- Home

- »

- Animal Health

- »

-

Canine Atopic Dermatitis Market Size, Industry Report, 2020-2027GVR Report cover

![Canine Atopic Dermatitis Market Size, Share & Trends Report]()

Canine Atopic Dermatitis Market Size, Share & Trends Analysis Report By Product, By Mode Of Administration (Topical, Oral), By Distribution Channel (Retail, E-commerce), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-179-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

Report Overview

The global canine atopic dermatitis market size was estimated at USD 911.6 million in 2019 and is expected to witness a CAGR of 9.0% during the forecast period. Increasing incidences of atopic dermatitis in dogs fueled by air pollution and allergens is the key driver for this market. The most common symptoms associated with atopic dermatitis are scratching, itching, foul odor, loss of hair, scaly skin, etc. The breeds found to be most susceptible to this canine atopic dermatitis are Golden Retriever, German Shepherd, Labrador, andPug. Rapid industrialization in the developing and developed countries is anticipated to further propel the market growth.

According to the American College of Veterinary Dermatology (ACVD) report, around 10% to 15% of dogs suffered from this canine atopic dermatitis in 2017. The x of this disease is not completely understood yet, though genetic abnormalities are reported to be one of the major reasons behind it. According to a study by the American Journal Of Veterinary Research, the risk to develop canine atopic dermatitis in golden retrievers was around 50% in the U.K. due to geographic variation, which is expected to bolster the revenue in the coming years.

The increasing number of veterinary practitioners is one of the major factors driving the demand for this market. According to the American Veterinary Medical Association, a total of 113,394 veterinary practitioners were present in the U.S. in 2018 compared to 110,531 in 2017. Moreover, increasing number of veterinary hospitals and clinics is propelling the market growth.

Furthermore, increasing R&D investment by the key industry players, product launches, and strong drug pipeline are also expected to contribute significantly to the market growth. For instance, Kindred Biosciences, Inc. reportedly has 4 monoclonal antibodies in their pipeline for canine atopic dermatitis, which is expected to launch in the coming five years. In 2016, Zoetis launched Cytopoint, a monoclonal antibody which became a blockbuster drug in 2018.

The rising demand for pet insurance and increasing concern among pet owners are anticipated to exhibit a positive impact on the market in the coming years. Moreover, stringent regulations by the Food and Drug Administration (FDA) and other regulatory bodies in order to reduce the off label usage of human drugs in animals is boosting the market growth.

Product Insights

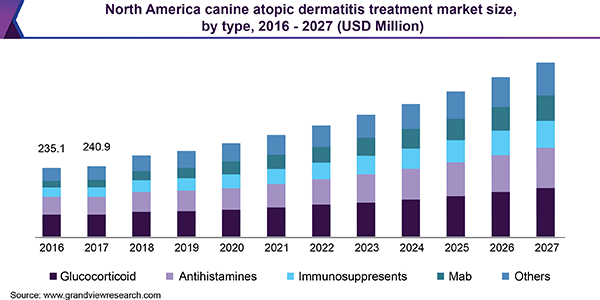

On the basis of product, the canine atopic dermatitis treatment market is segmented into glucocorticoids, antihistamines, immunosuppressants, MAbs, and others. Glucocorticoids dominated the market in terms of revenue in 2019, owing to its increased usage and cheaper cost. Topical and oral glucocorticoids were found to be the first line of treatment for the management of canine atopic dermatitis. Oral prednisone, prednisolone, and methylprednisolone are usually preferred for the treatment of acute flares. The side effects are also minimal as compared to other dosage forms.

The Monoclonal Antibodies (MAbs) segment is expected to show lucrative growth over the forecast period. This treatment therapy is comparatively new and found to be very effective. Zoetis launched its first MAb in 2016, which is administered to the patients every four to eight weeks and is claimed to reduce itching immediately. There are more MAbs currently under clinical trials and are expected to show positive results in the coming years.

Mode of Administration Insights

On the basis of mode of administration, the canine atopic dermatitis market is segmented into oral, topical, and injectable. The oral segment held the largest revenue share in 2019 owing to its lesser price. Moreover, it is more convenient as compared to injectable and topical modes. The dog owners can administer the drugs by themselves which is further fueling its demand.

The injectable segment is expected to show lucrative growth over the forecast period owing to its efficacy and potency. Rapid onset of action can be seen in the case of injectable, which is expected to propel the demand in the near future. Currently, veterinarians are prescribing a combination of oral and injectable therapy for better results. Growth of the injectable segment will be fueled by the presence of an extensive product pipeline.

Distribution Channel Insights

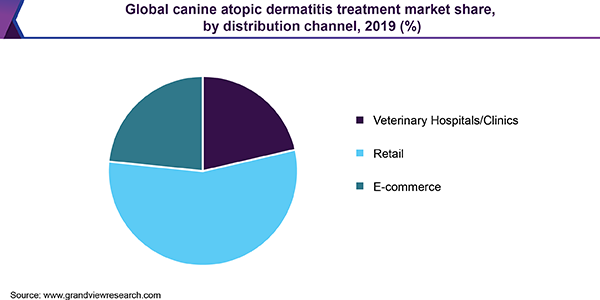

By the distribution channel, the canine atopic dermatitis treatment market is segmented into veterinary hospitals/clinics, retail, and e-commerce. The retail segment dominated the market in 2019 owing to increased product availability. The advent of retail pharmacy chains is a major contributor to the share of the distribution channel segment. Adoption of digitalized systems in retail pharmacies to reduce risk of errors in the prescriptions is anticipated to propel the revenue growth over the coming years. Moreover, veterinarians have begun to rely on general pharmacies to fill prescriptions for drugs, which are not available in vet pharmacies, which is further propelling the market growth.

Increasing popularity of e-commerce channels is a key factor contributing to the lucrativeness of the e-commerce segment over the forecast period. The convenience to choose from websites which offer a wide range of products with detailed product description is fueling the growth. Moreover, discounts on different sites and increasing consumer preference to buy product online is expected to propel the revenue growth of this segment.

Regional Insights

North America dominated the regional market in 2019 and is anticipated to witness the same trend over the forecast period. This growth can be attributed to the increasing incidence of canine atopic dermatitis in pet dogs, new product launches, and growing concern among pet owners. The rising pet ownership is further boosting the market growth. Furthermore, there is high investment in the development of new drugs by major players, which is expected to propel the growth over the forecast period.

Latin America held a substantial share owing to the presence of a large number of pet dogs in this region. Brazil and Argentina are among the top 10 countries having the highest number of pets in the world. Asia Pacific region is expected to show lucrative growth over the forecast period. The growing disposable income increases the probability of higher adoption of companion animals, which is further expanding the future growth prospects. Continual up-gradation of healthcare infrastructure is also presumed to present the market with high potential growth opportunities over the forecast period.

Canine Atopic Dermatitis Market Share Insights

The market is consolidated in nature. Zoetis held more than 50% of the revenue share as of 2018. The two main drugs of canine atopic dermatitis namely Apoquel and Cytopoint generated sizeable revenue in 2018. With around 20% growth in 2018, these drugs are poised to represent this market with significant growth opportunities in the next few years.

Other key players in the market include Elanco, Virbac, and Toray Industries. Extensive product pipeline by some new industry players such as Kindred Biosciences, AB Science is expected to bolster the market in the coming years. Strategies such as mergers, acquisitions, regional expansion, and launch of new products are being adopted by the players to maintain their share. For instance, in February 2019, Zoetis launched its blockbuster drug Apoquel in China to gain regional revenue share.

Report Scope

Attribute

Details

Base year for estimation

2019

Actual estimates/Historical data

2016 - 2018

Forecast period

2020 - 2027

Market representation

Revenue in USD Million & CAGR from 2016 to 2027

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Country Scope

U.S., Canada, Germany, U.K., France, Italy, Spain, Russia, Japan, China, India, Australia, Brazil, Mexico, Argentina, South Africa, Saudi Arabia

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global canine atopic dermatitis market report on the basis of product, mode of administration, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Glucocorticoids

-

Antihistamines

-

Immunosuppressants

-

MAbs

-

Others

-

-

Mode of Administration Outlook (Revenue, USD Million, 2016 - 2027)

-

Topical

-

Oral

-

Injectable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Veterinary Hospitals/Clinics

-

Retail

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."