- Home

- »

- Biotechnology

- »

-

Cell Cryopreservation Market Size, Industry Report, 2033GVR Report cover

![Cell Cryopreservation Market Size, Share & Trends Report]()

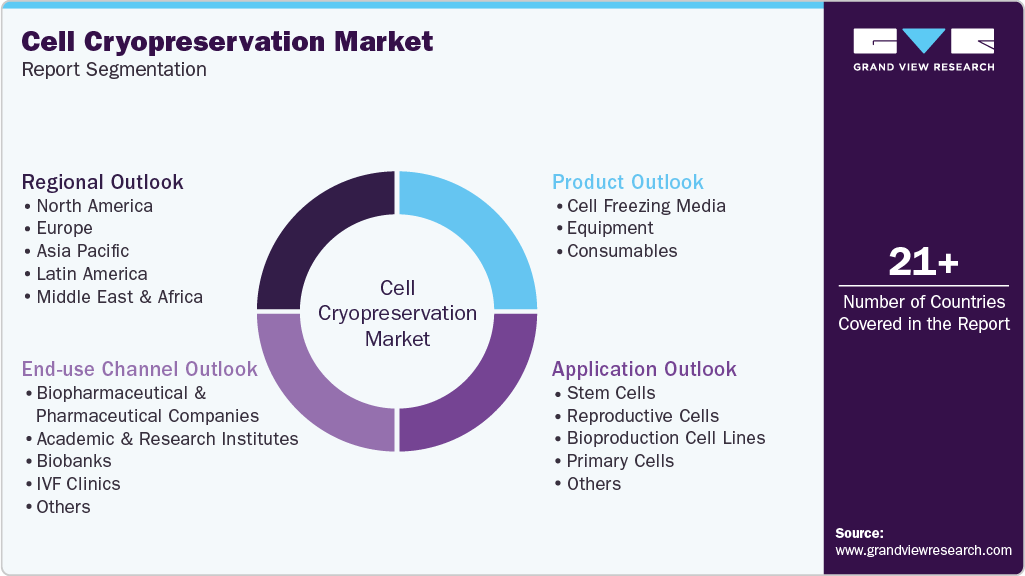

Cell Cryopreservation Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cell Freezing Media, Equipment, Consumables), By Application (Stem Cells, Bioproduction Cell Lines, Primary Cells), By End-use (Biobanks, IVF Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-147-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Cryopreservation Market Summary

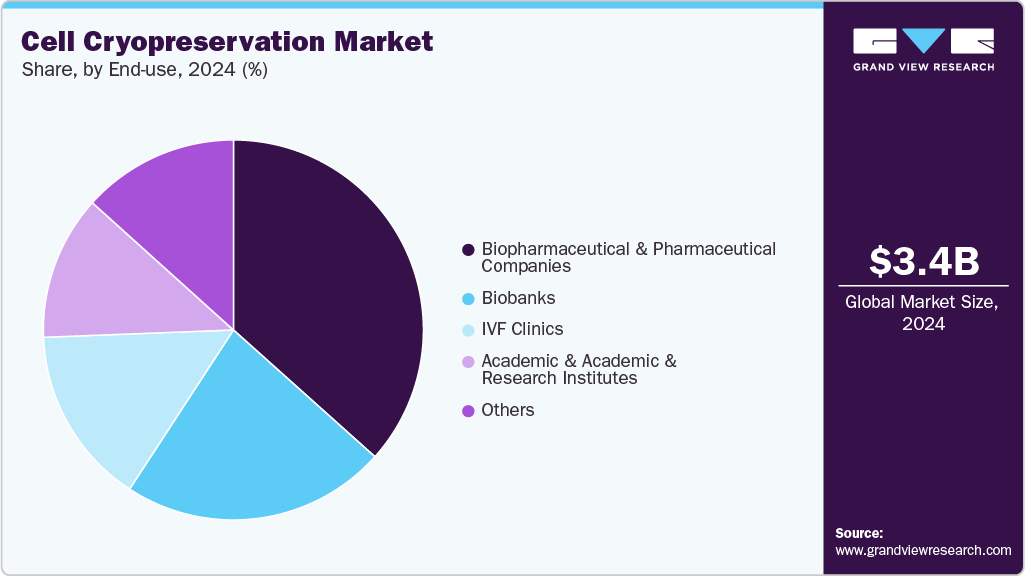

The global cell cryopreservation market size was estimated at USD 3.38 billion in 2024 and is projected to reach USD 8.86 billion by 2033, growing at a CAGR of 11.40% from 2025 to 2033. The market growth is due to the increasing adoption of cell cryopreservation as an alternative to conventional freezing techniques.

Key Market Trends & Insights

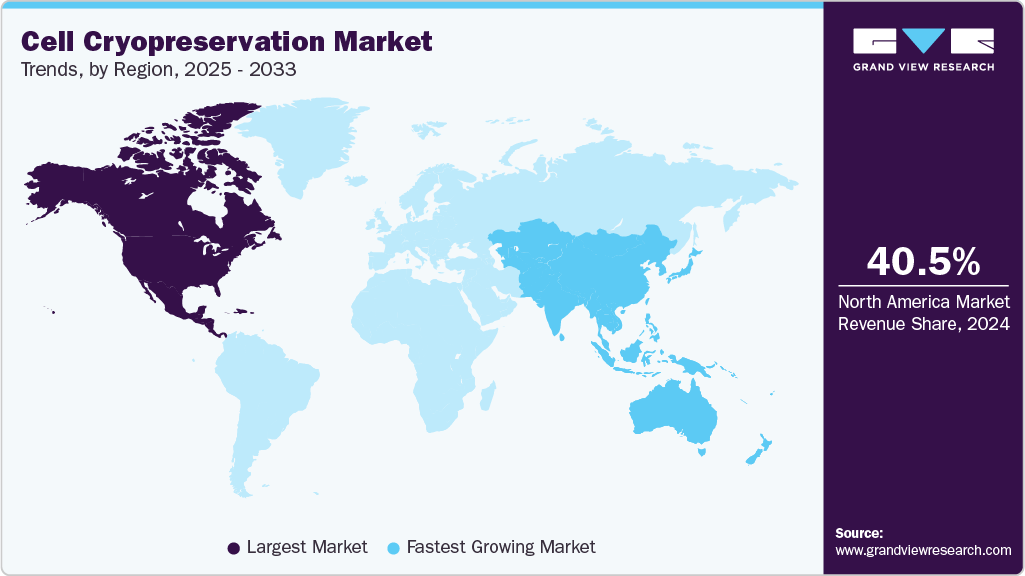

- The North America cell cryopreservation market held the largest share of 40.46% of the global market in 2024.

- The cell cryopreservation industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the consumables segment held 41.87% of the global revenue share in 2024.

- By application, the stem cells segment held the highest market share of 30.97% in 2024.

- By end-use, the biopharmaceutical & pharmaceutical companies segment held the highest market share of 36.63% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.38 Billion

- 2033 Projected Market Size: USD 8.86 Billion

- CAGR (2025-2033): 11.40%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, rising demand for effective freezing media across various end users and a wide range of new products is anticipated to fuel the market growth.

Fertility preservation

Fertility preservation is emerging as a significant market driver for the cell cryopreservation industry, owing to the growing adoption of assisted reproductive technologies (ART) and the rising prevalence of infertility cases. Moreover, many individuals delay parenthood due to career priorities, lifestyle choices, and late marriages, further accelerating the need for cryopreservation solutions. The trend is supported by advancements in cryoprotectants, vitrification techniques, and cell freezing media, ensuring higher post-thaw survival rates of oocytes, sperm, and embryos.

Live births per intended egg retrieval (all embryo transfers)

Age Group

Number of Cycle Starts

Live Births (%)

Singleton (% of live births)

Twins (% of live births)

Triplets or More (% of live births)

< 35

53088

42.8%

96.8%

3.1%

0.1%

35-37

35914

30.5%

97.3%

2.6%

0.1%

38-40

35511

19.4%

96.8%

3.1%

0.0%

41-42

18776

9.4%

97.1%

2.9%

0.0%

> 42

13831

2.8%

98.2%

1.8%

0.0%

Source: SART, Secondary Research, Grand View Research

Moreover, the rapid expansion of fertility clinics and ART centers worldwide, along with supportive government policies and insurance coverage for fertility preservation in certain regions of the world, further boosts the demand for cell cryopreservation techniques, media, and products. Social acceptance of elective egg freezing and increasing awareness of fertility preservation among women are broadening the consumer base. As fertility preservation continues transitioning from a niche medical need to a mainstream choice, it is expected to sustain strong growth in the cell cryopreservation market by driving innovation in freezing technologies, improving accessibility, and creating long-term storage demand.

Growth in cell and gene therapy

The increasing acceptance of cutting-edge therapies, regenerative medicine, and precision healthcare largely fuels demand in the cell cryopreservation market. Cell and gene therapies (CGT), such as CAR-T, TCR-T, NK cell therapies, and stem cell-based treatments, need dependable preservation methods to preserve cell viability and therapeutic effectiveness. Unlike traditional medicines, these live treatments are very vulnerable to environmental variables, necessitating effective cryopreservation methods. The necessity for scalable, reproducible, and effective freezing media, gear, and cold chain logistics has grown along with the fast growth in the pipeline of CGT products and the rise in regulatory approvals.

Moreover, growing investments in biobanking, fertility preservation, and extensive clinical trials stimulate market demand. Biobanks are essential for storing high-quality stem cells, cord blood, and patient-derived cells for future treatments, diagnostics, research, and reproductive health applications. For instance, there is rising awareness and acceptance of eggs, sperm, and embryo freezing. Also, the scope of cryopreservation treatments is expanding due to the rising prevalence of chronic and rare diseases and advancements in serum-free and chemically defined cryoprotectants that enhance post-thaw recovery. These trends demonstrate cryopreservation's critical role in ensuring the availability, stability, and worldwide accessibility of cells in research, clinical, and commercial uses.

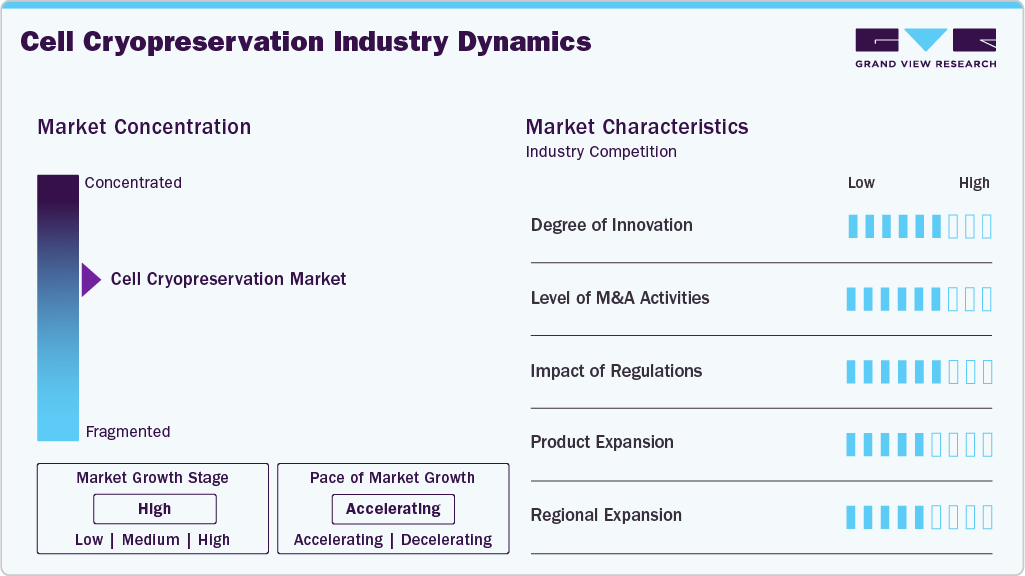

Market Concentration & Characteristics

The cell cryopreservation industry demonstrates a high degree of innovation, driven by advancements in vitrification techniques, serum-free and xeno-free cryoprotectants, and improved freezing media that enhance post-thaw viability and safety. For instance, in July 2025, the U.S. achieved a historic IVF milestone with the birth of a youngster from a 30-year-old frozen embryo. This accomplishment emphasizes the developments in cryopreservation, embryo adoption, and assisted reproductive technologies beyond reproductive health. The expanding applications of cryopreservation in regenerative medicine, cell treatments, and fertility preservation are forcing businesses to spend considerably in R&D, which is driving the creation of specialized products designed to meet different cell types and strengthening the business's dynamic and innovative environment.

The cell cryopreservation industry shows a moderate to high level of M&A activity, with companies acquiring specialized players in cryopreservation media, biobanking, and automated storage to expand their product portfolios and strengthen geographic reach. For instance, in April 2025, BioLife Solutions in the U.S. acquired PanTHERA CryoSolutions, strengthening its biopreservation portfolio with proprietary Ice Recrystallization Inhibitor technology and advancing leadership in consumables for the global CGT market. While alliances and licensing agreements help to encourage innovation and commercialization, the growing need for fertility preservation, cell therapies, and regenerative medicine propels strategic deals. Generally, consolidation is gradually changing the market as participants look for technical benefits and more general healthcare integration.

Regulations play an important role in the cell cryopreservation industry, ensuring safety, efficacy, and compliance through standards such as GMP and GTP. While strict regulations raise cost and approval timelines, they also improve patient safety and reliability. Supportive policies surrounding stem cell research and fertility preservation push adoption, making rules a safeguard and a facilitator of market expansion.

Product expansion in the cell cryopreservation industry is driven by developing specialized media, cryoprotectants, and automated storage solutions for different cell types, including stem cells, gametes, and embryos. Companies are continuously introducing advanced, serum-free, and xeno-free formulations and scalable and user-friendly storage systems to meet growing demand in fertility preservation, regenerative medicine, and cell therapy applications. This emphasis on varied and cutting-edge product lines enables players to capture new market segments, improve customer adoption, and improve their competitive positioning.

Regional expansion is a major growth driver in the cell cryopreservation industry, with companies pursuing opportunities in emerging markets amid rising demand for fertility preservation and cell therapies. North America and Europe lead the market due to strong healthcare infrastructure, and the Asia-Pacific region is growing fast because of the increased awareness and expanding healthcare infrastructure. Firms are strengthening local presence through partnerships, regional production, and targeted outreach to reach new patients and clients.

Product Insights

Based on product, the consumables segment held 41.87% of the global revenue share in 2024, accounting for the largest proportion of the market and expected to grow fastest throughout the forecast period. This is primarily due to benefits such as lower contamination, which are primarily due to the increasing adoption of cryovials, cryotubes, and other consumables by end users. Other factors, including the rising prevalence of chronic diseases, growing demand for biologics, and rising demand for cryopreservation among end users, will propel the segment's growth.

The freezing media segment is expected to witness the significant growth during the forecast period, due to the widespread use of cryopreservation media in various sectors, including stem cell regeneration, drug development, regenerative medicine, and biobanking. Technological advancements and rising demand for safe, efficient, standardized preservation solutions across research and clinical applications support this use.

Application Insights

The stem cell application segment held the largest market share of 30.97% in 2024, driven by its important function in regenerative medicine for treating ailments like heart disease, diabetes, and neurological problems. The demand for stem cell-based treatments is driven by the growing burden of chronic disease, an aging population, and lifestyle choices, which further supports the cell cryopreservation industry expansion.

Reproductive cells are expected to witness the fastest CAGR during the forecast period, due to an increase in the number of egg-freezing cycles, an increase in biobanks, and a surge in demand for personalized pharmaceuticals. The rising number of egg-freezing cycles has been identified as a major growth driver for cell cryopreservation. Extracting and freezing a woman's eggs for future use is known as egg freezing or oocyte cryopreservation. This approach has grown in recent years due to the possible benefits it offers, such as preserving fertility opportunities for women who want to postpone children or are at risk of fertility disorders.

End-use Insights

Biopharmaceutical and pharmaceutical companies accounted for the largest share in the global cell cryopreservation market in 2024, holding 36.63% of the market. The growth of the advanced cell therapy, regenerative medicine, and biologics market boosts this segment, as these products require high-quality and effective cryopreservation options to preserve cell viability and function.

Biobanks are expected to experience the fastest CAGR due to their importance as research and clinical repositories for tissues and cells. Developed nations store an average of 11 biobanks for every million people as of 2022. The Global Biobank Meta-Analysis Initiative (GBMI), spearheaded by MIT and the Broad Institute of Harvard University, along with global partners, seeks to interlink biobanks, enrich genetic diversity, and amplify the discovery of new genetic variations associated with diseases for global biobanks.

Regional Insights

North America held the largest market share of 40.46% in 2024, owing to its developed health infrastructure, well-established distribution networks, and major cryopreservation manufacturers. Increased disease rates and an aging population continue to encourage innovation within biopharma, increasing demand for and perpetuating regional growth for cell cryopreservation.

U.S Cell Cryopreservation Market Trends

The U.S. cell cryopreservation industry is driven by advances in regenerative medicine, cell and gene therapies, and fertility preservation. The strong healthcare system, the biobanking system, and the support provided by biopharma in research and development support market growth and advancements in techniques such as vitrification, xeno-free media, and automated storage, which improve safety and efficacy. Moreover, the country's supportive government initiatives and growing demand for cell-based treatments strengthen its dominance in the industry.

Europe Cell Cryopreservation Market Trends

In Europe, cell cryopreservation is advancing through a strong biobank network, international research partnerships, and encouraging regulatory frameworks from the EMA, all of which are contributing to the market's expansion. The region's emphasis on standardized practices, advanced healthcare infrastructure, and biotechnology investment continues to fuel the innovation in freezing media, cryoprotectants, and automated storage systems.

The UK cell cryopreservation market is backed by strong biobanking networks, strict HFEA regulations, and growing demand for fertility and stem cell storage. To further strengthen the country's leadership in life sciences and cryopreservation, the UK announced in July 2024 that it would support UK Biobank with nearly USD 63 million, and AWS contributed approximately USD 10 million in cloud services, which were matched by government funding to advance biomedical, data-driven healthcare research. Moreover, innovation from well-established companies like Cells4Life and startups like CryoLogyx emphasizes the nation's position as a center for cutting-edge, ethically regulated procedures.

The Germany cell cryopreservation market is growing significantly in the cell cryopreservation market, due to its robust biotech industry, cutting-edge healthcare system, and emphasis on regenerative medicine. Strict EU-aligned regulations guarantee safe and moral biobanking, while businesses like Merck KGaA and PromoCell support innovation with serum-free media and cutting-edge freezing technologies. Germany continues to lead Europe in cell cryopreservation due to its strong research funding and cross-sector collaborations.

Asia Pacific Cell Cryopreservation Market Trends

Asia Pacific is projected to witness the fastest growth in the cell cryopreservation market, driven by rising adoption in countries such as China and Japan. Preservation technologies are in high demand due to the region's large population, increasing chronic disease burden, aging population, and higher infertility rates. For instance, in July 2025, India's Supreme Court ruled that stem-cell preservation by cord blood banks constituted healthcare services, granting tax exemption and signaling applicability under GST, reducing costs and supporting broader accessibility of such services. This action lowers expenses and increases accessibility, indicating more extensive regulatory backing and accelerating the regional market's growth.

The China cell cryopreservation industry is growing rapidly, fueled by a strong push in regenerative medicine, growing biobanking networks, and rising demand for fertility preservation. An aging population is driving the adoption of cutting-edge cryopreservation techniques, increasing rates of chronic illnesses, and infertility. China is now one of the most dynamic markets in the Asia Pacific due to government support for biotech innovation and large investments from domestic and foreign companies.

In Japan, the cell cryopreservation market is expanding rapidly, driven by a rapidly aging population and rising demand for fertility solutions, which are boosting adoption. Backed by strict regulatory oversight and strong academic-industry collaboration, Japan continues to shape the global cryopreservation landscape.

Middle East & Africa Cell Cryopreservation Market Trends

The cell cryopreservation industry in the Middle East and Africa is emerging owing to the growing need for stem cells and regenerative therapies. As partnerships between global biobanks and academic and research institutes grow, nations like the United Arab Emirates, Saudi Arabia, and South Africa are increasing the adoption of cutting-edge cryopreservation technologies. Cell storage and preservation services are becoming more widely available throughout the region due to government efforts to improve access to healthcare and the expansion of the private healthcare industry.

The market for cell cryopreservation in Kuwait is expanding due to rising demand for regenerative therapies and increased awareness of fertility preservation. Clinics such as Dar Al-Baraa Medical Center and CellSave Arabia provide advanced services, including storing eggs, embryos, and cord blood. Kuwait is establishing itself as a regional center for cutting-edge cell preservation services with supportive government programs and improved healthcare systems.

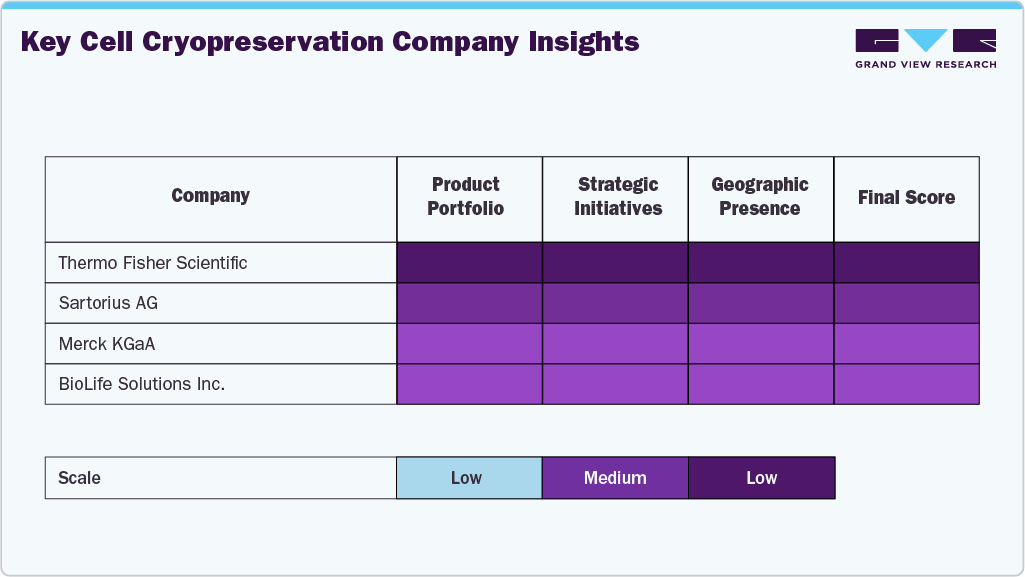

Key Cell Cryopreservation Company Insights

The cell cryopreservation industry is characterized by several established players who dominate through an advanced and wide range of product portfolios, strategic collaborations, and continuous investments in research and development. Leading companies such as Thermo Fisher Scientific Inc., Merck KGaA, Sartorius AG, PromoCell GmbH, Lonza, and BioLife Solutions Inc. have maintained significant market share due to their advanced cryopreservation technologies, broad application scope, and extensive global distribution networks.

Companies such as HiMedia Laboratories, Creative Biolabs, Corning Incorporated, and are expanding their reach by providing cutting-edge cryopreservation solutions, customized freezing media, and automated storage systems to satisfy the increasing demands of various end users.

The market for cell cryopreservation is seeing a dynamic intersection of new and established players. Mergers, acquisitions, strategic alliances, and advancements in automation, storage, and cryopreservation media fuel the competition in the market. Businesses combining customer-focused solutions with scientific innovation will be well-positioned to create long-term value in this quickly changing industry.

Key Cell Cryopreservation Companies:

The following are the leading companies in the cell cryopreservation market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Sartorius AG

- BioLife Solutions Inc.

- PromoCell GmbH

- Lonza

- HiMedia Laboratories

- Creative Biolabs

- Corning Incorporated

Recent Developments

-

In April 2024, Thermo Fisher Scientific launched TSX Universal Series ULT freezers, which are certified ENERGY STAR and provide improved performance, quicker recovery, and 33% energy savings for environmentally friendly laboratory operations.

-

In April 2024, the Pluristyx launch PluriFreeze cryopreservation media, supporting scalable, synthetic, animal-origin-free stem cell storage to enhance post-thaw viability and accelerate iPSC-based therapy development.

Cell Cryopreservation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.74 billion

Revenue forecast in 2033

USD 8.86 billion

Growth rate

CAGR of 11.40% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KGaA; Sartorius AG; PromoCell GmbH; Lonza; HiMedia Laboratories; Creative Biolabs; Corning Incorporated; BioLife Solutions Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Cell Cryopreservation Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global cell cryopreservation market on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell Freezing Media

-

Ethylene Glycol

-

Dimethyl Sulfoxide

-

Glycerol

-

Others

-

-

Equipment

-

Freezers

-

Incubators

-

Liquid Nitrogen Supply Tanks

-

-

Consumables

-

Cryogenic vials

-

Cryogenic tubes

-

Cooler boxes/containers

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Stem Cells

-

Reproductive Cells

-

Bioproduction Cell Lines

-

Primary Cells

-

Others

-

-

End-use Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical & Pharmaceutical Companies

-

Academic and Research Institutes

-

Biobanks

-

IVF Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. By application, the stem cell segment accounted for the largest share in 2024. Increased stem cell research and development of drugs by medical professionals and scientists is predicted to drive the expansion of the global market.

b. The global cell cryopreservation market size was estimated at USD 3.38 billion in 2024 and is expected to reach USD 8.86 billion in 2025.

b. The global cell cryopreservation market is expected to grow at a compound annual growth rate of 11.40% from 2025 to 2033 to reach USD 8.86 billion by 2033.

b. The key market players include Thermo Fisher Scientific Inc., Merck KGaA, Sartorius AG, PromoCell GmbH, Lonza, HiMedia Laboratories, Creative Biolabs, Corning Incorporated, and BioLife Solutions Inc.

b. The increased use of ready-to-freeze media, combined with a rising prevalence of infertility diseases, is driving demand for these products. Furthermore, the rising prevalence of chronic diseases, as well as the increasing importance of cell therapy for disease management, have prompted demand for effective cryopreservation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.