- Home

- »

- Advanced Interior Materials

- »

-

Ceramic Substrate Market Size, Share, Industry Report, 2033GVR Report cover

![Ceramic Substrate Market Size, Share & Trends Report]()

Ceramic Substrate Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Alumina, Aluminum Nitride), By End Use (Consumer Electronics, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-806-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramic Substrate Market Summary

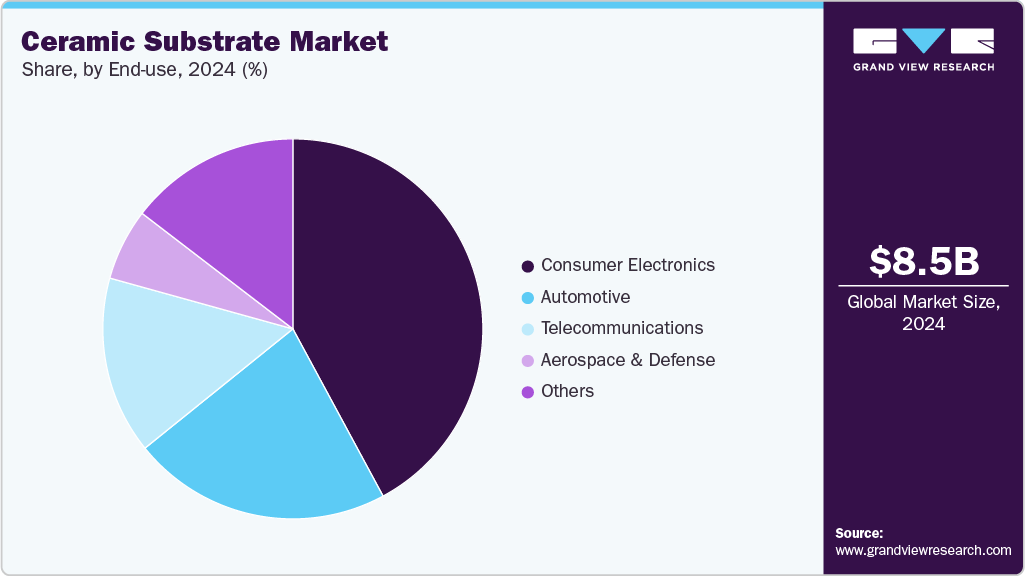

The global ceramic substrate market size was estimated at USD 8.54 billion in 2024 and is projected to reach USD 12.59 billion by 2033, growing at a CAGR of 4.5% from 2025 to 2033. Growth is driven by increasing demand for advanced electronic components, rising adoption of electric vehicles (EVs), and the expanding use of ceramic substrates in power modules, LEDs, and communication devices.

Key Market Trends & Insights

- Asia Pacific dominated the global ceramic substrate industry with a revenue share of over 49.0% in 2024.

- The ceramic substrate industry in Europe is expected to grow at a CAGR of 4.2% from 2025 to 2033.

- By product, alumina dominated the market with a revenue share of over 55.0% in 2024.

- In 2024, the consumer electronics mining segment held the largest share over 42.0% of the market.

Market Size & Forecast

- 2024 Market Size: USD 8.54 billion

- 2033 Projected Market Size: USD 12.59 billion

- CAGR (2025-2033): 4.5%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

In addition, the growing focus on miniaturization, improved thermal management, and high reliability in electronic systems is fueling market expansion. The ceramic substrate industry is increasingly aligning with global sustainability goals through the development of eco-friendly materials and the implementation of energy-efficient manufacturing processes. Ceramic substrates offer long operational life, recyclability, and reduced electronic waste compared to traditional materials, making them a preferred choice in green electronics and sustainable automotive systems. The shift toward electric vehicles (EVs), renewable energy integration, and energy-efficient LED lighting is further boosting demand for substrates that minimize environmental impact while maintaining performance reliability. Moreover, manufacturers are investing in cleaner production technologies, waste heat recovery, and raw material optimization to lower carbon footprints and enhance overall sustainability across the value chain.

Technological advancements are transforming the ceramic substrate landscape, with innovations focused on enhancing thermal conductivity, mechanical strength, and miniaturization capabilities. New material formulations such as aluminum nitride (AlN) and silicon nitride (Si₃N₄) are being widely adopted for high-performance applications in power electronics, 5G communication systems, and advanced driver-assistance systems (ADAS). The emergence of multilayer ceramic substrates and advanced fabrication techniques, such as laser direct structuring (LDS), is enabling compact, high-density circuit designs essential for next-generation electronics. Continuous R&D efforts aimed at improving substrate integration, heat dissipation, and cost efficiency are setting new technological benchmarks and driving widespread adoption across industries.

Drivers, Opportunities & Restraints

The ceramic substrate industry is primarily driven by the increasing adoption of electric vehicles (EVs), 5G communication systems, and high-power LED applications that require superior heat dissipation and electrical insulation. The shift toward advanced materials such as aluminum nitride (AlN) and silicon nitride (Si₃N₄) enhances performance reliability and supports miniaturization in high-frequency and high-voltage applications. On 22 September 2025, a market report highlighted the surge in AlN substrate demand, particularly from 5G base stations and EV power modules, as manufacturers expand capacity to meet the growing need for thermally stable and durable substrates. Moreover, the ongoing transition toward renewable energy and the proliferation of intelligent electronic devices continue to strengthen market growth prospects globally.

Emerging opportunities are centered on technological innovation and material advancement. Manufacturers are developing high-performance, multilayer, and low-temperature co-fired ceramic (LTCC) substrates to meet the requirements of next-generation power electronics and semiconductor packaging. The integration of laser direct structuring (LDS) and advanced co-firing techniques enables compact, lightweight, and high-density circuitry suitable for 5G and EV applications. For instance, on September 10, 2025, Kyocera Corporation announced the launch of a new multilayer ceramic substrate designed for 5G radio frequency modules, highlighting the trend toward miniaturized, high-speed electronic components. In addition, growing investments in SiC and GaN-based power devices are expected to open new avenues for ceramic substrate suppliers in the coming years.

Despite favorable market dynamics, high manufacturing costs, energy-intensive sintering processes, and raw material price volatility remain significant challenges. The production of high-purity alumina and AlN substrates requires costly processing technologies and stringent quality control, which drives up the end-product prices. On August 21, 2025, an industry report noted that fluctuations in raw material prices and energy costs had significantly impacted the profit margins of major ceramic substrate manufacturers, including CoorsTek and NGK Insulators. Furthermore, competition from low-cost alternatives such as polymer or metal-based substrates, along with slower standardization across electronic and automotive applications, continues to limit adoption in price-sensitive markets.

Product Insights

By product, alumina dominated the market with a revenue share of over 55.0% in 2024. Alumina is the most widely used ceramic substrate material in the global market, owing to its cost-effectiveness, excellent electrical insulation, and stable thermal performance. It is commonly applied in consumer electronics, automotive power modules, and telecommunication devices where reliability and thermal management are critical. Its relatively simple manufacturing process and availability in various grades make it a preferred choice for large-scale production. The combination of mechanical strength, chemical stability, and compatibility with metallization techniques contributes to alumina’s dominant position in the ceramic substrate industry.

Other ceramic substrate materials, including aluminum nitride (AlN), silicon nitride (Si₃N₄), beryllium oxide (BeO), and specialized composites, are gaining traction due to their high thermal conductivity, mechanical strength, and suitability for high-performance applications. Aluminum nitride and silicon nitride are increasingly used in advanced automotive electronics, EV power modules, and high-frequency telecommunication systems. At the same time, beryllium oxide finds niche applications in aerospace and defense due to its unique thermal and electrical properties. These materials, though representing a smaller market share compared to alumina, are seeing steady growth driven by demand for high-reliability and high-performance electronic systems.

End Use Insights

In 2024, the consumer electronics mining segment held the largest share, over 42.0% of the ceramic substrate market. onsumer electronics represent the largest end use segment for ceramic substrates, driven by the widespread adoption of smartphones, tablets, laptops, wearable devices, and LED lighting. Ceramic substrates in this segment provide essential thermal management, electrical insulation, and reliability for high-density circuits, ensuring stable performance in compact and miniaturized devices. The continual growth of smart devices and connected electronics globally reinforces the demand for alumina-based and other high-performance substrates in consumer electronics applications.

The automotive and telecommunications sectors are emerging as significant end users of ceramic substrates. In the automotive industry, substrates are increasingly used in electric vehicles, power modules, inverters, and advanced driver-assistance systems (ADAS) for thermal and electrical management. Telecommunication applications, particularly in 5G base stations and high-frequency RF modules, are driving the use of multilayer ceramic substrates and materials with high thermal conductivity to ensure signal stability and efficiency.

The others segment encompasses industrial electronics, medical equipment, renewable energy systems, and various specialized applications where ceramic substrates play a critical functional role. In industrial automation and power control systems, ceramic substrates are utilized due to their durability, heat resistance, and electrical insulation properties, thereby ensuring reliable performance in harsh environments. In the medical sector, they are applied in diagnostic imaging devices, laser systems, and implantable electronics due to their biocompatibility and precision. In addition, renewable energy systems, such as solar inverters and wind turbine converters, are increasingly adopting ceramic substrates to enhance energy efficiency and thermal management. Although this segment holds a smaller market share, it offers steady long-term growth potential driven by technological advancement and expanding application diversity.

Regional Insights

The North American ceramic substrate industry is witnessing steady growth, driven by the rapid adoption of electric vehicles, renewable energy technologies, and advanced communication infrastructure. The region benefits from a strong semiconductor manufacturing base and increasing investments in power electronics for EV charging systems and grid modernization. In July 2025, major OEMs in the U.S. and Canada announced expansion plans for EV power module production, further boosting the demand for high-performance AlN and Si₃N₄ substrates. Moreover, the ongoing development of 5G networks and innovative city projects continues to enhance market prospects across the region.

U.S. Ceramic Substrate Market Trends

The U.S. ceramic substrate industry remains the leading contributor to the North American industry, supported by its advanced electronics and automotive industries. The country’s focus on electrification, autonomous mobility, and defense electronics is driving sustained consumption of ceramic substrates with high thermal reliability. On 14 August 2025, CeramTec North America revealed plans to expand its U.S. manufacturing capacity for ceramic components to cater to semiconductor and EV applications. Government incentives for domestic semiconductor production under the CHIPS and Science Act have also accelerated local sourcing of advanced substrate materials, further strengthening the country’s market position.

Asia Pacific Ceramic Substrate Market Trends

Asia Pacific dominated the ceramic substrate market with a revenue share of over 49.0% in 2024. Asia Pacific ceramic substrate industry dominated the global market in 2024, driven by strong manufacturing capabilities, large-scale electronics production, and rising EV adoption. China, Japan, South Korea, and Taiwan serve as key production hubs for high-performance substrates used in semiconductors, LEDs, and power modules.

On October 5, 2025, Murata Manufacturing Co., Ltd. in Japan announced an increase in production capacity for AlN substrates to support the growing demand from 5G and automotive clients. In addition, supportive government initiatives promoting domestic chip fabrication and renewable energy integration across China and India are further accelerating regional market growth.

Europe Ceramic Substrate Market Trends

Europe’s ceramic substrate industry is expanding due to strong demand from the automotive, renewable energy, and industrial automation sectors. The region’s emphasis on sustainability and carbon reduction aligns with the use of ceramic substrates in EVs and energy-efficient LED systems. On 30 September 2025, Bosch announced the development of next-generation Si₃N₄-based ceramic substrates for high-voltage EV inverters, marking a key step in Europe’s shift toward electrified mobility. Furthermore, ongoing investments in 5G rollout and smart manufacturing under the EU’s digital transformation initiatives continue to drive substrate innovation across Germany, France, and the UK.

Key Ceramic Substrate Company Insights

Some of the key players operating in the market include Kyocera Corporation, Murata Manufacturing Co., Ltd., CoorsTek Inc., and others.

-

KYOCERA Corporation, established in 1959 and headquartered in Kyoto, Japan, is a manufacturer of advanced ceramics, electronic components, and semiconductor packaging technologies. The company produces ceramic substrates, including alumina, aluminum nitride (AlN), and silicon nitride (Si₃N₄), which are used in automotive electronics, power devices, and communication systems. KYOCERA offers a range of products, with a focus on quality, innovation, and sustainability in its operations.

-

Murata Manufacturing Co., Ltd., founded in 1944 and headquartered in Nagaokakyo, Japan, manufactures electronic components and materials. Its ceramic substrates support miniaturization, heat resistance, and reliability in applications such as 5G communication, automotive systems, and consumer electronics. Murata emphasizes research, engineering, and materials development in its ceramic-based solutions.

-

CoorsTek Inc., established in 1910 and headquartered in Golden, Colorado, produces technical ceramics and engineered materials. The company supplies high-purity ceramic substrates and components for electronics, industrial, medical, and automotive applications. CoorsTek’s products provide thermal conductivity, mechanical strength, and electrical insulation for various functional uses in electronic and industrial systems.

Key Ceramic Substrate Companies:

The following are the leading companies in the ceramic substrate market. These companies collectively hold the largest Market share and dictate industry trends.

- CoorsTek Inc.

- CTS Corporation

- Ferrotec Holdings Corporation

- KYOCERA Corporation

- Maruwa Co., Ltd.

- Murata Manufacturing Co., Ltd.

- NGK Insulators Ltd.

- ROGERS Corporation

- Toshiba Materials Co., Ltd.

- Vishay Intertechnology, Inc.

Recent Developments

-

KYOCERA Corporation, in September 2025, announced the expansion of its ceramics production facility in Kagoshima, Japan, to increase manufacturing capacity for aluminum nitride (AlN) and multilayer ceramic substrates used in power modules and 5G communication systems. The expansion is designed to meet the increasing global demand for ceramic substrates and support ongoing production needs. This move reflects KYOCERA’s efforts to maintain a steady supply in key electronic and automotive sectors.

-

Murata Manufacturing Co., Ltd., in October 2025, revealed plans to increase production of aluminum nitride (AlN) substrates at its Yasu plant in Shiga Prefecture, Japan. The expansion is designed to meet the demand for ceramic materials used in electric vehicles, renewable energy systems, and semiconductor devices. The project highlights Murata’s focus on strengthening its position in the global ceramics supply chain.

-

CoorsTek Inc., in August 2025, announced the commissioning of a new ceramics manufacturing line at its Golden, Colorado, facility. The initiative aims to enhance production efficiency and increase the output of high-purity alumina and silicon nitride substrates for electronics and industrial applications, while optimizing energy consumption in the manufacturing process. This development is part of CoorsTek’s broader strategy to modernize operations and improve resource efficiency.

Ceramic Substrate Market Report Scope

Report Attribute

Details

Market Definition

The market size represents total sales value of all ceramic substrate materials (Al₂O₃, AlN, Si₃N₄, BeO, etc.) supplied to various end-use sectors during the specified year.

Market size value in 2025

USD 8.84 billion

Revenue forecast in 2033

USD 12.59 billion

Growth rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; China; India; Japan; Australia; Brazil; South Africa; Iran

Key companies profiled

CoorsTek Inc.; CTS Corporation; Ferrotec Holdings Corporation; KYOCERA Corporation; Maruwa Co., Ltd.; Murata Manufacturing Co., Ltd.; NGK Insulators, Ltd.; ROGERS Corporation; Toshiba Materials Co., Ltd.; Vishay Intertechnology, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

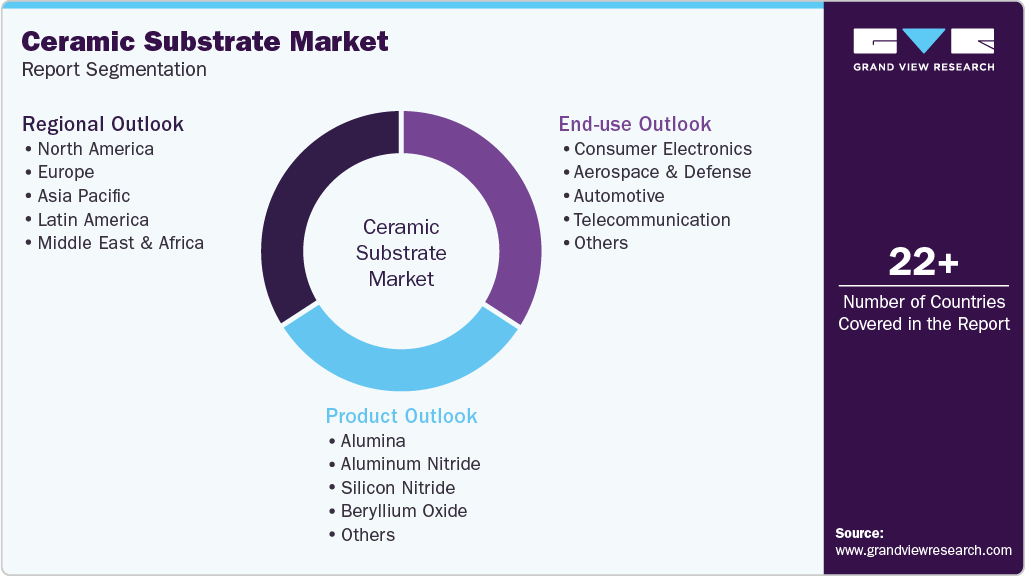

Global Ceramic Substrate Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global ceramic substrate market report by product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021-2033)

-

Alumina

-

Aluminum Nitride

-

Silicon Nitride

-

Beryllium Oxide

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021-2033)

-

Consumer Electronics

-

Aerospace & Defense

-

Automotive

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021-2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global ceramic substrate market size was estimated at USD 8.54 billion in 2024 and is expected to reach USD 8.84 billion in 2025.

b. The global ceramic substrate market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033, reaching USD 12.59 billion by 2033.

b. By product type, alumina accounted for the largest market share, reaching over 55.0% in 2024.

b. Some of the key vendors in the global ceramic substrate market include CoorsTek Inc., CTS Corporation, Ferrotec Holdings Corporation, KYOCERA Corporation, Maruwa Co., Ltd., Murata Manufacturing Co., Ltd., NGK Insulators Ltd., ROGERS Corporation, Toshiba Materials Co., Ltd., Vishay Intertechnology, Inc.

b. The global ceramic substrate market is driven by the rising demand for high-performance electronic components in electric vehicles, 5G communication systems, and power electronics. Increasing emphasis on thermal management, miniaturization, and reliability in modern devices further supports market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.