- Home

- »

- Biotechnology

- »

-

Cell Separation Market Size & Share, Industry Report, 2033GVR Report cover

![Cell Separation Market Size, Share & Trends Report]()

Cell Separation Market (2025 - 2033) Size, Share & Trends Analysis Report By Cell Type (Human Cells, Animal Cells), By Product (Consumables, Instruments), By Technique, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-707-0

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Separation Market Summary

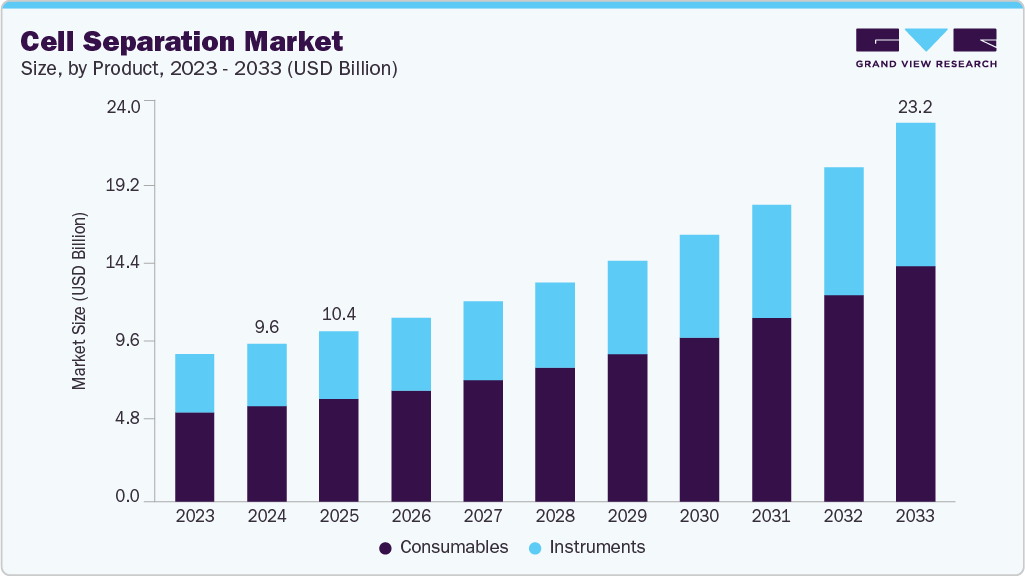

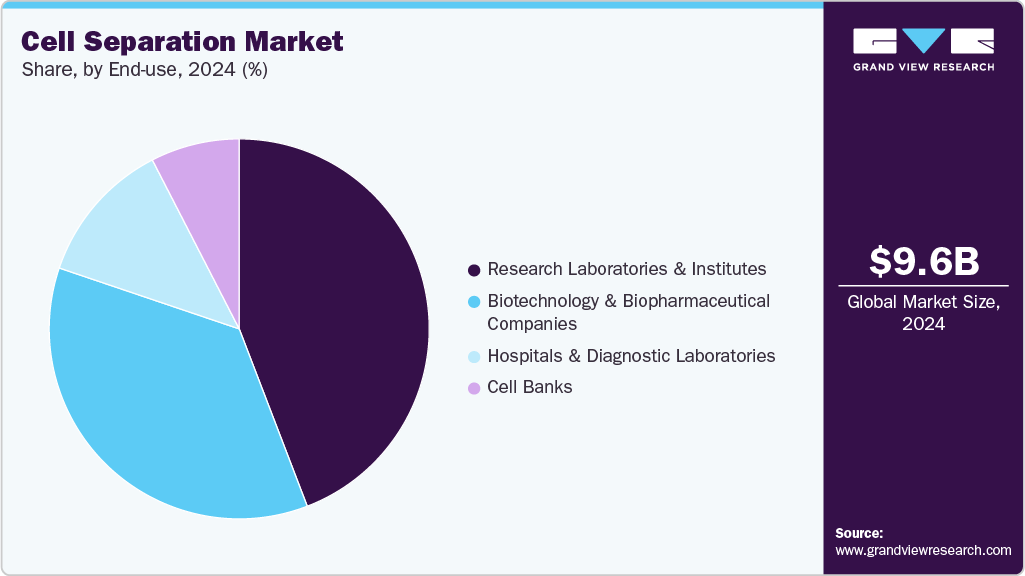

The global cell separation market size was estimated at USD 9.64 billion in 2024 and is projected to reach USD 23.16 billion by 2033, growing at a CAGR of 10.55% from 2025 to 2033. Cell separation plays an important role in various applications, including biologics designing and development, therapeutic protein production, in vitro diagnostics, and other research applications.

Key Market Trends & Insights

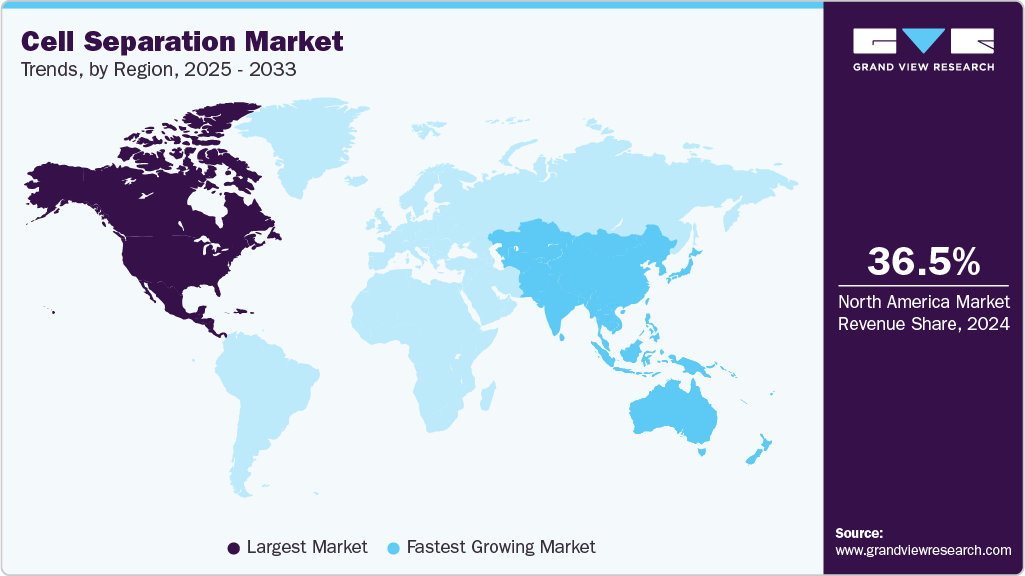

- The North America cell separation market held the largest revenue share of 36.54% in 2024.

- The cell separation industry in the U.S. is expected to grow significantly from 2025 to 2033.

- By product, the consumables segment held the highest market share of 60.25% in 2024.

- By cell type, the animal cells segment held the highest market share in 2024.

- By end use, the hospitals and diagnostic laboratories segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.64 Billion

- 2033 Projected Market Size: USD 23.16 Billion

- CAGR (2025-2033): 10.55%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Rising prevalence of chronic and infectious diseases, such as cancer and COVID-19, along with continuous government initiatives to improve the biotechnology industry, are the major factors contributing to market growth. Product innovation is one of the key growth determinants of the market. Various companies, such as NanoString Technologies, Levitas Bio, and Bionano Genomics, have undertaken product development strategies and expanded their offering. For instance, in April 2022, Levitas Bio announced the launch of the LeviCell EOS System, their next-generation platform for cell separation. The new product enables a targeted selection of viable cells and has a relatively higher throughput than the company's existing products. In addition, the COVID-19 pandemic has provided researchers with an opportunity to investigate and comprehend this novel infectious virus and to discover therapies and diagnostic aids for it.For instance, in March 2020, the U.S. President signed an emergency spending bill, wherein USD 3 billion is accounted to be used for the R&D of vaccines, medical treatments, and test kits. This has significantly boosted the demand for cell separation tools in research applications.Cell separation or isolation techniques are widely used to develop and manufacture biologics, such as monoclonal antibodies and recombinant proteins. These products have been gaining traction over the past few decades. With the substantial growth of specialty drugs and personalized medicine, the demand for biologics has been increasing. According to CAS (A division of the American Chemical Society), it was estimated that biologics will grow to USD 399.5 billion by 2025.

Moreover, the funding and current high demand have also motivated startups to enter the cell separation industry, despite the high cost of R&D. StartUs Insights identified and analyzed 957 startups in the field of cell and molecular biology solutions that are contributing to the sector growth. For instance, in October 2023, Veeda Group, in partnership with Atal Incubation Centre – Centre for Cellular and Molecular Biology (AIC – CCMB), newly introduced a half-day symposium in Hyderabad. The event, titled “Integrated Phase I Trial Solutions for Emerging Biopharmaceuticals: Addressing Development Challenges and Accelerating Timelines,” focused on optimizing processes and overcoming challenges in the development of New Chemical Entities (NCEs) and Large Molecules. Furthermore, the growing prevalence of chronic diseases has increased the demand for diagnostic solutions and research applications.

As per the American Cancer Society, in 2023, in the U.S. alone, more than 1.9 million new cases of cancer are projected to be diagnosed. According to the WHO, 58 million people worldwide are suffering from chronic hepatitis C infection,with approximately 1.5 million new infections occurring every year.Instruments and related products can render accurate and effective results and have indispensable applications in the fields of disease diagnosis and scientific research. However, these products have high prices, which could, to some extent, restrict market growth. The techniques also involve a wide range of expenses for equipment, reagents, kits, sera, and services. The experimental setup and the reagents utilized for certain applications are pricey. These factors are anticipated to limit the cell separation industry's growth to a certain extent during the forecast period.

Rising Demand for Cell-based Therapies

The expansion of cell therapy, including CAR-T, stem cell, and regenerative medicine treatments, is fueling the need for efficient, high-purity cell separation tools. Cell separation is a critical step in isolating specific populations like T-cells, NK cells, or stem cells for both autologous and allogeneic therapies. With the FDA approving more cell-based products and clinical trials accelerating, there’s growing pressure on labs and manufacturers to adopt scalable, automated, and GMP-compliant separation solutions.

Stem cell research is anticipated to propel the advancements in the field of cell separation, thus driving the significant growth of the cell separation industry. This is attributed to the growing number of R&D activities and rising demand for personalized medicines & regenerative medicines. For instance, as per the article published in August 2023, researchers utilize a grouping of cytokines, such as hepatocyte growth factor (HGF), oncostatin M (OSM), epidermal growth factor (EGF), fibroblast growth factor-2 (FGF2), and leukemia inhibitory factor (LIF) to guide mesenchymal stem cells toward a hepatocyte-like cell fate. Additional cytokines, like Activin A, are essential for directing induced pluripotent stem cells and embryonic stem cells into endoderm cells-the innermost layer in developing embryos. Meanwhile, cytokines such as interleukin-3 (IL-3) play a crucial role in facilitating stem cell migration. Thus, anticipated to drive the growth of the cell separation industry.

Furthermore, the increasing investments in stem cell research are also contributing to the expansion of the cell separation market. For instance, in September 2023, UC Irvine was designated as one of CIRM's cell and gene therapy manufacturing facilities, which was granted USD 2 million. This funding empowers the campus stem cell center to make strides in advancing regenerative medicine. Similarly, in October 2023, under the Accelerating Cures initiative, the Maryland Stem Cell Research Commission (MSCRC) has been assigned with approximately USD 4 million grands to impel the stem cell innovations within the U.S. This investment is designed to bolster research efforts and drive the development of stem cell companies, with the goal of translating scientific progressions into tangible outcomes. Thus, these investments are projected to propel the market growth.

FDA Approved Cell Therapies:

Name

Type

Manufacturer

Description

ABECMA

(2021)Cell (autologous, modified)

Celgene Corporation, a Bristol-Myers Squibb Company

CAR T cells recognize the B-cell maturation antigen (BCMA) and kill BCMA-expressing tumor cells. A lentiviral vector, developed by Bluebird Bio, is used to engineer the CAR T cells.

ALLOCORD

(2013)Cell (allogeneic)

SSM Cardinal Glennon Children's Medical Center

Blood cell transplant derived from the umbilical cord and placenta.

AMTAGVI

(2024)Cell (modified)

Iovance Biotherapeutics, Inc.

Engineered T cells for the treatment of adult patients with unresectable or metastatic melanoma previously treated with a PD-1 blocking antibody, and if BRAF V600 mutation positive, a BRAF inhibitor with or without a MEK inhibitor.

BREYANZI

(2021)Cell (autologous, modified)

Juno Therapeutics, Inc., a Bristol-Myers Squibb Company

CAR T cells engineered with lentivirus to attack CD19-expressing tumor cells. Treats patients with certain kinds of large B-cell lymphoma.

CARVYKTI

(2022)Cell (autologous, modified)

Janssen Biotech, Inc.

CAR T cells engineered with lentivirus to attack BCMA-expressing tumor cells. Treats patients with certain kinds of relapsed or refractory multiple myeloma.

CASGEVY

(2023)Cell (autologous, modified)

Vertex Pharmaceuticals, Inc.

CD34+ hematopoietic stem cells engineered with electroporation of CRISPR/Cas9 RNP complexes to decrease expression of BCL11A to increase fetal hemoglobin production. Treats patients with certain kinds of sickle cell disease.

Source: mirusbio

Market Concentration & Characteristics

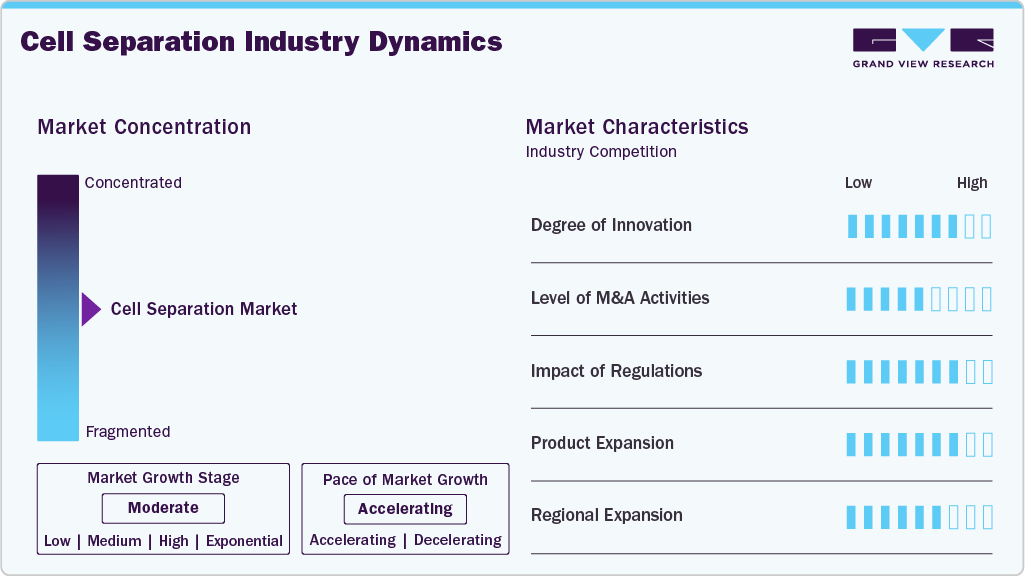

The cell separation market is characterized by moderate-to-high innovation, especially in the development of label-free, microfluidic, and high-throughput solutions. Innovations are being driven by increasing demand for single-cell analysis, cell therapy workflows, and minimal sample manipulation. Leading players like Miltenyi Biotec, STEMCELL Technologies, and Thermo Fisher are actively integrating AI-powered analytics and microfabrication technologies to improve precision and scalability. However, innovation is often incremental rather than disruptive, as platforms must meet strict validation and regulatory requirements for clinical use.

M&A activity in the cell separation space has been active but targeted, primarily involving strategic acquisitions by large life sciences companies looking to expand their capabilities in sample preparation, cell therapy tools, and diagnostics. For example, Danaher’s acquisition of Cytiva and Thermo Fisher’s acquisition of companies like PPD and PeproTech indicate a broader strategy of end-to-end workflow integration. While the market isn’t flooded with deals, select M&As are reshaping competitive dynamics by enabling bundled solutions and deeper vertical integration across research and clinical markets.

The impact of regulations in the cell separation market varies by application, low to moderate in academic and basic research settings, but significantly higher for clinical and GMP-compliant workflows. FDA, EMA, and ISO guidelines influence how companies design and validate their products for clinical manufacturing, especially in cell therapy applications. Vendors offering clinical-grade kits or instruments must adhere to cGMP standards and rigorous documentation, which often limits the speed of innovation and increases product development costs.

Product expansion is a key growth strategy, particularly among mid-to-large players that offer both manual and automated cell separation tools. Companies are broadening their portfolios to include customizable bead kits, closed-system separation devices, and integrated workflow platforms. Many are also expanding into adjacent categories like flow cytometry, cell counting, or sample preservation, aiming to provide more comprehensive solutions for researchers and CDMOs.

The cell separation industry is witnessing robust regional expansion, especially in Asia Pacific and parts of Latin America, driven by increased government funding for cell therapy, academic research, and biomanufacturing infrastructure. While North America and Western Europe remain core markets due to advanced R&D and regulatory maturity, companies are localizing manufacturing, forming distribution partnerships, and participating in regional consortia to tap into emerging biotech clusters in China, India, South Korea, and Brazil.

Product Insights

In 2024, the consumables segment dominatedthe cell separation market with the largest revenue share, due to repeated purchases of consumables. In addition, rising investments in R&D by pharmaceutical and biopharmaceutical companies for the development of advanced biologics, including monoclonal antibodies and vaccines, are driving the segment. Thus, the demand for consumables is also expected to remain high during the forecast period.

The instruments segment is projected to register a significant CAGR throughout the study period. Technological advancement in instruments provides efficient cell separation in research, diagnostics, and therapeutic applications. Thus, the industry for instruments is anticipated to witness significant growth during the forecast period. However, the high cost of instruments is expected to restrain market growth to a certain extent.Companies have initiated building sustainable technology to gain a competitive edge in the market. For instance, in March 2022, Element Biosciences disclosed details regarding upcoming Aviti DNA sequences. The product is anticipated to be a new benchtop instrument since the company stated that it can reduce reagent usage and cut down costs to approximately USD 7 per GB.

Cell Type Insights

The animal cells segment held the largest revenue share of 53.88% in 2024. The growing focus of government, private, and healthcare companies on new drug discoveries and development is a key factor driving the segment's growth. Drug discovery and development involve animal cells to examine efficacy, the pharmacokinetics of new drug molecules, and preliminary toxicity.

The human cell segment is anticipated to exhibit the fastest CAGR of 11.31% during the forecast period. Rising focus on human & cancer research and varied applications of isolated human cells in biopharmaceutical development, clinical trials, and research are among the major factors contributing to its largest share. Moreover, favorable reimbursement policies pertaining to personalized medicine in developed countries boost the demand for human cell isolation.

Technique Insights

The centrifugation segment dominated the cell separation industry by holding the largest revenue share of 41.14% in 2024. This is due to the extensive usage of this technique by academic institutes, research laboratories, and biotechnology and biopharmaceutical companies. Centrifugation is one of the most important steps in the process. Density gradient centrifugation and differential centrifugation are most commonly used for cell isolation/separation processes.

The surface marker technique is expected to witness the fastest CAGR of 11.83% during the forecast years. Rising investments in manufacturing infrastructure by companies and product advancements are prime factors supporting the growth of this segment. Manufacturers are engaged in the usage of advanced surface markers for production to ensure a better quality of the end product.

Application Insights

The biomolecule isolation segment dominated the cell separation market with a share of 30.43% in 2024 and is expected to witness the fastest CAGR during the forecast period. The growing focus on the production of biopharmaceuticals, including biosimilars, monoclonal antibodies, and recombinant proteins, is the most predominant factor contributing to its highest share. Also, increasing government funding for new drug development propels market growth.

The cancer research segment is projected to exhibit lucrative growth over the study period. Rising investment in cell-based research by companies and research laboratories is a key factor that can be attributed to the segment's growth. Several public-private organizations are investing heavily in cancer research owing to the increasing global incidence of cancer, thus driving the demand for innovative cell separation solutions.Furthermore, the emergence of precision medicine for cancer treatment is anticipated to enhance the market growth. For instance, PerkinElmer is expanding its offering with advanced technology for cancer research. This initiative is anticipated to boost the cancer research segment.

End Use Insights

The research laboratories and institutes segment accounted for the largest revenue share of 44.17% in 2024. This can be attributed to the increasing R&D initiatives by research institutions to develop novel therapies in oncology and neuroscience. The growing number of research institutes and laboratories across the globe is also anticipated to be a major driver of segment growth. For instance, in April 2022, Curate Biosciences collaborated with the City of Hope, a research and treatment organization for cancer in the U.S., to assess the company’s product, Curate Cell Processing System, for highly developed cell separation and intends to combine the platform with a workflow to produce CAR-T cell immunotherapy.

The biotechnology and biopharmaceutical companies segment will exhibit a gradual CAGR of 12.87% between 2025 and 2033. These companies are involved in extensive R&D activities for the development of new-generation therapeutics, which require cell separation techniques. Furthermore, increasing research activities by commercial organizations to develop efficient vaccines and therapeutics for COVID-19 are anticipated to create high demand for cell separation solutions, thereby supporting segment growth.

Regional Insights

North America dominated the global cell separation market with the largest revenue share of 36.54% in 2024. This can be attributed to the presence of well-established pharmaceutical & biotech industriesand the high adoption of technologically advanced solutions in the U.S. Furthermore, extensive research activities by research universities in the field of cell therapies have created a huge demand for cell separation solutions. In addition, the high prevalence of chronic and infectious diseases, including the outbreak of COVID-19, has led to an increase in the demand for cell separation solutions for research and clinical applications.

U.S Cell Separation Market Trends

In the U.S., the cell separation industry is being primarily driven by the surging demand for cell and gene therapies, alongside robust funding for biomedical research. The country has a high concentration of biotech companies, academic institutions, and translational research centers that require advanced separation technologies for immune profiling, single-cell studies, and manufacturing of therapeutic cell products. NIH and private investments in regenerative medicine and oncology are further pushing the adoption of scalable, clinical-grade solutions.

Europe Cell Separation Market Trends

Across broader Europe, the cell separation industry is influenced by increased public and EU-level funding for life sciences research, including Horizon Europe initiatives. There is a growing emphasis on personalized medicine and bio-manufacturing, with a focus on standardizing workflows across academic and commercial labs. Environmental regulations and the push for serum-free cell culture are also encouraging the adoption of more refined and automated cell separation techniques.

The growth of the UK cell separation market is driven by strong academic R&D infrastructure and government support for biotech innovation, particularly in areas like immuno-oncology, rare disease research, and stem cell therapy. The NHS's interest in integrating advanced therapies and national centers like the Cell and Gene Therapy Catapult is creating demand for scalable and GMP-compliant separation platforms. Brexit-related regulatory alignment with global standards is also influencing product sourcing and clinical adoption.

The cell separation market in Germany is expected to grow over the forecast period. Germany, being Europe’s largest life sciences hub, sees market growth led by biomanufacturing investments and strong collaboration between academia and industry. The presence of major biopharma companies and a focus on precision immunology are accelerating the use of high-performance separation systems. Funding through the German Research Foundation (DFG) and local innovation grants supports the development and deployment of advanced cell technologies across both academic and clinical settings.

Asia Pacific Cell Separation Market Trends

The Asia Pacific cell separation industry is projected to witness the fastest CAGR of 12.83% during the forecast period. The high growth can be attributed to thegrowing pharmaceutical and biotechnology industries in emerging economies, such as China and India. In addition, the growth in healthcare expenditure and an increase in market penetration of major global players in key Asia Pacific countries are expected to drive the segment over the forecast period. Furthermore, continuous stem and gene therapy research initiatives in Japan, China, and South Korea have boosted the demand for cell separation solutions in the region.

China’s cell separation market is expanding rapidly due to government initiatives promoting cell therapy and biotech infrastructure, such as the "Made in China 2025" plan. Local companies are investing heavily in R&D, while global players are forming joint ventures to tap into this growing demand. With rising numbers of cell therapy trials and academic projects focused on single-cell genomics and regenerative medicine, there’s increasing demand for both research-grade and GMP-certified separation products.

The cell separation market in Japan is driven by its national emphasis on regenerative medicine, backed by regulatory support from PMDA and strategic frameworks like the Act on the Safety of Regenerative Medicine. There is strong academic-industry collaboration in fields such as iPS cell research, and the adoption of cell separation tools for both research and therapeutic manufacturing is well-established. The market also benefits from the early adoption of automation in laboratory workflows.

MEA Cell Separation Market Trends

The development of the Middle East & Africa cell separation industry is still in its nascent stages. Still, it is being driven by government-backed healthcare modernization programs and increased academic research activity. Countries like Saudi Arabia, UAE, and South Africa are investing in biotechnology hubs and translational research centers, creating a demand for basic-to-intermediate cell separation tools, especially for immunology and infectious disease research.

Kuwait’s cell separation market is relatively niche but is supported by national efforts to expand precision medicine and medical research capacity. Key drivers include partnerships between government institutions and international universities, as well as initiatives under Vision 2035 to enhance health infrastructure. Most demand comes from academic labs and government-funded research institutions, with a gradual move toward integrating advanced technologies like magnetic and flow-based separation tools.

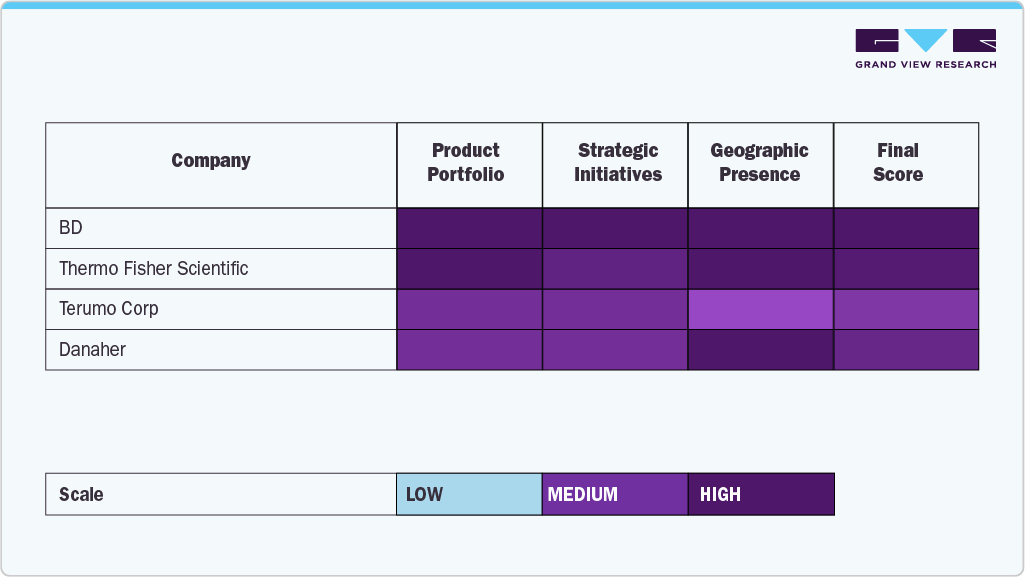

Key Cell Separation Company Insights

The cell separation market is characterized by a competitive mix of established technology leaders and emerging innovators, each contributing to market growth through robust product portfolios, strategic global partnerships, and ongoing investments in automation and digital transformation. Thermo Fisher Scientific holds a dominant global position with a broad product portfolio that spans magnetic bead-based kits, Dynabeads, reagents, and cell separation instruments. Its strong R&D, widespread distribution network, and integration with downstream applications (like cell analysis and culture) make it a top-tier player across all categories.

Danaher (via Cytiva & Beckman Coulter Life Sciences) plays a strong role through clinical-scale magnetic separation systems and automated solutions integrated into upstream bioprocessing workflows. Their influence is growing, especially in GMP and cell therapy applications.

Innovative companies like BD, Terumo Corp., and others increasingly capture market share by introducing modular, compact systems that meet specific research and clinical requirements. These players emphasize flexibility, customization, and sustainability, making them attractive partners in rapidly evolving sectors that require agile and cost-effective solutions.

Key players are engaged in organic and inorganic growth strategies, such as product-line expansion, collaborations, partnerships, mergers, and acquisitions, to garner a high market share.

Key Cell Separation Companies:

The following are the leading companies in the cell separation market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- BD

- Danaher

- Terumo Corp.

- STEMCELL Technologies Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Agilent Technologies, Inc.

- Corning Inc.

- Akadeum Life Sciences

Recent Developments

-

In January 2025, Researchers at K. N. Toosi University of Technology in Tehran, Iran, developed an innovative system that utilizes standing surface acoustic waves to isolate circulating tumor cells (CTCs) from red blood cells. This platform combines advanced computational modeling, experimental validation, and AI-driven algorithms to understand better and optimize complex acoustofluidic behaviors.

-

In July 2024, NanoCellect Biomedical is excited to introduce the VERLO Image-Guided Cell Sorter - a groundbreaking device designed to transform gentle flow cytometry, single-cell imaging, and cell sorting.

-

In May 2023, Akadeum Life Sciences launched a new series of products, namely leukopak human immune cell isolation and T-cell activation/expansion kits for cell therapy R&D. Through this development, the company strengthens the company’s Leukopak cell isolation product lines.

Cell Separation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.38 billion

Revenue forecast in 2033

USD 23.16 billion

Growth rate

CAGR of 10.55% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, cell type, technique, application, enduse, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait;

Key companies profiled

Thermo Fisher Scientific, Inc.; BD; Danaher; Terumo Corp.; STEMCELL Technologies Inc.; Bio-Rad Laboratories, Inc.; Merck KGaA; Agilent Technologies, Inc.; Corning Inc.; Akadeum Life Sciences

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Separation Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global cell separation market report based on product, cell type, technique, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumables

-

Reagents, Kits, Media, and Sera

-

Beads

-

Disposables

-

-

Instruments

-

Centrifuges

-

Flow Cytometers

-

Filtration Systems

-

Magnetic-activated Cell Separator Systems

-

-

-

Cell Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Human Cells

-

Animal Cells

-

-

Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

Centrifugation

-

Surface Marker

-

Filtration

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Biomolecule Isolation

-

Cancer Research

-

Stem Cell Research

-

Tissue Regeneration

-

In Vitro Diagnostics

-

Therapeutics

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Research Laboratories and Institutes

-

Hospitals and Diagnostic Laboratories

-

Cell Banks

-

Biotechnology and Biopharmaceutical Companies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell separation market size was estimated at USD 9.64 billion in 2024 and is expected to reach USD 10.38 billion in 2025.

b. The global cell separation market is expected to grow at a compound annual growth rate of 10.55% from 2025 to 2033 to reach USD 23.16 billion by 2033.

b. The consumables segment dominated the market for cell separation in 2024. This is due to repeated purchases of consumables for cell-based research. In addition, rising investments in R&D by pharmaceutical and biopharmaceutical companies for the development of advanced biologics such as monoclonal antibodies and vaccines are also driving the segment growth.

b. Some of the key players in the cell separation market are Thermo Fisher Scientific, Inc., BD, Danaher, Terumo Corporation, STEMCELL Technologies Inc., Bio-Rad Laboratories, Inc., Merck KGaA, Miltenyi Biotec, GenScript, and Corning Incorporated

b. The increasing interest of biopharmaceutical companies and researchers across the world in cancer and stem cell research is a major factor boosting the growth of the cell separation market. Advanced cell isolation products deliver improved separation of biological molecules including proteins, nucleic acids, chromatin, protein complexes for subsequent analysis. These factors are expected to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.