- Home

- »

- Consumer F&B

- »

-

CBD Wine Market Size, Share & Analysis Report, 2030GVR Report cover

![CBD Wine Market Size, Share & Trends Report]()

CBD Wine Market (2022 - 2030) Size, Share & Trends Analysis Report By Type, By Packaging (Glass Bottles, Can), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-943-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global CBD wine market size was valued at USD 10.38 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 32.0% from 2022 to 2030. The market growth is driven by the shifting consumer behavior patterns for food and beverages across the world and increasing relaxations in the laws of CBD edibles in various countries.

The COVID-19 pandemic has disrupted the global supply chain and distribution channel, owing to the restrictions and closure of restaurants, bars, and hotels globally. The first phase of COVID-19 was challenging for new brands because of regulatory uncertainty and retailers' lack of focus on bringing in new brands. However, there was a change in consumers’ buying behavior, and e-commerce sales of CBD wine have increased since then.

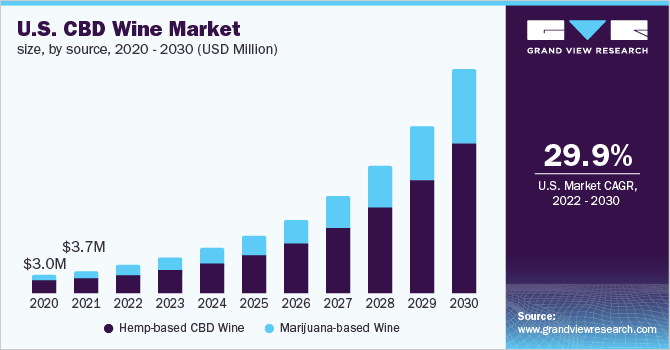

The demand for CBD products is growing globally, which has a significant impact on the CBD wine market. Hemp-based CBD and marijuana-based CBD wine are two major types in the CBD wine market. Hemp plants have significantly more CBD than marijuana plants, making them the more profitable alternative for manufacturers and the option with the fewest legal repercussions. Thus, the market penetration of hemp-based CBD wines is higher than marijuana-based CBD wines.

The enthusiasm for CBD wines is growing rapidly. North America dominated the CBD wine market, particularly among the millennials (26 to 41 years), a generation that is extremely aware of a healthy lifestyle. The increased focus on health and wellness and alcohol-free beverages across the globe is accelerating the demand for these wines.

The CBD wine is indeed making its way onto dispensary shelves. A large part of CBD's popularity stems from the legalization of cannabis, which includes CBD with well-moderated levels of THC. Several countries have legalized the cultivation and production of cannabis, opening up a whole new market for CBD wine, a new product that is gaining popularity in the CBD industry.

Source Insights

The hemp-based CBD wine segment accounted for 75.4% of the global revenue share in 2021. Hemp is a strain of cannabis sativa part of the genus cannabis with tetrahydrocannabinol (THC) content below 0.3%. It is typically produced from the hemp plant's leaves and flowers. North America is the largest market for hemp-based edibles owing to the legalization of recreational and medicinal cannabis in various states of the U.S. and Canada. In the 2018 Farm Bill, hemp was eliminated from the legal definition of marijuana under the Controlled Substances Act. Consequently, certain hemp-derived CBD products containing less than 0.3 percent THC are now legal in the U.S.

The marijuana-based CBD wine segment is expected to expand at a CAGR of 28.9% during the forecast period. These wines are consumed less as compared to hemp-based CBD wines. Marijuana plants have far greater and more variable THC levels than hemp plants. CBD derived from marijuana is allowed to obtain with a prescription. However, the requirements vary per state, based on the condition to be treated with CBD and the level of THC in the goods. In the U.S., 18 states have legalized the recreational and medical use of CBD-infused products produced from marijuana.

Product Type Insights

The no-alcohol CBD wine segment accounted for 88.5% of the global revenue share in 2021. CBD-infused wine may appeal to those who wish to give up drinking. As the wines are alcohol-free, users can enjoy the benefits of CBD without being influenced by alcohol. The ultimate goal is to achieve maximum relaxation. Each starts as an alcoholic wine that is then de-alcoholized and combined with a CBD or THC-infused emulsion. Globally growing demand for non-alcoholic beverages is expected to drive the market growth.

The low-alcohol CBD wine segment is expected to expand at a CAGR of 28.7% during the forecast period. CBD and hemp were legalized at the federal level by the 2018 Farm Bill. An alcoholic beverage infused with CBD must be permitted by the state liquor boards and the alcohol, tobacco, and trade bureau (TTB).

Packaging Insights

The glass bottles segment accounted for 85.9% of the global revenue share in 2021. Glass bottles are the primary packaging format for wines as it is nonporous, nontoxic surface, and have high impermeability. It also retains scents and carbonation very well, making it an excellent choice for wine. It evokes a sense of luxury that's difficult to achieve with other materials. Glass bottle has been a prominent packaging method for so long that it is often associated with a vintage or retro feel.

The cans segment is expected to grow at a CAGR of 36.6% during the forecast period. Cans are usually made of tinned, aluminum, or electro chrome-plated steel. Cans are quickly gaining popularity in the wine industry because of their benefits, including consumer convenience, an emphasis on cost and sustainability, and changes in consumer behavior.

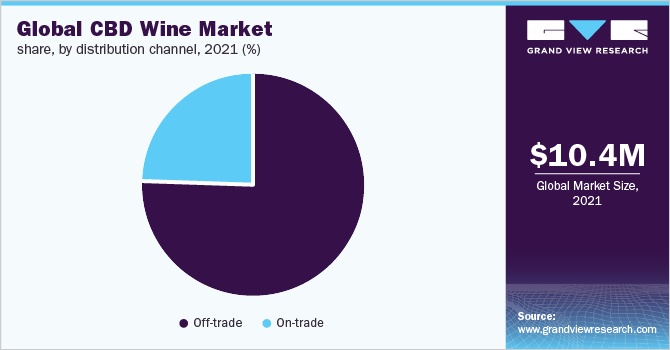

Distribution Channel Insights

The off-trade segment dominated the market and accounted for 74.0% of the global revenue shares in 2021. The off-trade distribution channel includes supermarkets, hypermarkets, retail outlets, specialty stores, and e-commerce platforms. Consumer inclination towards e-commerce is expected to drive segment growth. The lockdown across the nations further propelled the demand for off-trade sales of CBD wines. Consumers are buying these wines directly from retailers due to a variety of circumstances including working from home, strict COVID-19 protocols in pubs and bars such as wearing a mask, using sanitizers, etc.

The on-trade segment is expected to expand at a CAGR of 29.7% during the forecast period. The on-trade distribution channel includes outlets like bars, clubs, restaurants, hotels, coffee shops, and wine merchant’s stores. The COVID-19 pandemic affected on-trade activity significantly. Globally, there was a suspension of foreign tourism due to the lockdowns and preventive measures implemented.

Regional Insights

North America dominated the market and accounted for a 56.5% share of global revenue in 2021. The U.S. dominated the market owing to the legalization of medical and recreational marijuana in the country. California is the largest consumer of CBD wine in the U.S. North America remained the world’s highest consumption center for CBD wine. Consumers in the region are aware of CBD and its health benefits, and thus, consumption of CBD products is high in North America compared to other regions in the world.

The rest of the world is anticipated to expand at a CAGR of 41.0% during the forecast period in terms of revenue. The growth can be attributed to the increase in the relaxation of laws related to cannabis in various parts of the world. Australia dominated the Asia Pacific market in 2021. The Australian Capital Territory (ACT) was the first state or territory to legalize cannabis for personal use or possession. On January 31st, 2020, new laws came into effect, having a significant impact on the Australian wine industry as a potential opportunity. India is relatively late in entering the hemp and CBD markets. With the new regulation passed in November 2021 to allow hemp to be used as food, India's hemp and cannabis industries are ready for the next wave of products like CBD wine, gummies, etc.

Key Companies & Market Share Insights

Key players are increasingly focusing on producing new wines to gain market share in the world. For instance, in 2018, Bodegas Santa Margarita launched its first CBD-infused wine called Winabis, initialing the company’s first venture into the market of CBD-infused products. New product launches, innovation, geographical expansion, and mergers & acquisitions are some of the key strategies adopted by the players to strengthen their position in the market and gain a higher market share. Some prominent players in the global CBD wine market include:

-

House of Saka

-

Rebel Wine.Co.UK

-

Viv & Oak

-

Wines of Uruguay

-

CannaVines

-

Burdi W.

-

Hempfy

-

DrinkSipC

-

Bodegas Santa Margarita

CBD Wine Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 13.36 million

Revenue forecast in 2030

USD 126.8 million

Growth Rate

CAGR of 32.0% from 2022 to 2030 in terms of revenue

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in 000’ USD and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product type, packaging, distribution channel, and region

Regional scope

North America; Europe; Rest of the World

Country Scope

U.S.; Canada; Mexico; France; Switzerland; Australia; Japan

Key companies profiled

House of Saka; Rebel Wine.Co.UK; Viv & Oak; Wines of Uruguay; CannaVines; Burdi W.; Hempfy; DrinkSipC; Bodegas Santa Margarita

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the CBD wine market based on source, product type, packaging, distribution channel, and region:

-

Source Outlook (Revenue, USD Thousand; 2018 - 2030)

-

Hemp-based CBD Wine

-

Marijuana-based Wine

-

-

Product Type Outlook (Revenue, USD Thousand; 2018 - 2030)

-

Low-based CBD Wine

-

Marijuana-based Wine

-

-

Packaging Outlook (Revenue, USD Thousand; 2018 - 2030)

-

Bottles

-

Cans

-

-

Distribution Channel Outlook (Revenue, USD Thousand; 2018 - 2030)

-

On-trade

-

Off-trade

-

-

Regional Outlook (Revenue, USD Thousand; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Switzerland

-

-

Rest of the World

-

Australia

-

Japan

-

-

Frequently Asked Questions About This Report

b. The global CBD wine market size was estimated at USD 10.38 million in 2021 and is expected to reach USD 13.36 billion in 2022

b. The global CBD wine market is expected to grow at a compound annual growth rate of 32.0% from 2022 to 2030 to reach USD 126.8 million by 2030.

b. North America dominated the market and accounted for a 56.5% share of global revenue in 2021. The U.S. dominated the market owing to the legalization of medical and recreational marijuana in the country. California is the largest consumer of CBD wine in the U.S. North America remained the world’s highest consumption center for CBD wine. Consumers in the region are aware of CBD and its health benefits, and thus, consumption of CBD products is high in North America compared to other regions in the world.

b. Some key players operating in the CBD wine market include House of Saka, Rebel Wine.Co.UK, Viv & Oak, Wines of Uruguay, CannaVines, Burdi W., Hempfy, DrinkSipC, and Bodegas Santa Margarita.

b. Key factors that are driving the CBD wine market growth include the shifting consumer behavior patterns for food and beverages across the world and increasing relaxations in the laws of CBD edibles in various countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.