- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Ceramic Membrane Market Size, Industry Report, 2030GVR Report cover

![Ceramic Membrane Market Size, Share & Trends Report]()

Ceramic Membrane Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Ultrafiltration, Microfiltration, Nanofiltration, Others), By Application (Water & Wastewater Treatment, Industry Processing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-332-1

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramic Membrane Market Summary

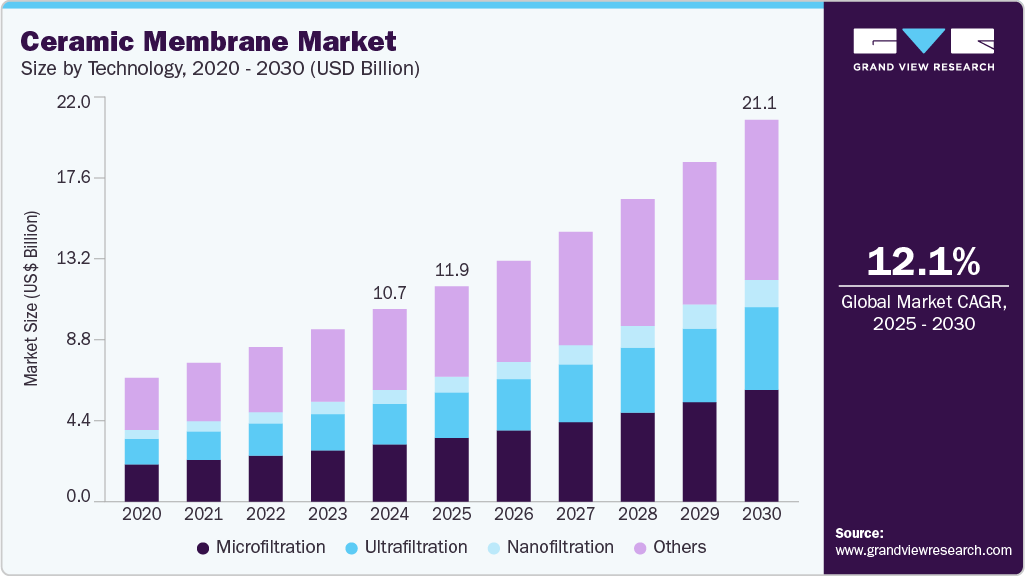

The global ceramic membrane market size was estimated at USD 10.67 billion in 2024 and is projected to reach USD 21.17 billion by 2030, growing at a CAGR of 12.1% from 2025 to 2030. This growth is attributed to the increasing application of ceramic membranes in various industries such as food & beverage, pharmaceutical, chemical, water & waste management, and biotechnology.

Key Market Trends & Insights

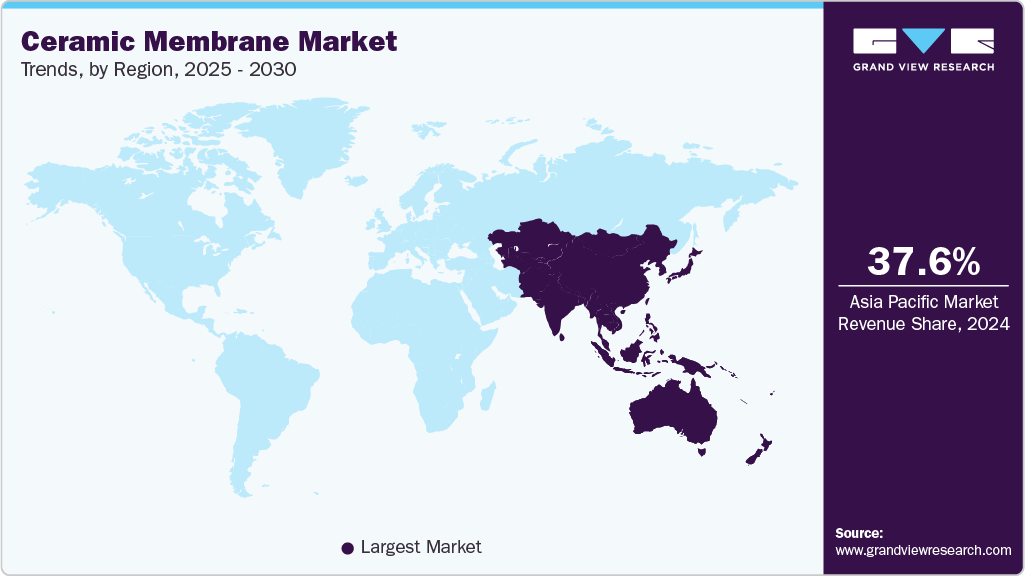

- The Asia Pacific ceramic membrane market held the largest market share of 37.6% in 2024.

- North America ceramic membrane market share is projected to grow at a significant CAGR from 2025 - 2030.

- Based on technology, the microfiltration technology segment accounted for a significant market revenue share of 29.7% in 2024.

- Based on application, the water & wastewater treatments segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.67 Billion

- 2030 Projected Market Size: USD 21.17 Billion

- CAGR (2025-2030): 12.1%

- Asia Pacific: Largest market in 2024

This growth is attributed to the increasing application of ceramic membranes in various industries such as food & beverage, pharmaceutical, chemical, water & waste management, and biotechnology. This product possesses various attributes, such as resistance to abrasion and durability. Moreover, the product is chemically, mechanically, and thermally stable. Such factors make it an ideal product for filtration in above-mentioned industries.

Clean water is a scarce and essential resource, making effective filtration increasingly important as global water demand rises due to rapid population growth. Ceramic membranes offer significant benefits, such as high durability, chemical and thermal resistance, long service life, and reduced maintenance needs. By integrating ceramic membranes into filtration systems, water can be managed more effectively, ensuring better performance and long-term sustainability.

Ceramic membrane’s research & development sector focuses on reducing the manufacturing cost, expanding its application, and improving product performance. Additionally, fabrication techniques also play an important role in the overall performance of the product. For instance, various processes such as extrusion, slip casting, and tape casting helps in production of ceramic membranes with managed thickness and porosity.

The value chain of the ceramic membrane market comprises raw material suppliers, manufacturers, distributors/suppliers, and end users. The market has a large number of raw material suppliers who provide materials such as binders, additives, coatings, and ceramic powders to the manufacturers. Furthermore, once the product is produced, manufacturers distribute their products through third-party distributors or often opt for direct distribution to reach end users.

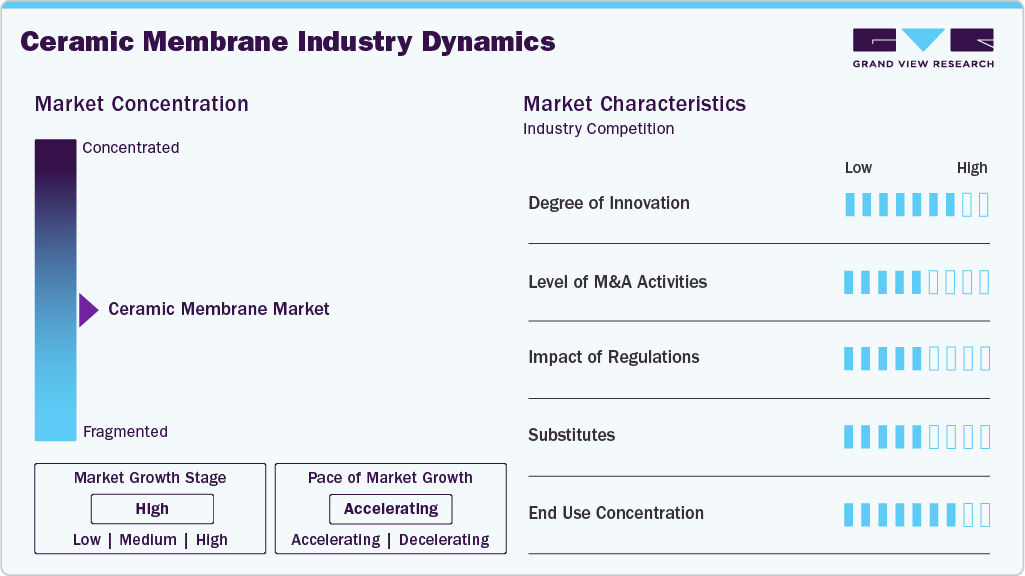

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The ceramic membrane industry is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advances in materials science, manufacturing techniques, and application areas with improved membrane durability, higher filtration efficiency, resistance to extreme conditions, and the integration of nanotechnology for enhanced performance in water treatment and industrial processes. IPNR Endura has advanced ceramic membrane technology, offering exceptional durability and resistance to harsh conditions. These membranes can filter out particles as small as 0.1 micrometers, making them ideal for high-purity applications.

The ceramic membrane industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. As larger companies seek to expand their technology portfolios, strengthen their market position, or enter new geographic regions. Strategic acquisitions often focus on gaining proprietary technologies, manufacturing capabilities, or access to established customer bases in industries such as water treatment, food and beverage, and pharmaceuticals.

The ceramic membrane industry is also subject to increasing regulatory scrutiny. Stringent environmental and water quality regulations are pushing industries to adopt more reliable and long-lasting filtration technologies. These regulations are accelerating market growth by encouraging innovation, driving compliance, and replacing less durable alternatives.

The power of substitutes for ceramic membranes is moderate. While polymeric and metal membranes are available and often cheaper, they generally offer lower durability and chemical resistance compared to ceramic membranes. Ceramics

Technology Insights

The market is segmented into ultrafiltration, microfiltration, nanofiltration, and others. Microfiltration technology accounted for a significant market revenue share of 29.7% in 2024. It uses membranes with open-pore structures and pore size lies roughly between 0.1 µm to 5 µm. The common application of ceramic microfiltration membrane is clarification, or removal of suspended solids to produce a clear liquid. Ceramic membranes which are made from inorganic materials are finding high adoption as they offer higher operating temperatures and durability compared to the membranes made from organic materials.

Ultrafiltration technology is expected to grow at the fastest CAGR over the forecast period. Ultrafiltration is a single-membrane filtration process with pore size between 0.01 µm to 0.1 µm that serves as an effective barrier to harmful bacteria, viruses, and other contaminants. The growth of this segment is attributed to its superior mechanical thermal stability, mechanical strength, and chemical resistance as compared to other options such as polymeric membranes.

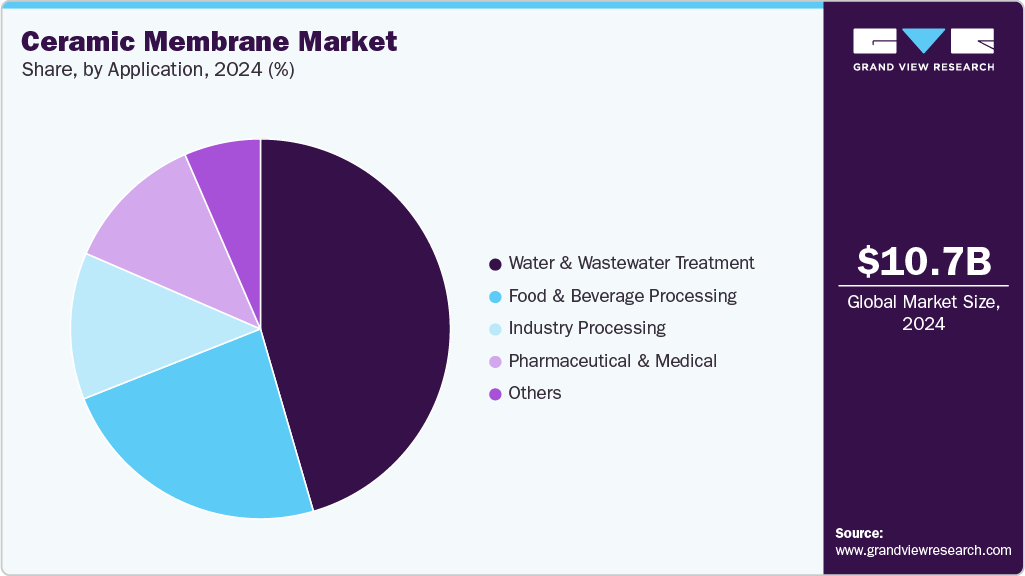

Application Insights

The water & wastewater treatments segment dominated the market in 2024. Rapidly increasing global population coupled with rising industrialization and urbanization is exerting considerable stress on the existing freshwater resources, thereby driving the need for ceramic membranes. Additionally, the presence of multiple regulations and mandates by governments of countries concerning water treatment and disposal to safeguard the environment is anticipated to drive product growth.

The pharmaceutical & medical segment is anticipated to grow at the fastest CAGR over the forecast period. Ceramic membranes are used to remove drug residues from wastewater via nanofiltration. They enable oil-water separation, germ/virus retention, and solvent filtration using ultrafiltration/nanofiltration. They are effective in dye separation and in filtering acids and caustics due to high chemical resistance. Microfiltration membrane with a 0.45 micrometer (μm) pore size is commonly used to clean liquids and water by removing large particles, and a finer membrane with a 0.2 μm pore size is used to sterilize liquid medicines by filtering out bacteria and other tiny organisms.

Regional Insights

North America ceramic membrane market share is projected to grow at a significant CAGR from 2025 - 2030. The North America ceramic membrane market is anticipated to experience rapid growth on account of rapid adoption of the technology for its utilization in application industries. National Primary Drinking Water Regulations (NPDWR) set legally enforceable standards for over 90 contaminants, including microorganisms, disinfectants, and inorganic chemicals, to ensure the safety of public water systems. These regulations require water systems to employ the best available technologies to meet contaminant limits and adhere to rigorous testing and monitoring protocols. In addition, the growing oil & gas industry and increasing product demand from power generation industries in countries such as the U.S. and Canada are expected to promote water filtration activities, thus driving the growth of the ceramic membrane market.

U.S. Ceramic Membrane Market Trends

The U.S. dominated the North America pore strips industry in 2024, owing to rising economic revival and government initiatives to promote environmental protection are expected to drive the ceramic membrane market in the U.S. Increasing pressure on the oil & gas industry to minimize pollutants in the released water is expected to boost the application of ceramic membrane, thereby fueling the market growth.

Europe Ceramic Membrane Market Trends

The ceramic membrane market in Europe has been witnessing continuous growth in recent years. This can be attributed to stringent environmental regulations and sustainability goals that are pushing industries to adopt cleaner and more efficient filtration technologies. Ceramic membranes offer superior chemical & thermal stability, making them ideal for hash industrial applications such as wastewater treatment, food & beverage processing, and pharmaceuticals.

Asia Pacific Ceramic Membrane Market Trends

The Asia Pacific ceramic membrane market held the largest market share of 37.6% in 2024, rapid industrialization and urbanization are increasing the demand for clean water and efficient water management systems, with ceramic membranes playing a vital role in addressing these challenges, thus driving the demand for more efficient and sustainable water treatment solutions. Ceramic membranes offer a durable, low-maintenance option ideal for regions facing infrastructure challenges and harsh water conditions. As a result, investment in ceramic membrane technology is gaining momentum across Asia to mitigate long-term economic and environmental costs.

The China ceramic membrane industry held a substantial market share in 2024. In Zhejiang, only 29% of small towns have access to safe water, and only 26% have wastewater treatment services. The lack of proper sanitation infrastructure is pushing local governments to invest in advanced water treatment solutions. Ceramic membranes, known for their durability and efficiency, are well-suited for treating polluted and complex wastewater in both urban and rural areas. Simultaneously, health-conscious consumers are driving growth in China's bottled water, cleansing juices, and nutritional drinks, further boosting demand for reliable membrane technologies.

Key Ceramic Membrane Company Insights:

Some of the key companies in the ceramic membrane industry include GEA Group Aktiengesellschaft, Pall Corporation and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

CeraFiltec GmbH specializes in ceramic membrane filtration systems. At Aquatech Amsterdam 2025, the company showcased its latest ceramic membrane technology. The innovations focus on energy efficiency, durability, and high filtration performance. Their products serve applications like desalination, wastewater reuse, and potable water treatment. CeraFiltec emphasizes sustainable and advanced water treatment solutions.

-

Nanostone Water, Inc. specializes in advanced ceramic ultrafiltration membrane systems. Headquartered in Massachusetts, it serves municipal and industrial water treatment markets. The company focuses on improving water quality, efficiency, and sustainability. Its membranes are used in surface water, seawater, and industrial reuse applications. Nanostone actively engages in industry events to showcase its innovations.

Key Ceramic Membrane Companies:

The following are the leading companies in the ceramic membrane market. These companies collectively hold the largest market share and dictate industry trends.

- GEA Group Aktiengesellschaft

- Pall Corporation

- Hyflux Ltd

- Kovalus Separation Solutions

- Nanostone

- Veolia

- TAMI Industries

- METAWATER Co., Ltd.

- ITN Nanovation AG

- SIVA Unit

Ceramic Membrane Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.93 billion

Revenue forecast in 2030

USD 21.17 billion

Growth rate

CAGR of 12.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, Application and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

GEA Group Aktiengesellschaft; Pall Corporation.; Hyflux Limited; Kovalus Separation Solutions; Nanostone.; Veolia; TAMI Industries; METAWATER. CO., LTD.; ITN Nanovation AG; SIVA Unit

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramic Membrane Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ceramic membrane market report based on technology, application, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultrafiltration

-

Microfiltration

-

Nanofiltration

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Water & Wastewater Treatment

-

Industry Processing

-

Food & Beverage Processing

-

Pharmaceutical & Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global ceramic membrane market size was estimated at USD 9.55 billion in 2023 and is expected to reach USD 10.67 billion in 2024.

b. The global ceramic membrane market is expected to grow at a compound annual growth rate (CAGR) of 10.3% from 2024 to 2030 to reach USD 21.16 billion by 2030.

b. Microfiltration technology accounted for the largest revenue share of over 29.8% in 2023 on account of its superior mechanical thermal stability, mechanical strength, and chemical resistance.

b. Some key players operating in the ceramic membrane market include GEA Group Aktiengesellschaft, Pall Corporation, Hyflux Ltd, Kovalus Separation Solutions, Nanostone, Veolia, TAMI Industries, METAWATER Co., Ltd., ITN Nanovation AG, and SIVA Unit.

b. The key factors that are driving the market growth is the increasing use of ceramic membrane in various end use industries on account of superior performance even in harsh industrial conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.