- Home

- »

- Medical Devices

- »

-

Cardiac Catheters And Guidewires Market Size Report, 2030GVR Report cover

![Cardiac Catheters And Guidewires Market Size, Share & Trends Report]()

Cardiac Catheters And Guidewires Market Size, Share & Trends Analysis Report By Product (Cardiac Catheters, Cardiac Guidewires), By End-use (Hospitals, Clinics, Ambulatory Surgical Centers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-541-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

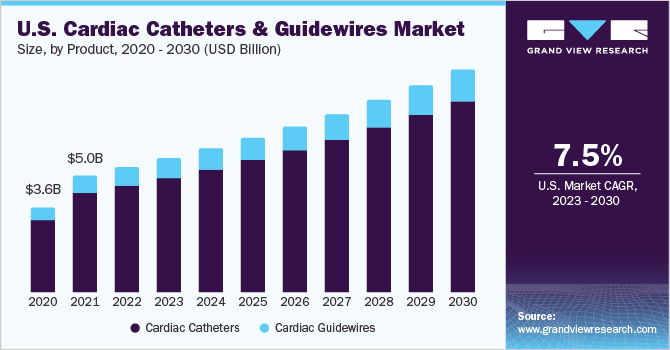

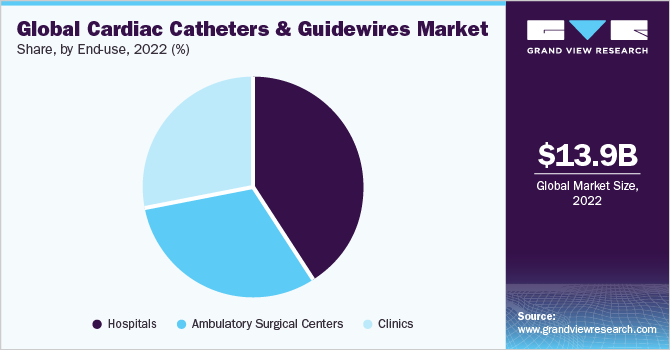

The global cardiac catheters and guidewires market size was estimated at USD 13.9 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. The industry growth is attributed to technological advancements, initiatives by various governments & organizations, and the rising incidence of chronic diseases. COVID-19 had a negative impact on the industry. As a result of COVID-19 emergency cases, hospitals were forced to free up capacity and resources for potential patients, resulting in a considerable decrease in the number of routine & elective procedures, such as cardiac catheterization procedural volume.

According to the National Center for Biotechnology Information, in 2021, both coronary angiography and percutaneous coronary intervention (PCI) volumes decreased by 64% in April 2020 compared to April 2019. However, the industry is likely to witness significant growth during the forecast period due to the high prevalence of chronic diseases, increased demand for improved healthcare systems among the geriatric population, presence of well-established healthcare facilities, and technological advancements. For instance, in January 2021 Medical Manufacturing Technologies—an Arcline investment management portfolio company that provides medical device manufacturing solutions—integrated Biomerics’ R&D Engineering into its automation technologies and catheter manufacturing, which was expected to propel industry growth.

The increasing prevalence of chronic diseases globally is likely to boost the demand for cardiac catheters & guidewires. For instance, according to FrontPublic Health in 2020, chronic non-communicable diseases (NCDs) account for about 80% of mortality in China among adults aged 60 years, with ischemic heart disease, stroke, chronic obstructive pulmonary disease (COPD), and type 2 diabetes being the most common. Moreover, according to a report published by the CDC in 2021, in the U.S., heart disease is a leading cause of death in both genders and members of the majority of racial & ethnic groups. Moreover, CVD claims one life every 33 seconds in the U.S.

In addition, as per a similar source, in 2021, 695,000 people in the U.S. died as a result of heart disease, i.e., 1 in every 5 deaths was from heart disease. As per a report published by the World Atlas, Russia has the highest prevalence of cardiovascular diseases (CVDs), and around 57.0% of the mortality in the country is due to CVDs. As a result, it is projected that rising CVD cases globally are likely to increase the demand for angioplasty, cardiac catheterization, and PCI. Cardiac catheters and guidewires are two necessities for these treatments. To unblock the coronary arteries, a cardiac catheter is introduced during PCI, for instance, a thin catheter with a deflated balloon tip is also introduced through the arm into the artery during balloon angioplasty.

The catheter tip is then put through the constricted location after being advanced through the artery until it reaches the occluded coronary artery. The balloon is inflated after being inserted into the constricted space to lessen the obstruction. The balloon is flattened, and the catheter is removed when the blockage is reduced. Moreover, the industry players undertake this strategy to strengthen their product portfolios and offer diverse technologically advanced, and innovative products. It is the most prominently adopted strategy by companies to attract more customers. For instance, in February 2022, the U.S. Food and Drug Administration (FDA) approved an additional indication for the use of Teleflex’s specialized catheters and coronary guidewires in crossing chronic complete occlusion percutaneous coronary procedures (CTO PCI), according to the company.

The growing interest in difficult PCI patients about the development of specialized equipment and treatment methods is another important factor that is anticipated to propel industry expansion during the forecast period. The industry is also being driven by the development of specific devices and treatment methods for patients who would otherwise undergo coronary artery bypass graft surgery (CABG) or be managed medically. For instance, in June 2021, Medtronic launched a new-generation drug-coated balloon (DCB) catheter “Prevail” in the European market for the treatment of CAD. Prevail DCB is used during PCI operations to treat blocked or restricted coronary arteries in people with CAD. The regional players are also making continuous efforts to launch new technologically advanced products and maintain their industry position.

Product Insights

In terms of product, the cardiac catheters segment led the global industry in 2022 and held the largest revenue share of 85.7%. The segment is also expected to witness the fastest CAGR over the forecast period. Cardiac catheters are generally used to open blocked blood vessels allowing enhanced blood flow. It gets inflated when inserted inside the blood vessels and thereby, increases the blood flow. Cardiac catheters are majorly used in cardiac catheterization, angioplasty, PCI, and other interventional procedures. In cardiac catheterization, they are used to evaluate heart muscle function, estimate the need for further treatment, and evaluate the presence of valve disease & coronary artery disease.

Similarly, in the case of angioplasty and other interventional procedures, the insertion of a catheter is the initial step of these procedures. The increasing cases of cardiovascular diseases globally are one of the major factors contributing to the segment's growth. For instance, as per the report published by the World Heart Federation, 85.0% of the deaths in low- to middle-income countries are caused due to cardiovascular diseases. Over 18.6 million people die from CVD globally making it the most common cause of death. In April 2019, Oscor, Inc., a U.S.-based implantable devices manufacturer, announced a strategic alliance with Micro Interventional Devices, Inc. (MID) to commercialize minimally invasive annuloplasty technology.

The cardiac catheter segment is further segmented into electrophysiology (EP) catheters, PTCA balloon catheters, IVUS catheters, PTA balloon catheters, guide extension catheters, and others. EP catheters are used for temporary intra-cardiac sensing, recording, stimulation, and mapping. In February 2023, Abbott announced approvals of two electrophysiology products - TactiFlex and FlexAbility catheters. TactiFlex is the world's first flexible tip, contact force sensing ablation catheter that received CE Mark and was launched in Europe to treat patients with abnormal heart rhythms such as atrial fibrillation (AFib). In addition, the FlexAbility ablation catheter secured the U.S. FDA approval to treat patients with complex heart conditions.

In addition, the percutaneous transluminal angioplasty (PTA) balloon catheter is less expensive than other treatment options, making it a cost-effective alternative for patients to treat a variety of vascular diseases such as stenosis, thrombosis, and peripheral arterial disease (PAD). In May 2022, Medtronic announced FDA approval for the IN.PACT 018 PTA Balloon Catheter, a DCB that is indicated for the interventional treatment of PAD in the superficial femoral & popliteal arteries.

End-use Insights

In terms of end-use, the hospitals segment dominated the global industry in 2022 with a revenue share of 40.7% due to the high incidence of cardiovascular diseases globally. The rising number of hospitals globally is also anticipated to support the segment growth over the forecast period. As per the report published by the American Hospital Association in 2023, there were around 6,129 hospitals in the U.S. in 2022, of which 2,978 are nongovernment not-for-profit community hospitals and 944 are state and local government community hospitals. As per the report published by the Centers for Disease Control & Prevention (CDC), coronary heart disease is the most common type of cardiovascular disease and more than 375,000 people died in 2021 in the U.S. Angioplasty, PCI, and cardiac catheterization are majorly recommended for the treatment of such problems, thus, an increase in cases of such diseases is expected to boost the hospital admission rate.

The ambulatory surgical centers (ASCs) segment is estimated to register the fastest CAGR of 8.0% over the forecast period. Ambulatory surgery facilities sometimes referred to as outpatient surgery centers, are frequently chosen by patients having less involved surgeries that require only a brief hospital stay. Rapid healing is possible with minimally invasive interventional techniques, which also have a short hospital stay. Thus, patients opting for such procedures generally prefer to choose ASCs. For instance, percutaneous transluminal coronary angioplasty (PTCA) and percutaneous transluminal angioplasty (PTA) are minimally invasive interventional procedures, that allow rapid healing, and the patients can get back to their normal life within a short period. Currently, the demand for minimally invasive procedures is increasing globally owing to its several advantages, which, in turn, boost the demand for ASCs.

Regional Insights

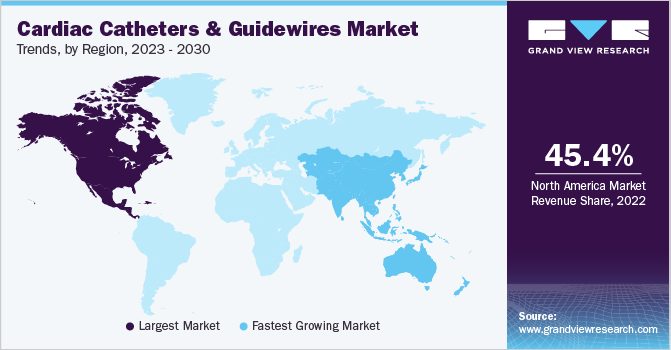

North America dominated the market in 2022 with the largest revenue share of 45.4%. This can be attributed to several factors, such as increased adoption of cardiac catheters and guidewire technology in primary care settings, improved accessibility, and high healthcare spending in countries with efficient reimbursement policies. Technological innovations and the growing incidence of chronic conditions are anticipated to further propel the region’s growth. The increasing incidence of chronic diseases in this region, such as cardiovascular disorders, has created a high demand for imaging analysis. For instance, according to the CDC, around 805,000 people in the U.S. each year suffer from a heart attack.

Asia Pacific is expected to register the fastest CAGR of 8.3% during the forecast period. The rising prevalence of cardiac diseases has created a demand for cardiac catheters & guidewires equipment in APAC countries. Furthermore, with some of the highest diabetes rates in the world, India and China have been the most affected countries. Diabetes claims the lives of about 1.5 million people every year, according to WHO estimates. The population of ASEAN countries is expected to reach 705 million by 2028. According to the British Medical Journal, the incidence rate of diabetes and cardiovascular disease is likely to reach 20% by 2025.

Key Companies & Market Share Insights

The industry players are adopting various strategies, such as mergers & acquisitions, partnerships, and product launches to strengthen their strong foothold in the market. Moreover, key companies invest heavily in research and development to launch new, innovative, technologically advanced products. For instance, in February 2023, Teleflex Inc. announced the milestones in its two new catheter releases: the first clinical use of GuideLiner Coast Catheter and the U.S. FDA clearance of Triumph Catheter.

In addition, in September 2021, Germany-based BIOTRONIK, a global medical technology company announced the addition of the new line extension sizes of the Fortress reinforced introducer sheath line by launching 7- and 8F-compatible sizes.

Furthermore, in November 2019, Terumo Medical Corp. acquired Aortica Corp. with an aim to strengthen the personalized vascular therapy business segment. This may increase the industry share of the company. In May 2019, Medtronic introduced the Telescope Guide Extension Catheter to aid in complicated coronary cases. This product accesses distal lesions and makes additional backup support possible. This may expand the customer base and industry share of the company. Some prominent players in the global cardiac catheters and guidewires market include:

-

Abbott

-

Boston Scientific Corp.

-

Getinge AB

-

Biosense Webster, Inc (Part of Johnson & Johnson)

-

Terumo Medical Corp.

-

BIOTRONIK SE & Co. KG

-

Medtronic

-

CORDIS (A, Cardinal Health Company)

-

QXMédical

-

Teleflex Inc.

-

B. Braun

-

C. R., Bard, Inc (has joined BD)

-

Cardinal Health

-

Merit Medical Systems

-

NIPRO

-

BrosMed Medical Co., Ltd.

Cardiac Catheters And Guidewires Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.9 billion

Revenue forecast in 2030

USD 24.9 billion

Growth rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott; Boston Scientific, Corp.; Getinge AB; Biosense Webster, Inc. (Part of Johnson & Johnson); Terumo Medical Corp.; BIOTRONIK SE & Co. KG; Medtronic, CORDIS (A, Cardinal Health Company); QXMédical; Teleflex Inc.; B. Braun; C. R., Bard, Inc. (has joined BD); Cardinal Health; Merit Medical Systems; NIPRO; BrosMed Medical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiac Catheters And Guidewires Market Report Segmentation

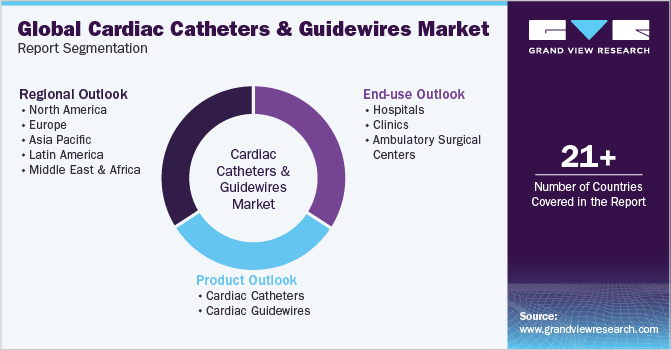

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cardiac catheters and guidewires market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Catheters

-

Electrophysiology catheters

-

PTCA balloon catheters

-

IVUS catheters

-

PTA balloon catheters

-

Guide extension catheter

-

Others

-

-

Cardiac Guidewires

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiac catheters and guidewires market size was estimated at USD 13.9 billion in 2022 and is expected to reach USD 14.9 billion in 2023.

b. The global cardiac catheters and guidewires market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 24.9 billion by 2030.

b. North America dominated the cardiac catheters and guidewires market with a share of 45.4% in 2022. This is attributable to rising healthcare awareness coupled with constant research and development initiatives.

b. Some key players operating in the cardiac catheters & guidewires market include Abbott, Boston Scientific Corporation, Getinge AB, Terumo Medical Corporation, and Medtronic.

b. Key factors that are driving the market growth include the rising prevalence of cardiovascular diseases (CVDs), favorable reimbursement policies for coronary intervention procedures, rising incidence of diabetes across the globe, and launch of new product lines in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."