- Home

- »

- Advanced Interior Materials

- »

-

Carbon Neutral Mining Market Size, Industry Report, 2033GVR Report cover

![Carbon Neutral Mining Market Size, Share & Trends Report]()

Carbon Neutral Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Renewable Energy & Microgrids, Electrification Of Mining Fleet & Equipment), By Mine Type (Surface, Underground), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-796-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Neutral Mining Market Summary

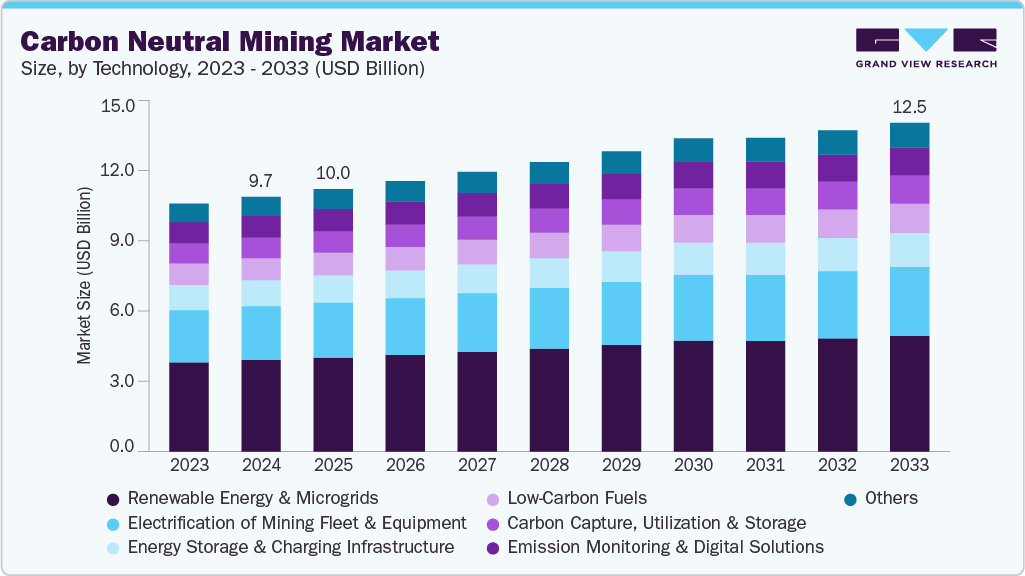

The global carbon neutral mining market size was estimated at USD 9.72 billion in 2024 and is projected to reach USD 12.53 billion by 2033, expanding at a CAGR of 2.9% from 2025 to 2033. The growth is driven by the increasing adoption of renewable energy in mining operations, stringent government regulations on carbon emissions, rising investments in sustainable mining technologies, and the growing commitment of major mining companies toward achieving net-zero emission targets.

Key Market Trends & Insights

- North America dominated the carbon neutral mining market with a revenue share of over 34.0% in 2024.

- The carbon-neutral mining market in Europe is expected to grow at a substantial CAGR of 3.2% from 2025 to 2033.

- By technology, renewable energy & microgrids dominated the market with a revenue share of over 35.0% in 2024.

- In 2024, the surface mining segment held the largest share, over 65.0% of carbon neutral mining market.

Market Size & Forecast

- 2024 Market Size: USD 9.72 Billion

- 2033 Projected Market Size: USD 12.53 Billion

- CAGR (2025-2033): 2.9%

- North America: Largest market in 2024

- Europe: Fastest growing market

Sustainability and decarbonization are key factors driving the market growth, as industries worldwide intensify efforts to achieve net-zero emission targets. Organizations are increasingly adopting renewable energy solutions, low-emission fuels, and efficient resource management practices to minimize their environmental footprint. The global shift toward responsible production and sustainable resource utilization, particularly in sectors supporting clean energy and circular economy initiatives, is reinforcing long-term commitments to carbon neutrality and environmentally conscious growth.

On the technological front, the market is witnessing significant advancements in automation, electrification, and the integration of renewable energy sources. The deployment of electric haul trucks, hydrogen-powered equipment, carbon capture systems, and AI-based monitoring solutions is transforming conventional mining operations into low-emission ecosystems. In addition, the use of smart grids, IoT-enabled energy management, and blockchain for carbon tracking enables transparency and efficiency across the value chain. These innovations are not only reducing operational carbon footprints but also enhancing productivity, positioning technology as a key enabler of the global shift toward carbon-neutral mining.

Drivers, Opportunities & Restraints

The carbon neutral mining market is primarily driven by growing regulatory pressure and corporate commitments to reducing greenhouse gas emissions. Major mining companies, such as Barrick Gold and BHP Group, have announced measurable targets for reducing emissions. Barrick achieved a 16% cut in its GHG emissions by 2023, while BHP has transitioned nearly half of its purchased power to renewable sources. Such initiatives reflect the broader industry shift toward the adoption of renewable energy, low-emission fuels, and energy-efficient systems. Additionally, the rising demand for responsibly sourced critical minerals, such as lithium, nickel, and copper used in clean energy technologies, is reinforcing investment in carbon-neutral mining operations worldwide.

Strong opportunities exist in the electrification of mining fleets, the integration of renewable energy, and carbon capture systems. For instance, Fortescue Metals Group, in April 2025, partnered with Liebherr to develop one of the world’s largest electric mining fleets, valued at over USD 2.8 billion, marking a significant step toward fossil-fuel-free operations. Similarly, Lloyds Metals and Energy Ltd. transitioned its Surjagarh mine in Maharashtra, India, into a green mine in January 2025, reducing its CO₂ emissions by over 30,000 tons annually. These examples demonstrate the increasing potential for mining companies to improve efficiency and ESG performance through decarbonization, digital monitoring, and circular economy practices, particularly in emerging markets with abundant renewable resources.

Despite the progress, the carbon neutral mining market faces significant challenges, including high upfront investment costs, limited renewable infrastructure, and technical complexities. Transitioning to electric or hydrogen-powered fleets and establishing renewable microgrids can increase initial project costs by 30-40% compared to traditional setups. Moreover, remote mining locations often lack stable grid connectivity, which hampers large-scale renewable energy deployment. Even major firms, allocating billions toward decarbonization, such as BHP’s USD 4 billion capital expenditure plan, struggle with Scope 3 emissions and slow adoption rates of new technologies. These factors collectively constrain the pace of achieving full carbon neutrality across the mining value chain.

Technology Insights

The renewable energy & microgrids segment dominates the global carbon neutral mining market, accounting for a significant share of total investments in 2024. Mining companies are increasingly adopting solar, wind, and hybrid microgrid systems to reduce reliance on diesel generators and minimize carbon emissions. These renewable-based systems not only lower operational costs but also ensure a reliable power supply in remote mining areas with limited grid access. Countries such as Australia, Canada, and Chile have been at the forefront of integrating renewable microgrids in large-scale mining operations. For instance, several mining majors have deployed hybrid solar-diesel or wind-battery systems, which deliver reductions of over 30-60% in energy-related emissions, reinforcing this segment’s leadership position in the carbon-neutral mining landscape.

Beyond renewable power integration, other key technologies, such as the electrification of mining fleets, low-carbon fuels, and carbon capture systems, are gaining momentum as complementary enablers of decarbonization. The deployment of electric haul trucks, battery storage, and hydrogen-powered equipment is transforming traditional mining operations into energy-efficient ecosystems. Meanwhile, emission monitoring and digital solutions provide real-time insights into carbon footprints, allowing companies to track progress toward sustainability goals. As renewable technologies mature and costs decline, synergy with these emerging solutions is expected to accelerate the mining industry’s transition toward fully carbon-neutral operations over the coming decade.

Mine Type Insights

The surface mining segment holds the dominant share in the global carbon neutral mining market, driven by its large-scale operations, higher production output, and easier integration of renewable energy systems. Surface mines, which account for a significant portion of global mineral extraction, offer greater flexibility for deploying solar farms, wind turbines, and microgrid infrastructure due to their open layouts and accessibility. Mining giants operating in regions such as Australia, Chile, and South Africa have increasingly transitioned to renewable-powered surface operations, substantially reducing Scope 1 emissions. The availability of space and favorable environmental conditions make surface mining the most suitable option for integrating renewable energy into and implementing large-scale electrification initiatives. For instance, Rio Tinto’s Gudai-Darri iron ore mine in Western Australia operates with a 34 MW solar plant that supplies nearly one-third of its energy needs, while Anglo American’s Los Bronces mine in Chile sources 100% of its electricity from renewable sources. The availability of space and favorable climatic conditions make surface mining the most suitable platform for integrating renewable energy and implementing large-scale electrification initiatives.

In addition to the adoption of renewable energy, surface mines are rapidly embracing the electrification of equipment and low-carbon fuel alternatives to achieve near-term emission reduction targets. The introduction of battery-electric haul trucks, autonomous electric drills, and hybrid conveyor systems has allowed operators to cut fuel consumption and lower operational costs. These technologies are particularly impactful in open-pit and strip-mining operations, where large mobile fleets are traditionally major contributors to carbon emissions.

Conversely, the underground mining segment, while smaller in share, is expected to witness steady growth over the next decade as electrification technologies become more compact and cost-efficient. The confined nature of underground environments presents challenges for integrating renewable energy, but also creates opportunities for reducing energy ventilation and monitoring emissions. Hybrid systems that combine low-carbon fuels with digital emission controls are gaining traction in underground mines as they seek partial decarbonization. Overall, while underground and other mine types are gradually progressing toward sustainability, surface mining is expected to continue dominating the carbon-neutral mining market due to its scale, adaptability, and faster transition potential toward net-zero operations.

Regional Insights

North America carbon neutral mining marketcontinues to lead the global market, driven by strong policy support, advanced technologies, and growing ESG commitments across the mining industry. The region’s progress is evident through recent projects such as IAMGOLD Corporation’s Côté Gold Mine in Ontario (Canada), which received approximately USD 1.1 million in federal funding under the Low Carbon Economy Fund to electrify key mining equipment and infrastructure expected to reduce over 7,500 tons of CO₂ emissions by 2030.

U.S. Carbon Neutral Mining Market Trends

The U.S. carbon neutral mining market is gaining momentum as part of the nation’s broader clean energy and net-zero agenda. Federal incentives such as the Inflation Reduction Act (IRA) have accelerated the adoption of renewable microgrids, carbon capture systems, and low-emission fleet technologies. A recent milestone, announced in March 2025, is Taseko Mines’ Florence Copper Project in Arizona, which employs in-situ recovery and solvent extraction/electrowinning (SX/EW) methods. This innovative approach has resulted in a reduction of up to 71% in carbon emissions compared to traditional open-pit copper mining, marking a significant advancement in sustainable extraction practices within the North American mining industry.

Asia Pacific Carbon Neutral Mining Market Trends

Asia Pacific remains the most significant and fastest-growing region in the carbon neutral mining market, led by China, Australia, and India, where governments and corporations are investing heavily in renewable-based mining solutions. In a notable example, Rio Tinto announced a USD 143 million investment in February 2025 to support the development of battery-electric haul trucks and renewable power infrastructure at its Pilbara iron ore operations. This initiative is part of the company’s broader decarbonization strategy aimed at cutting Scope 1 and 2 emissions by 50% by 2030, reinforcing its commitment to achieving net-zero operations by 2050.

Europe Carbon Neutral Mining Market Trends

The European market is growing at a substantial rate of carbon-neutral mining innovation, backed by stringent EU environmental regulations and green industrial policies. The continent’s leadership is reflected in projects such as Stegra AB’s (formerly H2 Green Steel) decarbonized steel mill in Boden, Sweden, which is likely to utilize renewable hydrogen instead of coal to reduce emissions by approximately 95%. Operations are expected to begin in 2026. Mining operators in Germany, Finland, and Sweden are also investing in electric mining equipment, carbon capture, utilization, and storage (CCUS) technologies, as well as digital emission monitoring systems, in line with the EU Green Deal.

Key Carbon Neutral Mining Company Insights

Some of the key players operating in the market include BHP Group Ltd., Rio Tinto Group, and Fortescue Metals Group Ltd., among others.

-

BHP Group Ltd., established in 1885 and headquartered in Melbourne, Australia, is one of the world’s largest diversified mining companies engaged in the production of iron ore, copper, coal, and nickel. The company has committed over USD 4 billion to decarbonization initiatives through 2030, focusing on the adoption of renewable energy, the electrification of mining operations, and the integration of low-carbon fuels to achieve net-zero operational emissions by 2050.

-

Rio Tinto Group, founded in 1873 and headquartered in London, United Kingdom, operates globally in the extraction and processing of minerals, including aluminum, copper, iron ore, and lithium. The company is investing heavily in renewable energy projects and battery-powered mining equipment to achieve a 50% reduction in Scope 1 and 2 emissions by 2030 and net-zero by 2050. Rio Tinto’s innovative decarbonization roadmap, which includes solar farms and hydrogen-based smelting, positions the company among the most advanced mining companies in their pursuit of carbon neutrality.

-

Fortescue Metals Group Ltd., established in 2003 and headquartered in Perth, Australia, is a leading producer of iron ore with a strong focus on clean energy transformation. The company aims to achieve zero emissions across its operations by 2030 through the electrification of its haul trucks, the development of hydrogen-powered mining fleets, and the integration of large-scale renewable energy sources. Fortescue’s Green Energy division is pioneering hydrogen and ammonia projects to decarbonize both its own operations and the broader resources sector, making it a key global driver in carbon-neutral mining.

Key Carbon Neutral Mining Companies:

The following are the leading companies in the carbon neutral mining market. These companies collectively hold the largest market share and dictate industry trends.

- Anglo American plc.

- BHP Group Ltd.

- Boliden AB

- Fortescue Metals Group Ltd.

- Glencore plc.

- Newmont Corporation

- Rio Tinto Group

- Sibanye-Stillwater Limited

- Teck Resources Limited

- Vale S.A.

Recent Developments

-

BHP Group Ltd, in June 2025, announced the launch of a large-scale solar and battery storage project at its Nickel West operations in Western Australia. The initiative aims to supply over 50% of the site’s electricity demand through renewable sources, significantly cutting Scope 2 emissions and supporting BHP’s goal of achieving net-zero operational emissions by 2050.

-

Rio Tinto Group, in April 2025, partnered with Caterpillar Inc. to deploy a fleet of fully electric haul trucks at its Gudai-Darri iron ore mine in Australia. This milestone marks one of the world’s first large-scale implementations of battery-electric mining trucks, projected to reduce annual CO₂ emissions by up to 30,000 tons, reinforcing Rio Tinto’s 2030 emission reduction targets.

-

Fortescue Metals Group Ltd, in January 2025, successfully commenced operations of its 100% renewable-powered hydrogen plant in Western Australia under Fortescue Energy. The facility will produce green hydrogen for use in mining trucks and heavy equipment, enabling Fortescue to progress toward its ambitious “real zero” target by 2030 and set a benchmark for decarbonization in the global mining industry.

Carbon Neutral Mining Market Report Scope

Report Attribute

Details

Market Definition

Capital and service spending by mining companies is directly targeted at achieving net-zero/carbon-neutral operations.

Market size value in 2025

USD 10.00 billion

Revenue forecast in 2033

USD 12.53 billion

Growth rate

CAGR of 2.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD Million/Billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, mine type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; China; India; Japan; Australia; Brazil; South Africa; Iran

Key companies profiled

Anglo American plc; BHP Group Ltd; Boliden AB; Fortescue Metals Group Ltd; Glencore plc; Newmont Corporation; Rio Tinto Group; Sibanye-Stillwater Limited; Teck Resources Limited; Vale S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Neutral Mining Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global carbon neutral mining market report based on technology, mine type, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Renewable Energy & Microgrids

-

Electrification of Mining Fleet & Equipment

-

Energy Storage & Charging Infrastructure

-

Low-Carbon Fuels

-

Carbon Capture, Utilization & Storage

-

Emission Monitoring & Digital Solutions

-

Others

-

-

Mine Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Surface

-

Underground

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Australia

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global carbon neutral mining market size was estimated at USD 9.72 billion in 2024 and is expected to reach USD 10.00 billion in 2025.

b. The global carbon neutral mining market is expected to grow at a compound annual growth rate of 2.9% from 2025 to 2033, reaching USD 12.53 billion by 2033.

b. By technology, renewable energy & microgrids dominated the market with a revenue share of over 35.0% in 2024.

b. Some of the key vendors in the global carbon-neutral mining market include Anglo American plc, BHP Group Ltd., Boliden AB, Fortescue Metals Group Ltd., Glencore plc, Newmont Corporation, Rio Tinto Group, Sibanye-Stillwater Limited, Teck Resources Limited, and Vale S.A.

b. The global carbon neutral mining market is driven by the increasing push for sustainability and net-zero commitments across the mining industry. Growing adoption of renewable energy, electrification of mining fleets, and carbon capture technologies are accelerating the transition toward low-emission operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.