- Home

- »

- Next Generation Technologies

- »

-

Car Insurance Market Size, Share & Growth Report, 2030GVR Report cover

![Car Insurance Market Size, Share & Trend Report]()

Car Insurance Market (2024 - 2030) Size, Share & Trend Analysis Report By Coverage, By Distribution Channel, By Vehicle Age, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-430-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Car Insurance Market Summary

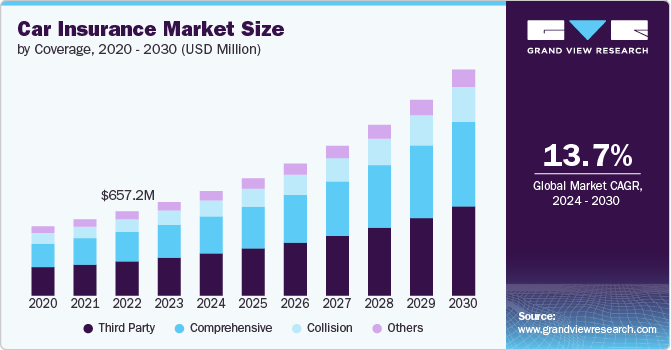

The global car insurance market size was estimated at USD 730.1 million in 2023 and is projected to reach USD 1,764.2 million by 2030, growing at a CAGR of 13.7% from 2024 to 2030. The rising number of road accidents is significantly contributing to the growth of the car insurance market.

Key Market Trends & Insights

- North America car insurance market led the global market and accounted for 33.2% of the global revenue in 2023.

- By coverage, the third party segment led the market and accounted for 40.5% of the global revenue in 2023.

- By distribution channel, insurance agents/brokers segment dominated the market in 2023.

- By vehicle age, new vehicle segment held the largest market share in 2023.

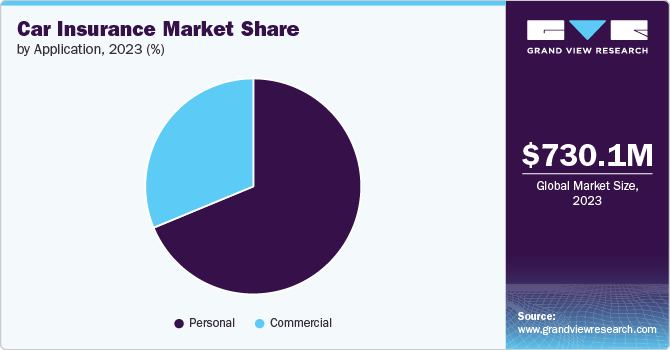

- By application, personal segment held the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 730.1 Million

- 2030 Projected Market Size: USD 1,764.2 Million

- CAGR (2024-2030): 13.7%

- North America: Largest market in 2023

As urban areas become more congested and the number of vehicles on the road rises, the likelihood of accidents naturally increases. This surge in accidents has led to a heightened awareness among drivers about the need for comprehensive insurance coverage. Consequently, more consumers are purchasing car insurance policies to safeguard against the financial risks associated with accidents, such as vehicle repairs, medical expenses, and legal liabilities. Insurance companies are responding to this trend by expanding their product offerings and enhancing claims processes to meet the growing demand for reliable and swift coverage.

The rising adoption of telematics, which involves using in-car devices to monitor driving behavior and collect data, is also contributing to the growth of the market. This technology allows insurers to offer usage-based insurance (UBI) plans, where premiums are determined based on real-time data about driving habits. These personalized plans appeal to safer drivers who can benefit from lower premiums while also providing insurers with more accurate risk assessments. As telematics becomes more sophisticated, it is expected to play a pivotal role in reshaping the car insurance landscape.

The growing popularity of Electric Vehicles (EVs) is also contributing to the market growth. With governments worldwide pushing for greener transportation and offering incentives for EV adoption, insurers are developing specialized policies tailored to these vehicles. EV insurance policies often consider factors unique to electric cars, such as battery life, charging infrastructure, and specialized repair costs. Insurers are also considering the environmental benefits of EVs, potentially offering lower premiums for these vehicles. This shift towards EVs prompts insurers to rethink traditional underwriting models and create new products catering to the changing automotive landscape.

The car insurance industry is also being shaped by the increasing prevalence of autonomous vehicles (AVs). As AV technology advances and becomes more widespread, traditional risk models based on human driving behavior are becoming less relevant. Insurers are now focusing on the technological reliability of AV systems and the liability of manufacturers in the event of a malfunction. This shift from driver-centric to vehicle-centric insurance is expected to lead to new types of policies and coverage options. The rise of AVs presents both challenges and opportunities for insurers as they navigate uncharted territory in risk management.

Digital disruption is another major trend impacting the car insurance market, with a growing number of customers preferring online platforms for purchasing policies and managing claims. Insurtech companies are leading the charge, offering seamless digital experiences and innovative products that challenge traditional insurers. The convenience and transparency of digital platforms are driving higher customer satisfaction and retention rates. Additionally, artificial intelligence and machine learning are being used to automate underwriting processes and improve fraud detection. This digital shift is enhancing operational efficiency and enabling insurers to better cater to evolving consumer preferences, thereby contributing to the market's growth.

Coverage Insights

The third party segment led the market and accounted for 40.5% of the global revenue in 2023. The growth of the segment is driven by regulatory requirements and cost considerations. In many regions, including various countries in Europe and Asia Pacific, third-party insurance is mandatory, which drives a demand for this type of coverage. In addition, its relatively lower premium cost compared to comprehensive coverage makes it an attractive option for budget-conscious users. The rising number of vehicle registrations and increased awareness about legal obligations contribute to the segment's growth. Moreover, the simplicity of third-party coverage, which focuses on liability protection for damage or injury caused to others, appeals to drivers looking for basic insurance solutions.

The comprehensive segment is projected to witness significant growth from 2024 to 2030. The segment is growing due to its broad range of protections and increasing consumer awareness of the benefits of extensive coverage. Comprehensive insurance offers protection against a wide array of risks, including theft, vandalism, natural disasters, and accidental damage, making it a preferred option for those seeking extensive protection. As vehicle ownership increases and the value of cars rises, drivers are more inclined to invest in comprehensive coverage to safeguard their assets against diverse risks, thereby driving the segment’s growth.

Distribution Channel Insights

The insurance agents/brokers segment dominated the market in 2023. The growing demand for personalized service and expert advice can be attributed to the segment’s growth. Agents and brokers offer valuable assistance in navigating the complexities of insurance policies, helping customers select the coverage that best suits their needs. Their in-depth knowledge of various insurance products and ability to compare options from multiple insurers enhance the purchasing experience. In addition, agents and brokers often build long-term relationships with clients, fostering trust and loyalty, thereby driving the segment’s growth.

The direct response segment is projected to witness significant growth from 2024 to 2030. Growing advancements in digital technology and a growing preference for online transaction processes are major factors behind the segment’s growth. Direct response insurance allows customers to purchase policies directly from insurers via online platforms, call centers, or mobile applications, offering convenience and immediate access to insurance products. The increasing adoption of digital tools and the rise of comparison websites also contributes to the growth of direct response channels, as they enable consumers to easily compare options and purchase policies without the need for intermediaries. This shift towards direct response is expected to continue as more consumers seek efficient, cost-effective ways to manage their insurance needs.

Vehicle Age Insights

The new vehicle segment held the largest market share in 2023 and is expected to be the fastest-growing segment throughout the projection period. This expansion is driven by the increasing sales of new cars globally, fueled by economic recovery, rising disposable incomes, and advancements in automotive technology. New vehicles, often equipped with advanced safety features and telematics, are attracting favorable insurance premiums, making them an attractive segment for insurers. The rapid adoption of electric vehicles (EVs) and connected cars is further bolstering this market, as these vehicles typically require specialized insurance products, offering new revenue streams for insurers. Additionally, the proliferation of digital platforms and insurtech innovations is making it easier for consumers to compare and purchase insurance policies, driving competition and enhancing market growth.

The used vehicle segment is steadily growing, driven by the increasing demand for pre-owned vehicles, which offer cost-effective alternatives to new cars amid economic uncertainties and rising new car prices. This segment is particularly attractive to cost-conscious consumers and first-time buyers, creating a robust market for insurers. Unlike new vehicles, used cars often require tailored insurance products that account for factors such as age, mileage, and condition, leading to diverse policy offerings. The rise of online marketplaces and digital tools for vehicle history reports and valuations has also made it easier for buyers to purchase used cars with greater confidence, subsequently increasing the demand for insurance coverage.

Application Insights

The personal segment held the largest market share in 2023 and is expected to be the fastest-growing segment during the forecast period. The personal car insurance segment is a cornerstone of the broader insurance industry, catering to individual vehicle owners and providing essential financial protection against risks such as accidents, theft, and liability. This market is characterized by intense competition, with insurers striving to offer competitive premiums and tailored coverage options that meet the diverse needs of consumers. The adoption of telematics and usage-based insurance (UBI) is transforming the personal car insurance landscape, allowing insurers to offer more personalized premiums based on driving behavior, which appeals to safer drivers seeking lower costs.

The commercial segment is anticipated to grow substantially throughout the projection period. The commercial car insurance market is a vital segment of the broader insurance industry, serving businesses that operate fleets of vehicles or rely on transportation as a key component of their operations. The growth of the segment is driven by the growing demand for commercial vehicles across sectors such as logistics, construction, ride-sharing, and delivery services, all of which require comprehensive coverage to protect against risks like accidents, theft, liability, and cargo damage. As businesses expand their fleets and increasingly adopt connected vehicle technologies, the need for specialized and flexible insurance solutions is rising. Insurers are responding by offering tailored policies that account for factors such as vehicle type, usage patterns, driver behavior, and business size.

Regional Insights

The North America car insurance market led the global market and accounted for 33.2% of the global revenue in 2023. Increasing demand for used and new vehicles in the region is expected to create growth opportunities for the regional market. Furthermore, the increasing costs of vehicle repairs is further contributing to the North American regional market growth.

The U.S. Car Insurance Market Trends

Car insurance market in the U.S. is anticipated to register significant growth from 2024 to 2030. The rise in urbanization and the growing number of vehicles on the road in the U.S. are contributing to an increased demand for car insurance, as more drivers require coverage to comply with legal requirements.

Europe Car Insurance Market Trends

Car insurance market in Europe is poised for significant growth from 2024 to 2030. The integration of advanced analytics and artificial intelligence in claims processing is reducing operational costs and improving customer satisfaction, driving growth in Europe car insurance market.

Asia Pacific Car Insurance Market Trends

Car insurance market in Asia Pacificis anticipated to register significant growth from 2024 to 2030. The expanding adoption of digital platforms and mobile applications by insurers in the Asia Pacific region is enhancing customer engagement and convenience, leading to higher policy renewal rates and attracting new customers.

Key Car Insurance Company Insights

The competitive landscape in the car insurance market is characterized by intense competition among both established players and new entrants. Established players are leveraging their extensive distribution networks, strong brand recognition, and comprehensive product offerings. However, the rise of insurtech companies and digital platforms is significantly contributing to the market by offering innovative, user-friendly products and services, often at competitive prices.

Key Car Insurance Companies:

The following are the leading companies in the car insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Allianz Group

- AXA

- Zurich Insurance Group

- Bajaj Finserv

- Liberty Mutual Insurance

- Progressive Casualty Insurance Company

- The Travelers Indemnity Company

- Chubb

- State Farm Mutual Automobile Insurance Company

- American International Group (AIG)

Recent Development

-

In January 2023, New India Assurance (NIA) launched Pay as You Drive (PAYD) policy, with features such as coverage beyond distance limit, discounts on renewals, and enhanced protections such as roadside help, nil depreciation, and return to invoice, and among others. Such policies offer personalized and flexible coverage options that cater to the specific needs of individual drivers, thereby contributing to the market’s growth.

Car Insurance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 815.0 million

Revenue forecast in 2030

USD 1,764.2 million

Growth rate

CAGR of 13.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Coverage, distribution channel, vehicle age, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Allianz Group; AXA; Zurich Insurance Group; Bajaj Finserv; Liberty Mutual Insurance; Progressive Casualty Insurance Company; The Travelers Indemnity Company; Chubb; State Farm Mutual Automobile Insurance Company; American International Group (AIG)

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Car Insurance Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the car insurance market based on coverage, distribution channel, vehicle age, application, and region.

-

Coverage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Third Party

-

Comprehensive

-

Collision

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Insurance Agents/Brokers

-

Direct Response

-

Banks

-

Others

-

-

Vehicle Age Outlook (Revenue, USD Billion, 2018 - 2030)

-

New Vehicle

-

Used Vehicle

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global car insurance market size was estimated at USD 730.1 million in 2023 and is expected to reach USD 815.0 million in 2024.

b. The global car insurance market is expected to grow at a compound annual growth rate of 13.7% from 2024 to 2030 to reach USD 1,764.2 million by 2030.

b. North America dominated the car insurance market with a share of 33.23% in 2023. Increasing demand for used and new vehicles in the region is expected to create growth opportunities for the regional market.

b. Some key players operating in the car insurance market include Allianz Group, AXA, Zurich Insurance Group, Bajaj Finserv, Liberty Mutual Insurance, Progressive Casualty Insurance Company, The Travelers Indemnity Company, Chubb, State Farm Mutual Automobile Insurance Company, and American International Group (AIG).

b. Key factors that are driving the market growth include the rising number of road accidents and the growing popularity of Electric Vehicles (EVs).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.