- Home

- »

- Automotive & Transportation

- »

-

Canada Transit Buses Market Size & Share Report, 2030GVR Report cover

![Canada Transit Buses Market Size, Share & Trends Report]()

Canada Transit Buses Market (2023 - 2030) Size, Share & Trends Analysis Report By Propulsion Type (Diesel, Electric, Hybrid, Others), And Segment Forecasts

- Report ID: GVR-4-68040-111-0

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

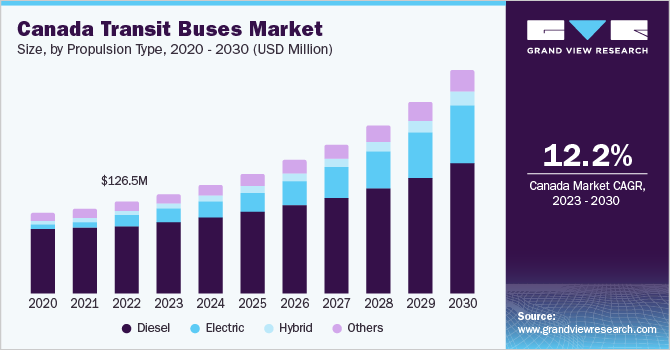

Canada transit buses market size was estimated at USD 126.5 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.2% from 2023 to 2030. Rising focus of bus operators and local government agencies in transitioning toward an electric fleet and growing need for governments to establish a strong transit system in rural areas of Canada are some of the key factors observed to be driving growth of the Canadian transit bus market. Moreover, growing awareness about eco-friendly batteries and aggressive investments in lithium-ion battery packs by OEMs and government agencies are factors expected to propel growth of the transit buses market in Canada.

With the rising investment in infrastructure expansion activities, the government of Canada is equally putting a strong emphasis on reducing levels of ozone-depleting substances and overall air pollution to fuel market growth. Growing opportunity for hydrogen fuel buses is further anticipated to impact growth of the Canadian transit buses market positively.

Furthermore, growing greenhouse gas emissions have prompted various initiatives to mitigate climate change, shifting policymakers' attention toward electric transit buses. As a result, Canadian government agencies are investing heavily in research & development of electrification of transit bus systems, thereby aligning with their vision of a sustainable transport system.

Apart from electric buses and charging infrastructure, transit bus operators need major turn-key solutions that cover every aspect, from installing various bus components to maintaining the vehicles. As a result, the Canadian Urban Transit Research & Innovation Consortium (CUTRIC) is playing a vital role in supporting Canadian agencies in their transition process. Consortium aims to support the commercialization of different technologies associated with an electrification of transit buses through development, demonstration, and industry-led collaborative methods that could innovate the zero-emission smart mobility system.

For instance, in May 2023, the Canadian government and City of Brampton joined forces to invest USD 807.3 million (CAD 1.1 million) in a comprehensive study on electrifying Brampton's transit system. This ambitious study will cover various crucial aspects, including assessing financial implications and potential savings, strategically allocating resources, conducting a thorough risk analysis, exploring energy-as-a-service options, determining necessary fleet and facility requirements, and utilizing advanced predictive modeling for optimal bus deployment. Additionally, this substantial investment aligns with Brampton's objective of achieving an impressive 80% reduction in greenhouse gas emissions by 2050, as outlined in Zero Emission Bus Implementation Strategy and Rollout Plan.

Increasing awareness regarding environment-friendly batteries and substantial investments in lithium-ion battery packs are anticipated to create promising opportunities for market growth in the foreseeable future. Rising focus on generating energy from renewable sources to promote energy conservation and combat climate change further augments the market’s expansion well.

For instance, in November 2022, the Canadian government invested USD 20.2 million (CAD 27 million) in E3 Lithium Ltd., a lithium resource and technology company, to enable the company to construct and demonstrate a lithium production plant in the country. The company can produce up to 20 kilotons of electric vehicle battery-grade lithium through this production facility. Thus, government support for the growth of electric vehicles in the country has been a key aspect contributing to the market growth.

Rising concerns regarding the continuous depletion of natural resources and detrimental impact of vehicular emissions on the environment are propelling the development of eco-friendly and sustainable transportation solutions. Fuel cell technology advancements are paving the way for another promising alternative to power buses, offering a potential solution to reduce environmental impact and promote greener mobility.

For instance, in January 2022, Hydrogen Fuel Cell Bus Council Inc. announced a formation of national alliance of public transit organizations, suppliers, and manufacturers, the first-of-its-kind, to advance hydrogen fuel cell technology and encourage its functions in public transportation. The ongoing initiatives and trials aimed at introducing innovative solutions using fuel cell technology are promising indicators for the growth of the Canadian transit bus market.

Market Dynamics

The Canada transit bus market has been evolving continuously in line with the advances in technology, and market incumbents have been trying aggressively to keep pace with the changing preferences of end users. The growing emphasis on safe and comfortable travel is primarily expected to drive further technological developments. Modern technologies, including IoT; and other evolving systems, such as real-time tracking and advanced braking, are expected to play a niche role in achieving de-carbonization targets. Market players, such as AB Volvo and Daimler AG, already have a linked ecosystem of applications, which helps in managing everyday operations and running buses smoothly using real-time data.

Modern buses are typically integrated with wireless sensors and standard radio technologies and are connected with ad hoc networks so that passengers can view the status of their buses in real time. Market players have also started offering Wi-Fi connectivity within their vehicles to improve the travel experience of passengers. IoT connectivity is also paving the way for a highly effective and convenient transportation system as the information gathered from commuters can help transportation authorities in offering improved services without compromising operational efficiency.

Automatic Vehicle Location and Control (AVLC) systems can particularly help in minimizing waiting times and in assisting passengers in reaching their destinations on time. AVLC systems track buses in transit using onboard diagnostics and satellite-based GPS data to estimate their arrival at each stop, thereby opening opportunities for operators to control their fleets dynamically in real time and enhance the quality of public transportation.

Propulsion Type Insights

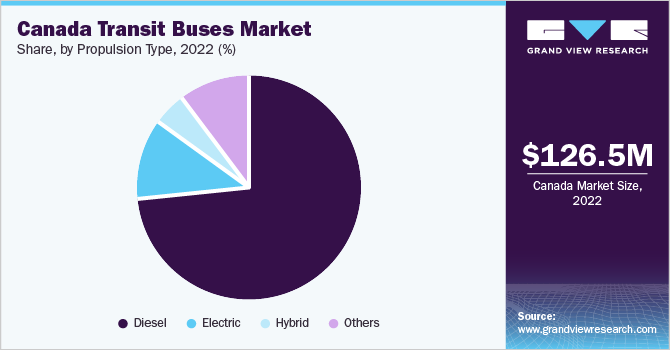

Based on propulsion type, diesel segment accounted for the largest share of over 73% in 2022. The segment’s growth can be attributed to the lower operating costs of diesel-powered buses. Also, several key players in Canada are investing aggressively in research and development to develop innovative, low-emission solutions that can potentially lower the volumes of nitrous oxide and particulate emissions from diesel engines. Moreover, transition to electric fleets still requires a robust electric ecosystem that covers all the aspects of the bus, from installation of components to maintenance and wear and tear of the vehicles.

The electric segment is expected to register the fastest growth rate over the forecast period. Continued electrification of public fleets and the aggressive adoption of electric transit buses by public fleet operators in Canada is projected to offer growth prospects for the Canadian transit bus market. Several companies have also emphasized investing in electric transit business, which is expected to further support growth of the electric segment and the overall transit bus space in Canada. For instance, in August 2022, Alexander Dennis Ltd., a subsidiary of NFI Group, announced the launch of new electric bus solutions entirely developed and integrated in-house with its expertise, expanding its portfolio of zero-emission buses.

Key Companies & Market Share Insights

Canadian market for transit buses is consolidated and characterized by the presence of large players. Key industry players such as AB Volvo, Daimler AG, Blue Bird Corporation, NFI Group, and Proterra Inc., among others, offer a wide range of electric mobility products for logistics & transportation, public transportation, micro-mobility, and shared mobility. These market players are also focused on manufacturing electric mobility products with a better range for the long haul. New product launches and upgradation of existing products have remained a key strategy of these players. For instance, in April 2023, Nova Bus, a subsidiary of AB Volvo, announced its partnership with Durham Region Transit (DRT), Ontario, to supply six units of the LFSe+ electric bus model. The contract is the first stage towards DRT’s EMission Zero program aimed at reducing greenhouse gas. Some of the prominent players in the Canada transit buses market include:

-

AB Volvo

-

Anhui Ankai Automobile Co., Ltd.

-

Blue Bird Corporation

-

Daimler AG (Mercedes-Benz Group AG)

-

Iveco S.p.A

-

Navistar, Inc. (Traton SE)

-

BYD Company Limited

-

Proterra Inc.

-

NFI Group

-

FirstGroup plc

-

Group Keolis SAS

-

Mobico Group

Canada Transit Buses Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 137.3 million

Revenue forecast in 2030

USD 307.2 million

Growth rate

CAGR of 12.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Propulsion type

Country scope

Canada

Key companies profiled

AB Volvo; Anhui Ankai Automobile Co., Ltd.; Blue Bird Corporation; Daimler AG (Mercedes-Benz Group AG); Iveco S.p.A; Navistar, Inc. (Traton SE); BYD Company Limited; Proterra Inc.; NFI Group; FirstGroup plc; Group Keolis SAS; Mobico Group

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Transit Buses Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Canada transit buses market report based on propulsion type:

-

Propulsion Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Electric

-

Hybrid

-

Others

-

Frequently Asked Questions About This Report

b. The Canada transit buses market size was estimated at 126.5 million in 2022 and is expected to reach 137.3 million in 2030.

b. The Canada transit buses market is expected to grow at an annual compound rate of 12.0% from 2023-2030 to reach 307.2 million by 2030.

b. The Diesel segment accounted for the largest share of 73.65 % in 2022. The segmental growth I ascribed to factors such as The segment growth can be attributed to their lower operating costs. Also, several key players in Canada are investing aggressively in research and development to develop innovative, low-emission solutions that can potentially lower the volumes of nitrous oxide and particulate emissions from diesel engines.

b. The key players that dominated the Canada transit buses market in 2022 include AB Volvo, Anhui Ankai Automobile Co., Ltd., Blue Bird Corporation, Daimler AG (Mercedes-Benz Group AG), Iveco S.p.A, Navistar, Inc. (Traton Group), BYD Company Limited., Proterra Inc., NFI Group, FirstGroup plc, Group Keolis SAS, Mobico Group, among others. These players offer a wide range of electric mobility products to logistics & transportation, public transportation, micro-mobility, and shared mobility.

b. The continuous electrification of public transit systems is expected to drive the growth of the Canada transit buses market. The growing awareness about eco-friendly batteries and the aggressive investments in lithium-ion battery packs is expected to propel the growth of the Canada transit buses market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.