- Home

- »

- Biotechnology

- »

-

Cell Counting Market Size, Share & Growth Report, 2030GVR Report cover

![Cell Counting Market Size, Share & Trends Report]()

Cell Counting Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables & Accessories), By Application (Complete Blood Count, Stem Cell Research), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-592-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

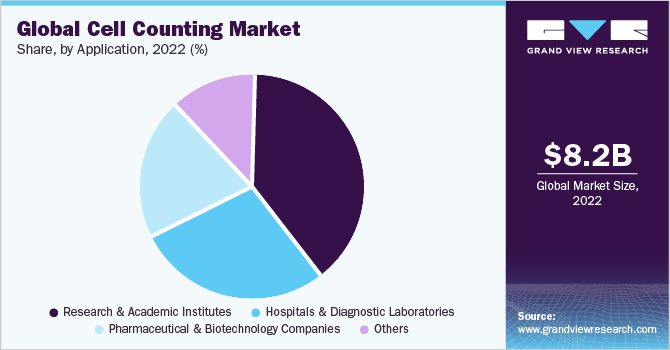

The global cell counting market size was valued at USD 8.23 billion in 2022 and is anticipated to grow at a CAGR of 8.2% from 2023 to 2030. Growing demand for biologics in the treatment of chronic and infectious diseases, the rising investments for biotechnology and biopharmaceutical industries, the development of advanced cell based research are some factors propelling the market growth. Biologics development involves the usage of various cell counting products such as flow cytometers and spectrophotometers, which control the cell concentration in biologics, thereby fueling growth prospects for this market.

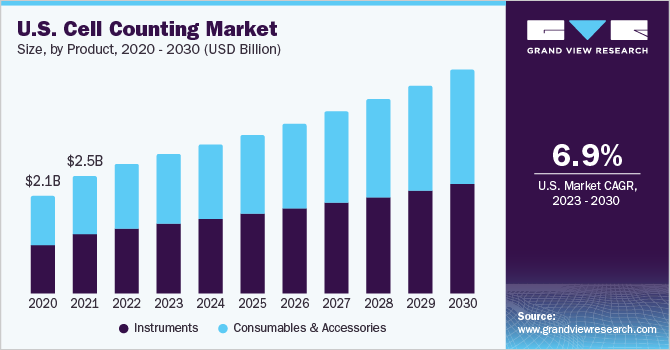

U.S. cell counting market size, by product, 2020 - 2030 (USD Million)

COVID-19 had a substantial impact on the market growth. There was a significant rise in the use of cell counting devices during the pandemic as lymphopenia and osteopenia were the potential indicators of COVID-19. Moreover, the study published by BMC in June 2021 concluded that the WBC count of the COVID-19 patient during admission is significantly correlated with the death of patients. A higher level of white blood count should be given further care in the COVID-19 treatment. The growing importance of cell count in patients suffering from COVID-19 has augmented the growth of the market during the pandemic. Cell counting instruments are progressively being adopted in numerous areas of research such as neuroscience cancer biology and immunology, which exhibit remunerative growth opportunities for the market.

Cell counting helps in the identification and determination of primary tumors, circulating tumors, and metastatic tumors, which are critical for disease monitoring and therapeutic targeting. Moreover, they are extensively used in cancer research to regulate intra-tumor heterogeneity, which is essential for the determination of cancer progression. It is expected to witness exponential growth as blood cell counting is imperative for the assessment of various diseases and its adoption is anticipated to increase over the forecast period.

In addition, technological advancements in these devices will offer lucrative opportunities in the study period. For instance, in January 2023, CellDrop, an automated cell counter by DeNovix has been awarded as Sustainable Laboratory Product of the Year in the SelectScience Scientists’ Choice Awards due to its specialization of eliminating the need for cell counting slides. They have already saved 8.5 million slides which is equal to 30,000 kg of plastic. In April 2021, CytoSMART Technologies launched automated CytoSMART Exact FL, the company’s first fluorescence cell counter. It is a dual fluorescence device and is used for typical laboratory applications. In Dec 2020, Merck launched Scepter 3.0, which is an automated handheld cell counter. Scepter 3.0 can count thousands of cells per measurement with extreme accuracy. Similarly, in June 2020, DeNovix launched the first in-the-market imaging cell counter, which eradicates the requirement for slides, thus reducing the environmental footprint of the laboratory.

Government initiatives for promoting cell therapeutics research are widening the growth prospects for the market. Furthermore, funding related to stem cell research has augmented in recent years, which has further accelerated the growth of research. For instance, in March 2023, Stem Cell Research and Eli and Edythe Broad Center of Regenerative Medicine at UCLA received funding of more than USD 5.7 million from the California Institute for Regenerative Medicine to enhance the stem cell-based technologies to treat cancer and intellectual disabilities.

Product Insights

On the basis of products, the cell counting market is categorized into consumables & accessories and Instruments. The consumables and accessories segment accounted for the largest revenue share of 54.14% in 2022 and is expected to grow at the fastest CAGR of 8.4% over the forecast period. Consumables and accessories used with these devices include reagents, microplates, magnetic beads, and chamber slides. The growth of consumables and accessories is attributed to their high usage volume. Moreover, the launch of novel products propels segment growth. For instance, in December 2020, eNuvio launched a reusable 3D cell culture microplate. eNuvio anticipates that scientists will benefit from this environmentally friendly device for a long period of time, both economically and scientifically.

Reagents sub-segment held the largest revenue share of 56.3% in 2022. The large revenue share is attributed to the repeated purchase of these products for use during spectrophotometry, flow cytometry, and automated cell counting. Need for frequent recalibrations of these instruments prior to conducting experiments increases their demand. The automated Cell Counter by Corning simply associates the device with tablet or computer by connecting CytoSMART Cloud App. The system generates summary reports instantly with every count which can be accessed remotely on our device.

Application Insights

Complete blood count held the largest revenue share of 59.1% in 2022. The complete blood count is one of the most common tests used for the evaluation of an individual’s overall health. The test is used to measure several blood components such as RBC, WBC, hemoglobin, hematocrit, and platelets. Increasing incidence of blood disorders such as anemia and leukemia is slated to boost segment growth as complete blood count is commonly used to monitor such conditions. For instance, in July 2022, MicroBioSensor launched QUICKCHECK, a medical device designed in a collaboration with Smallfry. QUICKCHECK is a rapid detection & a portable device enabling nurses to perform instant leukocyte count test at patient’s home.

Stem cell research is anticipated to expand at the fastest CAGR of 9.5% over the forecast period. The exponential growth is a result of the growing need for mass production of human stem cells for clinical and research applications. Stem cells are highly imperative in fields such as regenerative medicine, cancer therapy, and transplantation. Automated devices facilitate the determination of stem cell viability and concentration of nucleated cells in cord blood or human bone marrow accurately. In addition, features such as fluorescence imaging are increasingly being utilized to quantify GFP efficiency for transfecting stem cell applications. In January 2023, Axion BioSystems announced the launch of Omni Pro 12, designed to provide a programmed solution to assist multiple users with research and provide live-cell analysis platform.

End-use Insights

In 2022, research and academic institutes accounted for the largest revenue share of 39.6%. The dominant share can be attributed to the extensive adoption of cytometers in cell biology research studies. Cytometers find applications in measuring parameters such as physical properties, type, and lineage, which are used by researchers to study the progression of viruses, pathogens, and other bacteria. Strategic activities by key market players further drive the segment. For instance, in March 2021, Alliance Global installed an Automated Cell Counter system at the United Arab Emirates University in Al Ain.

The hospitals & diagnostic laboratories segment held a market share of 28.2% and is expected to grow at a CAGR of 7.7% during the forecast period. This is attributed to the high footfall in the hospitals segment and adoption of technologically advanced devices in the diagnostic laboratories. In July 2021, Neuberg Diagnostics Private Limited, India’s pathology organization, expanded its presence in the country by inaugurating a pathology lab in Telangana.

The pharmaceutical and biotechnology companies segment is anticipated to grow at the fastest CAGR of 9.0% during the forecast period. Cell counting is an important aspect of checking the potency of any biological product. These devices are used to determine the number of cells in a particular culture solution, which is then added to the bioreactors/fermenters to achieve the desired product. Increasing demand for biologics produced through bioprocessing in these bioreactors/fermenters is anticipated to boost device demand over the forecast years.

Regional Insights

In 2022, North America accounted for the largest revenue share of over 37.6% owing to the increasing focus on biomedical and cancer research. The rise in the prevalence of chronic diseases, such as cardiovascular and blood diseases, is one of the major factors anticipated to fuel the adoption of these devices. As per the American National Red Cross, in the U.S., sickle cell disease affects 90,000 to 100,000 individuals.

Asia Pacific is expected to grow at the fastest CAGR of 10.3% over the forecast period. This exponential CAGR can be attributed to the local presence of certain clinical research and biopharmaceutical companies, stem cell research activities, across this region. In addition, the growing geriatric population, which is highly susceptible to chronic diseases, is predominantly driving the market in the region. This has resulted in an increase in the adoption of these devices at an unprecedented rate owing to an increase in the number of clinical tests conducted annually for geriatric patients. In May 2023, Sysmex, a leading diagnostic solutions organization, announced that it would launch its Clinical Flow Cytometry System in Japan following the launch in Asia Pacific, North America and Europe.

In June 2020, fully automated biochemistry and hematology analyzer were inaugurated at Mon District Hospital in Nagaland, India. The haematology analyzer is used for analyzing white blood cells, red blood cells and platelet count.

Key Companies & Market Share Insights

Key players in this market are implementing various strategies including partnerships through mergers and acquisitions, geographical expansions, and strategic collaborations to expand their market presence. For instance, in January 2023, ThermoFisher Scientific Inc, announced the completion of the acquisition of The Binding Site Group, one of the leaders in specialty diagnostics. The acquisition has expanded ThermoFisher’s existing specialty diagnostics product portfolio and has further added pioneering innovation in monitoring & diagnosis of multiple myeloma.

In May 2021, PerkinElmer announced the expansion of its Cell biology proficiencies by procuring Nexcelom Bioscience. The acquisition gives PerkinElmer access to Nexcelom Bioscience’s cell-counting product range and improves its QA/QC capacity. Some prominent players in the global cell counting market include:

-

ThermoFisher Scientific, Inc.

-

Merck KGaA

-

Agilent Technologies

-

PerkinElmer, Inc.

-

BD

-

Danaher

-

Bio-Rad Laboratories, Inc.

-

BioTek Instruments, Inc.

-

GE Healthcare

-

DeNovix Inc.

Cell Counting Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.82 billion

Revenue forecast in 2030

USD 15.46 billion

Growth Rate

CAGR of 8.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/ billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

ThermoFisher Scientific, Inc.; Merck KGaA; Agilent Technologies; PerkinElmer, Inc.; BD; Danaher; Bio-Rad Laboratories, Inc.; BioTek Instruments Inc.; GE Healthcare; DeNovix Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Counting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cell counting market on the basis of product, application, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Spectrophotometers

-

Flow Cytometers

-

Hemocytometers

-

Automated Cell Counters

-

Microscopes

-

Others

-

-

Consumables & Accessories

-

Reagents

-

Microplates

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Complete Blood Count

-

Automated Cell Counters

-

Manual Cell Counters

-

-

Stem Cell Research

-

Cell Based Therapeutics

-

Bioprocessing

-

Toxicology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Diagnostic Laboratories

-

Research & Academic Institutes

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell counting market size was estimated at USD 8.23 billion in 2022 and is expected to reach USD 8.82 billion in 2023.

b. The global cell counting market is expected to grow at a compound annual growth rate of 8.21% from 2023 to 2030 to reach USD 15.46 billion by 2030.

b. North America dominated the cell counting market with a share of 37.5% in 2022. This is attributable to the increasing focus on biomedical, stem cells, and cancer research and the rise in the prevalence of chronic diseases, such as cardiovascular and blood diseases.

b. Some key players operating in the cell counting market include Agilent Technologies; Thermo Fisher Scientific, Inc.; Merck KGaA; PerkinElmer, Inc.; BD; Danaher; Bio-Rad Laboratories, Inc.; BioTek Instruments, Inc.; and GE Healthcare.

b. Key factors that are driving the cell counting market growth include the rising prevalence of chronic diseases such as cancer, HIV, and Alzheimer’s. The increasing prevalence of these diseases has surged clinical research activities, consequently propelling the demand for cell counting instruments and consumables. Government initiatives working to promote the development of cell therapeutics, wherein cell counting plays an imperative role, are also expanding growth prospects for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."