- Home

- »

- Medical Devices

- »

-

Cardiovascular Devices Market Size & Share Report, 2030GVR Report cover

![Cardiovascular Devices Market Size, Share & Trends Report]()

Cardiovascular Devices Market Size, Share & Trends Analysis Report By Product (Diagnostic & Monitoring (ECG, Holter), Surgical Devices (Pacemakers, Stents)), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-992-0

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Cardiovascular Devices Market Trends

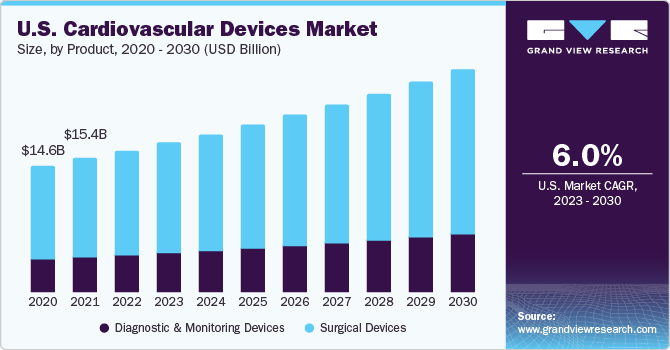

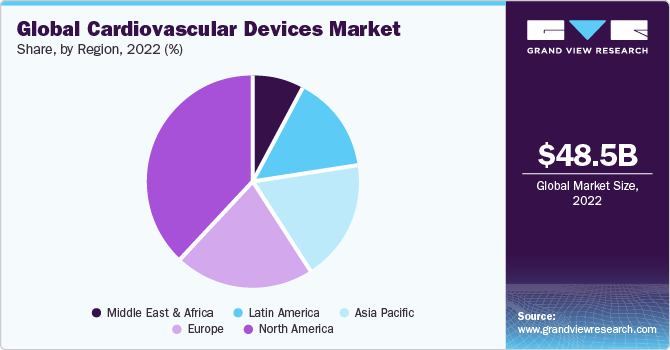

The global cardiovascular devices market size was valued at USD 48.49 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. Cardiovascular disease is one of the most prevalent medical conditions worldwide. For instance, according to research released by the Heart and Stroke Foundation of Canada in February 2022, 750,000 people have been diagnosed with heart failure, and 100,000 are identified with this fatal condition yearly. Therefore, cardiovascular devices serve a crucial role in accurately detecting and mitigating heart disorders, which fuels market expansion. The main drivers of this market also include rapid technical development, an increase in affordable and effective devices, and rising demand for minimally invasive procedures.

The primary driver boosting the growth of the market is the surge in the number of cases of chronic cardiovascular disorders. Increasing cases have led to an increased demand for cardiovascular devices. Heart or coronary artery stents are among the most essential cardiovascular devices. They facilitate the treatment of cardiac illnesses considered a serious risk to life, namely heart attacks, coronary disease, atrial fibrillation, and the expansion of clogged arteries. Cardiovascular disease takes one life in the U.S. every 33 seconds, and heart disease claimed the lives of about 695,000 people in 2021, accounting for 1 in 5 fatalities. The World Health Organization estimates that cardiac disorders are responsible for 17.9 million deaths in 2019.

The spike in regulatory authority approvals of innovative products also contributes significantly to the market's expansion. Throughout the forecast period, the market will likely be driven by several initiatives taken by governmental authorities to make cardiovascular devices accessible to a significant number of people in developing regions. For instance, in India, the Kerala state government has launched a novel program to assist kids with congenital heart disease (CHD), called Hridyam. As of 2023, the program has achieved a milestone of 6,000 free surgeries.

The technologies adopted for developing cardiac devices and the indications for these devices have advanced substantially during the past decade. Due to this, cardiology devices are being used to treat a larger number of patients, which has yielded tremendous treatment and monitoring results. One such development that significantly benefits cardiology is artificial intelligence, which has better skills for monitoring specific heart problems. For instance, in July 2021, the United States FDA granted Medtronic approval to employ two AccuRhythm artificial intelligence algorithms, increasing the precision of the data provided to doctors so they may more accurately identify and treat aberrant heart rhythms.

The efforts adopted in response to the amplified demands for these devices in emerging nations have also boosted the market. The widespread usage of cutting-edge devices in developing countries results from easy accessibility. Furthermore, investors have their sights set on expanding the affordability of cardiovascular equipment in nations like Mexico, China, India, and others. As a result, a significant market share for cardiovascular devices is anticipated in the future.

In February 2020, AliveCor, a prominent Al-based electrocardiogram (EC) technology and business cardiac solution provider, announced the launch of KardiaMobile, which is used to record, store, and transfer a single channel of electrocardiogram patterns in the Mexican region from the Federal Commission to safeguard against hygiene risks. AliveCor & Inpharamo, a medical solutions provider with headquarters in Mexico, have partnered to make this launch possible.

Product Insights

On the basis of product, the cardiovascular devices market has been segmented into diagnostic & monitoring devices and surgical devices. The diagnostic and monitoring device segment is then segmented into ECG, Holter monitors, event monitors, implantable loop recorders, echocardiograms, PET scans, MRI, cardiac CT, and Doppler fetal monitors. The surgical devices segment is categorized as pacemakers, stents, catheters and accessories, guidewires, cannulae, electrosurgical procedures, valves, and occlusion devices.

The surgical devices segment accounted for the largest revenue share of around 75% in 2022, owing to the rising number of domestic and international players to meet the growing demand for cutting edge cardiovascular devices. The market would also be driven by key firms releasing new products. For instance, in December 2020, Abbott introduced its new dlip-delivery system to treat patients with regurgitation of the mitral valve.

The diagnostics and monitoring devices segment is expected to grow at the fastest CAGR of 7.6% during the forecast period. The diagnostic and monitoring devices segment's Electrocardiogram (ECG) is anticipated to account for an important share of the market. Due to the most recent wave of lightweight, small, and affordable devices, especially well-liked in the home healthcare sector, more individuals are utilizing ECGs for diagnosis and monitoring purposes. Owing to the rise in cardiovascular diseases, ECG monitoring is necessary.

Additionally, the advent of the wireless ECG has made it possible to diagnose and monitor patients in real-time, which has helped the industry expand. For instance, in January 2022, Philips started providing a 12-lead electrocardiogram (ECG) solution for use in decentralized clinical trials that could be carried out at the convenience of a patient's home.

Regional Insights

North America dominated the market and accounted for the largest revenue share of over 35% in 2022. The key reasons for this region's dominance were the high adoption of cutting-edge surgical procedures, growing consumer knowledge of commercially available goods, and a sizable target patient pool. Moreover, the increasing adoption of home healthcare devices due to government penalties enforced on hospitals for patient readmissions is propelling the demand for diagnostic and monitoring cardiovascular systems enormously.

Asia Pacific is expected to grow at the fastest CAGR of 8.9% during the forecast period. Japan is anticipated to lead the market in the Asia-Pacific region, followed by China. China is thought to have the largest population of elderly people worldwide and the highest obesity rates due to sedentary lives and poor eating habits. These factors are anticipated to make heart disorders increasingly prevalent in this nation, which will benefit the growth of the cardiovascular device market. Additionally, it is anticipated that the growing medical tourism sector will increase demand for cardiovascular systems in nations such as Japan, China, Malaysia, Thailand, and India.

Key Companies & Market Share Insights

Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. In October 2022, Biosense Webster, a Johnson & Johnson Services, Inc. subsidiary, introduced the HELIOSTAR Balloon Ablation Catheter in Europe. This is recommended for application in catheter-based cardiovascular electrophysiology tracing (stimulating and monitoring) for the atria and cardiac ablation when paired with a competent multi-channel RF generator.

Key Cardiovascular Devices Companies:

- Abbott

- GE HealthCare

- Edwards Lifesciences Corporation

- W. L. Gore & Associates, Inc.

- Siemens Healthcare GmbH

- BIOTRONIK SE & Co. KG

- Canon Medical Systems Asia Pte. Ltd.

- B. Braun SE

- LivaNova PLC

- Cardinal Health

- Medtronic

- Boston Scientific Corporation

Cardiovascular Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 51.73 billion

Revenue forecast in 2030

USD 83.56 billion

Growth rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott; GE HealthCare; Edwards Lifesciences Corporation; W. L. Gore & Associates, Inc.; Siemens Healthcare GmbH; BIOTRONIK SE & Co. KG; Canon Medical Systems Asia Pte. Ltd.; B. Braun SE; LivaNova PLC; Cardinal Health; Medtronic; Boston Scientific Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiovascular Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cardiovascular devices market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic & Monitoring Devices

-

ECG

-

Holter Monitors

-

Event Monitors

-

Implantable Loop Recorders

-

Echocardiogram

-

PET Scan

-

MRI

-

Cardiac CT

-

Doppler Fetal Monitors

-

Cardiac Diagnostic Catheters

-

-

Surgical Devices

-

Pacemakers

-

Stents

-

Catheters & Accessories

-

Guidewires

-

Cannulae

-

Electrosurgical Procedures

-

Valves

-

Occlusion Devices

-

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiovascular devices market size was estimated at USD 48.49 billion in 2022 and is expected to reach USD 51.73 billion in 2023

b. The global cardiovascular devices market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 83.56 billion by 2030.

b. North America dominated the cardiovascular devices market with a share of 38.14% in 2022. This is attributable to the high adoption of advanced surgical treatments, rising awareness regarding commercially available products, and the presence of a considerably-sized target patient pool.

b. Some key players operating in the cardiovascular devices market include Medtronic; Becton, Dickinson and Company; Cardinal Health, Inc.; Boston Scientific Corporation; B. Braun Melsungen AG; Abbott Laboratories, Inc.; Cook Medical, Inc.; Terumo Cardiovascular Systems Corporation; and St. Jude Medical, Inc.

b. Key factors that are driving the market growth include increased prevalence of chronic heart ailments due to sedentary lifestyles along with the introduction of technologically advanced surgical procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."