- Home

- »

- Food Safety & Processing

- »

-

Central & South America Food Safety Testing Market Report, 2030GVR Report cover

![Central & South America Food Safety Testing Market Size, Share & Trends Report]()

Central & South America Food Safety Testing Market Size, Share & Trends Analysis Report By Test (Allergen Testing, Chemical & Nutritional Testing), By Application (Dairy & Dairy Products, Processed Food, Beverages), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-761-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

The Central & South America food safety testing market size was estimated at USD 1369.5 million in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2030. The market is anticipated to be driven by growing instances of outbreaks of foodborne diseases, leading to consumer awareness regarding safety, which will consequently drive market growth. The rising demand for packaged eatables in the region driven by technological improvement, changing lifestyles, modern retail trades, and increased popularity of quick-service restaurants positively impacts market growth. In addition, innovative processing techniques for extending the shelf life of eatables is expected to drive the demand for processed food.

A wide range of chemical additives and preservatives used in the processing of eatables to extend the shelf life are projected to drive the demand for the chemical examination of processed food products. In addition, packaged eatables exhibit contamination due to the migration of chemicals from packaging materials which is further expected to increase the need for food testing. The government agencies are stepping up to monitor the food supply chain to minimize the contamination. The private sector is also contributing to the efforts by testing the raw ingredients and final products. In addition, increasing international trade with other countries, where regulations are stringent, is expected to boost food safety testing.

Drivers, Opportunities & Restraints

The food safety testing industry in Central and South America is experiencing significant growth driven by increasing consumer awareness and regulatory pressures. As populations become more health-conscious, there is a rising demand for safe and high-quality food products. Additionally, governments in the region are implementing stricter food safety regulations to prevent foodborne illnesses and ensure public health, prompting food manufacturers to invest in comprehensive testing solutions to comply with these standards.

Despite the positive outlook, the food safety testing industry faces several challenges, including limited financial resources for small- and medium-sized enterprises (SMEs) in the food industry. Many of these companies struggle to afford advanced testing technologies and quality assurance processes, which can hinder their ability to comply with regulations. Furthermore, the lack of trained personnel and infrastructure in certain areas can also limit the effectiveness and reach of food safety testing initiatives.

The growth of the food export industry presents lucrative opportunities for food safety testing in Central & South America. As countries increasingly participate in international trade, there is a pressing need to adhere to food safety standards to gain access to lucrative markets. Furthermore, advancements in technology, such as rapid testing methods and mobile testing labs, offer innovative solutions that can enhance testing efficiency and accuracy, paving the way for industry expansion.

Test Insights

The microbiological testing test segment led the market and accounted for 45.0% of the overall revenue share in 2024. Microbiological testing is a crucial segment within the food safety testing industry, focusing on the detection of harmful microorganisms such as bacteria, viruses, fungi, and parasites in food products. These tests are essential to ensure the safety, quality, and compliance of food with regulatory standards. They help identify pathogens like Salmonella, E. coli, Listeria, and Campylobacter, which can cause foodborne illnesses. The growing awareness of foodborne diseases, stringent food safety regulations, and rising consumer demand for safe and hygienic food products are driving the demand for microbiological testing.

Genetically Modified Organism (GMO) testing is a critical component of the food safety and quality assurance process, particularly as the production and consumption of genetically modified crops increase. This type of testing is designed to detect the presence of genetically modified DNA in food products, ensuring compliance with regulatory standards and consumer preferences. GMO testing is crucial for verifying labeling accuracy, identifying unintentional contamination, and assessing the environmental impact of GMOs. As consumers and governments continue to prioritize transparency and sustainability, GMO testing plays a key role in maintaining food safety, traceability, and public trust in the food supply.

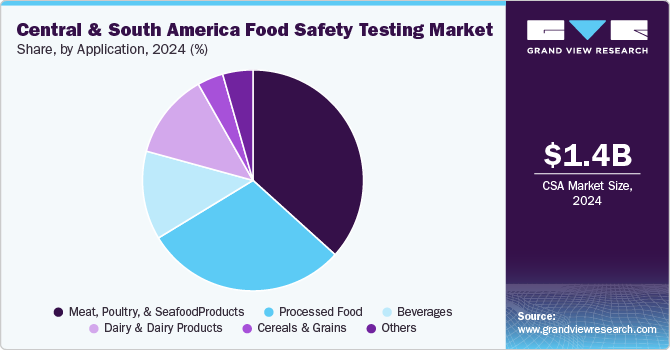

Application Insights

The meat, poultry, & seafood products application segment led the market and accounted for 36.7% of the overall revenue share in 2024. Food safety testing in meat, poultry, and seafood products is essential to ensure these high-risk foods are free from harmful pathogens and contaminants that can pose serious health risks to consumers. Testing methods are employed to detect foodborne pathogens such as Salmonella, E. coli, Listeria, and Vibrio, which are commonly found in raw meat, poultry, and seafood. These products are particularly vulnerable due to their perishable nature and potential for contamination during processing, handling, or storage. Food safety testing in these categories involves a variety of techniques, including microbiological assays, PCR, and rapid pathogen detection systems, to confirm product safety and quality.

Food safety testing in processed foods is vital to ensure that these ready-to-consumer products meet safety standards and are free from contaminants that could harm consumers. Since processed foods undergo various stages of preparation, packaging, and distribution, they are susceptible to risks such as microbial contamination, chemical residues, and adulteration. Testing methods in this sector often include microbiological analyses to detect pathogens like Salmonella, Listeria, and E. coli, as well as tests for allergens, additives, preservatives, and pesticide residues. Additionally, testing for shelf life, nutritional content, and packaging integrity is critical for maintaining product quality and consumer safety. As processed foods become a significant part of the diet, food safety testing ensures compliance with regulatory requirements, mitigates public health risks, and helps build consumer trust in the safety and quality of these products.

Country Insights

Paraguay Food Safety Testing Market Trends

The food safety testing market in Paraguay is witnessing steady growth as the country strengthens its agricultural and food export sector. With Paraguay being a significant producer of commodities like beef, soy, and maize, food safety testing has become increasingly important to meet international standards and ensure the quality and safety of these products for export. The market is driven by rising awareness of foodborne diseases, stricter regulations, and demand from trade partners, particularly in Europe and North America, for high-quality, safe food products. Testing services in Paraguay focus on microbiological analysis, pesticide residues, and GMO testing to maintain food safety and regulatory compliance, ensuring that local food producers can compete in the overall market.

Brazil Food Safety Testing Market Trends

Brazil's food safety testing market is one of the largest in Latin America, driven by its position as a major global exporter of meat, poultry, soybeans, coffee, and other agricultural products. With growing concerns over foodborne illnesses and stringent international regulations, Brazil has placed significant emphasis on enhancing its food safety systems. The market is characterized by a high demand for microbiological testing, pesticide residue analysis, and GMO testing to ensure food safety and traceability, particularly in the meat and poultry sectors. Brazil's strong regulatory framework, coupled with the increasing adoption of advanced testing technologies such as PCR and rapid pathogen detection systems, is helping the country maintain its status as a leading food exporter while safeguarding consumer health.

Key Central & South America Food Safety Testing Company Insights

Some of the key players operating in the market include Bureau Veritas and Intertek Group plc.

-

Bureau Veritas is a global leader in testing, inspection, and certification services, specializing in ensuring compliance with industry standards and regulations across a wide range of sectors. Founded in 1828 and headquartered in Paris, France, the company provides services in areas such as quality, health and safety, environmental protection, and social responsibility. Bureau Veritas offers a comprehensive suite of solutions, including product testing, certification, audits, and inspections, with a strong presence in industries like construction, automotive, food, energy, and consumer goods. Its focus on sustainability, innovation, and operational excellence has made Bureau Veritas a trusted partner for businesses seeking to enhance their product quality, mitigate risks, and ensure regulatory compliance on a global scale.

-

Intertek Group plc is a leading multinational provider of quality and safety solutions, offering testing, inspection, certification, and consulting services to industries worldwide. Founded in 1885 and headquartered in London, UK, Intertek operates in over 100 countries and serves a broad range of sectors, including food, textiles, electronics, oil and gas, and healthcare. The company helps businesses improve product quality, ensure safety standards, and meet regulatory requirements through a range of services, such as performance testing, risk management, and environmental assessments. Intertek is recognized for its expertise in product testing, supply chain management, and market access solutions, with a strong commitment to sustainability, innovation, and customer satisfaction.

Mérieux NutriSciences Corporation and Microbac Laboratories, Inc. are some of the emerging market participants in the market.

-

Mérieux NutriSciences Corporation is a global leader in food safety and quality testing, providing a wide range of services to ensure the safety, compliance, and integrity of food products. A part of the Institut Mérieux group, the company offers comprehensive solutions for food analysis, including microbiological testing, sensory analysis, nutritional labeling, and allergen testing, across various industries such as food and beverage, agriculture, and consumer goods. Headquartered in the United States, Mérieux NutriSciences operates laboratories and service centers around the world, helping clients meet regulatory standards and protect consumers' health. The company's commitment to innovation, sustainability, and excellence has made it a trusted partner for food manufacturers, retailers, and regulatory bodies.

-

Microbac Laboratories, Inc. is a prominent provider of testing and analytical services, specializing in food safety, environmental, and industrial testing. With a strong focus on providing reliable and accurate results, Microbac serves industries such as food and beverage, pharmaceuticals, agriculture, and environmental protection. The company offers a broad spectrum of services, including microbiological testing, chemical analysis, and quality control to help businesses meet regulatory requirements and ensure the safety and quality of their products.

Key Central & South America Food Safety Testing Companies:

- Bureau Veritas

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- ALS

- Eurofins Scientific

- LGC Limited

- Mérieux NutriSciences Corporation

- Microbac Laboratories, Inc.

Recent Developments

-

In April 2023, ALS acquired ASR Laboratórios (ASR), a renowned leader in conducting agrochemical and household product testing in Brazil. ASR, which was established in 2014 and operates from Charqueada, São Paulo, Brazil, specializes in a comprehensive array of analytical studies focused on quality assurance, product registration, efficacy, and R&D support for the household products, agrochemicals, and cosmetics industries. This strategic acquisition enhances ALS's presence in Brazil and across the globe.

-

In April 2023, ALS acquired Hidro.Lab. doo, a provider of environmental testing services. Established in 2003 and operating from Kastav, Croatia, Hidro.Lab offers an extensive range of offerings, including physical-chemical laboratory testing and sampling, with a specific focus on solid waste, wastewater, and surface water analysis. This acquisition represents a regionally significant milestone for ALS, as it gains a well-established business with a strong market position in Croatia. The addition of Hidro.lab to ALS's portfolio enhances the company's offerings and further solidifies its presence in the Croatian market.

Central & South America Food Safety Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,473.7 million

Revenue forecast in 2030

USD 2,050.7 million

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Test, application, country

Country Scope

Brazil; Peru; Ecuador; Bolivia; Colombia; Paraguay

Key companies profiled

Bureau Veritas; Intertek Group plc; SGS Société Générale de Surveillance SA; ALS; Eurofins Scientific; LGC Limited; Mérieux NutriSciences Corporation; Microbac Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Central & South America Food Safety Testing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Central & South America food safety testing market based on test, application, end-use, and country:

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Allergen Testing

-

Chemical & Nutritional Testing

-

Genetically Modified Organism (GMO) Testing

-

Microbiological Testing

-

Residues & Contamination Testing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Meat, Poultry, & Seafood Products

-

Dairy & Dairy Products

-

Processed Food

-

Beverages

-

Cereals & Grains

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Colombia

-

Peru

-

Bolivia

-

Ecuador

-

Paraguay

-

Frequently Asked Questions About This Report

b. The Central & South America food safety testing market size was estimated at USD 1,369.5 million in 2024 and is expected to reach USD 1,473.7 million in 2025.

b. The Central & South America food safety testing market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030 to reach USD 2,050.7 million by 2030.

b. The microbiological testing test segment led the market and accounted for 44.7% of the overall revenue share in 2024. Microbiological testing is a crucial segment within the food safety testing market, focusing on the detection of harmful microorganisms such as bacteria, viruses, fungi, and parasites in food products. These tests are essential to ensure the safety, quality, and compliance of food with regulatory standards.

b. Some of the key players operating in the Central & South America food safety testing market include SGS S.A., Intertek Group plc, Bureau Veritas SA, Eurofins Scientific SE, Mérieux NutriSciences, Microbac Laboratories, Inc., and Nova Biologicals, Inc.

b. Key factors that are driving the market growth include growing instances of outbreaks of foodborne diseases leading to consumer awareness regarding food safety.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."