- Home

- »

- Next Generation Technologies

- »

-

Casino Management System Market, Industry Report, 2030GVR Report cover

![Casino Management System Market Size, Share & Trends Report]()

Casino Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Security & Surveillance, Analytics, Accounting & Cash Management, Player Tracking), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-188-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Casino Management System Market Summary

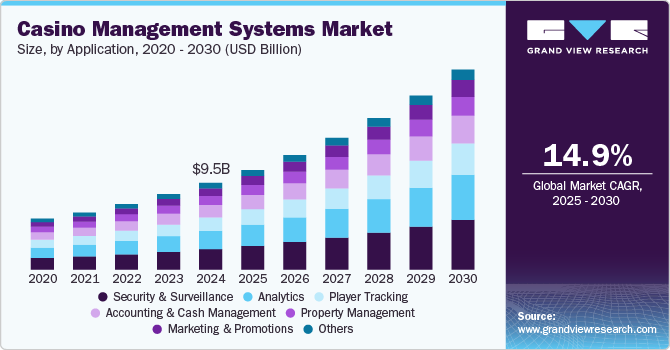

The global casino management system market size was estimated at USD 9,459.8 million in 2024 and is projected to reach USD 21,818.5 million by 2030, growing at a CAGR of 14.9% from 2025 to 2030. The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and Internet of Things (IoT) is one of the primary drivers of the growth in the casino management system industry.

Key Market Trends & Insights

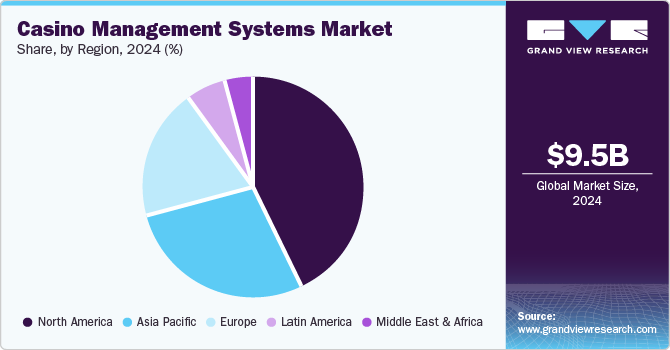

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, security and surveillance accounted for a revenue of USD 2,672.8 million in 2024.

- Analytics is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9,459.8 Million

- 2030 Projected Market Size: USD 21,818.5 Million

- CAGR (2025-2030): 14.9%

- North America: Largest market in 2024

AI and ML are being leveraged to enhance predictive analytics, optimize gaming operations, and provide personalized customer experiences. For example, casinos are using AI to analyze customer behavior, predict gaming preferences, and provide tailored rewards or promotions.

Casinos are increasingly adopting management systems to enhance operational efficiency and reduce costs. A modern CMS allows casinos to integrate various functions, such as casino floor management, gaming management, hotel management, customer loyalty programs, and staff management, into a single platform. This integration helps casinos reduce operational silos, improve data accuracy, and enhance decision-making. The automation of routine tasks, such as guest check-ins, ticketing, and billing, also reduces the time and labor required for these processes, resulting in significant cost savings and improved customer satisfaction.

The growing legalization and the rising number of gaming establishments are expected to be key factors driving casino management system industry growth in the near future. Furthermore, the increasing number of gambling clubs around the world is contributing to the expansion of the casino management systems market. As of December 2023, the American Gaming Association (AGA) reported that there were 1,011 gaming clubs in the U.S., making it the country with the highest number of casinos in the world.

The growing social acceptance of casinos and the expanding global casino industry are key drivers of market growth, as governments increasingly allow the establishment of gambling venues to stimulate economic development and attract international tourism. However, the legalization and rapid growth of online gaming platforms have posed significant challenges to the traditional casino market. Additionally, strict government regulations and complex gaming laws are expected to further restrain market expansion.

Application Insights

The security and surveillance segment dominated the market and accounted for the revenue share of over 23.0% in 2024, driven by the increasing need for enhanced safety measures to protect patrons, staff, and assets within casino premises. Advanced surveillance technologies, such as AI-powered video analytics and facial recognition systems, are being adopted to monitor activities, detect fraudulent behavior, and ensure compliance with gaming regulations. Additionally, the rising focus on data-driven security solutions and real-time monitoring capabilities supports the seamless operation of casinos while addressing evolving threats and enhancing customer trust.

The analytics segment is expected to grow at a significant CAGR of 16.2% over the forecast period, driven by the increasing demand for data-driven decision-making to optimize casino operations and enhance customer experiences. Casinos are leveraging advanced analytics tools to gain insights into player behavior, preferences, and spending patterns, enabling personalized marketing strategies and loyalty programs. Additionally, analytics solutions help in improving operational efficiency by identifying trends, predicting demand, and streamlining resource allocation. The rising adoption of AI and machine learning in predictive analytics further drives growth, allowing casinos to forecast revenues, manage risks, and ensure regulatory compliance effectively.

Regional Insights

The casino management system industry in North America held the largest share of over 43.0% in 2024. The rising competition among casinos in North America has intensified the need for advanced customer relationship management (CRM) tools within CMS. Operators are leveraging these tools to analyze player preferences, create tailored loyalty programs, and enhance engagement. As the industry continues to evolve, the demand for scalable and customizable CMS solutions is expected to grow, enabling casinos to stay competitive in an increasingly digital and customer-centric market.

U.S. Casino Management System Market Trends

The casino management system industry in the U.S. is expected to grow significantly at a CAGR of 13.4% from 2025 to 2030. With stringent state-specific gaming laws and growing concerns about cybersecurity, casinos are adopting robust CMS solutions to ensure transparency and protect sensitive data. The increasing demand for cashless gaming and contactless payment systems has also driven the need for CMS upgrades, particularly as operators look to cater to tech-savvy customers seeking safer and more convenient transaction methods.

Europe Casino Management System Market Trends

The casino management system industry in Europe is anticipated to register a considerable growth from 2025 to 2030. The rise of cashless gaming and digital payment solutions is a key trend shaping the Europe market for casino management systems. Casinos are upgrading their systems to accommodate these modern payment methods, which offer greater convenience to players and improved security for operators.

The UK casino management system market is expected to grow rapidly in the coming years. As sustainability becomes a priority, casinos are turning to casino management system solutions that support energy-efficient operations, such as smart lighting and climate control systems. These environmentally friendly features align with corporate social responsibility (CSR) goals and appeal to eco-conscious customers.

The casino management system market in Germany held a substantial market share in 2024. The focus on responsible gambling is influencing the adoption of CMS solutions equipped with features for monitoring player behavior, setting betting limits, and enabling self-exclusion. These tools help operators align with the regulatory focus on protecting vulnerable players.

Asia Pacific Casino Management System Market Trends

Asia Pacific is anticipated to register a significant CAGR from 2025 to 2030. The market in the region is significantly influenced by the rapid expansion of integrated resorts and casinos in key regions like Singapore, Macau, and emerging markets such as Thailand. As these countries focus on enhancing their casino industries, there is an increased demand for CMS solutions that can efficiently manage complex operations across multiple gaming, hotel, and entertainment services.

The Japan casino management system market is expected to grow rapidly in the coming years. Japan’s casino industry is subject to strict regulations, including measures aimed at preventing problem gambling and maintaining transparency. Casino management system CMS platforms that offer real-time reporting, compliance tracking, and anti-money laundering (AML) capabilities are in high demand. The Japan Casino Regulatory Commission (JCRC) is responsible for overseeing casino operations, ensuring that CMS solutions are aligned with the country’s stringent gaming laws.

The casino management system market China held a substantial market share in 2024. The country’s gaming sector, characterized by large-scale integrated resorts such as the Venetian Macao and Galaxy Macau, drives demand for sophisticated CMS platforms that can manage operations spanning casinos, hotels, restaurants, entertainment, and retail services. The complexity of managing these multi-faceted resorts necessitates advanced CMS technologies, including real-time analytics, cross-platform integration, and enhanced customer relationship management (CRM) features.

Key Casino Management Systems Company Insights

Key players operating in the casino management system industry are SAP SE, Red Hat, Inc., Genpact, IBM Corporation, and Accenture. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2025, NOVOMATIC signed an agreement to acquire the French casino group Vikings Casinos SAS, marking a significant step in its ongoing international expansion strategy. This acquisition allows NOVOMATIC to strengthen its presence in the French market, one of Europe's largest gaming regions, while greatly expanding its portfolio. The move aligns with the company’s growth objectives and reinforces its position in the competitive European gaming landscape.

-

In February 2024, Light & Wonder, Inc. expanded its integration services by partnering with SHR Group to integrate its Allora CRS booking engine with Light & Wonder’s loyalty platform, L&W ENGAGE. This collaboration enhances the capabilities of hotel operators by providing advanced booking features that seamlessly integrate with the system-independent loyalty platform. The integration allows operators to customize customer experiences based on predicted revenue value, offering exclusive member rates and promotions through both the booking engine and call center.

-

In November 2023, Konami Gaming, Inc. entered a strategic partnership with AI solutions provider Xailient Inc. to introduce its SYNK Vision technology across the Asia-Pacific region. This innovative facial recognition and player tracking technology will integrate with Konami’s SYNKROS casino management system, offering features such as facial recognition login for a seamless user experience. Additionally, SYNK Vision will enable casinos to anonymously track and reward players, enhancing operational efficiency and customer engagement while ensuring privacy. This collaboration marks a significant step forward in the integration of AI-driven solutions in the gaming industry.

Key Casino Management Systems Companies:

The following are the leading companies in the casino management systems market. These companies collectively hold the largest market share and dictate industry trends.

- Advansys

- Agilysys NV LLC

- Honeywell International, Inc.

- IGT.

- Konami Gaming, Inc.

- Light & Wonder, Inc.

- Lotteries and Gaming Saskatchewan

- Next Level Security Systems, Inc.

- NOVOMATIC

- Playtech plc

Casino Management System Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.87 billion

Revenue forecast in 2030

USD 21.82 billion

Growth rate

CAGR of 14.9% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Advansys; Agilysys NV LLC; Honeywell International, Inc.; IGT.; Konami Gaming, Inc.; Light & Wonder, Inc.; Lotteries and Gaming Saskatchewan; Next Level Security Systems, Inc.; NOVOMATIC; Playtech plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Casino Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global casino management system market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Security And Surveillance

-

Analytics

-

Accounting & Cash Management

-

Player Tracking

-

Property Management

-

Marketing & Promotions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global casino management system market size was estimated at USD 9.46 billion in 2024 and is expected to reach USD 10.87 billion in 2025.

b. The global casino management system market is expected to grow at a compound annual growth rate of 14.9% from 2023 to 2030 to reach USD 21.82 billion by 2030.

b. The casino management system market in North America held a largest share of over 43.0% in 2024. The rising competition among casinos in North America has intensified the need for advanced customer relationship management (CRM) tools within CMS.

b. Some key players operating in the casino management system market include Advansys, Agilysys NV LLC, Honeywell International, Inc., IGT., Konami Gaming, Inc., Light & Wonder, Inc., Lotteries and Gaming Saskatchewan, Next Level Security Systems, Inc., NOVOMATIC, Playtech plc

b. Key factors driving market growth include the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and the Internet of Things (IoT). AI and ML are being leveraged to enhance predictive analytics, optimize gaming operations, and provide personalized customer experiences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.