Business travelers, expatriates, relocating families, and long-stay guests seek fully furnished units with amenities like kitchens, high-speed internet, and workspaces, often located near business districts or transport hubs. Cost-effectiveness compared to hotels, flexible booking and stay durations, personalized services, and safety features are key decision drivers. Increasingly, environmentally conscious travelers also prefer properties with sustainable practices.

Type Insights

Serviced apartments for short term stays accounted for a revenue share of 68.04% in 2024. Business travelers, tourists, and relocating professionals often need accommodations for a few days to a few weeks, and serviced apartments provide the convenience of hotel-like services (housekeeping, furnished units, flexible booking) combined with the comfort of home-style amenities such as kitchens and living spaces. Moreover, Canada’s strong inflow of short-term international visitors, corporate travel demand, and temporary relocations due to projects or training programs reinforce the preference for short-term serviced stays, making the short stays the most widely used and commercially viable.

Serviced apartments for long term stays is expected to grow at a CAGR of 16.2% from 2025 to 2033. Long-term stays cater to the needs of expatriates, relocating employees, students, and digital nomads who require accommodation for several months as they prefer more flexibility and comfort than traditional leases. Rising immigration, workforce mobility, and housing shortages in major Canadian cities make long-term serviced apartments attractive, offering fully furnished spaces, utilities, and services without the commitments of standard rental agreements.

Booking Mode Insights

Direct booking accounted for a revenue share of 47.49% in 2024. Direct booking offers operators and guests greater value and control than third-party platforms. For operators, direct booking reduces commission costs paid to online travel agencies (OTAs), allows stronger brand visibility, and enables guest data collection for loyalty programs and personalized services. For guests, booking directly offers better pricing, flexible cancellation policies, and customized service packages. Direct booking becomes the most preferred and trusted channel in a market where corporate clients, relocators, and long-stay travelers prioritize reliability and tailored experiences.

Bookings through corporate contractors is expected to grow at a CAGR of 16.4% from 2025 to 2033. Many companies prefer to manage accommodation for their employees on temporary assignments, training programs, or project-based relocations. Using corporate contracts ensures standardized quality, negotiated rates, and streamlined billing, reducing administrative effort for the company and the employee. With Canada’s growing business travel, multinational projects, and workforce mobility, serviced apartments booked via corporate contractors offer a reliable, cost-effective, and convenient solution.

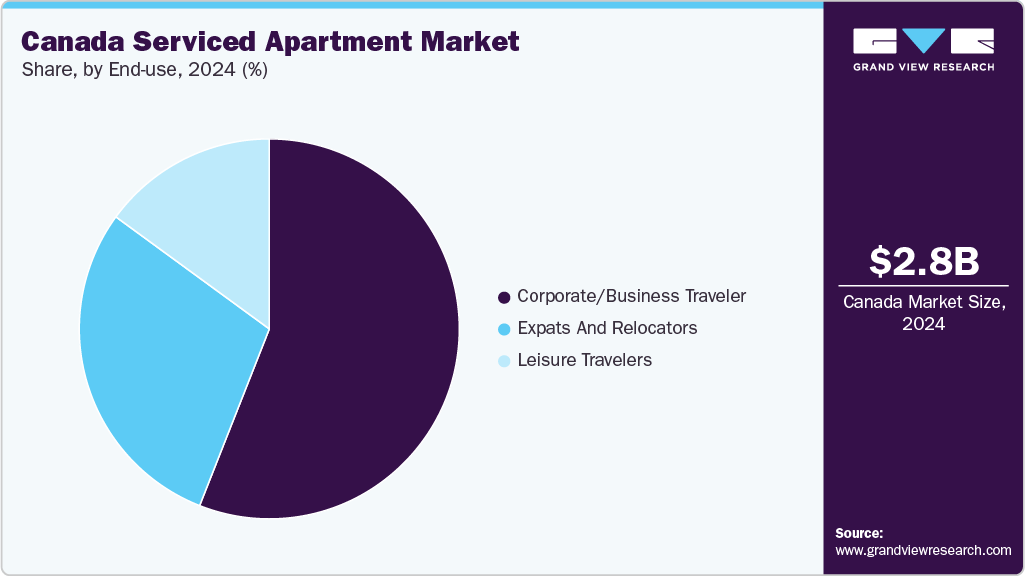

End-use Insights

Serviced apartments for corporate/business travelers accounted for a revenue share of 55.98% in 2024. They demand flexible, comfortable, and fully equipped accommodations for project assignments, training programs, client meetings, and temporary relocations. Unlike tourists, business travelers often stay for weeks or months, making serviced apartments more cost-effective and practical than hotels while providing services like housekeeping, Wi-Fi, and proximity to business districts. Canada’s strong presence of multinational companies, frequent corporate mobility, and expanding sectors such as technology, finance, and natural resources further fuel this demand.

Serviced apartments for expats and relocators is expected to grow at a CAGR of 16.7% from 2025 to 2033 due to the country’s strong immigration policies, global talent recruitment, and growing international employees assigned to Canadian offices. With Canada welcoming record levels of newcomers and skilled professionals, many individuals and families require temporary housing while they settle, search for permanent homes, or complete work assignments. Serviced apartments meet these needs by offering fully furnished, ready-to-move-in units with flexible lease terms, cost efficiency compared to hotels, and amenities that support a smooth transition.

Key Canada Serviced Apartment Company Insights

The market comprises well-established brands and emerging operators adapting to evolving hospitality trends. Providers are enhancing guest experiences by offering innovative comfort solutions, improving unit functionality and durability, and incorporating sustainable practices. By broadening their service offerings and responding to changing customer needs, these companies maintain a strong competitive edge and solidify their position in the service industry.

-

Sonder Holdings Inc. is a tech-enabled hospitality company that provides serviced apartments combining home comforts with hotel-like services. Founded in 2014 and headquartered in San Francisco, it operates in over 40 cities worldwide, offering keyless entry, digital concierge services, and personalized experiences.

-

Premiere Suites is Canada’s largest fully furnished temporary housing provider, offering over 1,300 serviced apartments, condos, and townhouses across 38 cities, including Toronto, Vancouver, Montreal, and Calgary. Catering mainly to business travelers, relocating families, and interim residents, each suite features fully equipped kitchens, spacious living areas, high-speed Wi-Fi, and bi-weekly housekeeping. The company also offers pet-friendly and accessible options and extends its reach through an Alliance Program covering over 10,000 furnished suites nationwide, earning recognition for quality and customer service.

Key Canada Serviced Apartment Companies:

- Premiere Suites

- Corporate Stays

- Sonder Holdings Inc

- DelSuites Inc.

- Today Living Group

- Situ accommodation

- National Corporate Housing

- Blueground

- The Apartment Network

- Toronto Boutique Apartments (TBA)

Recent Developments

-

In December 2023, Marriott International introduced Apartments by Marriott Bonvoy, a new soft-brand concept offering luxury apartment rentals in select U.S. and Canadian cities. The first property under this brand, Casa Costera in Isla Verde, Puerto Rico, opened in December 2023. It features 107 units with full kitchens and in-unit laundry. Designed for travelers seeking home-like amenities during extended stays, these apartments emphasize local design elements and offer limited hotel-like services.

-

In July 2023, Wyndham Hotels & Resorts expanded its ECHO Suites Extended Stay brand by signing 60 new properties across the U.S. and Canada, marking the brand's debut in Canada. This expansion includes a partnership with MasterBUILT Hotels, a Canadian developer experienced in constructing Microtel by Wyndham hotels. The ECHO Suites brand features a modular design with 124-room layouts, emphasizing efficiency and high return on investment.

Canada Serviced Apartment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.99 billion

Revenue forecast in 2033

USD 9.52 billion

Growth rate

CAGR of 15.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, booking mode

Country scope

Canada

Key companies profiled

Premiere Suites; Corporate Stays; Sonder Holdings Inc; DelSuites Inc.; Today Living Group; Situ accommodation; National Corporate Housing; Blueground; The Apartment Network; Toronto Boutique Apartments (TBA)

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Serviced Apartment Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Canada serviced apartment market report based on type, end-use, and booking mode:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Long Term (>30 Nights)

-

Short Term (<30 Nights)

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Corporate/ Business Traveler

-

Leisure Travelers

-

Expats and Relocators

-

-

Booking Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Direct Booking

-

Online Travel Agencies

-

Corporate Contracts

-

Frequently Asked Questions About This Report

b. The Canada serviced apartment market was estimated at USD 2.76 billion in 2024 and is expected to reach USD 2.99 billion in 2025.

b. The Canada serviced apartment market is expected to grow at a compound annual growth rate of 15.6% from 2025 to 2033 to reach USD 9.52 billion by 2033.

b. Serviced apartments for short term stays accounted for a revenue share of 68.04% of the Canada serviced apartment market in 2024. Business travelers, tourists, and relocating professionals often need accommodations for a few days to a few weeks, and serviced apartments provide the convenience of hotel-like services.

b. Some of the key players in the Canada serviced apartment market is Premiere Suites; Corporate Stays; Sonder Holdings Inc; DelSuites Inc.; Today Living Group; Situ accommodation; National Corporate Housing; Blueground; The Apartment Network; Toronto Boutique Apartments (TBA).

b. In Canada, demand for serviced apartments is fueled by the need for flexible long-stay options among business travelers, expatriates, and relocating families, alongside the rise of remote work and digital nomads seeking home-like spaces with productivity features.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.