- Home

- »

- Renewable Chemicals

- »

-

Caprylic Acid Market Size And Share, Industry Report, 2030GVR Report cover

![Caprylic Acid Market Size, Share & Trends Report]()

Caprylic Acid Market (2025 - 2030) Size, Share & Trends Analysis By Application (Personal Care, Pharmaceutical, Food & Beverages), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-751-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Caprylic Acid Market Summary

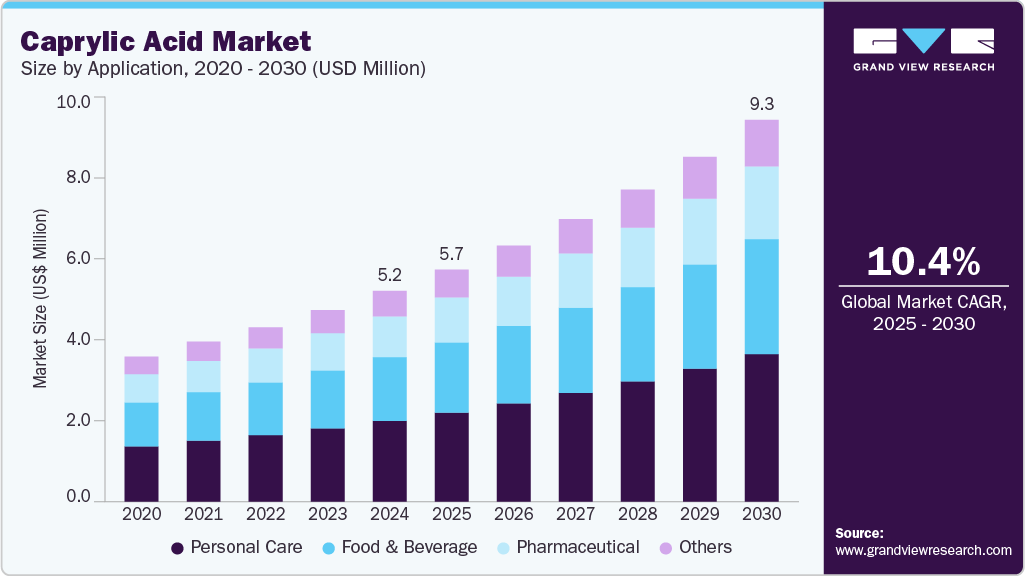

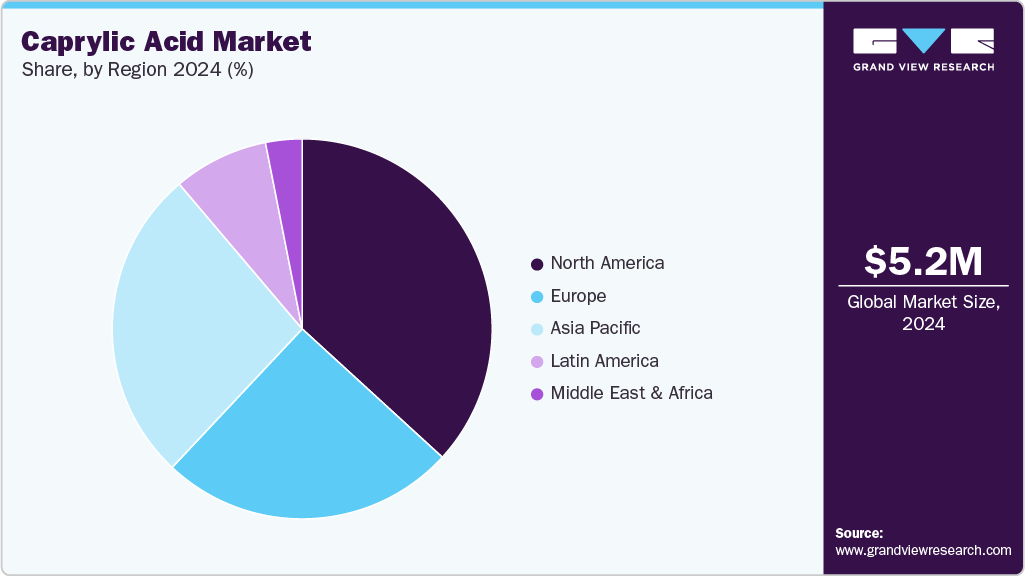

The global caprylic acid market size was valued at USD 5.2 million in 2024 and is projected to reach USD 9.3 billion by 2030, growing at a CAGR of 10.4% from 2025 to 2030. Due to its antimicrobial properties, caprylic acid is increasingly used as an additive and preservative in the food and beverage industry.

Market Size & Trends:

- The North America caprylic acid market accounted for the largest revenue share of 36.8% in 2024.

- In 2024, the U.S. caprylic acid market accounted for the largest revenue share in the regional market.

- By application, the personal care segment dominated the market and accounted for a market revenue share of 38.3% in 2024.

- The food & beverage segment is expected to witness significant growth over the forecast period.

Key Market Statistics:

- 2024 Market Size: $5.2 Million

- 2030 Estimated Market Size: $9.3 Million

- CAGR: 10.4% (2025-2030)

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

It aids in extending the shelf life of products by preventing the growth of bacteria and fungi, which is valuable in producing dairy products, processed foods, and beverages. The growing consumer preference for natural ingredients further drives the demand for caprylic acid in this sector, as it is derived from natural sources such as coconut and palm oil.

Caprylic acid is known for its antifungal, antiviral, and anti-inflammatory properties, making it a key ingredient in various health supplements and medications. It is widely used to treat fungal infections, such as Candida. It is also used for its potential in managing other health conditions such as irritable bowel syndrome (IBS) and Crohn’s disease. The growing consumer awareness regarding health and wellness and the increasing prevalence of lifestyle-related diseases are increasing the demand for caprylic acid in these industries.

Caprylic acid is also gaining traction in personal care and cosmetics due to its emollient and skin-conditioning properties. It is often used in formulations of skincare products, hair care products, and cosmetics, providing benefits such as UVA protection, moisturizing, and skin softening. As consumers become more conscious of the ingredients in their personal care products, there is a growing preference for natural and organic ingredients, which is driving the demand for caprylic acid. Additionally, its compatibility with other ingredients and its ability to enhance the texture and stability of products make it a popular choice among manufacturers. For instance, in November 2023, Croda launched several sunscreen ingredients that offer high SPF and effective UVA protection. Solaveil CZ-300 includes zinc oxide, caprylic/capric triglyceride, polyhydroxystearic acid, and isostearic acid. Solaveil CT-300 Caprylic/Capric Triglyceride Titanium Dioxide Polyhydroxystearic Acid Aluminum Stearate Alumina.

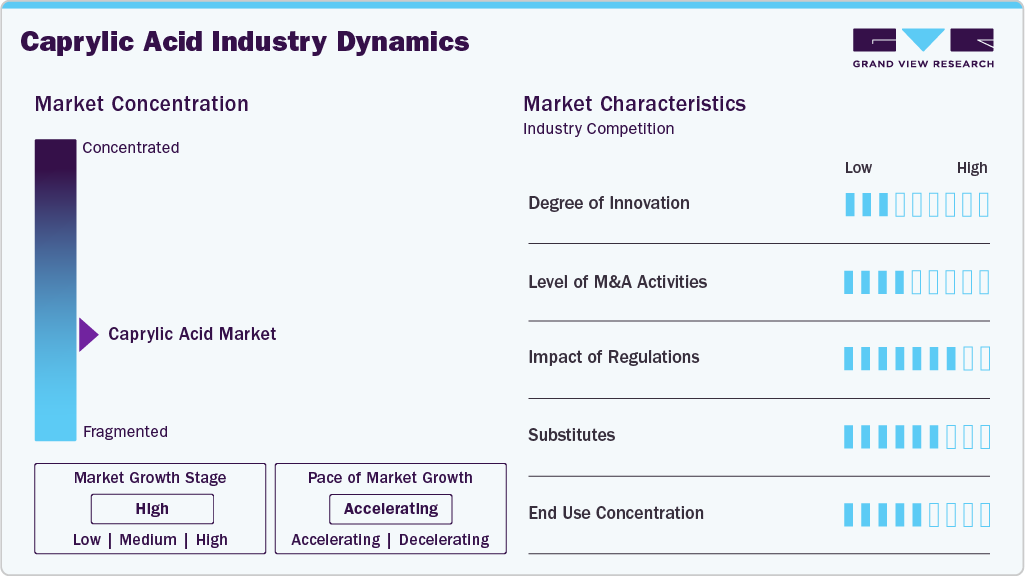

Market Concentration & Characteristics

The market growth stage is high, and the market growth is accelerating. The caprylic acid market has moderate innovation, primarily focused on improving extraction processes, developing bio-based alternatives, and expanding applications in personal care, pharmaceuticals, and food industries. Substitutes are available for caprylic acid depending on the application, such as other medium-chain fatty acids (e.g., capric acid, lauric acid) or synthetic alternatives. However, caprylic acid’s natural antimicrobial properties and food-grade status still give it a strong foothold.

Environmental, health, and food safety regulations significantly influence industry, especially in the EU and North America. Compliance with Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), FDA, and other regulatory bodies affects production methods and product approval. The market serves multiple sectors, including personal care, food and beverages, pharmaceuticals, and industrial uses. While personal care and food dominate, no single end-use completely controls demand, indicating moderate concentration.

Application Insights

The personal care segment dominated the market and accounted for a market revenue share of 38.3% in 2024. Caprylic acid has multifunctional properties, making it a versatile ingredient in personal care formulations. It is an emollient that helps moisturize and soften the skin by forming a barrier that prevents water loss. Additionally, it includes antimicrobial properties, which make it effective in preserving the stability of formulations and preventing the growth of bacteria and fungi. Its ability to improve product texture and its spreading ability enhance the consumer's sensory experience. These factors combined drive the demand for Caprylic acid in personal care.

The food & beverage segment is expected to witness significant growth over the forecast period. With growing consumers’ awareness about food safety and the potential health risks associated with synthetic additives, the demand for natural food preservatives is also growing consistently. Caprylic acid, derived from natural sources such as coconut oil and palm kernel oil, has antimicrobial properties, effectively inhibiting the growth of bacteria, yeast, and mold in food products. This extends the shelf life of various food and beverage items without synthetic chemicals, including dairy products, baked goods, and beverages. The growing consumer preference for these products free from artificial preservatives and additives drives the demand for caprylic acid in the food and beverage industry.

Regional Insights

The North America caprylic acid market accounted for the largest revenue share of 36.8% in 2024. Food processing in North America is a highly established industry, with a strong focus on innovation and quality control. Caprylic acid is used as a natural preservative across various food products due to its antimicrobial properties, which aid in extending product life and maintaining product quality. The growing demand for processed and convenience foods free from synthetic preservatives drives the adoption of natural alternatives such as caprylic acid.

U.S. Caprylic Acid Market Trends

In 2024, the U.S. caprylic acid market accounted for the largest revenue share in the regional market. The U.S. is a significant personal care and cosmetics market, and consumers are increasingly demanding high-quality, safe, and effective products. Caprylic acid is widely used in this industry for its emollient, skin-conditioning, and antimicrobial properties. It is a common ingredient in skincare products, haircare formulations, and cosmetics, particularly in products designed for sensitive or problem-prone skin. The trend toward clean beauty, with growing consumers’ preference for products made with natural and non-toxic ingredients, further increases the demand for caprylic acid in the U.S. personal care market.

Europe Caprylic Acid Market Trends

Europe caprylic acid market is expected to witness significant growth over the forecast period. The functional food and nutraceutical markets in Europe are experiencing growth as consumers increasingly seek foods and supplements that offer additional health benefits. Owing to its health-promoting properties, caprylic acid is integrated into various functional foods, including fortified beverages, energy bars, and meal replacement products. Additionally, it is used in MCT (medium-chain triglycerides) oil, which is prevalent among athletes, fitness enthusiasts, and individuals. The increasing demand for functional foods and nutraceuticals, driven by a growing focus on preventive health and wellness, drives the demand for caprylic acid in Europe.

The UK caprylic acid market is expected to witness significant growth over the forecast period. Caprylic acid is increasingly used in the pharmaceutical sector due to its potential therapeutic benefits, especially its antimicrobial and antifungal properties. It is being explored as an ingredient in treating conditions such as infections and microbial imbalances. Additionally, its role in formulations for drug delivery systems, where medium-chain fatty acids enhance the bioavailability of active pharmaceutical ingredients, is driving its adoption.

Asia Pacific Caprylic Acid Market Trends

Asia Pacific caprylic acid market is expected to witness the fastest CAGR of 11.6% over the forecast period. The expansion of e-commerce in the Asia Pacific region significantly impacts the distribution and accessibility of caprylic acid-based products. Online platforms provide consumers with easy access to a wide range of dietary supplements, personal care products, and organic food items containing caprylic acid. The convenience of online shopping, combined with the ability to research and compare products, has increased the sales and visibility of the caprylic acid industry in the region. The growing e-commerce sector enables wider distribution and access to these products for a diverse consumer base.

India caprylic acid market is expected to witness significant growth over the forecast period. Caprylic acid is a natural preservative used in organic food products. It aids in maintaining product integrity and safety without compromising organic standards. The growth of the organic food sector, which prioritizes using natural ingredients and sustainable practices, drives the demand for the caprylic acid market in India. As the demand for organic food continues to rise, the use of caprylic acid in this segment is expected to increase.

Key Caprylic Acid Market Share Insights

Key players in the caprylic acid market include VVF L.L.C., Oleon NV, Wilmar International Ltd, Emery Oleochemicals, and others.

-

VVF L.L.C. is a global company specializing in manufacturing personal care products, oleochemicals, and specialty chemicals. VVF’s product offerings include a wide range of bar soaps, liquid soaps, hand sanitizers, skin care products under various brands, and bulk supplies of fatty acids, glycerin, and other oleochemical derivatives used in industries such as personal care, food, and pharmaceuticals.

-

Emery Oleochemicals is a global company that produces natural-based specialty chemicals. Their product lines are organized into several business units, including Green Polymer Additives, Eco-Friendly Polyols, and Bio-Lubricants, each focused on providing suitable solutions.

Key Caprylic Acid Companies:

The following are the leading companies in the caprylic acid market. These companies collectively hold the largest market share and dictate industry trends.

- VVF L.L.C.

- Oleon NV

- Wilmar International Ltd.

- KLK OLEO

- Emery Oleochemicals

- P & G Chemicals

- PT. Ecogreen Oleochemicals

- Temix Oleo Srl

- Pacific Oleochemicals, Sdn. Bhd.

- Musim Mas Group

Recent Developments

-

In April 2024, Wild Biome launched a two-part supplement system, Detoxification and Repopulation, developed for leaky gut syndrome and its associated issues in dogs. For Detoxification, the MCT-3 Oil supplement is designed to detoxify the gut microbiome, targeting the overgrowth of yeast with its concentration of caprylic acid. In Repopulation, the DT-Synbiotic 1 formula includes a blend of prebiotics, enzymes, and probiotics, supporting microbial balance and gut function.

-

In April 2022, Symrise launched a biobased version of caprylyl glycol, 1,2-octanediol. It is an antimicrobial and moisturizing ingredient commonly utilized in lotions and other personal care products. Symrise's biobased caprylyl glycol is derived from plant sources, specifically caprylic acid in coconut and palm oil.

Caprylic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.7 million

Revenue forecast in 2030

USD 9.3 million

Growth Rate

CAGR of 10.4% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report Updated

May 2025

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, and South Africa

Key companies profiled

VVF L.L.C., Oleon NV, Wilmar International Ltd, KLK OLEO, Emery Oleochemicals, P & G Chemicals, PT. Ecogreen Oleochemicals, Temix Oleo Srl, Pacific Oleochemicals, Sdn. Bhd., Musim Mas Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Caprylic Acid Market Report Segmentation

This report forecasts revenue growth at global levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global caprylic acid market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Care

-

Pharmaceutical

-

Food & Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.