- Home

- »

- Homecare & Decor

- »

-

Online Travel Agencies Market Size, Industry Report, 2030GVR Report cover

![Online Travel Agencies Market Size, Share & Trends Report]()

Online Travel Agencies Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Accommodation Booking, Transportation Booking, Tour & Excursions), By Booking Platform, By Age Group, By Traveler Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-582-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Travel Agencies Market Summary

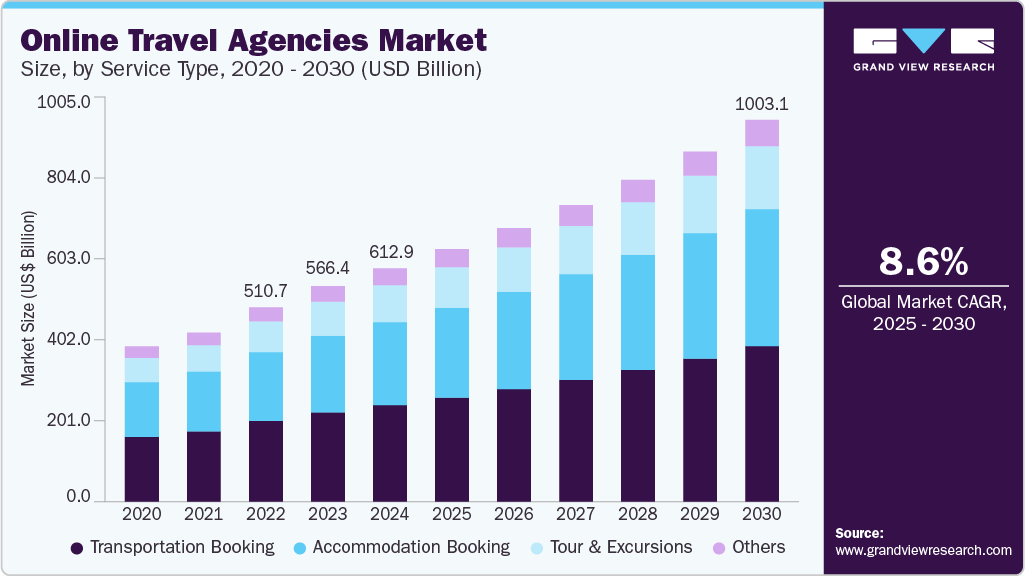

The global online travel agencies market size was estimated at USD 612.95 billion in 2024 and is projected to reach USD 1,003.13 billion by 2030, growing at a CAGR of 8.6% from 2025 to 2030. The industry has experienced substantial growth, driven by increasing internet penetration, smartphone usage, and consumer preference for convenient, self-service travel bookings.

Key Market Trends & Insights

- Europe dominated the global market in 2024 with a share of 31.87%.

- U.S. dominated the global market in 2024.

- By traveler type, OTAs for leisure travelers segment dominated the global market, capturing a share of 63.17% in 2024.

- By service type, transportation bookings segment dominated the global OTAs market, with a share of 41% in 2024.

- By booking platform, online travel booking through mobile devices (app-based) segment dominated the market with a share of 52.19% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 612.95 Billion

- 2030 Projected Market Size: USD 1,003.13 Billion

- CAGR (2025-2030): 8.6%

- North America: Largest market in 2024

Online travel agencies (OTAs) offer a wide range of services, including flights, accommodation, transportation, and tour packages, making them a one-stop solution for travelers. Key players continue to innovate through personalized offerings and user-friendly platforms. The industry was significantly disrupted by the COVID-19 pandemic, with a sharp revenue decline due to global travel restrictions. However, it has rebounded strongly, supported by the rise in domestic travel and digital transformation. The market is projected to grow steadily in the coming years.The OTA industry is witnessing robust growth, fueled by the post-pandemic recovery in the travel and tourism industry. According to UN Tourism, international tourism rebounded to 99% of pre-pandemic levels in 2024, recording 1.4 billion international tourists-a significant 11% increase from 2023. This resurgence is largely attributed to relaxed travel restrictions, pent-up travel demand, and improved traveler confidence. OTAs, which offer convenient digital platforms for booking flights, accommodations, and experiences, have played a crucial role in streamlining travel planning and meeting the evolving needs of tech-savvy consumers.

Another factor driving the OTA market is the surge in both international and domestic travel spending. The World Travel and Tourism Council reports that international visitor spending rose by 11.6% year-over-year, reaching US$ 1.9 trillion, while domestic tourism spending hit US$ 5.3 trillion, marking a 5.4% growth. This growth highlights a strong global appetite for travel, both within national borders and abroad.

OTAs benefit directly from this increase, as travelers increasingly turn to digital platforms to compare prices, access travel reviews, and secure last-minute deals. The convenience and personalization offered by OTAs have made them essential players in the post-pandemic travel ecosystem.

Emerging trends such as mobile-first booking, the integration of artificial intelligence for personalized recommendations, and the rise of sustainable travel choices are also transforming the OTA landscape. Consumers today demand seamless user experiences, real-time updates, and flexible cancellation policies-features that OTAs are continuously enhancing.

Moreover, partnerships between OTAs and local experience providers are enriching travel offerings, allowing users to explore more curated and authentic experiences. With global travel nearing full recovery and digital adoption at an all-time high, OTAs are well-positioned to lead the next phase of growth in the travel and tourism industry.

Consumer Insights

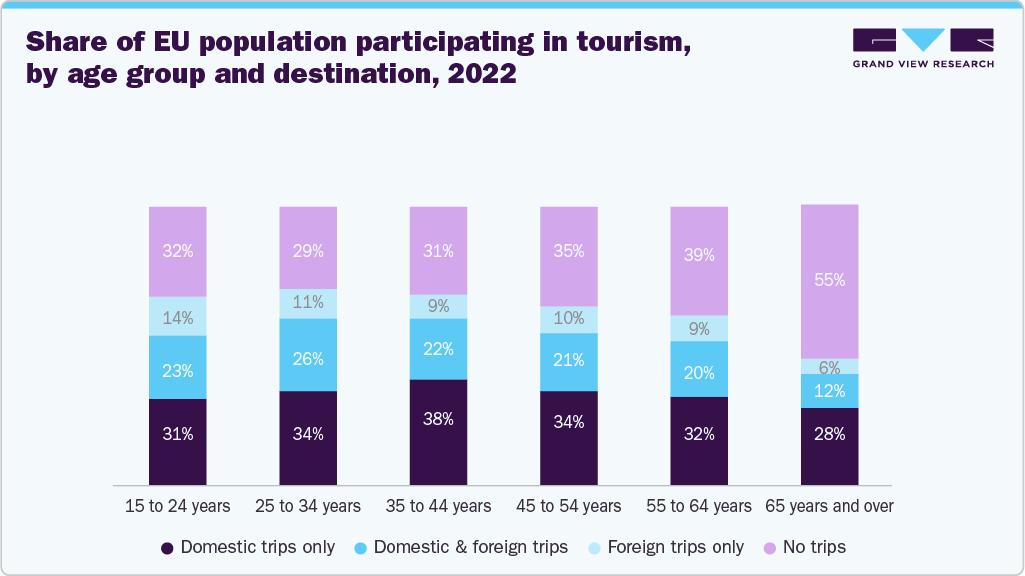

Consumer insights and preferences in the industry reveal evolving trends influenced by age, digital access, and travel behavior. While the OTA market is growing, disparities in travel participation remain, especially across age groups. According to Eurostat, in 2022, 38% of EU residents aged 15 and over did not travel for personal purposes, indicating a sizable portion of the population remains untapped by the travel and tourism industry. Notably, 55% of individuals aged 65 and older did not take any trips, significantly higher than the 33% of non-travelers among those aged 15-64. The figures below highlight a generational gap in travel engagement, which influences OTA marketing strategies, product offerings, and accessibility features.

Younger and middle-aged travelers, who are more digitally active, are driving OTA usage. Among people aged 15-64 who did travel, over half (51%) opted for domestic destinations, showing a preference for short-haul and more manageable trips. In contrast, 62% of traveling seniors also chose domestic travel, likely due to health concerns, ease of access, and comfort. These patterns suggest that while international tourism is recovering, a strong focus remains on domestic travel-an insight OTAs are leveraging by offering tailored local experiences, flexible booking options, and user-friendly mobile platforms.

Additionally, consumer preferences are shifting toward convenience, personalization, and value for money. OTAs are increasingly integrating AI-driven features to recommend customized itineraries and deals based on user behavior. Travelers are also showing a growing interest in sustainable travel, unique local experiences, and wellness-oriented getaways. For older demographics, accessibility, safety, and support services are key considerations, prompting OTAs to enhance inclusive travel options. Overall, understanding consumer behavior across different age segments helps OTAs refine their services, target campaigns more effectively, and tap into underrepresented markets like senior travelers and non-traveling populations.

Service Type Insights

Transportation bookings dominated the global OTAs market, with a share of 41% in 2024. Flights, trains, and car rentals are typically booked first, driving consistent user engagement on OTA platforms. Consumers rely on OTAs for real-time availability, competitive pricing, route options, and convenience. Additionally, the frequent need for transportation, both for business and leisure, ensures a steady demand.

Tours and excursion bookings are estimated to grow at a CAGR of about 9.3% from 2025 to 2030. Modern travelers increasingly seek authentic, local, and immersive experiences rather than just visiting destinations. To meet this trend, online travel agencies are expanding their offerings with curated activities, guided tours, and adventure packages. Technological advancements and easy online booking further boost accessibility, encouraging more travelers to include tours and excursions as essential parts of their journeys.

Booking Platform Insights

Online travel booking through mobile devices (app-based) dominated the market with a share of 52.19% in 2024 due to the widespread use of smartphones and the convenience of app-based platforms. Travelers prefer mobile apps for their ease of use, real-time updates, personalized offers, and on-the-go access. Enhanced user experience, secure payment options, and integration of loyalty programs further drive mobile bookings, making them the preferred choice for tech-savvy and frequent travelers.

Online travel booking through desktop/laptop (web-based) is anticipated to grow at a CAGR of about 8.9% from 2025 to 2030. While mobile dominates for convenience, many users still prefer desktops for complex travel planning, such as multi-city trips or group bookings, where a larger screen and detailed navigation are beneficial. Businesses and older demographics also favor desktops for security, accuracy, and ease of comparing multiple options before finalizing bookings.

Traveler Type Insights

OTAs for leisure travelers dominated the global market, capturing a share of 63.17% in 2024, primarily driven by rising demand for personalized, flexible, and experience-oriented travel solutions. Leisure travelers often plan vacations, weekend getaways, and family trips, relying heavily on OTAs for convenience, competitive pricing, and diverse options for flights, hotels, and activities. The growing popularity of solo travel, adventure tourism, and cultural exploration has further fueled OTA usage. Unlike business travelers, leisure travelers spend more time researching and customizing their trips, making OTAs their preferred platform for comprehensive trip planning and seamless booking experiences.

Online travel agencies catering to entertainment, sports, and event travelers are projected to expand at a CAGR of 9.7% between 2025 and 2030, supported by increasing consumer interest in event-based travel experiences. Travelers increasingly plan trips around specific events, creating demand for flexible and dynamic booking options. Online travel agencies cater to this niche by offering event-focused travel packages, last-minute deals, and localized experiences. The growing trend of combining leisure with entertainment-driven travel, especially among younger audiences, and the return of large-scale global events post-pandemic are major drivers of this segment’s rapid growth.

Age Group Insights

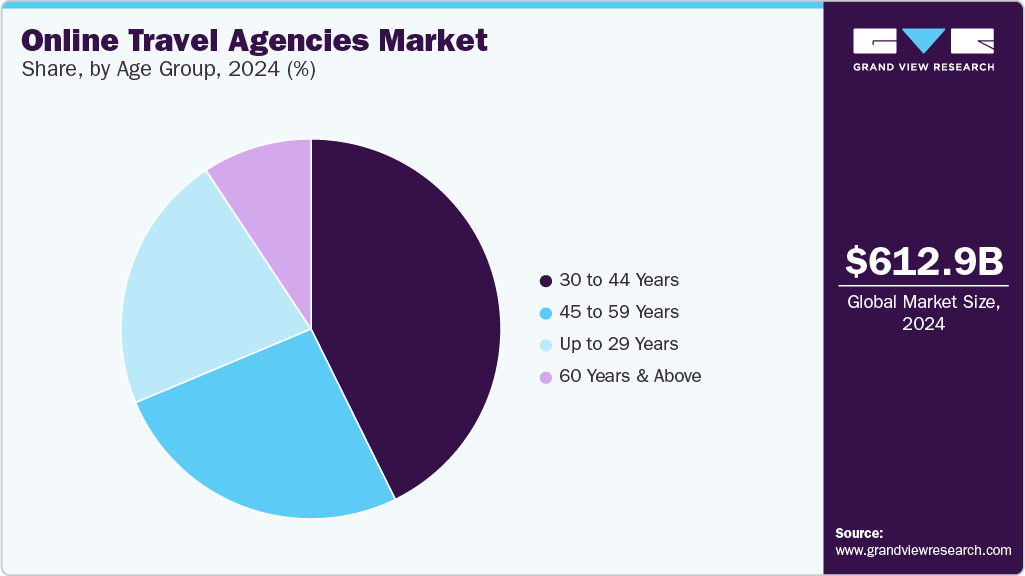

Travelers aged between 30 and 44 years held a majority global OTAs market share of about 42.68% in 2024. This age group often balances work and leisure travel, leading to higher demand for efficient, flexible booking solutions. They actively use mobile apps and online platforms for trip planning, favor convenience, and seek personalized travel experiences. Their lifestyle and income level make them key contributors to the growth of the online travel agencies industry. The preference for travel is high among this age group due to their high purchasing power, frequent travel habits, and strong digital literacy.

Bookings among travelers aged 29 and below are projected to grow at a CAGR of 9.6% from 2025 to 2030, driven by their high levels of digital engagement, a strong inclination toward mobile app-based reservations, and increasing demand for experiential and cost-effective travel options. This generation, including Gen Z and younger millennials, values convenience, real-time deals, and social media-driven travel inspiration. They are more likely to explore new destinations, take frequent short trips, and use OTAs to compare options and secure discounts. Their increasing financial independence and global mindset make them a rapidly expanding customer base for OTAs.

Regional Insights

North America online travel agencies (OTAs) industry captured 29.85% of the overall industry in 2024. North America’s highly competitive travel ecosystem, comprising airlines, hotels, short-term rentals, and experiential travel providers, has fueled OTA partnerships and aggregations, enhancing platform value. The surge in domestic travel, coupled with a steady revival in international outbound tourism, has intensified the need for centralized, user-friendly booking platforms. OTAs have capitalized on this shift by offering last-minute deals, bundling options, and robust customer service support, all of which appeal to a demographic increasingly comfortable with online transactions. Furthermore, the growing emphasis on sustainability and unique travel experiences has led OTAs to diversify their offerings-highlighting eco-friendly stays, niche travel products, and off-the-beaten-path destinations-thus expanding their relevance in the evolving North American travel landscape.

U.S. Online Travel Agencies (OTAs) Market Trends

The online travel agencies (OTAs) industry in the U.S. dominated the global market in 2024. The growth of OTA demand is underpinned by a mature e-commerce environment and changing consumer behavior favoring digital-first engagement across all stages of the travel lifecycle. U.S. travelers increasingly prioritize flexibility, real-time updates, and transparent pricing-all of which OTAs are well-positioned to deliver. The strong cultural shift toward DIY travel planning, bolstered by widespread mobile adoption and high internet connectivity, has led to greater reliance on OTA platforms for both domestic and international travel arrangements. In particular, the rise of short-haul getaways, solo travel, and multi-generational family vacations has created a market need for curated, responsive, and multi-category booking tools-needs effectively met by leading OTA platforms.

Europe Online Travel Agencies (OTAs) Market Trends

The online travel agencies (OTAs) industry in Europe dominated the global market in 2024 with a share of 31.87% due to its well-developed tourism infrastructure, high internet penetration, and strong demand for both domestic and international travel. The region’s diverse cultural heritage, numerous travel destinations, and efficient transportation networks attract millions of tourists annually. European travelers, especially in countries like Germany, the UK, and France, increasingly prefer digital platforms for booking flights, accommodations, and tours. Additionally, government support for tourism, widespread use of mobile devices, and a tech-savvy population contribute to OTA's growth.

Asia Pacific Online Travel Agencies (OTAs) Market Trends

The online travel agencies (OTAs) industry in Asia Pacific is expected to grow at a CAGR of 9.8% from 2025 to 2030. The region's growing internet and smartphone penetration is driving digital adoption, especially among younger, tech-savvy travelers. Expanding tourism infrastructure, low-cost airlines, and government initiatives to boost tourism further support growth. Countries like China, India, and Southeast Asian nations are witnessing a surge in both domestic and international travel, prompting greater reliance on OTAs for convenient, affordable, and personalized booking experiences.

Key Online Travel Agencies (OTAs) Companies Insights

Key players operating in the online travel agencies (OTAs) market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Online Travel Agencies Companies:

The following are the leading companies in the online travel agencies market. These companies collectively hold the largest market share and dictate industry trends.

- Expedia, Inc

- Booking Holdings Inc.

- MAKEMYTRIP PVT. LTD.

- Airbnb, Inc.

- Trip.com

- Tongcheng Travel

- Tripadvisor LLC

- Webjet

- eDreams ODIGEO

- Despegar

Recent Developments

-

In October 2024, Booking.com, a leading player in the global digital travel industry, is advancing its AI-driven capabilities to offer more personalized and efficient travel solutions. By incorporating tools like Smart Filter, Property Q&A, and Review Summaries, the platform is leveraging Generative AI (GenAI) to enhance essential phases of the trip planning journey. These innovations help users easily discover suitable lodging, assess customer feedback, and make bookings with greater confidence and speed.

-

In September 2024, Expedia Group expanded its Travel Shops platform by forming new partnerships with celebrities, brands, and media outlets. The company has launched more than 100 interactive storefronts, using collaborations with key influencers, established names, and media partners to broaden its visibility and boost customer engagement.

Online Travel Agencies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 663.70 billion

Revenue forecast in 2030

USD 1,003.13 billion

Growth rate

CAGR of 8.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, booking platform, age group, traveler type, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; and UAE

Key companies profiled

Expedia, Inc.; Booking Holdings Inc.; MAKEMYTRIP PVT. LTD.; Airbnb, Inc.; Trip.com; Tongcheng Travel; Tripadvisor LLC; Webjet; eDreams ODIGEO; Despegar

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Travel Agencies Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global online travel agencies market report by service type, booking platform, age group, traveler type, and region.

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Accommodation Booking

-

Transportation Booking

-

Tour & Excursions

-

Others

-

-

Booking Platform (Revenue, USD Billion, 2018 - 2030)

-

Mobile Devices (App-based)

-

Desktop/Laptop (Web-based)

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 29 Years

-

30 to 44 Years

-

45 to 59 Years

-

60 Years & Above

-

-

Traveler Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Leisure Travelers

-

Business Travelers

-

Entertainment, Sports, and Event Travelers

-

Educational Travelers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America (CSA)

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global online travel agencies market was estimated at USD 612.95 billion in 2024 and is expected to reach USD 663.70 billion in 2025.

b. The global online travel agencies market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 1,003.13 billion by 2030.

b. The Europe dominated the market with a share of around 31.87% in 2024. This can be attributed to high internet penetration, strong tourism infrastructure, widespread smartphone usage, and a well-established travel culture across major European countries.

b. Some of the key players operating in the online travel agencies market include Expedia, Inc.; Booking Holdings Inc.; MAKEMYTRIP PVT. LTD.; Airbnb, Inc.; Trip.com; Tongcheng Travel; Tripadvisor LLC; Webjet; eDreams ODIGEO; Despegar.

b. The global online travel agencies (OTA) market is propelled by factors such as widespread internet and smartphone adoption, advancements in AI and machine learning for personalized services, increased consumer demand for convenience and flexibility, and the growing trend of solo and experiential travel.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.