- Home

- »

- Pharmaceuticals

- »

-

Cannabis Pharmaceuticals Market Size & Share Report 2030GVR Report cover

![Cannabis Pharmaceuticals Market Size, Share & Trends Report]()

Cannabis Pharmaceuticals Market (2024 - 2030) Size, Share & Trends Analysis Report By Brand Type (Sativex, Epidiolex, Other Brands), By Region (North America, Middle East And Africa, Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68038-473-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cannabis Pharmaceuticals Market Summary

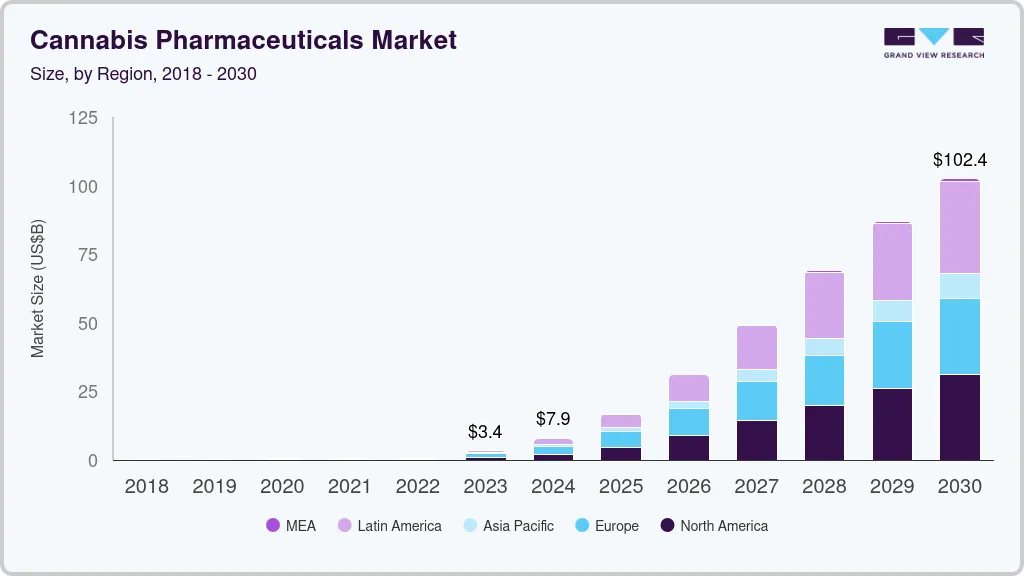

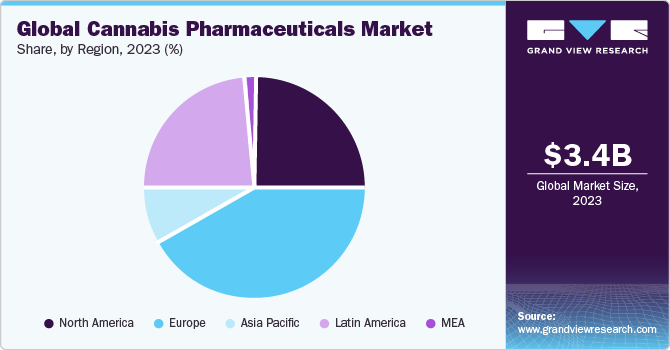

The global cannabis pharmaceuticals market size was estimated at USD 3.4 billion in 2023 and is projected to reach USD 102.4 billion by 2030, growing at a CAGR of 53.3% from 2024 to 2030. Increased awareness regarding medicinal drugs derived from cannabidiol (CBD) and a shift towards using cannabis for prescription medications are expected to fuel market expansion.

Key Market Trends & Insights

- The cannabis pharmaceutical market in Europe accounted for the largest revenue share of 41.9% globally.

- Based on brand type, the epidiolex segment led the market and accounted for 48.6% of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.4 Billion

- 2030 Projected Market USD 102.4 Billion

- CAGR (2024-2030): 53.3%

- Europe: Largest market in 2023

Moreover, the growing adoption of pharmaceutical products containing cannabis for addressing various medical disorders such as chronic pain, sleep disorders, anorexia, inflammation, schizophrenia, multiple sclerosis, and epilepsy, stands out as a key driver propelling market growth.

The rising number of clinical trials signifying the positive effects of utilizing cannabis pharmaceuticals for treating various medical conditions, such as multiple sclerosis, epilepsy, chronic pain, and cancer, is a major factor boosting market growth. According to the Royal Australian College of General Practitioners (RACGP) study published in October 2021, over 55,00,000 Australians suffering from chronic pain currently use cannabis as a medication. In addition, over 125,000 approvals were issued as of July 2021 under SAS-B, out of which over 60% were approved to treat chronic pain. Positive results provided by clinical trials help change the perspective of patients & healthcare professionals toward cannabis and pharmaceutical drugs developed using cannabis. For instance, as per the data provided by ClinicalTrials.gov, as of 2023, there are around 847 active studies for Sativex, either recruiting, not recruiting, or enrolling by invitation. In addition, around 401 clinical trials are active for Epidiolex under the same criteria.

Furthermore, the increasing number of clinical research and trials for numerous health conditions, owing to the therapeutic properties of cannabis, majorly cannabidiol, is further influencing market growth positively. In addition, several key players & emerging companies in the cannabis pharmaceuticals space are concentrating on the development of pharmaceutical formulations based on cannabis and its derivatives, such as THC & CBD. This is anticipated to drive the market growth in the coming years. For instance, in February 2023 Aurora Cannabis Inc. collaborated with MedReleaf Australia to introduce a medical cannabis brand called CraftPlant for patients in Australia. This brand encompasses three new products-Greendale, Navana, and HiVolt-which doctors can prescribe. All three products are derived from cultivars and have a high THC content along with significant levels of terpenes.

The legalization of medical cannabis is gaining momentum in various countries, including the U.S., Canada, UK, Croatia, Czech Republic, Cyprus, Colombia, Chile, Australia, Barbados, Denmark, Finland, Poland, and Portugal. The continuous political support for cannabis legalization is fueling market growth potential. For instance, in April 2023, the Governor of Delaware allowed companion bills to pass into law. In May 2023, the Governor of Minnesota approved a comprehensive cannabis legislation that legalized the recreational use of cannabis in the state. Moreover, Kentucky’s General Assembly passed a law legalizing medical cannabis for residents of Kentucky, effective from January 1, 2025, which made Kentucky’s the 40th state to enact such legislation.

Incorporating artificial intelligence and robotics into cannabis farming can significantly improve efficiency and standardize yields by offering advanced crop management and yield prediction capabilities. This technology reduces costs and the need for manual labor by leveraging data analysis from various indicators, such as environmental conditions and soil quality, to optimize growing practices, forecast potential problems, and manage resources effectively. AI also facilitates quality assurance through imaging technology and streamlines processes such as irrigation and harvesting through automation and remote monitoring, ultimately enhancing productivity, and fostering innovation within the cannabis industry.

Furthermore, various cannabis companies are investing in R&D to incorporate AI in their cannabis cultivation process. A new platform known as Weed-GPT will be launched in June 2023. This AI platform is specifically designed for the cannabis industry. Leveraging advanced natural language processing and machine learning algorithms, Weed-GPT provides tailored solutions to meet growers', distributors', and consumers' unique needs. From optimizing cultivation techniques and predicting market trends to enhancing customer engagement and product development, Weed-GPT offers a comprehensive suite of tools to drive innovation and efficiency in every aspect of the cannabis business ecosystem.

Furthermore, owing to the growing demand for the use of cannabis, mainly CBD, for medical purposes, key players are investing in the development of cannabis-based drugs. Favorable government initiatives supporting research further increase the R&D investments by companies. These factors have led to a shift from investments in traditional medications to cannabis-based pharmaceuticals. The growing product pipeline and increasing R&D activities of various market players signify the growing number of clinical trials and research funding, which is expected to support market growth in the coming years.

Clinical trials investigating the potential advantages of cannabinoids for treating psychiatric disorders, particularly anxiety and depression, have noticeably risen. In the past 13 years, the UK ranked second in clinical trials registered through clinicaltrials.gov, constituting 13% of all trials. This position followed the US, where the majority (54%) of trials were recorded.

The growing number of cannabis dispensaries prescribing cannabis products owing to increasing consumer acceptance is estimated to drive market potential. For instance, as per the Flow Hub 2024 study, approximately 75% of the American population resides in a state where cannabis is legal for either recreational or medical purposes and nearly 80% of the American population resides in a county where there is at least one cannabis dispensary available. California boasts a staggering over 3,655 dispensaries, which is more than double the number found in the state with the second-highest count.

Countries that have not legalized cannabis or cannabis-based products have allowed the import of these products and are making them available to patients through medical pharmacies, owing to the increasing demand for cannabis for medical purposes. Additionally, several nations, including Spain, France, and Germany, are initiating medical cannabis initiatives aimed at encouraging the use of cannabis and boosting its market demand while also ensuring that patients have access to a diverse range of medical cannabis products. For instance, as per the International Cannabis Business Conference conducted in February 2024, the Ministry of Health in Spain has initiated the process of creating a Royal Decree to regulate the medicinal use of cannabis around the country. The shift of cannabis from a recreational substance to a medically prescribed drug is propelling the growth of the market for pharmaceutical products derived from cannabis.

Market Concentration & Characteristics

The market is characterized by a moderate-to-high degree of growth owing to rising investment in R&D programs and increased demand for cannabis-containing vapes, pre-rolls, and gummies. For instance, the Philadelphia College of Osteopathic Medicine (PCOM) conducts medical marijuana research to assess the impact of medical cannabis on behavior, quality of life, chronic pain, and more.

The market is characterized by a high degree of innovation owing to ongoing clinical trials on the use of cannabis and its medicinal properties, increasing product demand due to its health benefits, and growing preference for cannabis extracts such as oils and tinctures. For instance , in November 2023, a Tasmanian medicinal cannabis farm tripled its production as demand for cannabis-based products increased . The growing company aims to take advantage of the thriving medicinal cannabis sector in Australia. The company is advocating for a slight relaxation of stringent advertising regulations to be able to inform its customers about the local origin of its product.

The market is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. Through M&A activity, these companies can expand their product portfolio, enter new territories, and strengthen their market position. For instance, in May 2022, Canopy Growth Corporation entered into agreements to acquire Lemurian, Inc., a producer of high-quality cannabis extracts, to broaden Canopy Growth’s portfolio of premium brands with significant opportunities to scale across North America.

The market is expected to witness significant growth owing to the increasing number of countries legalizing and providing a systematic regulatory framework for the cultivation and sale of cannabis. For instance, in February 2024, state regulators approved regulations allowing adults to grow limited amounts of cannabis for personal use at home in New York. Under the new regulations, adults are expected to be allowed to grow up to six cannabis plants on their private property and harvest up to five pounds of cannabis flower. Households with multiple adults may be permitted to grow up to six mature plants. Cultivators can grow from seeds or purchase immature plants from licensed providers.

Many companies are adopting various strategies, which include collaboration, product expansion, and partnerships, to strengthen their market position. For instance, in October 2023, Cantourage Group SE, a producer and distributor of medical cannabis, launched a range of high-THC medicinal cannabis flowers in Switzerland in collaboration with Astrasana.

The popularity of cannabis-containing foods and the legalization of cannabis is rapidly rising due to the various health benefits associated with cannabis. Due to legalization, many market players are expanding their market presence in such areas. For instance, in October 2022, Canopy Growth Corporation, a Canadian-based cannabis company, announced that it is ready to enter into the U.S. cannabis market with a new holding company, i.e., Canopy USA. This move allowed Canopy Growth Corporation to complete its acquisition of California extracts maker Jetty, Colorado-based edibles specialist Wana Brands, and New York-based Acreage Holdings.

Brand Type Insights

Based on brand type, the Epidiolex segment led the market and accounted for 48.6% of the global revenue in 2023. Epidiolex is a prescription-based medicine that is utilized for the treatment of seizures associated with Dravet syndrome and Lennox-Gastaut syndrome detected in patients aged 1 year & above. In the European Union, it is approved in 27 countries, along with Liechtenstein, Iceland, and Norway. Growing awareness, clinical trials, and research claiming positive applications of the drug on certain medical conditions are expected to increase the adoption of Epidiolex over the forecast period.

Moreover, initiatives taken by European Union Commission to clear Transnational Medical Marijuana and Research is further propelling the demand for Cannabis pharmaceutical in the region. In February 2024, EU officials approved activists to commence a campaign for a multinational initiative aimed at enhancing access to medical marijuana and advancing research on the therapeutic properties of cannabis. The aim is to promote access to medical cannabis and facilitate the transportation of cannabis and its derivatives prescribed for therapeutic purposes to ensure individuals can fully exercise their right to health.

Sativex is expected to grow at a lucrative rate over the forecast period. The increasing number of approvals for this medication for the treatment of symptoms such as spasticity caused due to multiple sclerosis in different countries is expected to boost the growth of this brand over the forecast period. In addition, as of 2023, Sativex had been approved in around 29 countries for the treatment of muscle spasticity associated with multiple sclerosis. Moreover, an increase in the number of clinical trials of the drug for other medical conditions such as spinal cord injury, posttraumatic stress disorder, neurological conditions, chronic pain, and cancer is further expected to drive the market over the forecast period.

Regional Insights

North America is the second largest cannabis pharmaceuticals market worldwide, owing to the rising awareness regarding the medical benefits of cannabis-based products, the easy availability of cannabis-based medicines, and the large distribution network of Sativex in the Canadian markets. Furthermore, the region has a large number of patients suffering from mental disorders, chronic pain, and cancer. These individuals depend more on cannabis-based products as compared to traditionally available pharmaceutical products owing to its high efficiency. This is further anticipated to drive the market in the region over the forecast period.

U.S. Cannabis Pharmaceuticals Market Trends

The cannabis pharmaceuticals market in the U.S. accounted for the largest share in North America in 2023. This can be attributed to the utilization of medical cannabis owing to government approvals. As of 2023, the use of medical marijuana is legal in around 38 states and the District of Columbia. These states have proper, publicly available medical marijuana plans or programs. In addition, California was the first state to legalize the medical use of cannabis; due to high demand, other states followed in approving the use of marijuana for medical applications. Furthermore, adoption and awareness regarding the use of cannabis as a pharmaceutical drug for the treatment of certain medical conditions are growing in the country. Hence, increasing awareness among Americans is expected to fuel the market growth over the forecast period.

Europe Cannabis Pharmaceutical Market Trends

The cannabis pharmaceutical market in Europe accounted for the largest revenue share of 41.9% globally. This is attributed to increasing cannabis consumption, rising awareness, and positive attitudes towards cannabis and its products. The presence of major manufacturers and various initiatives by key cannabis players in the region support the market growth. For instance, in August 2020, INFORMED I.P., a regulatory authority in Portugal, granted a license to Clever Leaves, a provider of legal cannabis, for the cultivation, import, and export of medical cannabis.

Furthermore, the increasing acceptance of cannabis-based medications for medical use and changing patient behavior concerning cannabis are some of the major factors boosting market growth in the region. European markets, such as Italy, the UK, and Germany, are major markets due to less stringent laws concerning sales and distribution of cannabis pharmaceuticals-Sativex and Epidiolex. In addition, distribution agreements by Jazz Pharmaceuticals in major European countries through partnerships with other market players, such as Almirall S.A., are expected to boost the market growth in the region over the forecast period.

The UK cannabis pharmaceutical market is one of the leading markets in the world in terms of granting approvals for the utilization of cannabis pharmaceuticals, such as Sativex, owing to the increasing adoption of cannabis for medical purposes, a rising number of research proclaiming the benefits of cannabis in the treatment of certain medical conditions, and growing awareness about medical cannabis. For instance, in April 2022, NHS England launched a patient registry to collect information on the prescribing of cannabis-based products for medicinal use.

The cannabis pharmaceutical market in France is anticipated to grow significantly over the forecast period. The increasing demand for cannabis and marijuana for medical purposes in the country, coupled with the rising prevalence of medical conditions such as epilepsy, multiple sclerosis, and cancer, is anticipated to boost the France cannabis pharmaceutical market growth in the coming years. Furthermore, increasing awareness and strategic initiatives by key players in the market are expected to propel market growth. For instance, in May 2023, the French General Directorate of Health (DGS) chose Ethypharm and Aurora Europe GmbH as the suppliers of dried medical cannabis flowers to continue the French trial period, which has been extended till March 2024. Aurora Europe GmbH is a subsidiary of Aurora Cannabis, Inc.

The Italy cannabis pharmaceutical market is anticipated to grow at a significant rate over the forecast period. Italy has approved the usage of medical cannabis in the country. The Netherlands is one of the major countries exporting cannabis to Italy. In April 2022, the Ministry of Defense issued a notice to select companies capable of cultivating cannabis plants for providing to the Military Chemical and Pharmaceutical Plant in Florence to manufacture pharmaceutical raw materials and medicines. This led to an increase in the utilization of cannabis and marijuana for medical purposes in the country.

Asia Pacific Cannabis Pharmaceutical Market Trends

The cannabis pharmaceutical market in Asia Pacific is growing due to the awareness regarding the benefits provided by cannabis-based pharmaceuticals on certain medical conditions, such as tuberous sclerosis complex, cancer, chronic pain, epilepsy, and multiple sclerosis, is anticipated to boost the market growth in the coming years. In addition, the rising number of clinical studies demonstrating the positive effects of cannabis pharmaceuticals and the increasing number of countries in the region allowing the use of cannabis-based pharmaceuticals are among the factors propelling the market growth in the region. Despite uncertain and stringent regulations in various countries in the region, the advantages associated with cannabis-based pharmaceuticals are likely to fuel market growth in the Asia Pacific region over the forecast period.

The Japan cannabis pharmaceutical market is growing as the government is adopting a less stringent approach toward the utilization of cannabis for medical purposes owing to the significant benefits of cannabis in the treatment of certain conditions. Furthermore, positive regulations concerning research in the country are anticipated to boost market growth in the coming years. However, the laws concerning the cultivation and consumption of cannabis are stringent, and cannabis is termed a narcotic drug by the country.

Key Cannabis Pharmaceutical Company Insights

Companies are turning to expansion in their product portfolios as well as expansion through mergers and acquisitions of small players in the industry. For instance, June 2023 marked a partnership between Avicanna Inc., a cannabinoid-based pharmaceutical company, and the Canadian Consortium for the Investigation of Cannabinoids to develop an educational course accessible to the medical community across Canada.

Key Cannabis Pharmaceuticals Companies:

The following are the leading companies in the cannabis pharmaceuticals market. These companies collectively hold the largest market share and dictate industry trends.

- Jazz Pharmaceuticals, Inc.

- AbbVie, Inc.

- Insys Therapeutics, Inc.

- Bausch Health Companies, Inc.

Recent Developments

-

In September 2023, SOMAÍ Pharmaceuticals, a European manufacturer of pharmaceutical cannabis products, received authorization from the Portuguese Health Authority INFRAMED to produce, import, and export for its facility in Lisbon, Portugal.

-

In August 2023, Avicanna Inc. completed the acquisition of the Medical Cannabis by Shoppers operation from Shoppers Drug Mart, subsequently introducing a new medical cannabis care platform called MyMedi.ca.

-

In February 2023, Aurora Cannabis Inc., a Canadian company, partnered with MedReleaf Australia to introduce CraftPlant, a new medical cannabis brand. This launch introduced three innovative products, Navana, HiVolt, and Greendae, to serve the Australian patient community.

-

In January 2023, Celadon Pharmaceuticals Plc declared that the UK Medicines and Healthcare Products Regulatory Agency (MRHA) had officially registered its cannabis active pharmaceutical ingredient at its Midlands facility in the UK, meeting the Good Manufacturing Practice (GMP) standards.

-

In May 2021, Jazz Pharmaceuticals completed its acquisition of GW Pharmaceuticals plc, which manufactures and markets cannabinoid-based prescription medicines.

Cannabis Pharmaceuticals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.8 billion

Revenue forecast in 2030

USD 102.4 billion

Growth Rate

CAGR of 53.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Brand type, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Netherlands; Spain; Croatia; Poland; Czech Republic; Switzerland; Japan; New Zealand; Australia, Brazil; Mexico; Colombia; Uruguay; South Africa, Israel

Key companies profiled

Jazz Pharmaceuticals, Inc.; AbbVie, Inc.; Insys Therapeutics, Inc.; Bausch Health Companies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cannabis Pharmaceuticals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cannabis pharmaceuticals market report based on brand type and region.

-

Brand Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sativex

-

Epidiolex

-

Other Brands

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Netherlands

-

Croatia

-

Poland

-

Czech Republic

-

Switzerland

-

Spain

-

-

Asia Pacific

-

Japan

-

New Zealand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Uruguay

-

Chile

-

Peru

-

-

Middle East and Africa (MEA)

-

South Africa

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global cannabis pharmaceuticals market size was estimated at USD 3.4 billion in 2023 and is expected to reach USD 7.8 billion in 2024.

b. The global cannabis pharmaceuticals market is expected to grow at a compound annual growth rate of 53.3% from 2024 to 2030 to reach USD 102.4 billion by 2030.

b. Epidiolex dominated the cannabis pharmaceuticals market with a share of 48.6% in 2023. This is attributable to the growing approval of the drug for the treatment of seizures associated with Dravet syndrome and Lennox-Gastaut syndrome in various countries.

b. Some key players operating in the cannabis pharmaceuticals market include Jazz Pharmaceuticals, Inc.; AbbVie Inc.; Bausch Health Companies, Inc.; and Insys Therapeutics, Inc.

b. Key factors that are driving the cannabis pharmaceuticals market growth include the rapidly progressing transformation of cannabis from herbal preparations to prescription drugs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.