- Home

- »

- Food Additives & Nutricosmetics

- »

-

Carrageenan Market Size & Share Analysis Report, 2030GVR Report cover

![Carrageenan Market Size, Share & Trends Report]()

Carrageenan Market (2023 - 2030) Size, Share & Trends Analysis Report By Processing Technology (Semi-refined, Gel Press, Alcohol Precipitation), By Function, By Product Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-268-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carrageenan Market Summary

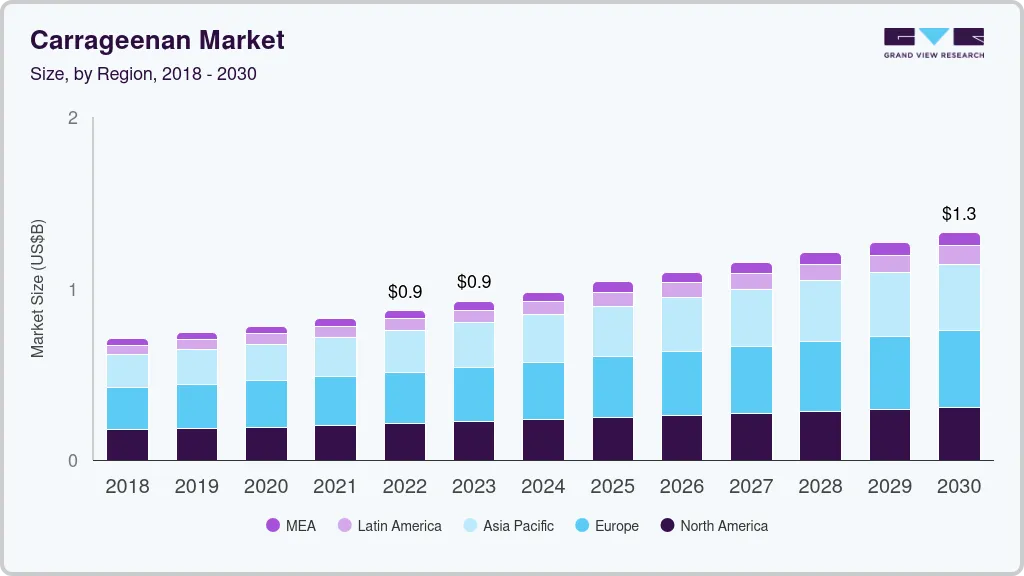

The global carrageenan market size was estimated at USD 871.66 million in 2022 and is projected to reach USD 1.32 billion by 2030, growing at a CAGR of 5.4% from 2023 to 2030. Increasing product penetration in dairy and processed meat products on account of carrageenan’s mouth feel characteristics to imitate a fatty feeling is expected to boost the market growth over the forecast period.

Key Market Trends & Insights

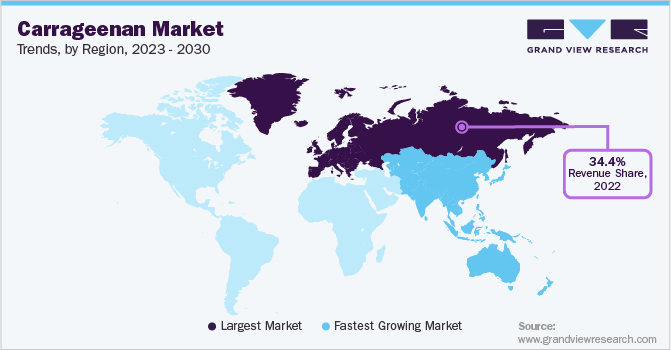

- The Europe held the largest revenue share of 34.4% in 2022.

- The Asia Pacific is likely to expand at the fastest growth rate in terms of revenue over the forecast period.

- Based on function, the thickening agent segment held the largest revenue share of 38.7% in 2022.

- Based on product type, the kappa segment accounted for the largest revenue share of 68.3% in 2022.

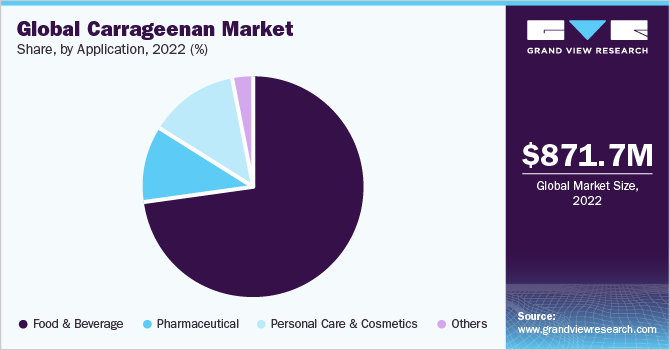

- Based on application, the food and beverage segment dominated the market with a value share of 72.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 871.66 Million

- 2030 Projected Market Size: USD 1.32 Billion

- CAGR (2023-2030): 5.4%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

The primary factor contributing to the wide usage of carrageenan in the food industry is its capability to bind with water and enhance the properties of food ingredients. A rising preference for food and pharmaceutical products with ingredients derived from plant sources instead of animal-derived ingredients, such as gelatin, is likely to increase the product demand.

The U.S. accounted for the largest revenue share in 2022 in the North American market. The U.S. is a mature market for processed food products having a large food manufacturing base in the country, making the product a highly in-demand additive for food processing applications, as a thickening and gelling agent.

The product is majorly utilized as a viscosity control agent in personal care products and water-based cosmetics due to its water-binding capacity. It functions as a thickening, stabilizing, and suspending agent in sunscreens, lotions, and body washes. For instance, products such as L'Oréal’s Pure-clay Glow-mask and Natural Moisturizing Lubricant of DreamBrands Inc. contain carrageenan.

The cultivation of the product has led to positive socio-economic development in coastal countries. In Asia Pacific, carrageenan cultivation and processing are increasing particularly in Southeast Asian countries due to the favorable climatic conditions. Technologies such as semi-refined type processing are widely used by small and medium-scale players in these countries owing to comparatively easier processes and lower processing costs.

In this industry, product differentiation depends on raw material and extraction processes followed. Kappa and iota types are suitable for use as gelling agents, whereas lambda is majorly used as a thickening agent as it does not have the ability to form a gel. For instance, Cargill, Incorporated has developed Satiagel ADG 0220 Seabird carrageenan that can be used for gelled dairy desserts. The company has further diversified the product range by developing Seabrid carrageenan, which can be utilized for creamy dairy desserts as a texturizing agent.

It is further considered as a treatment against COVID-19 due to its antiviral properties. In December 2020, a clinical trial was initiated collaboratively by the Cardiff University, Marinomed Biotech AG, Walgreens Boots Alliance, and Abertawe Bro Morgannwg University Health Board for analyzing the efficacy of carrageenan nasal and throat spray against COVID-19.

Processing Technology Insights

Semi-refined technology dominated the market with a revenue share of more than 50.1% in 2022. A semi-refined process is a cost-effective method, thereby gaining traction in the market. Semi-refined carrageenan (SRC) contains insoluble matter, such as cellulose. The advent in technology has led to the emergence of food-grade semi-refined carrageenan, increasing its application in food products, thereby boosting its demand.

In the majority of countries across the globe, semi-refined carrageenan has been tested safe for human consumption and thus can be used in food applications. For instance, semi-refined carrageenan is approved as an ‘E407a’ food additive according to the European Union (EU) regulation 2012/231/EU.

Alcohol precipitation is traditionally used for carrageenan extraction from seaweed, which gives a refined and purified form of the product. However, multiple steps involved in the alcohol precipitation method increase the cost of overall processing which is expected to hamper the segment growth.

Gel press is mainly used to make kappa-type carrageenan as seaweed such as Eucheumacottonii can only be processed through this method. Kappa-type carrageenan has the ability to form a gel when treated with potassium salts such as KCl used in the gel press method.

Function Insights

The thickening agent segment held the largest revenue share of 38.7% in 2022. This can be attributed to the rising demand for clean-label thickeners in the food and pharmaceutical industry. The gelling agent segment held a significant revenue share in 2022 owing to the increasing demand for plant-derived gelling additives that can be readily used in vegan products.

The stabilizer segment is expected to grow rapidly with a surge in demand from the bakery, confectionery, and beverage applications. Stabilizers are used to prevent the formation of undesirable ice crystals and improve the texture properties of the product. For instance, a carrageenan stabilizer can improve the mouthfeel of beverages, such as kombucha and coconut water.

The others segment includes carrageenan functionalities such as binding agents and emulsifiers. The others segment is expected to expand at the highest CAGR due to increase in the product demand from manufacturers of ready-to-eat and packaged food products. Constant efforts to phase out genetically modified organisms (GMOs) and partially hydrogenated oils (PHO) based emulsifiers are likely to support the growth of the industry.

Product Type Insights

The kappa segment accounted for the largest revenue share of 68.3% in 2022. It is the most used product type in ice creams, cheese, puddings, and chocolates. For instance, MCLS EUROPE, a wholly-owned subsidiary of Mitsubishi Corporation, offers pure refined Kappa carrageenan that can be used in dairy and dessert products as gelling and swelling agents and fat replacers.

Iota carrageenan is being studied for its anti-viral properties. As per a study published on August 09, 2021, by the Journal of Pharmacology Research & Perspectives, nasally administered iota-carrageenan resulted in an increase in the recovery rate of common cold patients. The increase in recovery rate was 139% for those with coronavirus infections; 119% for influenza A infections; and 70% for rhinovirus infection.

Lambda held a relatively lower revenue share in 2022 and is majorly prepared by the alcohol precipitation method. Lambda is a non-gelling sulfated carrageenan extracted from red seaweed. It has a high viscosity and is thereby widely used as a thickening agent in dairy products.

Application Insights

The food and beverage segment dominated the market with a value share of 72.8% in 2022. Carrageenan finds application in bakery, dairy, and meat products and beverages. Carrageenan is added to these products to alter viscosity or texture, which, in turn, improves their sensory properties.

It is utilized as excipients in drug delivery systems. It is also used as a foaming, wetting, solubilizing, and stabilizing agent in pharmaceutical products. Rising R&D investment in drug formulations for the production of stable and effective products is expected to fuel the segment growth.

The personal care and cosmetics segment is expected to expand at the highest revenue-based CAGR over the projected period on account of the rising applications of the product in the end-use market. This product is added in water-based personal care and cosmetic products as a viscosity control agent owing to its water-binding property.

Other applications include the agriculture industry. The use of the product in agricultural applications represents a promising approach for developing plant growth and plant defense techniques. Carrageenan is also used as thickeners and rheology modifier agents in textile printing.

Regional Insights

Europe held the largest revenue share of 34.4% in 2022. The growth in the European region can be attributed to favorable government policies. The gel-press technique is gaining popularity in the region since the demand for alcohol precipitated carrageenan incurs higher manufacturing costs. In Europe, both types of carrageenan: refined and semi-refined are approved by the European Union to be used in food products under food additive codes E407 and E 407a, respectively, thus boosting the product demand.

In 2022, North America accounted for a considerable revenue share. Seaweed processing is increasing in the U.S. and Canada, which is expected to support the market growth in the region. As per the Food and Agricultural Organization, the U.S. was one of the top 10 exporters of seaweed-based hydrocolloids in 2019, accounting for a 4.82% share in the exports of seaweed-based hydrocolloids globally.

The market in the Asia Pacific is likely to expand at the fastest growth rate in terms of revenue over the forecast period. The presence of major food industry players such as China Mengniu Dairy Co. Ltd., and Inner Mongolia Yili Industrial Group Co., Ltd. has resulted in the significant growth of the overall food and beverage industry in China, thus fueling the product demand.

The product demand in Central and South America is primarily driven by Brazil with the growth of the end-use industries. For instance, as per the USDA, the food retail sector in Brazil is expected to grow by 4.5% in 2021, thereby propelling the industry growth.

Key Companies & Market Share Insights

The companies active in the market are focusing on partnerships with small-sized companies having a strong foothold in the local markets. For instance, in August 2020, CP Kelco and Biesterfeld announced an expansion of their partnership in the food and nutrition segment in Europe. As a part of this partnership, Biesterfeld is expected to distribute the former’s carrageenan products in European countries.

Major players engaged in the manufacturing of carrageenan have a global reach owing to their wide geographical presence with several manufacturing facilities and sales offices spread across the major continents. Some prominent players in the global carrageenan market include:

-

DuPont

-

Ingredion Incorporated

-

Ashland

-

CP Kelco U.S., Inc.

-

Cargill, Inc.

-

Ceamsa

-

W Hydrocolloids, Inc.

-

Gelymar

-

Caldic B.V.

-

Ina Food Industry Co. Ltd.

-

PT. Gumindo Perkasa Industri

-

ACCEL Carrageenan Corporation

-

BLG

-

MCPI Corporation

-

AEP Colloid

-

Marcel Carrageenan

-

TBK Manufacturing Corporation

-

Shemberg Ingredients and Gums Corporation

-

Prinova Group LLC

-

LAUTA Ltd.

-

Aquarev Industries

-

Bang &Bonsomer

-

AgargelIndustria e ComercioLtda

-

Zhenpai Hydrocolloids Co., Ltd.

-

Tate & Lyle

Carrageenan Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 924.74 million

Revenue forecast in 2030

USD 1.32 billion

Growth Rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Processing technology, function, product type, application, region

Regional scope

North America; Europe; Asia Pacific; CSA; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

DuPont; Ingredion Incorporated; Ashland; CP Kelco U.S., Inc.; Cargill, Inc.; Ceamsa; W Hydrocolloids, Inc.; Gelymar; Caldic B.V.; Ina Food Industry Co. Ltd.; PT. Gumindo Perkasa Industri; ACCEL Carrageenan Corporation; BLG; MCPI Corporation; AEP Colloid; Marcel Carrageenan; TBK Manufacturing Corporation; Shemberg Ingredients and Gums Corporation; Prinova Group LLC; LAUTA Ltd.; Aquarev Industries; Bang &Bonsomer; Agargel Industria e ComercioLtda; Zhenpai Hydrocolloids Co., Ltd.; Tate & Lyle.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carrageenan Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carrageenan market report based on processing technology, function, product type, application, and region:

-

Processing Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Alcohol Precipitation

-

Gel Press

-

Semi-refined

-

-

Function Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thickening Agent

-

Gelling Agent

-

Stabilizer

-

Others

-

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Kappa

-

Iota

-

Lambda

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Bakery

-

Confectionery

-

Meat Products

-

Dairy Products

-

Sauces & Dressings

-

Beverages

-

Others

-

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global carrageenan market size was estimated at USD 871.66 million in 2022 and is expected to reach USD 924.74 million in 2023.

b. The global carrageenan market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 1,324.62 million by 2030.

b. Kappa segment dominated the carrageenan market with a share of nearly 68.3% in 2022 owing to properties including the gelling and stabilizing ability.

b. Some of the key players operating in the global carrageenan market include DuPont, Ingredion Incorporated, Ashland, CP Kelco U.S., Inc, Cargill, Inc., Ceamsa, W Hydrocolloids, Inc, Gelymar, Caldic B.V., Ina Food Industry Co Ltd., PT. Gumindo Perkasa Industry, ACCEL Carrageenan Corporation, BLG, MCPI Corporation, AEP Colloid, Marcel Carrageenan, and TBK Manufacturing Corporation among others.

b. Wide applicability for the product market in the food & beverage, oil, and gas, pharmaceutical industry owing to its multi-functionality, especially its ability to modify the viscosity of substances are key factors driving the carrageenan market in the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.