- Home

- »

- Homecare & Decor

- »

-

Car Rental Market Size And Share, Industry Report, 2030GVR Report cover

![Car Rental Market Size, Share & Trends Report]()

Car Rental Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle (Luxury Cars, Executive Cars), By Application (Local Usage, Airport Transport), By Booking Mode, By Region, And Segment Forecasts

- Report ID: 978-1-68038-568-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Car Rental Market Summary

The global car rental market size was estimated at USD 149.87 billion in 2024 and is projected to reach USD 278.03 billion by 2030, growing at a CAGR of 10.5% from 2025 to 2030. This growth is largely driven by a rise in global travel for both business and leisure purposes, increasing the demand for convenient and flexible transportation options.

Key Market Trends & Insights

- The car rental market in North America accounted for a share of 36.39% of the global market revenue in 2024.

- Car rental industry in the U.S. is expected to grow at a CAGR of 8.7% from 2025 to 2030.

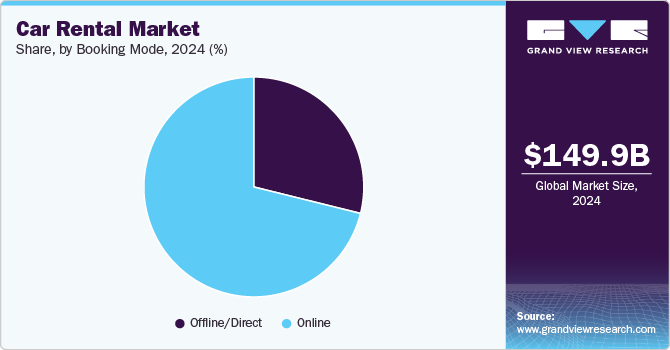

- By booking mode, the online bookings segment held a revenue share of over 71% in 2024.

- By application, Car rentals for airport transport segment held a revenue share of over 38% in 2024.

- By vehicle, the economy car rentals segment held a revenue share of over 32% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 149.87 Billion

- 2030 Projected Market Size: USD 278.03 Billion

- CAGR (2025-2030): 10.5%

- North America: Largest market in 2024

Technological advancements, particularly in online booking and mobile app integration, have made car rental services more accessible to customers, streamlining the rental process and improving the customer experience. The adoption of smartphones and internet penetration across developed and developing regions has further contributed to the car rental industry growth. Car rental operators have enhanced their services through better customer and corporate data management, allowing for personalized offerings and more efficient fleet operations. Major players are also leveraging integrated global systems to manage their international operations more effectively, positioning themselves to capture a growing number of global travelers.

A significant trend in the market is the rise of bleisure travel, where business trips are combined with leisure activities. This trend is especially popular among younger employees, driving demand for flexible rental services that cater to both corporate and family travel needs. In addition, car rental companies are focusing on sustainability, incorporating eco-friendly vehicles like electric and hybrid cars to meet the growing demand for environmentally conscious transportation options.

The pandemic had a temporary negative impact on the car rental industry, particularly in airport rentals, but post-pandemic recovery is evident as global travel resumed. Companies have adapted to new hygiene and safety standards, building customer confidence. Moreover, the trend toward non-airport rentals is reshaping the industry with increased demand in urban and suburban areas as domestic travel rises, presenting new opportunities for growth.

Consumer Insights

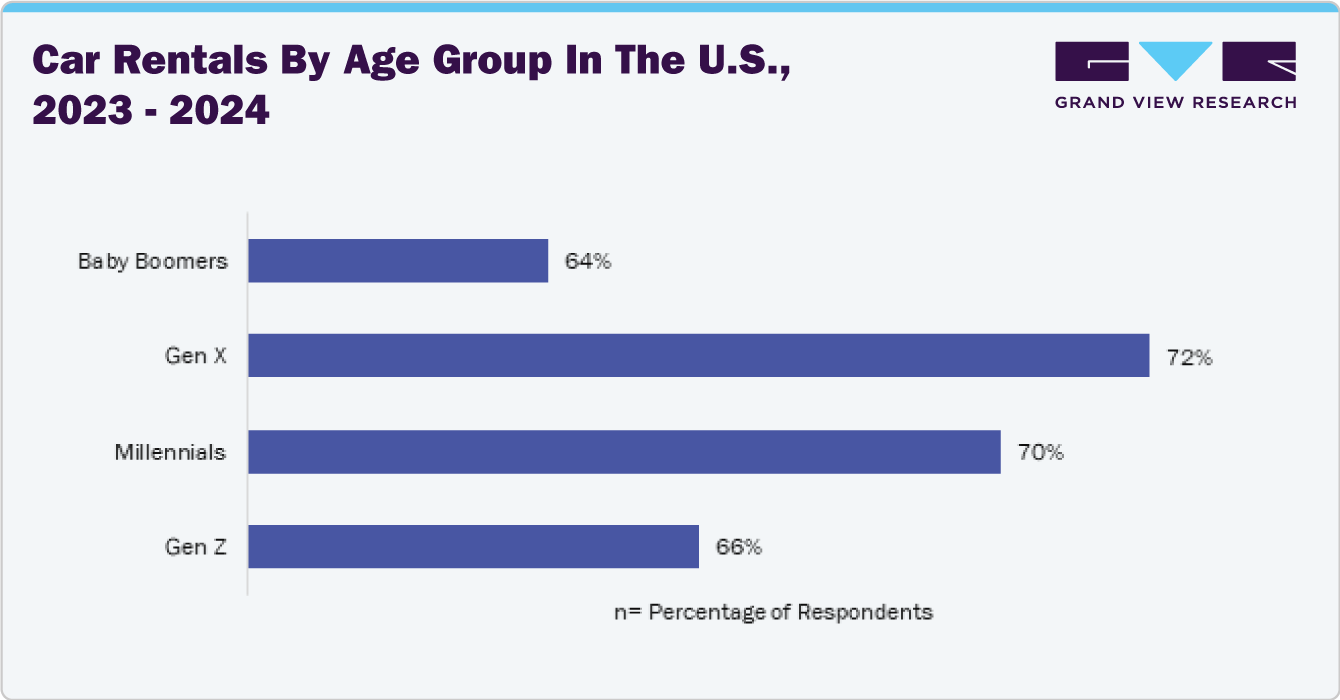

An October 2024 survey conducted by Zubie’s rental fleet management team, involving a sample of 2,016 respondents from the U.S., highlighted rental car preferences, driving behaviors, and attitudes towards rental cars. According to the survey, in 2023, 48 million Americans rented a car, marking a 19.4% increase from the previous year. On average, consumers rent two cars per year, with 74% of them primarily using rental cars for vacation and leisure travel.

Consumer behavior regarding safety while driving rental cars varies based on factors such as age and gender. The survey revealed that men are twice as likely as women to drive recklessly in a rental car. Among different age groups, Millennials are the most likely to drive recklessly. In addition, 52% of car renters stated they drive more cautiously when renting high-end or luxury vehicles.

An analysis of Google searches related to rental car accidents in the U.S. revealed that Tampa, Florida, has the highest rate of rental car collisions among major U.S. cities, based on keyword search volume. Tampa is closely followed by Atlanta, Georgia, and Miami, Florida-cities known for their heavy traffic and high tourism. For rental car companies and operators, telematics and fleet management software offer solutions to track vehicles and protect their assets by detecting high-risk drivers, which can safeguard the company’s profitability.

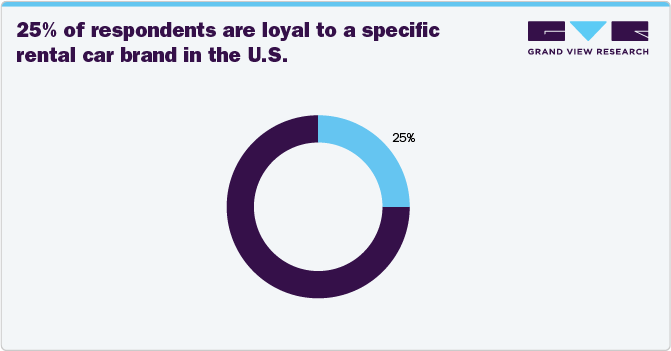

Affordability is the top priority for 77% of consumers when selecting a rental car, with Americans budgeting an average of USD 86.04 per day. Nearly half of the respondents (48%) choose fuel-efficient vehicles to save on costs. However, hidden fees remain a concern, as 56% of respondents report a disconnect between advertised prices and their final bills. While only 25% of consumers show brand loyalty, 48% are willing to rent from a less convenient location to save money. In addition, 57% find the rental checkout process frustrating, with 40% expressing dissatisfaction when returning the car.

Vehicle Insights

Economy car rentals held a revenue share of over 32% in 2024 due to their affordability, widespread availability, and strong demand from budget-conscious consumers. These vehicles offer a cost-effective solution for travelers seeking basic, reliable transportation for short trips or vacations. The rising popularity of economy cars is attributed to the increasing number of leisure travelers, with many opting for these vehicles to save on travel expenses. In addition, car rental companies are expanding their fleets of compact and economy models to meet growing demand. For instance, major rental companies like Enterprise and Hertz continue to prioritize their economy car offerings, capitalizing on the need for low-cost options.

SUVs rentals are projected to grow at a CAGR of 10.7% from 2025 to 2030. SUVs offer more spacious interiors and increased cargo capacity compared to traditional sedans, making them an attractive option for families and travelers with larger groups or luggage. In addition, SUVs provide a sense of safety and stability, which can be especially appealing for customers seeking reliable and comfortable transportation during their travels. The popularity of road trips and outdoor adventures has also contributed to the rising demand for SUV rentals, as these vehicles are well-suited for various terrains and weather conditions.

Application Insights

Car rentals for airport transport held a revenue share of over 38% in 2024, driven by the high volume of travelers flying domestically and internationally. Airport car rentals offer convenience and flexibility for tourists, business travelers, and those in need of reliable transport from airports to hotels or meeting locations. Airports are major hubs for rental services, with companies like Avis, Hertz, and Enterprise strategically placing rental desks and fleets at major terminals to cater to passengers' immediate transportation needs. In addition, the growth in international tourism and the resurgence of air travel post-pandemic has boosted demand for airport car rentals as travelers seek easy and cost-effective ways to navigate unfamiliar destinations.

Car rentals for local usage are projected to grow at a CAGR of 12.1% from 2025 to 2030, driven by increasing urbanization, changes in mobility preferences, and the shift toward flexible, on-demand transportation solutions. Consumers are increasingly turning to car rentals for short-term, local travel due to the growing popularity of “car-sharing” models, especially in urban areas where owning a personal vehicle is less practical. Companies like Zipcar and Turo have popularized this trend, offering local rental options that cater to both short-term business and leisure needs. In addition, the growth of subscription-based services and digital platforms allowing users to rent vehicles for specific time frames further supports this trend, making car rentals for local usage an attractive alternative to traditional car ownership.

Booking Mode Insights

Online bookings held a revenue share of over 71% in 2024. This is attributed to the growing preference for digital platforms that offer convenience, transparency, and competitive pricing. Consumers increasingly use online channels such as company websites, apps, and third-party platforms like Expedia or Kayak to compare prices, read reviews, and make bookings in real time. The rise of mobile-first and user-friendly apps has made the booking process smoother, especially for travelers who need to secure transportation quickly.

Offline/direct car rental bookings are projected to grow at a CAGR of 9.7% from 2025 to 2030, as they remain a preferred option for some consumers, particularly those seeking personalized service or booking in areas with less internet penetration. Offline bookings often appeal to older consumers or those who may not be as familiar with digital platforms. In addition, travelers who prefer to rent cars directly at rental counters-such as at airports or city locations-are still a sizable market, especially in regions where internet access might be limited or less reliable. Some customers also prefer face-to-face interactions for transparency and to ask specific questions about vehicle features or insurance options, making offline rentals an essential component of the car rental ecosystem in both emerging and established markets.

Regional Insights

The car rental market in North America accounted for a share of 36.39% of the global market revenue in 2024. The presence of some of the leading car rental operators in this region, such as Avis Budget Group and Enterprise Rent-a-Car, is anticipated to provide lucrative growth opportunities. The increasing number of business and leisure trips across the region is also a critical factor propelling regional growth. In addition, the region includes numerous popular tourist destinations that attract a large number of travelers who require car rental services, ultimately boosting market growth.

U.S. Car Rental Market Trends

Car rental industry in the U.S. is expected to grow at a CAGR of 8.7% from 2025 to 2030. A key driver is the strong demand for rental cars in the post-pandemic era, with leisure and business travel recovering robustly. As of 2023, travel to major U.S. cities such as New York, Los Angeles, and Miami have seen a significant uptick, spurring the need for short-term vehicle rentals. The increasing popularity of road trips, especially among domestic tourists, is also fueling growth. In addition, the expanding presence of electric vehicles (EVs) in rental fleets, especially with companies like Enterprise and Hertz investing in EV options, aligns with the growing consumer interest in eco-friendly transportation.

Europe Car Rental Market Trends

The Europe car rental industry accounted for a share of over 24% of the global market revenue in 2024, largely due to the region's thriving tourism industry and high volume of international travelers. Popular destinations such as Spain, Italy, and France continue to attract millions of tourists each year, creating a stable demand for rental cars. For example, Spain’s Costa Brava and the French Riviera are renowned for attracting both domestic and international visitors who rely on car rentals for convenience.

Asia Pacific Car Rental Market Trends

The car rental industry in Asia Pacific is expected to grow at a CAGR of 12.7% from 2025 to 2030. Rising disposable incomes of consumers, steadily growing economies, and increasing expenditure on business travel are expected to impact the regional market growth favorably. The markets in China and India are expected to expand exponentially over the forecast period. Government bans on car purchases in certain parts of China to address the rising issues of pollution and traffic are anticipated to encourage people to opt for car rental services.

Key Car Rental Company Insights

The global market is moderately fragmented and is characterized by the presence of a large number of international and local players. Key car rental players are anticipated to focus on expansion strategies to gain regional market share, create brand awareness, and penetrate developing markets. The main focus of these players is on enhancing their services to maximize profitability and gain a larger customer base.

Strategic partnership is another critical strategy implemented by market participants to strengthen their hold on the market. For instance, in January 2023, Hertz and Uber Technologies Inc. disclosed their plans to offer up to 25,000 electric vehicles (EVs) for rental to Uber drivers in Europe by 2025. The rental deal will encompass models from renowned brands like Polestar and Tesla. The rollout began in January 2023 in London, with Hertz, which will add over 10,000 EVs by 2025, allowing Uber drivers to rent these vehicles for their ride-hailing services.

Key Car Rental Companies:

The following are the leading companies in the car rental market. These companies collectively hold the largest market share and dictate industry trends.

- Enterprise Holdings

- The Hertz Corporation

- Avis

- Europcar

- Sixt

- ALD Automotive

- Localiza

- Movida

- Carzonrent

- Al-Futtaim Vehicle Rentals (AVR)

Recent Developments

-

In May 2023, Car Karlo Mobility Technologies LLP unveiled their self-driven car rental services in Pune, India. The company aims to tap into the rapidly expanding Indian market by introducing a user-friendly car rental booking website and mobile app.

-

In April 2022, SIXT, a leading global mobility provider, continued with its expansion throughout the U.S. The company revealed plans to open new branches in Charlotte and Baltimore, to provide customers with a broader selection of rental options along the East Coast.

-

In April 2021, GoAir joined forces with Eco Europcar to introduce car rental services in 100 cities throughout India, encompassing 25 airports. The partnership allows GoAir to provide chauffeur-driven cars, ranging from mid to luxury car segments, through Eco Europcar's platform.

-

In May 2021, Uber Technologies Inc. introduced a car rental service named Uber Rent in Washington DC. In addition, the company revealed its plans to expand the Uber Reserve option for several major airports in the U.S.

Car Rental Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 168.48 billion

Revenue forecast in 2030

USD 278.03 billion

Growth rate (Revenue)

CAGR of 10.5% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, application, booking mode, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, South Africa, UAE

Key companies profiled

Enterprise Holdings, The Hertz Corporation, Avis, Europcar, Sixt, ALD Automotive, Localiza, Movida, Carzonrent, Al-Futtaim Vehicle Rentals (AVR)

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Car Rental Market Report Segmentation

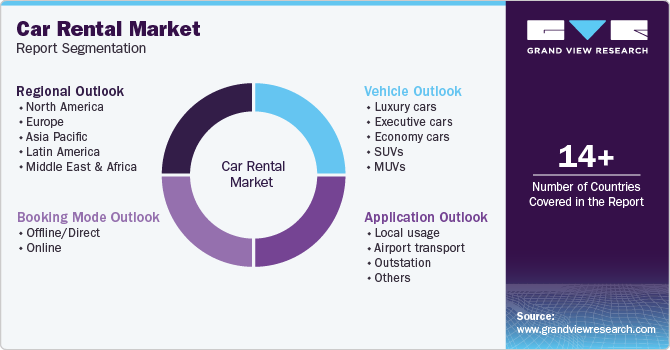

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global car rental market based on vehicle, application, booking mode, and region:

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Luxury cars

-

Executive cars

-

Economy cars

-

SUVs

-

MUVs

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Local usage

-

Airport transport

-

Outstation

-

Others

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline/Direct

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global car rental market size was estimated at USD 149.87 billion in 2024 and is expected to reach USD 168.48 billion in 2025.

b. The global car rental market is expected to grow at a compound annual growth rate of 10.5% from 2025 to 2030, to reach USD 278.03 billion by 2030.

b. The car rental market in North America accounted for a share of 36.39% of the global market revenue in 2024. The presence of some of the leading car rental operators in this region, such as Avis Budget Group and Enterprise Rent-a-Car, is anticipated to provide lucrative growth opportunities.

b. Some key players operating in the car rental market include Enterprise Rent-A-Car, The Hertz Corporation, Sixt SE, Europcar, and Avis Budget Group.

b. Key factors that are driving the car rental market growth include an upsurge in travel and tourism activities across the globe and improved road infrastructure, coupled with increased disposable incomes, especially in emerging economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.