- Home

- »

- Clinical Diagnostics

- »

-

Cancer Diagnostics Market Size And Share Report, 2030GVR Report cover

![Cancer Diagnostics Market Size, Share & Trends Report]()

Cancer Diagnostics Market Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Type (IVD, LDT), By Application (Breast Cancer, Lung Cancer), By End-use, By Test Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-213-6

- Number of Report Pages: 240

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cancer Diagnostics Market Size & Trends

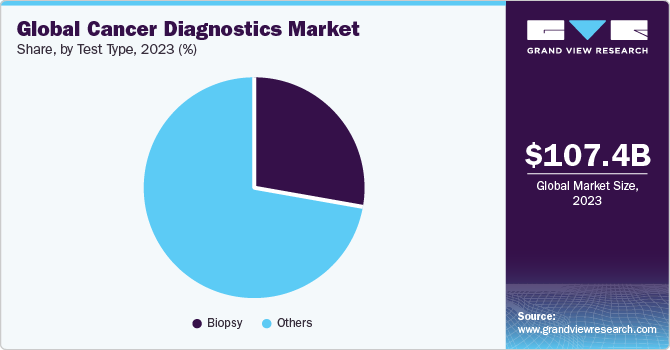

The global cancer diagnostics market size was estimated at USD 107.45 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.16% from 2024 to 2030. The growth of this industry is attributed to the growing prevalence of cancer, technological advancements in diagnostics procedures, and rising initiatives undertaken by private and public organizations. Moreover, increasing initiatives to develop novel imaging solutions for providing more accurate and precise diagnoses are anticipated to fuel market growth over the forecast period. For instance, in September 2022, Radiopharm Theranostics entered into collaboration with The University of Texas MD Anderson Cancer Center for the launch of Radiopharm Ventures, LLC involved in the development of novel radiopharmaceutical products.

Global rise in the prevalence of cancer is one of the major factors facilitating market growth. For instance, according to the Pan American Health Organization (PAHO), an estimated 20 million new cases and 10 million deaths are expected in 2023, and annual reported cases are expected to reach about 30 million by 2040. The need for development of diagnostics options that can detect the disease at an early stage, and help improve disease management and reduce mortality, is likely to propel market growth. It is also indicated that one in six women and one in five men are likely to develop cancer at some point in their lives.

In addition, the 5-year prevalence was around 50.5 million in 2020. Personalized medicine is expected to change the diagnosis and care delivery landscape as treatment planning is based on data obtained through a holistic approach.Major companies operating in the personalized medicine space are involved in several investment programs pertaining to precision medicine. Furthermore, companies providing molecular decision support systems are combining genomic data with clinical data to minimize gaps in precision medicine practice. However, cancer diagnostic tests are expensive, increasing the financial burden on families of patients.

The government insurance framework is not as well-defined in developing countries as it is in developed countries. Thus, the middle-class patient population who are not covered under any insurance (private or government) cannot afford these tests. Furthermore, many private insurance companies in developing countries do not cover the costs associated with diagnosis. As a result, the high cost of diagnosis is limiting the adoption of screening tools, especially in developing countries.

Market Dynamics

Technological advancement in the field of cancer diagnosis is another major factor driving the demand for diagnosis tools. FDA support for developing biomarkers & mass cytometry; launch of various flow cytometry reagents for diagnosis and drug discovery; technologically advanced miniaturized devices, facilitating portability and precision; developing cell and bead-based flow cytometry techniques are major factors boosting market growth. Similarly, the use of AI in diagnosis has gained significant traction. According to the NCI, researchers are experimenting with AI to diagnose prostate cancer. AI tools are used to detect suspicious areas visible during an MRI scan, which necessitate biopsies to confirm the presence of malignant cells.

Increasing demand for noninvasive and minimally invasive tests for cancer diagnosis at an early stage is encouraging market players to introduce novel testing products. For instance, demand for cfDNA tests, liquid biopsy, and LDTs is expected to experience significant growth in the coming years. Stringent regulatory frameworks across the globe pertaining to marketing approval of novel tests are expected to impede market growth to some extent. Companies are introducing LDTs for the early-stage diagnosis of different types of cancers. Factors, such as lack of awareness about novel testing products, high cost of medical imaging systems, and limited availability or absence of professionals, especially in developing and underdeveloped countries, may adversely impact market growth over the forecast period.

Product Insights

Consumables segment held the largest share of 59.98% in 2023 and is anticipated to grow at the fastest growth rate over the forecast period. Developing imaging diagnostic techniques or effective monoclonal antibody-based assays for detecting antigens and small chemicals generated by malignant cells would considerably improve diagnostic medicine. Although mAb technology is still in its early stages, new developments in recombinant antigen synthesis and antibody creation techniques have greatly expanded its potential in diagnosis.

Instruments segment is anticipated to grow at a significant growth rate over the forecast period. Analytical instruments are pieces of equipment and machines that aid in automating the diagnostic process and bringing samples and reagents together. Kits and robots are used in pathology laboratories to help quantify & detect infectious microorganisms, blood antigens, and viral load. Increasing technological advancements are expected to fuel growth over the forecast period. For instance, in March 2022, Illumina announced the launch of the TruSight Oncology Comprehensive test kit, an IVD test used for profiling various cancers, in Europe. Moreover, leading market participants are entering into partnerships to strengthen their product portfolios and offer precise diagnostic solutions.

Type Insights

In vitro diagnostics (IVD) segment dominated the in 2023 with a share of 52.75% due to the increasing adoption of IVD owing to the rise in testing amid COVID-19 pandemic. Development of automated IVD systems for hospitals and laboratories that offer accurate, efficient, and error-free diagnosis is expected to fuel market growth. For instance, in March 2019, BD announced receiving CE-IVD certification for the automated flow cytometry system, BD FACSDuet, which allows clinical laboratories to increase their efficacy and throughput over manual processes.Furthermore, the launch of innovative IVD products has increased due to several R&D initiatives and partnership programs undertaken by players.

LDTs (Laboratory Diagnostic Tests) were estimated to grow at the highest CAGR from 2024 to 2030. LDTs are important tools to rapidly incorporate new information and decide which drug to utilize for personalized therapy. They enable treatments to shift from a “one drug fits all” approach to a much more personalized approach based on the unique genetics of each person and their disease.Since they are generated and utilized in same facility, LDTs are launched into the market without independent regulatory assessment or FDA approval. For instance, in May 2022, Guardant Health launched Shield, a blood-based LDT, to detect early signs of colorectal cancer in adult patients aged above 45 years.

Application Insights

Breast cancer segment accounted for the largest revenue share of 16.09% in 2023. Increased R&D in advanced screening tools for breast cancer is anticipated to boost segment growth. A research study published in Scientific Reports, in September 2019, studied a novel screening test that combined the expression of MMP-1 or matrix metalloproteinase-1 and miR-21 expression in urinary exosomes, which can help detect 95% of breast cancers without the development of metastasis. The study concluded that both markers provide specificity and sensitivity, and therefore, can be used for the screening of breast cancer.

Lung cancer is expected to grow at the fastest CAGR of 7.68% from 2024 to 2030 owing to an increase in the availability of various technologically advanced products for cancer diagnostics. Oncocyte offers DetermaDx, a multigene assay that can help measure gene expression in circulating blood cells to identify lung nodules, avoiding invasive biopsy procedures.Growth in the number of R&D activities to develop novel diagnostic tests is expected to propel industry growwth. For instance, in July 2018, a research diagnostic study launched in Cancer Immunology, Immunotherapy, aimed at studying an innovative, novel, and noninvasive test for early detection of lung cancer using liquid immunobiopsy metabolic activity profiles.

End-use Insights

Laboratories segment dominated the market in 2023 with a share of 51.84%. Diagnostic laboratories are expected to show significant growth over the forecast period owing to increased testing and the availability of resources for performing tests. There has been an improved reliance of hospitals on diagnostic laboratories for testing & evaluation, which further leads to accelerated growth. Increased awareness about personalized medicine, technological advancements, and a rise in demand for affordable services are some of the key factors expected to drive the segment growth. Another major factor boosting segment growth is a rise in government initiatives to provide various facilities, such as compensation for diagnostic tests. Furthermore, regulatory authorities are undertaking initiatives to improve clinical laboratory diagnostic services and ease the process of diagnosis.

Others segment, which includes home-based tests, is anticipated to register the fastest CAGR of 7.16% from 2024 to 2030 due to increased adoption of home-based and technologically advanced treatments during the COVID-19 pandemic, as well as the acknowledged need for new models in the cancer community and among payers to reduce unscheduled hospitalizations & emergency department visits. Acute home-based treatment offers a promising alternative to conventional outpatient clinics, emergency rooms, and inpatient hospital-based oncology care models. Moreover, key players are focusing on developing home-based tests for easy accessibility, and enhanced acceptability further drives the segment demand.

Test Type Insights

Comparing panel-based tests to BRCA1/2 genetic testing can help determine the inherited risk of breast and ovarian cancers. The clinical value and yield of panel-based testing are higher for hereditary risk of other malignancies, such as pheochromocytoma-paraganglioma and colon cancer. Patients with genetic abnormalities linked to a hereditary cancer syndrome are more likely than the general population to experience the beginning of certain cancers earlier than is typical. Therefore, a need to provide early detection further propels the demand for panel tests. For instance, Laboratory Corporation of America Holdings offers VistaSeq, a hereditary cancer panel developed to detect genetic mutations associated with more than 50 hereditary cancer syndromes.

Biopsy is estimated to grow at the fastest CAGR from 2024 to 2030 due to various benefits associated with the test, including early detection of cancer. In addition, a biopsy helps determine the cancer’s aggressiveness and likelihood of spreading to other organs. A biopsy helps in the selection of a specific treatment plan, depending on the spread of cancer.Product launches are among the key factors responsible for the growth of this market. For instance, in January 2023, OverC received FDA approval and was granted a breakthrough device designation intended to be used in the detection of liver, esophageal, pancreatic, ovarian, and lung cancer.

Regional Insights

North America dominated the market with a revenue share of 40.37% in 2023. Growing cancer burden in the U.S. and Canada, as well as increasing focus of medical device companies on developing novel diagnostic devices that can detect cancer, are positively impacting market growth. Moreover, product launches are key factors influencing market growth. For instance, in July 2022, Nanostics Inc. announced the launch of a clinical investigation for bladder cancer, aimed at identifying the most effective indicators of the disease for early detection. The study aims to identify a minimally invasive liquid biopsy test to diagnose bladder cancer using the Nanostics ClarityDX diagnostic platform.

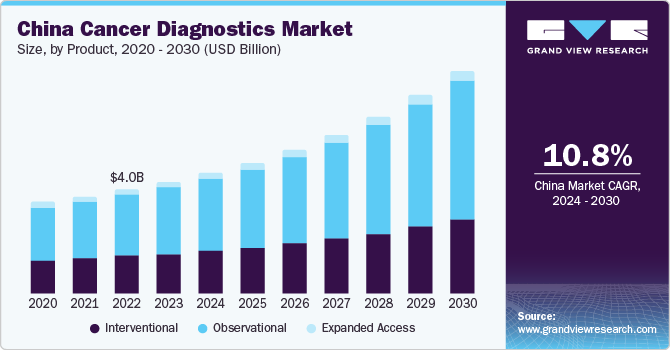

Asia Pacific market is expected to grow at the fastest CAGR from 2024 to 2030 owing to various factors, such as increasing healthcare reforms. Rising cancer prevalence is a major factor driving market growth. For instance, according to a report published by PubMed Central in March 2022, China has a high incidence. It was predicted that there would be approximately 4.8 million new cases in China by 2022, with lung cancer being the most common. As a result, the country's high cancer prevalence is expected to drive market growth. Key international players are expanding in the Asia Pacific regional market, which is expected to positively impact overall industry growth.Taiwan and Singapore governments offer favorable regulatory and funding support.

Key Companies & Market Share Insights

Some of the key players are adopting strategies, such as acquisitions and collaborations, to strengthen their presence in other regional markets. This can lead to improved product development, operational efficiencies, or expanded market reach. Companies are undertaking various strategies, such as M&As, collaborations, partnerships, etc., to gain higher market share. For instance:

-

In February 2023, F. Hoffmann-La Roche announced expanding its collaboration with Janssen to advance personalized healthcare by focusing on companion diagnostics

-

In April 2023, Quest Diagnostics acquired Haystack Oncology in an all-cash deal to expand MRD testing services, initially targeting colorectal, breast, and lung cancers, aiming to enhance patient outcomes through early MRD detection after treatment

-

In June 2023, Blue Earth Diagnostics received FDA approval for high-affinity radio hybrid (rh) Prostate-Specific Membrane Antigen (PSMA)-targeted PET imaging agent, POSLUMA, for prostate cancer detection and localization. It's based on innovative radio hybrid technology, providing accurate imaging and potential therapeutic applications

Key Cancer Diagnostics Companies:

- Abbott

- F. Hoffmann-La Roche Ltd.

- GE Healthcare

- QIAGEN

- BD

- Koninklijke Philips N.V. (Philips)

- Siemens Healthcare GmbH

- Hologic, Inc.

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 113.36 billion

Revenue forecast in 2030

USD 162.31 billion

Growth rate

CAGR of 6.16% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use, test type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Abbott; F. Hoffmann-La Roche Ltd.; QIAGEN; BD; Siemens Healthcare GmbH; Thermo Fisher Scientific, Inc.; Hologic, Inc.; Koninklijke Philips N.V. (Philips); Illumina, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cancer diagnostics market report based on product, type, application, end-use, test type, and regions:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instruments

-

Pathology-based Instruments

-

Slide Staining Systems

-

Tissue Processing Systems

-

Cell Processors

-

PCR Instruments

-

NGS Instruments

-

Microarrays

-

Other Pathology-based Instruments

-

-

Imaging Instruments

-

Others

-

-

Consumables

-

Antibodies

-

Kits & reagents

-

Probes

-

Others

-

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

IVD

-

By Type

-

Diagnosis

-

Early Detection

-

Therapy Selection

-

Monitoring

-

-

By Technology

-

Polymerase Chain Reaction (PCR)

-

In Situ Hybridization (ISH)

-

Immunohistochemistry (IHC)

-

Next-generation Sequencing (NGS)

-

Microarrays

-

Flow Cytometry

-

Immunoassays

-

Other IVD Testing Technologies

-

-

-

LDT

-

Imaging

-

Magnetic Resonance Imaging (MRI)

-

Computed Tomography (CT)

-

Positron Emission Tomography (PET)

-

Mammography

-

Ultrasound

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Lung Cancer

-

Prostate Cancer

-

Skin Cancer

-

Blood Cancer

-

Kidney Cancer

-

Liver Cancer

-

Pancreatic Cancer

-

Ovarian Cancer

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Others

-

-

Test Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biopsy

-

Fine-needle Aspiration

-

Core Biopsy

-

Surgical Biopsy

-

Skin Biopsy /Punch Biopsy

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cancer diagnostics market size was estimated at USD 107.45 billion in 2023 and is expected to reach USD 113.36 billion in 2024.

b. The global cancer diagnostics market is expected to grow at a compound annual growth rate of 6.16% from 2024 to 2030 to reach USD 162.31 billion by 2030.

b. The breast cancer segment held the largest share of 16.09% in the overall market in 2023. The growth of R&D in advanced screening tools for breast cancer is anticipated to boost the segment significantly.

b. Major players competing in the cancer diagnostics market include GE Healthcare; Abbott; F. Hoffmann-La Roche Ltd; Qiagen N.V.; Becton Dickinson & Company; and Siemens Healthcare GmbH.

b. The rising prevalence of cancer cases, constant technological advancements in diagnostics, and increasing demand for effective screening tests are some of the prime factors spurring demand for cancer screening tools and techniques across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."