- Home

- »

- Biotechnology

- »

-

Cell Sorting Market Size & Share, Industry Report, 2033GVR Report cover

![Cell Sorting Market Size, Share & Trends Report]()

Cell Sorting Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cell Sorters, Reagents & Consumables), By Technology, By Application (Research, Clinical), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-990-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Sorting Market Summary

The global cell sorting market size was estimated at USD 261.1 million in 2024 and is projected to reach USD 569.1 million by 2033, growing at a CAGR of 9.19% from 2025 to 2033. The industry has witnessed significant advancements, driven by innovations such as high-speed sorting and advanced detection capabilities, which enhance precision and efficiency.

Key Market Trends & Insights

- The North America cell sorting market held the largest share of 43.61% of the global market in 2024.

- The cell sorting industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the reagents and consumables segment held the highest market share of 64.29% in 2024.

- Based on technology, the fluorescence-based droplet cell sorting segment held the highest market share in 2024.

- By application, the research applications segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 261.1 Million

- 2033 Projected Market Size: USD 569.1 Million

- CAGR (2025-2033): 9.19%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Technological Innovations

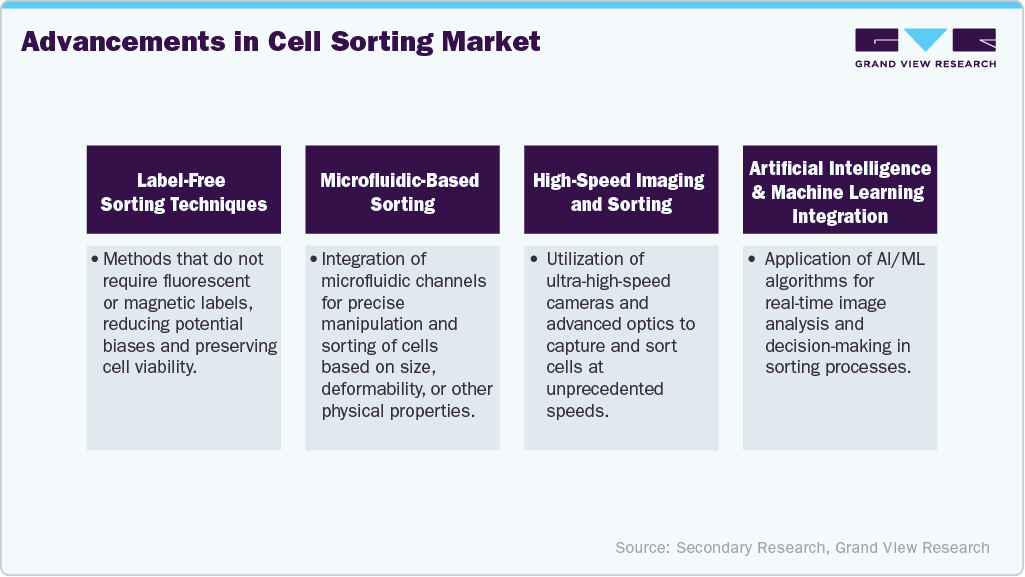

The market for cell sorting has grown significantly due to technological advancements. The reliability of sorting results has been further improved by automation, software integration, and instrument sensitivity advancements, opening these technologies to a greater variety of labs and clinical settings. Because of this, adoption rates have increased for therapeutic and research applications, which has fueled market expansion. These advancements have made cell sorting tools essential in various fields, including research and clinical applications. Fluorescence-Activated Cell Sorting (FACS), in particular, is a significant contributor to the market’s growth due to its ability to provide quick and quantitative measurements of cell properties, making it an essential tool for sorting heterogeneous cell populations.

Moreover, its integration with proteomics, genomics, and high-throughput screening platforms has greatly expanded cell sorting's market potential and usefulness. The global cell sorting market is experiencing sustained demand due to the new opportunities this convergence of technologies brings to academic, clinical, and industrial users.

Increasing Clinical Applications

One major factor deriving the market's expansion is the growing use of cell sorting in clinical settings. Because they make it possible to precisely isolate and analyze cell populations, cell sorting technologies are widely used in diagnostics, cancer research, and infectious disease studies. Globally, hospitals, research facilities, and diagnostic labs are adopting cell sorting due to its increasing use in clinical research and laboratory diagnostics.

By finding and examining these uncommon cells, especially in autoimmune and cancerous conditions, clinicians can make more precise diagnoses, track the effectiveness of treatments, and create customized treatment plans. The clinical utility of cell sorting is growing quickly due to the rising global prevalence of cancer and chronic diseases and the growing focus on precision medicine. This trend directly translates into higher demand for cell sorting instruments and related consumables, supporting sustained growth in the global market.

Market Concentration & Characteristics

The degree of innovation in the cell sorting industry is a key growth driver, as continuous technological advancements enhance efficiency and capabilities. For instance, in October 2023, in Japan, Sony launched the FP7000 Spectral Cell Sorter, supporting high parameter sorting with over 44 colors, advanced spectral unmixing, and automated workflows for efficient cell analysis. Cell sorting applications in research, diagnostics, and therapeutics are growing because of innovations such as automated sorting systems, microfluidic-based platforms, and integration with single-cell genomics and proteomics workflows.

The level of M&A activities in the cell sorting industry has been steadily increasing, as a significant market growth driver. Major players are pursuing strategic acquisitions and partnerships to expand their product portfolios, enhance technological capabilities, and strengthen their global presence. For instance, in February 2021, in the USA, Thermo Fisher Scientific acquired cell sorting technology assets from Propel Labs, including the Bigfoot Spectral Cell Sorter and 40 employees, expanding its flow cytometry and cell analysis portfolio. These mergers and acquisitions enable companies to access advanced cell sorting technologies, integrate complementary solutions, and enter new geographic markets more rapidly.

Regulations are essential to the cell sorting industry because they guarantee the' dependability, quality, and safety of tools and supplies. For clinical and diagnostic applications, adherence to regulations set forth by regulatory bodies such as the European Medicines Agency and the U.S. Food and Drug Administration is crucial, impacting new product development and launch schedules. Regulatory requirements encourage manufacturers to create reliable, superior solutions, which spur innovation even though they can raise costs and complexity. Regulatory approvals also improve market accessibility and credibility, promoting the wider use of cell sorting technologies in clinical and research settings worldwide.

The cell sorting industry is growing due largely to product expansion, as businesses consistently release new tools, materials, and integrated solutions to satisfy changing clinical and research demands. The global cell sorting market can grow steadily if manufacturers provide a greater range of sophisticated and adaptable solutions to draw in new clients, break into unexplored markets, and bolster their competitive position.

Regional expansion is a significant growth driver in the cell sorting market, as companies aim to strengthen their global presence and tap into emerging markets. Rising investments in biotechnology, life sciences research, and healthcare infrastructure in areas like the Middle East, Asia Pacific, and Latin America are creating new prospects for market penetration. Manufacturers can increase accessibility, shorten lead times, and improve customer support by setting up local sales networks, distribution channels, and service centers.

Product Insights

Reagents and consumables dominated the market with a revenue share of 64.29% in 2024. These products provide essential products for precise and efficient cell sorting. The rising use of high-throughput applications, single-cell analysis, and sophisticated sorting technologies has further strengthened these materials' dominance in the global cell sorting market.

Services are expected to register the fastest CAGR during the forecast period. The increasing demand for outsourcing complex and high-precision cell sorting experiments to specialized service providers drives this growth. Research facilities and labs need help managing sophisticated cell sorters, and as cell sorting technology develops, there will likely be a greater need for technical support and training services.

Technology Insights

Fluorescence-based droplet cell sorting (FACS) technology accounted for the largest revenue share of 42.14% in 2024 due to FACS's high precision, speed, and adaptability in separating particular cell populations using a variety of fluorescent markers. As it can be easily modified, fluorescence-based droplet sorting is suitable for diverse biological fields, including regenerative medicine and vaccine development.

Magnetic-activated cell sorting (MACS) technology is expected to register the fastest CAGR during the forecast period. MACS does not rely upon fluorescence-based technologies; thus, it is less equipment-intensive and can be applied commercially and in research settings. The ongoing development of smaller magnetic microbeads and automated magnetic separating systems in immunology, stem cells, and cancer research enhances the demand for this type of sample prep. Continuous product development and coupling of MACS with high-throughput and automated sample-preparation workflows are likely to contribute to MACS technology's uptake and sustained position within the growing global cell-sorting market.

Application Insights

Research applications held the largest market share in 2024. The significant funding directed by government and private organizations toward biomedical research is producing scientific gains. The National Institutes of Health (NIH) has announced that funding is being increased, allowing researchers to explore complex biological questions. Collaboration between academia and industry has thrived, and cell sorting tools have been used to make strides in research.

Clinical applications are expected to grow significantly over the forecast period. Due to the rising prevalence of chronic diseases, including cancer, diabetes, and autoimmunity, there is increased interest in cell sorting technologies. Providers need advanced diagnostic methods to determine disease cause and optimize therapy. Technologies, including FACS and microfluidics, have improved cell sorting systems' efficiency, as technology evolves, making them more valuable in clinical laboratories and daily diagnostics.

End Use Insights

Research institutions led the market with a revenue share of 38.90% in 2024. Top research institutions drive in the scientific domain concerning cancer biology, immunology, and stem cell biology. Moreover, competent staff with the necessary training in modern equipment are the ones who are most ready to use these technologies for innovation, and thus, they are able to set new trends in the industry, unlike the rest of the users.

The medical school and academic institutions segment is expected to grow significantly during the forecast period. Medical colleges and educational institutions often gain funding through government and privately backed grants, as well as those sponsored by trade or industry. These bodies conduct intensive training where students are trained on state-of-the-art equipment related to their research, such as flow cytometry and cell sorting. When combined with access to the associated technology, such an educational environment further encourages innovation and develops the next generation of scientists.

Regional Insights

North America dominated the cell sorting market with a share of 43.61% in 2024. The growth of the cell sorting market can be attributed to various factors, including a well-established healthcare industry, rising incidence of chronic diseases, increased R&D spending, and technological innovation driven by key players. Moreover, North America’s significant R&D expenditure, involving pharmaceutical, biotech, and university research centers, contributes to market growth.

U.SCell Sorting Market Trends

The U.S. maintains its position as a leader in the cell sorting industry, with commercially available platforms such as FACS and MACS. The good research ecosystem of the U.S. is constituted by top universities, research centers, and biotech companies, each competing to perform far-reaching research and innovation in the applications of cell sorting: cancer, immunological studies, and stem cell research.

Europe Cell Sorting Market Trends

Europe cell sorting market was identified as a lucrative region in the global cell sorting market in 2023. Europe is facing a growing burden of chronic diseases, including cancer and diabetes. The area has invested heavily in the biotechnology and pharmaceutical sectors to address this. This influx of funding has enabled increased research spending and initiatives, including those involving cell sorting technologies, which are crucial in developing new drugs.

The UK cell sorting industry is experiencing swift growth due to the uptrend in life sciences research, biotechnological innovations, and healthcare solutions. State subsidies and partnerships between publicly funded research institutions and private companies are energizing the industry and facilitating the rapid uptake of technology.

Germany’s cell sorting market maintained a significant market share in 2024. The country’s rigorous regulatory standards guarantee high-quality products in the biotechnology sector. Many international companies located in Germany have been very successful in creating a stable base, supporting innovation through cooperation with other countries and development, and making Germany a big player in the international cell sorting market.

Asia Pacific Cell Sorting Market Trends

Asia Pacific is projected to exhibit the fastest growth, with a CAGR of 11.51% over the forecast period. The region is experiencing an uptrend in the progress of cell sorting techniques, including FACS and MACS. The area has been undergoing extensive research activities in the biotech and pharma sectors over the last ten years. Nations like China and India that are still developing have placed research and development at the top of their agendas, thus fueling demand for cell sorting systems and creating the market's growth potential.

China's cell sorting market is anticipated to expand substantially within the forecast period. This growth can be attributed to increased R&D activities in biotech and pharma, rising healthcare facilities, and medical research funding. Besides the chronic diseases' high incidence (e.g., cancer and HIV), which require the healthcare sector to have a supply of advanced diagnostic tools, this has led to the increasing demand for efficient cell sorting methods.

The Japan cell sorting market is experiencing solid growth, mainly contributed by rising investments in biotechnology, pharmaceutical research, and regenerative medicine. The country’s emphasis on stem cell research, cancer biology, and immunotherapy has notably increased the uptake of sophisticated cell sorting technology in academic and industrial settings. Besides this, government support and funding programs for developing the life sciences sector in Japan are also contributing to expanding the market.

MEA Cell Sorting Market Trends

The cell sorting industry in the Middle East and Africa (MEA) region is an emerging market supported by the rising investments in healthcare infrastructure, biotechnology research, and diagnostics capabilities. The United Arab Emirates, Saudi Arabia, and South Africa are among the countries that are rapidly shifting their focus towards the development of biomedical research and life sciences education, which is leading to a greater use of modern cell sorting technologies. Moreover, collaborations with overseas biotech companies and the founding of new research institutions are the main factors that facilitate the entrance of cutting-edge cell sorting devices and expertise in the region. Therefore, the MEA region is becoming closer to a thriving market with abundant possibilities for the future cell sorting industry worldwide.

The Kuwait cell sorting market is emerging, driven by increasing investments in healthcare infrastructure, biomedical research, and life sciences initiatives. The changed perspective towards personalized medicine, regenerative therapies, and disease diagnostics is keeping the trend of demand for the accuracy of cell isolation solutions intact. Besides that, the collaboration with foreign universities and the creation of special laboratories are two factors that have facilitated the availability of state-of-the-art instruments and skills in cell sorting.

Key Cell Sorting Company Insights

The primary players keep their dominance in the cell sorting market, among other things, by having a wide range of products, being at the forefront of technology, and forming strategic partnerships. Some of the top companies, which include BD, Bio-Rad Laboratories, Danaher Corporation, Sony Group Corporation, and Miltenyi Biotec, have very high shares of the market because they provide cutting-edge cell sorting instruments, consumables, and product solutions for research as well as clinical applications across the globe. Their solid global distribution networks and continuous R&D activities have gone a long way in making their positions in the market more stable.

Companies like On-chip Biotechnologies, Cytonome/ST, Union Biometrica, Thermo Fisher Scientific, and uFluidix are propelling their brand through the provision of groundbreaking and tailored cell sorting technologies, such as microfluidics-based platforms, high-throughput solutions, and customized sorting services. These products satisfy the need for accurate cell isolation, single-cell analysis, and immunotherapy development, which has increased due to the requirements of research institutions, pharmaceutical companies, and biopharmaceutical enterprises.

Top players in the cell sorting industry are going on to deepen their commanding position by integrating groundbreaking technological functionalities, extensive service provisions, and favorable growth measures. Their concentration on achieving precision, volume, and user-friendliness has a ripple effect on the demand of such application areas as stem cell research, oncology, immunology, and therapeutic regeneration; therefore, they can keep propagating the cell sorting market globally.

Key Cell Sorting Companies:

The following are the leading companies in the cell sorting market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Sony Group Corporation

- Miltenyi Biotec

- On-chip Biotechnologies Co., Ltd.

- Cytonome/ST, LLC

- Union Biometrica, Inc.

- Thermo Fisher Scientific Inc.

- uFluidix

Recent Developments

-

In January 2025, SGS launched Germany’s first commercial cell sorting service using BD FACSAria Fusion, providing biopharmaceutical companies with high-precision FACS for ATMP development, rare cell isolation, and biomarker analysis.

-

In April 2024, BD (Becton, Dickinson and Company) globally launched new FACSDiscover S8 cell sorters, featuring BD CellView imaging and SpectralFX technology, expanding access to high-speed, image-enabled spectral cell sorting for research in cell biology, cancer, and immunology.

Cell Sorting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 281.6 million

Revenue forecast in 2033

USD 569.1 million

Growth rate

CAGR of 9.19% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

BD; Bio-Rad Laboratories, Inc.; Danaher Corporation; Sony Group Corporation; Miltenyi Biotec; On-chip Biotechnologies Co., Ltd.; Cytonome/ST, LLC; Union Biometrica, Inc.; Thermo Fisher Scientific Inc.; uFluidix

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Cell Sorting Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global cell sorting market on the basis of product, technology, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell Sorters

-

Reagents and Consumables

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Fluorescence-based Droplet Cell Sorting

-

Jet-in-air Cell Sorting

-

Cuvette-based Cell Sorting

-

-

Magnetic-activated Cell Sorting

-

MEMS - Microfluidics

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Research Applications

-

Immunology & Cancer Research

-

Stem Cell Research

-

Drug Discovery

-

Other Research Applications

-

-

Clinical Applications

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Research Institutions

-

Medical Schools and Academic Institutions

-

Pharmaceutical and Biotechnology Companies

-

Hospitals and Clinical Testing Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.