- Home

- »

- Renewable Energy

- »

-

Carbon Credit Market Size, Share & Growth Report, 2030GVR Report cover

![Carbon Credit Market Size, Share & Trends Report]()

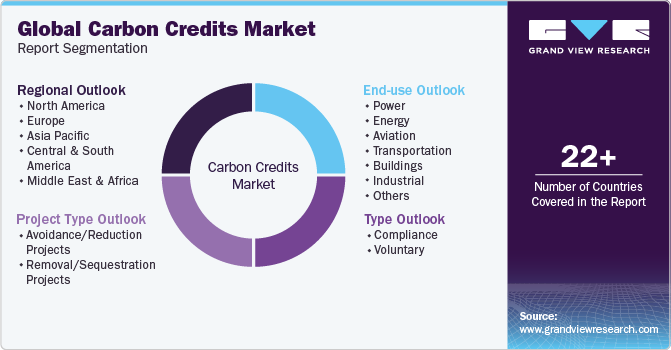

Carbon Credit Market Size, Share & Trends Analysis Report By Type (Compliance, Voluntary), By Project Type (Avoidance/Reduction Projects, Removal/Sequestration Projects), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-080-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Carbon Credit Market Size & Trends

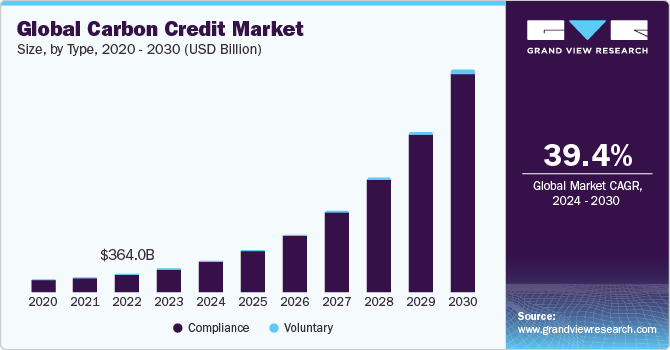

The global carbon credit market size was estimated at USD 479.41 billion in 2023 and is expected to grow at a CAGR of 39.4% from 2024 to 2030. The demand for carbon credits has been increasing in recent years due to factors such as various government-introduced policies & regulations aimed at reducing greenhouse gas (GHG) emissions. Companies that are subject to these regulations may need to purchase carbon credits to offset their emissions and comply with the regulations. The Indian Government has passed the Energy Conservation Bill, 2022, which clears the way for establishing carbon credit markets. The global market growth is primarily driven by a combination of state-level programs and voluntary markets.

There are also voluntary markets in the U.S. where companies can purchase carbon credits to offset their emissions. These voluntary markets are often used by companies that want to reduce their carbon footprint but are not required to do so by regulation. Overall, the U.S. market is relatively small compared to the markets in other regions, such as Europe, but it is growing and could potentially play a larger role in reducing GHG emissions in the future. Companies are increasingly recognizing the importance of sustainability and reducing their carbon footprint as part of their corporate social responsibility initiatives.

This has led to an increased demand for carbon credits as a way to offset their emissions. In addition, growing concerns about climate change and its potential impacts have led to an increased demand for carbon credits. One of the major challenges faced by the market includes price volatility of carbon credits, which is subject to fluctuate as per demand and supply. This can make it difficult for companies to plan for the long term and can also make it challenging to ensure that the price of carbon credits provides a sufficient financial incentive for emissions reductions.

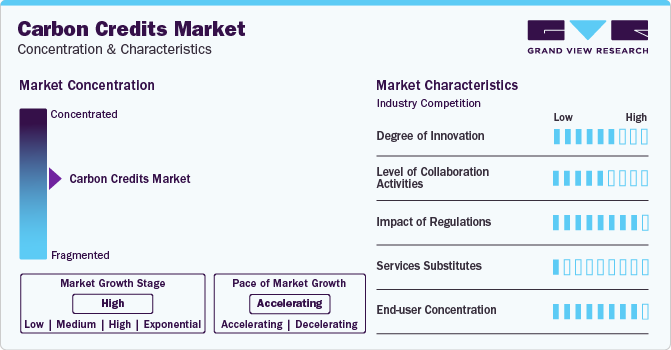

Market Concentration & Characteristics

Emerging economies and companies are now showing interest in trading carbon credits. For instance, in June 2023, Saudi Arabia-based investment firm, Olayan Financing Company (OFC), a subsidiary of The Olayan Group, became a participant in the largest carbon credit auction in Nairobi, Kenya, where over 2 million tons of high-quality carbon credits were auctioned to over 16 companies in Saudi Arabia.

Emission trading schemes (ETSs) are highly effective parameters that facilitate economic growth and carbon mitigation, especially for economically emerging countries, such as China and India. These schemes can further increase the cash flow, production, and investment decisions of regulated companies. According to the government of China, in 2022, the daily weighted average price of China Emission Allowances (CEAs) representing carbon prices in the national compliance market was USD 8.34/mtCO2e (metric tons of carbon dioxide-equivalent), which was higher than the previous year’s price of USD 7.35/mtCO2e. The rising prices in China are anticipated to boost the shift toward greener economic situations.

Type Insights

Based on type, the market is further categorized into compliance and voluntary. In terms of revenue, the compliance segment accounted for the largest share of 98.80% in 2023. The compliance carbon credit market is a market where companies and organizations, that are regulated by a government or a specific authority, are required to offset their carbon emissions by purchasing carbon credits. These credits represent a reduction in GHG emissions from an approved project, such as renewable energy or energy efficiency initiatives.

Governments around the world are implementing policies and regulations to reduce GHG emissions and combat climate change. Many of these regulations require companies to offset their emissions by purchasing carbon credits. These factors are expected to drive the compliance carbon credits market growth. Carbon credits can provide financial incentives for companies to invest in low-carbon technologies and projects. By reducing their emissions and purchasing carbon credits, companies can reduce their exposure to carbon taxes and other costs associated with carbon emissions.

Project Type Insights

On the basis of project type, the market has been divided into removal/sequestration projects and avoidance/reduction projects. The removal/sequestration projects segment is further sub-segmented into technology-based and nature-based projects. In terms of revenue, the avoidance/reduction projects segment dominated the market in 2023 and accounted for a share of 66.45% of the overall revenue.

Avoidance/reduction projects involve the implementation of various strategies to avoid or reduce carbon emissions by undertaking measures for improving the energy efficiency of the system and initiating renewable energy projects. According to a report published by the World Meteorological Organization (WMO) in May 2023, there is a 66% probability that the average annual rate of increase in near-surface global temperatures from 2023 to 2027 will be at least 1.5 above the pre-industrial levels owing to the greenhouse gas emissions for at least one year.

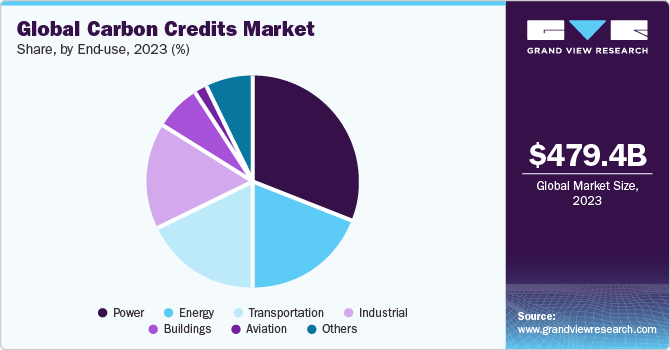

End-use Insights

Based on end-uses, the market is further divided into energy, power, transportation, buildings, power, industrial, and others. In terms of revenue, the power segment emerged as the largest segment in 2023 with a revenue share of 31.09%. The others segment includes agriculture, forestry, and waste. The power end-use segment is a large emitting sector and uses low GHG technologies to adopt carbon-offsetting projects and schemes. Companies worldwide are making efforts to adopt renewable energy sources, such as solar energy, wind energy, and geothermal energy, to reduce their carbon emissions and generate carbon credits. These credits can be further sold to other companies or the open market for additional revenue generation. Carbon offsets are a market-based mechanism used to mitigate GHG emissions, including those in the energy sector.

Essentially, carbon offsets allow entities to fund emission reduction projects elsewhere to offset their own emissions. In the energy sector, this can involve investing in renewable energy projects, such as wind or solar, or in methane-based projects. In the industrial sector, different industrial processes, such as the manufacturing of steel, chemicals, etc., release carbon dioxide as a byproduct into the atmosphere. Moreover, the combustion of distinctive fuels, such as natural gas, coal, and petroleum coke, during the production of chemicals, releases significant amounts of carbon dioxide into the atmosphere. According to the International Energy Agency (IEA), direct carbon dioxide emissions globally from primary chemical production were recorded to be approximately 935 Mt in 2022.

Regional Insights

The North American carbon credit market growth is driven by a combination of government programs and voluntary markets. At the state level, several cap-and-trade programs have been introduced to cap the total amount of greenhouse gas emissions allowed within the state; this requires companies to purchase carbon credits to offset their emissions.

U.S. Carbon Credit Market Trends

The U.S. carbon credit market is expected to have significant growth over the coming years. In the U.S., GHG emissions are increasing due to the rising energy demand from end-use industries, such as power, aviation, and chemicals. According to a report published by the United States Environmental Protection Agency (USEPA), the total U.S. GHG emission was 6,340.2 million metric tons of carbon dioxide equivalent (MMT CO2 Eq) in 2021. Furthermore, CO2 emissions from fossil fuel combustion increased by 6.8% compared to 2020. Carbon dioxide emission was also high in the U.S. due to the use of coal, natural gas, and fossil fuels. In the energy sector, greenhouse gases are generated due to the combustion of fossil fuels, such as coal, oil, and natural gas, during the electricity generation. According to the U.S. Energy Information Administration, energy consumption in the U.S. was 4.05 trillion kilowatt-hours (kWh) in 2022, 2.6% higher compared to 2021. In addition, HVAC systems consume most of the electricity. With the growing population, the electricity demand is rising in the U.S., which has been positively contributing to GHG emissions. Hence, there is a need to adopt GHG control measures. Therefore, with the growing GHG emission & energy demand and expansion in the power industry, the market demand is also expected to increase.

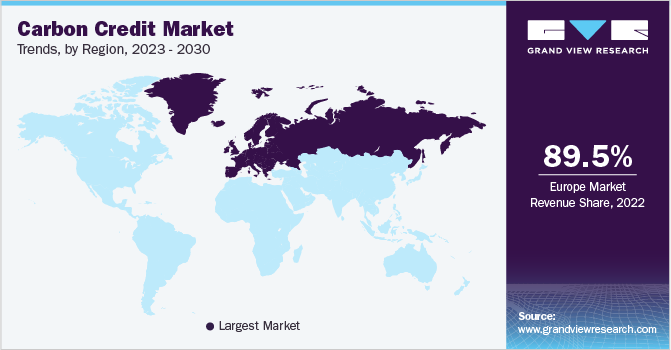

Europe Carbon Credit Market Trends

The carbon credit market in Europe accounted for the largest revenue share of 89.26% in 2023. The market is based on the EU’s Emissions Trading System (ETS), which is the largest carbon market in the world. The ETS was established in 2005 and covers more than 11,000 installations in the power and industrial sectors in 31 European countries. These installations are responsible for around 45% of the EU's GHG emissions. The price of carbon offsets in the EU ETS is largely determined by supply and demand. The total supply of allowances is capped by the EU, and the price of carbon credits can fluctuate based on factors, such as economic conditions, energy prices, and climate policies. The demand for carbon credits can also be influenced by factors, such as the price of fossil fuels, the availability of renewable energy, and adoption of low-carbon technologies.

The UK carbon credit market accounted for the largest share of 38.39% of the Europe market revenue in 2023 owing to the adoption of favorable government schemes to reduce carbon emissions.The UK Emissions Trading Scheme (UK ETS) is a collective scheme of participants, including the UK, Scottish & Welsh governments, the Northern Ireland Department of Agriculture, and Environment & Rural Affairs.The scheme applies to energy-intensive industries, such as power generation and aviation.

The carbon credit market in Italy is expected to grow at the fastest CAGR of 41.2% from 2024 to 2030. According to the International Energy Agency, the country aims to reduce carbon emissions by 38% below 2005 levels by 2030. The country’s emission reduction goals are expected to propel growth for the carbon credit market in the country over the forecast period.

Asia Pacific Carbon Credit Market Trends

Asia Pacific has most of the countries, such as China and India, with rapidly growing economy. Moreover, the demand for fossil fuels for energy generation is increasing owing to its increased consumption in these countries. It is anticipated to result in increased carbon emissions in the region, which is expected to boost market growth.

The China carbon credit market accounted for the largest share of 59.12% in the Asia Pacific market. Owing to the growing building & construction activities in China, demand for carbon sinks is expected to increase during the forecast period. This increased carbon sink requirement is expected to drive the domestic market growth.

The carbon credit marketin Australia is expected to grow at a CAGR of 46.4% from 2024 to 2030 owing to the rising GHG emissions in the country. According to a report published by the Government of Australia in August 2023, GHG emissions of the order of 465.9 million tons of carbon dioxide equivalent were recorded in the country in 2022. The trend shows an increase in GHG emissions (0.1%) with most of the GHG emissions from the transportation sector in the country.

Central & South America Carbon Credit Market Trends

In Central & South America, the demand for carbon credit projects is expected to increase owing to increase in power generation, transportation, industrial growth, and infrastructure development. As the region is observing growth in the manufacturing output, the energy demand has been rising.

The Brazil Carbon Credit Market accounted for the largest share of 72.13% in 2023 in Central & South America owing to the increasing number of carbon removal projects to achieve carbon neutral status.

Middle East & Africa Carbon Credit Market Trends

Countries in the region, such as UAE and Saudi Arabia, have signed international GHGs and global thermal maintenance treaties such as the Paris Agreement. These agreements made it mandatory for the countries to reduce their GHG emissions. Furthermore, companies in the region have adopted sustainability measures to reduce their carbon footprint. Hence, due to the international collaboration & agreements and these countries’ active involvement & investment in the implementation of carbon removal projects boost the market demand.

The carbon credit marketin UAE accounted for the largest share of 82.15% in 2023. In the UAE, GHG emissions are expected to increase in the coming months due to an increase in the production and consumption of fossil fuels. According to the report published by Climate Action Tracker in July 2023, UAE is one of the first countries to submit the new NDC to the United Nations Framework Convention on Climate Change. The government has been working proactively to take adequate measures to reduce GHG emissions to fulfill its NDC.

The Saudi Arabia carbon credit market is expected to grow at a significant rate from 2024 to 2030. Due to the growing oil production, GHG emissions from oil refineries. To mitigate these emissions and achieve sustainability goals, the demand for carbon credit market is expected to increase in the coming years.

Key Carbon Credit Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to expand & maintain their market share. Key companies in the carbon credit market include WGL Holdings Inc, EKI Energy Services Ltd., NativeEnergy, ClearSky Climate Solutions, and 3Degrees Group, Inc., among others.

-

In March 2024, Toucan launched the world’s first String PV inverter market for biochar carbon credits as a response to increasing carbon credit demand

-

In January 2024, EKI and Jospong Group announced a partnership to generate carbon credits up to USD 1 billion in Ghana

-

In December 2023, ACX announced a partnership with CT group to explore Carbon credit market opportunities in Vietnam

-

In July 2023, JSW announced plans to generate more carbon credits with the expansion of its portfolio. The company currently has 20-21 accumulated carbon credits and plans to further increase them with the commencement of solar module manufacturing, a battery energy storage system, and a green hydrogen production unit. All these projects will be completed by 2025

Several companies are engaged in framework development to improve their global market share. For instance, in March 2023, The Integrity Council for the Voluntary Carbon Market inaugurated its Core Carbon Principles and Program-level Assessment Framework for carbon credits setting thresholds on carbon emission and sustainable development.

Key Carbon Credit Companies:

The following are the leading companies in the carbon credit market. These companies collectively hold the largest market share and dictate industry trends.

- 3Degrees Group, Inc.

- Carbon Care Asia Ltd.

- CarbonBetter

- ClearSky Climate Solutions

- EKI Energy Services Ltd.

- Finite Carbon

- NativeEnergy

- South Pole Group

- Torrent Power Ltd.

- WGL Holdings Inc.

Carbon Credit Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 644.78 billion

Revenue forecast in 2030

USD 4,734.35 billion

Growth rate

CAGR of 39.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, project type, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Germany; Spain; Italy; The Netherlands; Sweden; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia

Key companies profiled

3Degrees Group, Inc.; Carbon Care Asia Ltd.; CarbonBetter; ClearSky Climate Solutions; EKI Energy Services Ltd.; Finite Carbon; NativeEnergy; South Pole Group; Torrent Power Ltd.; WGL Holdings Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Credit Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the carbon credit market report on the basis of type, project type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Compliance

-

Voluntary

-

-

Project Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Avoidance/Reduction Projects

-

Removal/Sequestration Projects

-

Nature-based

-

Technology-based

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Power

-

Energy

-

Aviation

-

Transportation

-

Buildings

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

The Netherlands

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global carbon credit market was estimated at USD 479.41 billion in 2023 and is projected to reach USD 644.78 billion in 2024.

b. The global carbon credit market is expected to witness a compound annual growth rate of 39.4% from 2024 to 2030 to reach USD 4,734.35 billion by 2030.

b. Europe emerged as the largest regional segment and accounted for 89.26% of the market in 2023. Growing concern about climate change and its potential impacts has led to an increased demand for carbon credits over the forecast period.

b. Some of the key players operating in the carbon credits market include 3Degrees Group, Inc., Carbon Care Asia Ltd., CarbonBetter, ClearSky Climate Solutions, EKI Energy Services Limited, Finite Carbon, among others.

b. The demand for carbon credits has been increasing in recent years due to a number of factors, such as several governments have introduced policies and regulations aimed at reducing greenhouse gas emissions which is driving growth of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."