- Home

- »

- Biotechnology

- »

-

Cell Therapy Market Size, Share And Growth Report, 2030GVR Report cover

![Cell Therapy Market Size, Share & Trends Report]()

Cell Therapy Market (2024 - 2030) Size, Share & Trends Analysis Report By Therapy Type (Autologous (Stem Cell Therapies, Non-stem Cell Therapies), Allogeneic), By Therapeutic Area, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-701-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Therapy Market Summary

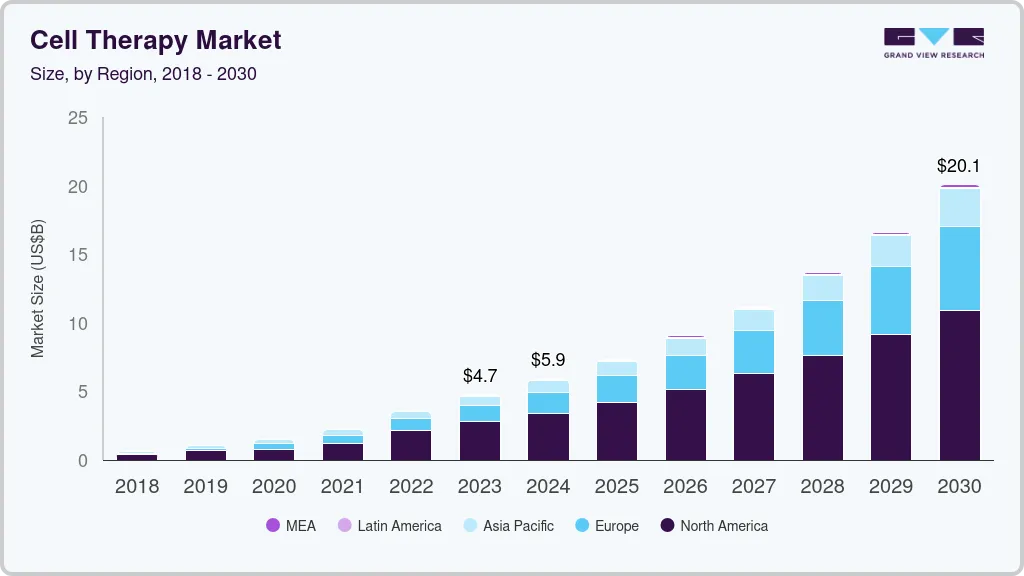

The global cell therapy market size was estimated at USD 4.74 billion in 2023 and is projected to reach USD 20.07 billion by 2030, growing at a CAGR of 22.66% from 2024 to 2030. The market for cell therapy is constantly growing to include new cell types, which presents significant opportunities for companies to strengthen their market positions.

Key Market Trends & Insights

- The North America accounted for the largest revenue share of 58.7% in 2023.

- The Asia Pacific is estimated to register a significant CAGR during the forecast period due to increased demand for cell therapy in the region.

- Based on therapy type, the autologous therapy segment dominated the market with a share of 91.22% in the year 2023.

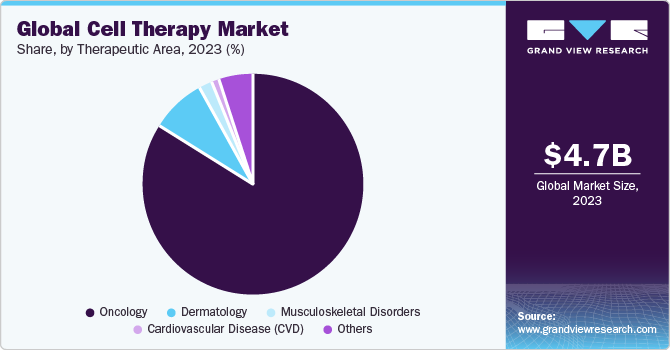

- Based on therapeutic area, the oncology segment dominated the overall market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.74 Billion

- 2030 Projected Market Size: USD 20.07 Billion

- CAGR (2024-2030): 22.66%

- North America: Largest market in 2023

As a result, during the past few years, there has been a dramatic increase in the number of companies engaged in developing cell therapies.

The rise in funding for cell therapy clinical studies, the adoption of useful guidelines for cell therapy manufacturing, and the success of products are some of the major factors influencing the growth in the number of companies in the market. The development of cell banking facilities and the ensuing growth in cell manufacturing, storage, and characterization have enhanced the market's ability to handle large volumes on a global scale. Furthermore, several companies are offering cell therapy characterization research and analysis services which is boosting the growth of cell-based therapeutics manufacturing. This has directly contributed to the market's increased revenue generation over the previous few years.

The increase in the number of clinical trials can be attributed to the presence of private and government funding agencies that are constantly providing approvals to support projects across different stages of clinical trials. The majority of late-stage projects in Europe are receiving funds through EU grants. For instance, in July 2022, Achilles Therapeutics declared that it had been awarded a USD 4.2 million Horizon Europe, the EU’s key funding initiative for research and innovation. This funding was awarded to advance personalized therapy manufacturing.

The rise of personalized medicine has led to an increase in clinical studies. Cellular therapies, especially those involving genetically modified cells, offer the potential for customized treatments that target the unique genetic makeup of individual patients. This personalized analysis enhances treatment effectiveness and minimizes adverse effects, marking a paradigm shift in the way healthcare is delivered.

Stem cell therapy is also increasingly gaining attention due to its applications in therapeutics for autoimmune and metabolic disorders. It plays an essential role in developing immunity in an individual to fight against various metabolic disorders. For instance, in May 2022, Sernova and Evotec entered into a collaboration for development of cell therapy to be used for the treatment of insulin-dependent diabetes using induced pluripotent stem cells (iPSC)-based therapeutics.

In addition, automation in adult stem cells & cord blood processing and storage are the key technologies expected to positively influence growth of the adult & cord blood cells market. Furthermore, key entities in the market are involved in collaborations to reprogram newborn stem cells from umbilical cord blood as well as tissue into induced pluripotent stem cells (IPSCs). These developments are expected to drive growth of market over the forecast period.

Market Concentration & Characteristics

The cell therapy landscape is also characterized by a high degree of innovation. Pioneering research and technological breakthroughs are enhancing the efficacy and safety of cell-based therapies. These innovations encompass several key areas, from novel cell sources and manufacturing techniques to optimized delivery methods.

Companies are pursuing mergers and acquisition strategies to strengthen their pipelines, expand geographical reach, and accelerate product development. As the cell therapy industry matures, M&A activities serve as a pivotal force in consolidating resources, optimizing manufacturing capabilities, and securing intellectual property, fostering a competitive landscape for sustainable growth.

The increasing availability of advanced cell engineering technologies and genetic editing tools, such as CRISPR-Cas9, has led to an increased focus on regulations in this industry. Regulatory measures for enhancing efficacy & reducing the risk of adverse reactions are expected to present significant challenges for market growth.

The market is also witnessing high levels of product and regional expansion due to rising number of approvals for cell-based therapeutics granted by key regulatory authorities such as the U.S. FDA and EMA in recent years. This attribute is anticipated to fuel market growth in near future.

Therapy Type Insights

Autologous therapy segment dominated the market with a share of 91.22% in the year 2023. The growth in the segment is attributed to the high adoption of numerous CAR-T therapies owing to its favorable outcomes for treatment of various types of cancers and genetic disorders. The FDA has approved some of such therapies and their wider adoption is currently under progress. For instance, in February 2022, the U.S. FDA accorded its approval to the drug called ciltacabtagene autoleucel (Carvykti) for adult subjects with multiple myeloma that is irresponsive to the refractory therapeutics or that has relapsed after therapeutics.

Allogeneic cell therapy segment is estimated to register substantial growth in the market from 2024 to 2030. The growth can be attributed to its high adoption for designing novel therapeutic regimes. There are 542 active allogenic CAR-T agents in the global pipeline, with many of them yielding favorable outcomes. For instance, Adaptimmune Ltd. collaborates with Genentech to focus on utility of allogeneic therapies derived from iPSCs to create T-cells with higher proliferation capacity than the mature T-cells.

Therapeutic Area Insights

The oncology segment dominated the overall market with the largest revenue share in 2023. CAR T-cells targeting CD19 are reported to provide high rates of complete and long-lasting remissions for patients with acute lymphocytic leukemia (ALL). Furthermore, increasing FDA approval for novel therapies is expected to create growth opportunities for the market. For instance, in October 2021, the U.S. FDA approved the use of the brexucabtagene autoleucel (Tecartus), a CAR T therapy for individuals with B-cell precursor ALL who have not responded to prior treatment (refractory) or whose condition has returned after treatment. With this approval, brexucabtagene became the first CAR T treatment for adults with ALL.

The musculoskeletal disorders segment is anticipated to witness significant market expansion in the forthcoming years. Considerable research is being conducted on technologies aimed at enabling the regeneration or restoration of impaired musculoskeletal tissues. Researchers across diverse groups are analyzing clinically applicable cell types used in therapies to address musculoskeletal tissue degeneration. They are also exploring the direct application of engineered or native skeletal progenitor cells to stimulate tissue repair and revitalize musculoskeletal tissues. These factors are expected to drive the segment growth.

Regional Insights

North America accounted for the largest revenue share of 58.7% in 2023. This is attributed to the collaborative research initiatives by research institutes and the pharmaceutical giants. There are emerging advancements in the region through numerous collaborations. For instance, in June 2022, Immatics entered into a collaboration with Bristol Myers Squibb to develop Gamma Delta Allogeneic Cell Therapy Programs. The availability of funds from government organizations significantly contributes to market growth in the U.S. For instance, in January 2022, Cellino Biotech announced that it raised around USD 80 million through a Series A financing round from 8VC, Felicis Ventures, and other investors. The company plans to use these funds to expand access to stem cell-derived therapies to develop the first independent human cell foundry by 2025.

Asia Pacific is estimated to register a significant CAGR during the forecast period due to increased demand for cell therapy in the region. Certain factors, such as increasing awareness about novel therapies, growing investments, and expected favorable policies by governments, are estimated to accelerate market growth during the forecast period. For instance, in June 2022, Tessa Therapeutics Ltd. raised USD 126 million through rounds of series funding to catalyze the development of next-generation cancer therapy. Similarly, the South Korean market is expected to exhibit lucrative growth due to various strategic initiatives undertaken by local players and international companies. For instance, in August 2022, Panacell Biotech announced that it would be using Natural Killer (NK) cells, brown Adipose-Derived Stem Cells (ADSC), and exosomes for treating COVID-19 infection.

Key Companies & Market Share Insights

Cell therapy market is currently experiencing increased efforts of key companies to develop and launch novel cell therapies for multiple indications. Companies with strong pipeline and resources are pushing for product approvals to gain first mover advantage in the specific applications. Companies are also engaging in collaborations and licensing agreements to sustain their foothold in the highly competitive market environment.

Some of the key players operating in the market include Bristol-Myers Squibb Company, Novartis AG, Gilead Sciences, Inc.

-

Bristol-Myers Squibb Company is involved in the development and marketing of CAR-T cell therapies. In May 2023, the company received European Commission (EC) approval for Breyanzi for treatment of refractory or relapsed large B-cell lymphoma in adult patients.

-

Novartis AG is also involved in the development of various cell therapies to strengthen its market position. In January 2020, the company announced that Kymriah would be publicly funded to treat eligible adult patients with relapsed or refractory DLBCL in Australia.

-

Aurion Biotech, Holostem Terapie Avanzate S.r.l., Nkarta, Inc. are some of the emerging market participants in the market.

-

In October 2023, Aurion Biotech began a phase 1/2 clinical trial of cell therapy for corneal edema in the U.S.

-

In October 2023, Nkarta, Inc. announced the FDA's approval of an IND application to investigate NKX019, its allogeneic, CD19-directed CAR NK cell therapy candidate, to cure lupus nephritis.

Recent Developments

-

In October 2023, Aurion Biotech began a phase 1/2 clinical trial of cell therapy for corneal edema in the U.S.

-

In October 2023, Nkarta, Inc. announced the FDA's approval of an IND application to investigate NKX019, its allogeneic, CD19-directed CAR NK cell therapy candidate, to cure lupus nephritis.

-

In June 2023, Vertex Pharmaceuticals Incorporated and Lonza revealed a joint venture to facilitate the manufacturing of Vertex's portfolios of investigational stem cell therapies. These therapies are designed to aid individuals with Type 1 Diabetes (T1D), with a specific focus on the VX-880 and VX-264 programs currently undergoing clinical trials.

-

In May 2023, Johnson & Johnson signed a global collaboration & licensing agreement with Cellular Biomedicine Group to develop next-generation CAR-T therapies.

-

In March 2023, Adaptimmune Therapeutics plc. and TCR2 Therapeutics announced a strategic alliance to form a world-class cell therapy organization for solid tumors.

-

In May 2023, the Bristol-Myers Squibb Company received European Commission (EC) approval for Breyanzi for treatment of refractory or relapsed large B-cell lymphoma in adult patients. This approval would improve company’s position in European market

-

In January 2020, the Novartis AG announced that Kymriah would be publicly funded to treat eligible adult patients with relapsed or refractory DLBCL in Australia.

Key Cell Therapy Companies:

- Novartis AG

- Gilead Sciences, Inc.

- Bristol-Myers Squibb Company

- Johnson & Johnson Services, Inc

- JCR Pharmaceuticals Co., Ltd.

- JW Therapeutics

- Atara Biotherapeutics

- Anterogen Co., Ltd.

- MEDIPOST

- S. BIOMEDICS

- Aurion Biotech

- Holostem Terapie Avanzate S.r.l

- Nkarta, Inc.

Cell Therapy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.89 billion

Revenue forecast in 2030

USD 20.07 billion

Growth rate

CAGR of 22.66% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Therapy type, therapeutic area, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country scope

U.S.; Canada; UK; Germany; Switzerland; Japan; China; India; South Korea

Key companies profiled

Novartis AG; Gilead Sciences, Inc.; Bristol-Myers Squibb Company; Johnson & Johnson Services, Inc; JCR Pharmaceuticals Co., Ltd.; JW Therapeutics; Atara Biotherapeutics; Anterogen Co., Ltd.; MEDIPOST; S. BIOMEDICS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell therapy market based on therapy type, therapeutic area, and region:

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Allogeneic Therapies

-

Stem Cell Therapies

-

Hematopoietic Stem Cell Therapies

-

Mesenchymal Stem Cell Therapies

-

-

Non-Stem Cell Therapies

-

Keratinocytes & Fibroblast-based Therapies

-

Others

-

-

-

Autologous Therapies

-

Stem Cell Therapies

-

BM, Blood, & Umbilical Cord-derived Stem Cells

-

Adipose Derived Cells

-

Others

-

-

Non-Stem Cell Therapies

-

T-Cell Therapies

-

CAR T Cell Therapy

-

T Cell Receptor (TCR)-based

-

-

Others

-

-

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Disease (CVD)

-

Musculoskeletal Disorders

-

Dermatology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global cell therapy market size was estimated at USD 4.74 billion in 2023 and is expected to reach USD 5.89 billion in 2024.

b. The global cell therapy market is expected to witness a compound annual growth rate of 22.66% from 2024 to 2030 to reach USD 20.07 billion by 2030.

b. The autologous therapies segment dominated the 2023 market with a revenue share of 91.2% owing to the presence of a substantial number of approved products for clinical use.

b. Some key players in the cell therapy market are Novartis AG, Gilead Sciences, Inc., Bristol-Myers Squibb Company, Johnson & Johnson Services, Inc, JCR Pharmaceuticals Co., Ltd., JW Therapeutics, Atara Biotherapeutics, Anterogen Co., Ltd., MEDIPOST, S. BIOMEDICS

b. Key drivers of the cell therapy market are increasing clinical studies pertaining to the development of cellular therapies, growing adoption of regenerative medicine, and introduction of novel platforms and technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.