- Home

- »

- Electronic & Electrical

- »

-

Car Phone Holder Market Size, Share & Trends Report, 2030GVR Report cover

![Car Phone Holder Market Size, Share & Trends Report]()

Car Phone Holder Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Air Vent, Suction Cup, Adhesive, CD Slot), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-919-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Car Phone Holder Market Summary

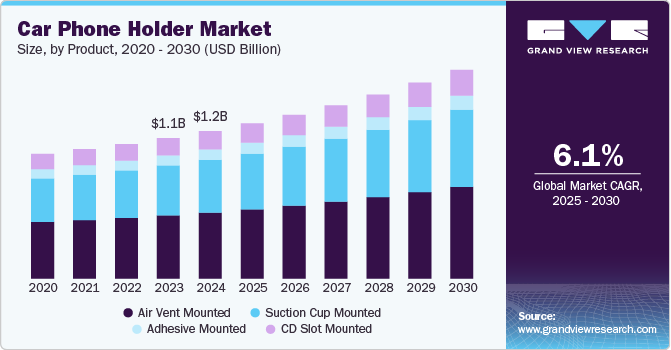

The global car phone holder market size was estimated at USD 1.18 billion in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2030. The market growth is driven by the increasing adoption of smartphones, vehicle ownership, and the need for in-car connectivity solutions.

Key Market Trends & Insights

- North America accounted for a share of 28.0% of the global revenue in 2024.

- By product, air vent mounted phone holders segment accounted for a market revenue share of 44.8% in 2024.

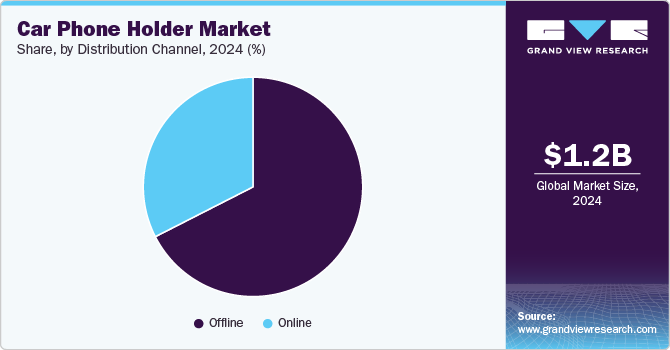

- By distribution channel, sales of car phone holders through offline channels accounted for a revenue share of 67.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.18 Billion

- 2030 Projected Market Size: USD 1.68 Billion

- CAGR (2025-2030):6.1%

- North America: Largest market in 2024

With the proliferation of navigation apps, hands-free communication, and entertainment on the go, consumers are seeking safer ways to use their phones while driving, which boosts the demand for phone holders. The shift toward smart vehicles and the rising focus on road safety regulations, which discourage handheld phone use, further support the market's growth.

Car phone holders are designed to securely position mobile devices for safe viewing while driving. These accessories, which can be attached to air vents or the windscreen via rubber suction pads, allow drivers to use their phones hands-free. With strong magnetic mounts and easy installation, they provide a convenient solution for keeping devices accessible. The rising need for safety, convenience, and cost-effective solutions has fueled demand for these holders, which help drivers access features like navigation and voice assistants, reducing the risk of car crashes.

According to the World Health Organization (WHO), around 1.3 million people die annually due to road traffic accidents. Car phone holders contribute to safer driving by enabling hands-free navigation, phone calls, and music control. With most smartphones featuring voice recognition, users can easily interact with their devices for navigation or communication while driving. Additionally, increasing car ownership, driven by low interest rates and affordable fuel, is contributing to the growth in demand for car phone holders as more people purchase or upgrade their vehicles.

The car phone holder market is expected to grow significantly in the coming years due to rising interest in vehicle customization and the growing number of passenger cars. As disposable incomes rise and consumers become more safety-conscious, demand for car phone holders is set to increase. Additionally, the desire for enhanced driving experiences is expected to further drive the market’s expansion in the near future.

Product Insights

Air vent mounted phone holders segment accounted for a market revenue share of 44.8% in 2024. Air vent mounts are typically secured to the slats of the car's front air vent, allowing users to conveniently position their phones either to the right or left of the steering wheel, depending on the vent's location. These mounts generally work best with rectangular vents, as they can be firmly hooked into place, offering better stability compared to round vents.

The suction cup-mounted car phone holder market is projected to grow at a CAGR of 6.7% from 2025 to 2030. These are the most common mounts for car phone holders, designed to adhere to windshields or dashboards, offering versatility in their placement. CD slot-mounted phone holders are expected to be the second fastest-growing segment, as they are easy to install without causing damage to the car's CD slot while keeping the phone conveniently within reach while driving.

Distribution Channel Insights

Sales of car phone holders through offline channels accounted for a revenue share of 67.5% in 2024. Key brick-and-mortar stores, including hardware specialty shops, hypermarkets, supermarkets, and brand-specific outlets selling automotive parts, are integral to the offline store segment. These outlets allow customers to visually inspect a range of products, compare prices, and review specifications before making a purchase, driving growth in the offline distribution channel for car phone holders and related products.

The sales of car phone holders through online channels are anticipated to grow at a CAGR of 6.8% from 2025 to 2030. The growth of online platforms by manufacturers and online retailers, combined with flexible payment options and free delivery services, is driving the growth of the online distribution segment. Increasing internet penetration and the shift in consumer preferences toward online shopping further boost this segment. Key factors contributing to its growth include the rise of smartphone usage, the influence of social media, and advancements in e-commerce technology. Moreover, since online shoppers avoid fixed costs like rent and utilities, they can offer significant discounts on car phone holders, enhancing the segment's appeal and supporting its continued expansion.

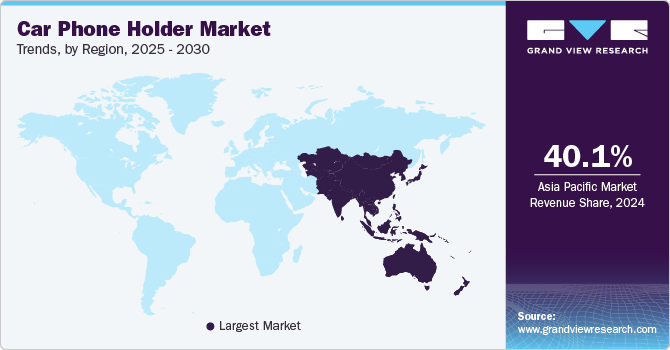

Regional Insights

The car phone holder market in North America accounted for a share of 28.0% of the global revenue in 2024. One of the primary drivers is the increasing use of smartphones and the growing demand for in-car connectivity solutions, especially for navigation and hands-free communication. The rise in vehicle ownership, coupled with advancements in automotive technologies such as smart vehicles and integrated infotainment systems, further fuels demand.

U.S. Car Phone Holder Market Trends

The car phone holder market in the U.S. is projected to grow at a CAGR of 5.9% from 2025 to 2030 due to increasing reliance on smartphones for navigation, communication, and entertainment while driving. This trend has been amplified by strict road safety regulations, such as hands-free driving laws, which have led to a growing demand for car phone holders to minimize distractions and improve safety.

Europe Car Phone Holder Market Trends

The car phone holder market in Europe is projected to grow at a CAGR of 5.5% from 2025 to 2030. European countries enforce strict regulations regarding distracted driving. As a result, drivers are looking for hands-free solutions, boosting the demand for car phone holders that comply with safety standards. The popularity of ride-sharing services (e.g., Uber, Bolt) has increased the need for car phone holders among drivers who want to utilize their smartphones for navigation and communication during rides.

The car phone holder market in the UK is projected to grow at a CAGR of 4.6% from 2025 to 2030. The increasing prevalence of smartphone usage among drivers fuels demand for these accessories as individuals seek convenient solutions for navigation and hands-free communication. Strict road safety regulations in the U.K. also play a significant role; with laws against using handheld devices while driving, many consumers are turning to car phone holders to ensure compliance and enhance safety.

The Germany car phone holder market is projected to grow at a CAGR of 6.1% from 2025 to 2030. The country's high smartphone penetration rate and widespread adoption of mobile technology are primary contributors, as more drivers seek convenient ways to utilize navigation and communication apps safely while on the road.

Asia Pacific Car Phone Holder Market Trends

The car phone holder market in Asia Pacific accounted for a share of 40.1% of the global revenue in 2024. With a significant increase in consumer demand for passenger vehicles, the Asia Pacific region, covering 29.3 million square kilometers, is home to over 60.0% of the global population. Emerging countries like India and China are among the fastest-growing nations in terms of population. Over the past two decades, the Asian economy and its industries have been undergoing substantial changes, with the automotive sector being no exception.

Latin America Car Phone Holder Market Trends

The car phone holder market in Latin America is projected to grow at a CAGR of 6.3% from 2025 to 2030. The increasing ownership of smartphones and passenger vehicles in the region is driving demand for car phone holders as consumers seek convenient and safe ways to use their devices while driving. Additionally, the rise in urbanization across Latin American countries has led to increased traffic congestion, making hands-free solutions more appealing to drivers who rely on navigation apps to navigate busy roads.

Middle East & Africa Car Phone Holder Market Trends

The car phone holder market in the Middle East & Africa is projected to grow at a CAGR of 4.3% from 2025 to 2030. In many countries, road safety concerns are on the rise, prompting governments to implement stricter regulations against distracted driving. This regulatory landscape encourages consumers to adopt hands-free solutions, such as car phone holders, to comply with legal requirements and enhance safety on the road.

Key Car Phone Holder Company Insights

The market is highly competitive due to the significant presence of both domestic and local players. Manufacturers are focused on developing and designing a diverse range of products to meet the changing needs of consumers. Additionally, industry participants are implementing key strategies such as multichannel sales, establishing extensive distribution networks, and enhancing branding and promotional efforts. They are also leveraging online marketing and pursuing expansion into untapped markets through collaborations with car dealerships and accessories online.

Key Car Phone Holder Companies:

The following are the leading companies in the car phone holder market. These companies collectively hold the largest market share and dictate industry trends.

- Arkon Resources, Inc.

- Bestrix

- Kenu

- Brodit AB

- Baseus

- iOttie, Inc.

- ZAAP

- Amkette

- Portronics

- Olixar

Recent Developments

-

In August 2021, NUMBER ZERO launched a dynamic new magnetic car phone holder on Indiegogo, which is the world’s first 5-in-1 magnetic car phone holder with dynamic animation. This new-age phone holder offers a new way for drivers to go hands-free on the road while also serving as décor, scent diffuser, animated toy, and table-top phone stand.

-

In May 2021, Inbase, a leading name in innovative and portable digital products, launched the latest series of 5 car mounts and holders for tablets and smartphones at competitive prices for the larger section of the automotive utility accessories market.

Car Phone Holder Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.24 billion

Revenue forecast in 2030

USD 1.68 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion & million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia

Key companies profiled

Baseus; Brodit AB; Arkon Resources, Inc.; Kenu; iOttie, Inc.; Olixar; Bestrix; Amkette; Portronics; ZAAP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Car Phone Holder Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global car phone holder market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Air Vent Mounted

-

Suction Cup Mounted

-

Adhesive Mounted

-

CD Slot Mounted

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global car phone holder market size was estimated at USD 1.18 billion in 2024 and is expected to reach 1.24 USD billion in 2022.

b. The global car phone holder market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 1.68 billion by 2030.

b. The Asia Pacific dominated the car phone holder market with a share of 40.1% in 2024. This is attributable to the thriving automobile industry, increasing adoption of personal cars coupled with the rising number of smartphone users in the region

b. Some key players operating in the car phone holder market include Baseus; Brodit AB; Arkon Resources, Inc.; Kenu; IOttie, Inc.; Olixar; Bestrix; Amkette; Portronics; ZAAP

b. Key factors that are driving the car phone holder market growth include an increasing number of road accidents, growing consumer awareness about the importance of car phone holders, and strict government regulations for road safety

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.