- Home

- »

- Pharmaceuticals

- »

-

Cancer Vaccine Market Size, Share & Growth Report, 2030GVR Report cover

![Cancer Vaccine Market Size, Share & Trends Report]()

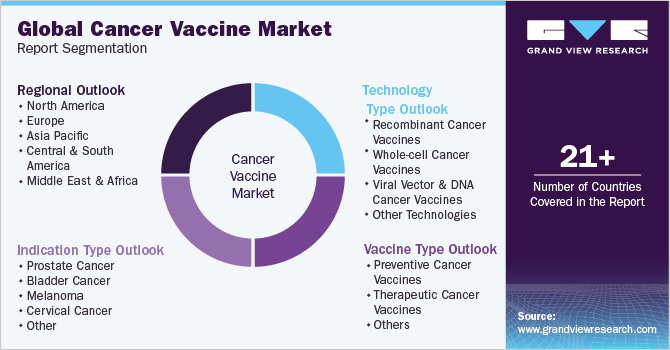

Cancer Vaccine Market Size, Share & Trends Analysis Report By Indication Type (Bladder, Cervical), By Vaccine Type (Preventive, Therapeutic), By Technology Type (Recombinant, Whole-cell), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-096-2

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

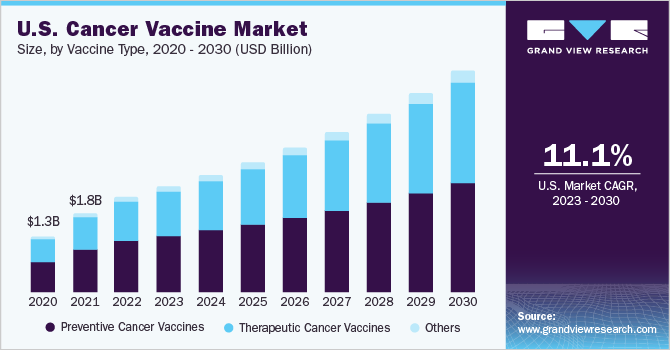

The global cancer vaccine market size was estimated at USD 7.31 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.04% from 2023 to 2030. The market is witnessing growth due to factors, such as the rising prevalence of cancer, increasing awareness about vaccination, and focus on personalized vaccines among key players in the market. Moreover, the rising investments and government funding in the development of vaccines are anticipated to propel market growth. For instance, in January 2023, the UK government announced an investment of USD 25.13 (£20) billion for increasing R&D vaccine development. Immunotherapy has emerged as a promising approach to treatment, and vaccines are an integral part of this field.

The discovery and development of immune checkpoint inhibitors, adoptive cell therapies, and other immunotherapeutic strategies have paved the way for innovative vaccines that harness the power of the immune system to target and eliminate oncolytic cells. Moreover, technological advancements have played a crucial role in the development of innovative vaccines. Techniques, such as next-generation sequencing, high-throughput screening, and bioinformatics, have enabled the identification and characterization of tumor-specific antigens and the design of more precise and effective vaccines. Advances in vaccine delivery systems, such as viral vectors and nanoparticles, have also enhanced the efficacy and safety of vaccines. Moreover, technological advancements in research have led to the introduction of more effective and targeted vaccines.

Improved formulations, adjuvants, and delivery systems enhance vaccine efficacy, immunogenicity, and safety, contributing to market growth. Furthermore, continued investment in R&D by manufacturers and pharmaceutical companies further fuels market growth. However, the development, testing, and approval processes are complex and time-consuming. Regulatory requirements and stringent safety standards are the major restraints for vaccine manufacturers, leading to delays in vaccine availability and market entry. Moreover, ensuring an adequate and consistent supply of vaccines and their equitable distribution can be a logistical challenge. Maintaining cold chain storage and transportation, especially in resource-limited settings, is expected to highly impact the availability and accessibility of vaccines.

Vaccine Type Insights

The preventive vaccine segment held the largest share of 53.90% of the overall revenue in 2022. Several malignancies are caused by viral infections, and preventative vaccinations play a significant role in lowering the risk. Preventive vaccines, such as those against the HPV and hepatitis B viruses, have aided in the reduction of virus-related malignancies , such as cervical and liver cancer. Researchers from the ACS reported in January that HPV vaccination was responsible for a 65% decrease in cervical cancer incidence among women aged 20 to 24 years between 2012 and 2019. The therapeutic vaccine segment is expected to have the fastest growth rate over the projected period.

Therapeutic vaccines offer the prospect of highly specific therapies that are relatively noninvasive and inexpensive and can be effective in combination with standard radiation or chemotherapies or with immunomodulatory drugs. However, the development of therapeutic vaccines against cancers that are nonviral has been fraught with setbacks.Only a handful of vaccinations have gotten FDA approval. In 2010, the FDA authorized sipuleucel-T (Provenge, Dendreon Pharmaceuticals), a prostate cancer vaccination based on dendritic cells. Five years later, the FDA approved talimogene laherparepvec an oncolytic viral therapy, or T-VEC (Imlygic, Amgen), for select patients with metastatic melanoma. Many additional vaccinations are still being tested in clinical studies.

Indication Type Insights

The cervical cancer segment held the largest share of 29.83% of the overall revenue in 2022 and is anticipated to grow at the fastest growth rate from 2023 to 2030. The segment growth is attributed to the rising prevalence of the condition. According to the WHO, it is the fourth most common cancer in women, which accounted for around 604,000 cases in 2020. Moreover, increasing awareness regarding the prevention and elimination of cervical cancer is anticipated to fuel market growth. For instance, in June 2023, the University of Alabama at Birmingham entered into a partnership with the ACS and the Alabama Department of Public Health announced the launch of a statewide action plan as an elimination plan as a result of public health problems in Alabama.

The bladder cancer segment is expected to show a significant growth rate over the forecast period.The segment growth is attributed to the rising initiatives in the research and development of vaccines for bladder cancer. In May 2022, ImmunityBio, Inc. announced that it has submitted Biologics License Application for a combination of IL-15 super agonist and BCG as new immunotherapy for bladder cancer. Moreover, personalized vaccines are constantly being studied to be used for the treatment of bladder cancer; in April 2021, research from Mount Sinai Health System showed promising results of personalized vaccines for multiple forms.

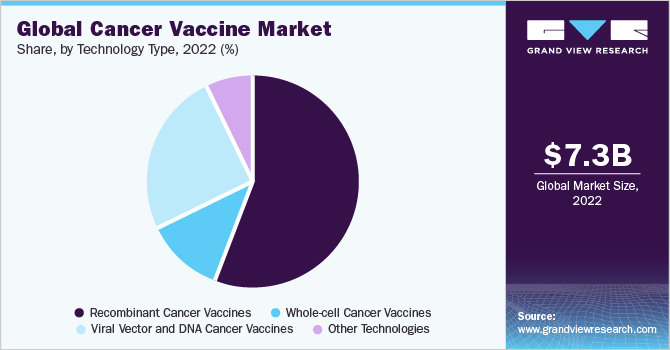

Technology Type Insights

The recombinant vaccine segment held the largest share of 56.50% of the overall revenue in 2022. These are the majorly available vaccines on the market. Key players operating in the market have vaccines developed through the use of recombinant technology. These vaccines include Gardasil/Gardasil-9 used for HPV cancers, BCG vaccine for early-stage bladder cancer developed by Merck & Co., Inc., HEPLISAV-B developed by Dynavax Technologies., ADSTILADRIN used for bladder cancer developed by Ferring B.V. Furthermore, the rising need for providing therapeutic vaccine for treatment of the condition is propelling the overall market growth.

The viral vector and DNA cancer vaccines segment is expected to register the fastest CAGR over the forecast period.The segment growth is attributed to the extensive adoption of viral vectors for vaccine development. The unique capability of many of these viral vectors to trigger the cellular arm of the immune response, specifically T-cells with cell-killing capability, has enhanced the use of viral vector technology in the development of therapeutic vaccines against chronic infectious illnesses and cancer. Moreover, the technology is constantly being researched for the development of personalized vaccines further helping in reducing the time of patients’ months to weeks or days.

Regional Insights

North America held the largest share of 35.35% of the overall revenue in 2022 and is expected to maintain this dominant position throughout the forecast period. The market in the region is growing due to the increasing burden of cancer, rising research & development, and a growing healthcare infrastructure in the region. According to the CDC, in 2020, 1,603,844 new cancer cases were reported in the U.S. leading to deaths of around 602, 347 due to the condition. The high prevalence rate of the conditions leads to an increasing demand for vaccines, which propels regional market growth.

For instance, in April 2023, according to studies carried out by American Association for Cancer Research, mRNA-4157/V940, when used in combination with pembrolizumab, enhanced the clinical benefit of patients with tumor mutational burden. Asia Pacific is estimated to register the fastest growth rate over the forecast period. This rapid growth is attributed to the rising geriatric population, increasing research for the introduction & development of cancer vaccines, and various initiatives to raise awareness about the rising prevalence of cancer cases. In June 2023, Crowell & Moring International joined forces with TogetHER for Health; Roche; and CAPED for raising awareness about the increasing cervical and breast cancer cases in the region with the launch of the Asia-Pacific Women's Cancer Coalition.

Key Companies & Market Share Insights

Key players operating in the field of vaccine development are continually concentrating on introducing and improving existing technologies that help improve patient outcomes and considerably increase healthcare effectiveness and efficiency. For instance, in December 2022, Moderna, Inc. in partnership with Merck & Co., Inc. announced positive Phase 2b KEYNOTE-942/mRNA-4157-P201 trial results for mRNA-4157/V940, a personalized mRNA vaccine. Some of the key players in the global cancer vaccine market include:

-

Merck & Co., Inc.

-

GSK plc

-

Dendreon Pharmaceuticals LLC.

-

Dynavax Technologies.

-

Ferring B.V.

-

Amgen, Inc.

-

Moderna, Inc.

-

Sanofi

-

AstraZeneca

-

Bristol-Myers Squibb Company

Cancer Vaccine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.09 billion

Revenue forecast in 2030

USD 16.84 billion

Growth rate

CAGR of 11.04% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vaccine type, indication type, technology type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck & Co., Inc.; GSK plc; Dendreon Pharmaceuticals LLC; Dynavax Technologies; Ferring B.V.; Amgen, Inc.; Moderna, Inc.; Sanofi; AstraZeneca; Bristol-Myers Squibb Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.Explore purchase options

Global Cancer Vaccine Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the cancer vaccine market report based on vaccine type, indication type, technology type, and region:

-

Vaccine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Preventive Cancer Vaccines

-

Therapeutic Cancer Vaccines

-

Others

-

-

Indication Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prostate Cancer

-

Bladder Cancer

-

Melanoma

-

Cervical Cancer

-

Other

-

-

Technology Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Recombinant Cancer Vaccines

-

Whole-cell Cancer Vaccines

-

Viral Vector and DNA Cancer Vaccines

-

Other Technologies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cancer vaccine market size was estimated at USD 7.31 billion in 2022 and is expected to reach USD 8.09 billion in 2023.

b. The global cancer vaccine market is expected to grow at a compound annual growth rate of 11.04% from 2023 to 2030 to reach USD 16.84 billion by 2030.

b. North America dominated the cancer vaccine market with a share of 35.35% in 2022. This is attributable to the increasing burden of cancer, growing research and development in field of vaccine development, and a growing healthcare infrastructure in the region.

b. Some key players operating in the cancer vaccine market include Merck & Co., Inc., GSK plc, Dendreon Pharmaceuticals LLC., Dynavax Technologies., Ferring B.V., Amgen, Inc., Moderna, Inc., Sanofi, AstraZeneca, and Bristol-Myers Squibb Company.

b. Key factors that are driving the cancer vaccine market growth include factors such as the rising prevalence of cancer, increasing awareness for vaccination, and growing focus on personalized vaccines among key players in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."