- Home

- »

- Consumer F&B

- »

-

Cereal Bars Market Size, Share And Growth Report, 2030GVR Report cover

![Cereal Bars Market Size, Share & Trends Report]()

Cereal Bars Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Snack Bars, Energy & Nutrition Bars), By Distribution Channel (Traditional Grocery Stores, Convenience Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-313-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cereal Bars Market Summary

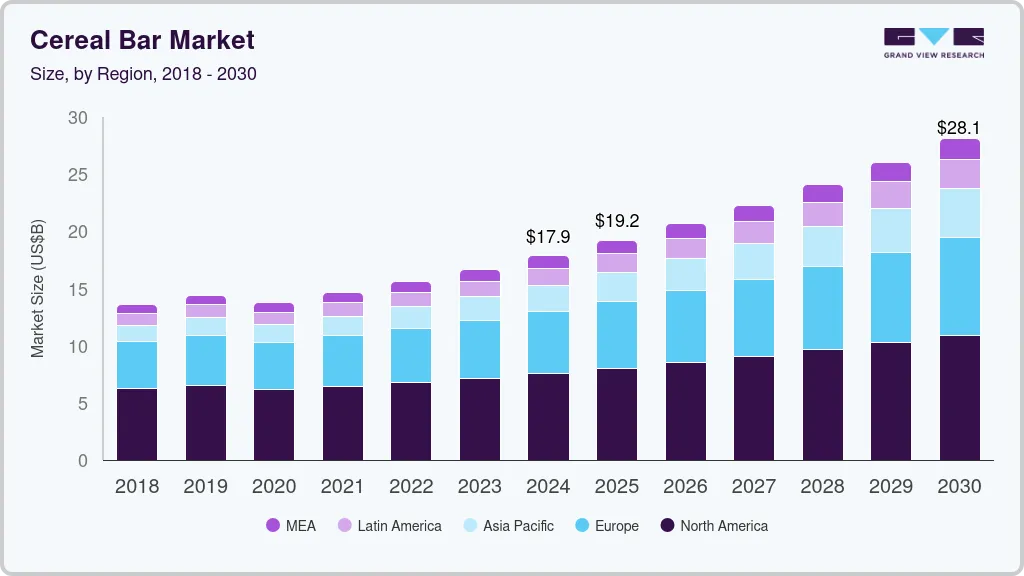

The global cereal bar market size was estimated at USD 17.88 billion in 2024 and is projected to reach USD 28.12 billion by 2030, growing at a CAGR of 7.9% from 2025 to 2030. With increasing awareness of the importance of nutrition for overall health and well-being, consumers actively seek healthier snack choices.

Key Market Trends & Insights

- The North American cereal bars market dominated the global industry with the largest revenue share of 42.4% in 2024.

- The cereal bars market in U.S. is expected to grow significantly over the forecast period.

- By product, the snack bars segment dominated the market with the largest revenue share of 46.2% in 2024.

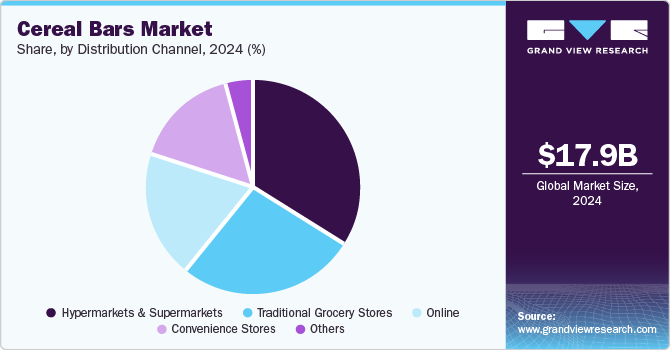

- By distribution channel, sales through hypermarkets & supermarkets dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.88 Billion

- 2030 Projected Market Size: USD 28.12 Billion

- CAGR (2025-2030): 7.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

They are looking for options that provide essential nutrients while also meeting their dietary preferences and health goals. As consumers prioritize their health, there is an increased demand for nutritious, better-for-you snack options. Cereal bars are sought after by a larger consumer base seeking simplicity and nutrition in their snacks. This trend prompts manufacturers to innovate and fortify their products to meet the evolving preferences for healthier, ready-to-eat snacks. Key industry players are focusing on product innovation and research and development (R&D) efforts to cater to this demand. For instance, in January 2023, Kellogg's Company received FDA approval to increase Vitamin D3 fortification in its breakfast cereals and grain-based bars.The rise of on-the-go snacking, especially among younger consumers in countries such as the U.S., India, China, Brazil, and Vietnam, is reshaping the grocery landscape. This "snackification" trend drives increased demand for snack category products such as cereal bars, breakfast cereals, cakes, and pastries. In May 2023, Nature Valley, a brand under General Mills, introduced Nature Valley Savory Nut Crunch Bars. These bars come in three flavors-White Cheddar, Everything Bagel, and Smoky BBQ-offering a unique and savory twist to the traditional snack bar experience. The company's commitment to providing wholesome snacks with real ingredients is evident in these new offerings with ingredients like whole grain oats, peanuts, almonds, and nut butter.

Millennials and Gen Z consumers are driving the demand for functional bars that fulfill specific nutritional needs, support energy requirements, aid weight management, or provide sleep support. In addition, the popularity of plant-based and ketogenic diets is fueling the development of new cereal bar varieties.

One notable trend is the emphasis on plant-based and vegan options, catering to the rising popularity of plant-based diets and offering alternative protein sources. New entrants are incorporating functional ingredients such as probiotics and omega-3 fatty acids to provide added health benefits beyond basic nutrition. They also respond to the demand for low-sugar and allergen-free options, while exploring customization and personalization to meet individual dietary preferences. Furthermore, sustainability is a key focus, with startups adopting eco-friendly packaging solutions and emphasizing artisanal production methods.

The cereal bar industry has witnessed significant merger and acquisition (M&A) activity in recent years. This trend is driven by several factors, including the desire for companies to expand their product portfolios, enter new markets, achieve economies of scale, and innovate by integrating new brands and technologies.

Regulations in the cereal bar industry significantly impact various aspects of the industry, including product formulation, labeling, marketing, and overall business operations. Manufacturers must comply with stringent food safety and quality standards set by regulatory bodies such as the Food and Drug Administration (FDA) in the US, and the European Food Safety Authority (EFSA) in the EU. These regulations ensure that cereal bars are safe for consumption and free from contaminants.

Consumers may consider several product substitutes in the cereal bar industry based on their nutritional needs, dietary preferences, and lifestyle choices. These substitutes often cater to similar consumer demands for convenience, healthfulness, and specific nutritional benefits. Substitutes in the cereal bar industry include protein bars, granola bars, meal replacement bars, and homemade bars, among others.

The cereal bar market has seen a variety of product launches in recent years, reflecting consumer demand for healthier, more diverse, and convenient snack options. These launches often focus on incorporating trending ingredients, addressing specific dietary needs, and offering innovative flavors and textures.

Regional expansion in the cereal bar industry involves companies strategically entering new geographic markets to capitalize on growth opportunities, expand their customer base, and diversify their revenue streams.

Product Insights

The snack bars segment dominated the market with the largest revenue share of 46.2% in 2024. Snack bars are highly convenient, offering a quick and nutritious option for consumers on the go. The increasing health consciousness among consumers has driven demand for healthier snack alternatives, and snack bars often contain beneficial ingredients like whole grains, nuts, and fruits. Additionally, the variety of flavors and formulations in the snack bars segment caters to diverse consumer preferences, further boosting its market share.

The energy & nutrition bars segment is expected to grow at the fastest CAGR of 8.9% over the forecast period. Increasing consumer awareness about health and wellness has led to a higher demand for convenient, on-the-go nutrition solutions. Energy and nutrition bars are packed with essential nutrients, making them popular for fitness enthusiasts, athletes, and busy individuals seeking a quick energy boost. Additionally, the growing trend of functional foods and the availability of bars catering to specific dietary needs, such as gluten-free, vegan, and high-protein options, further propel the market.

Distribution Channel Insights

Sales through hypermarkets & supermarkets dominated the market with the largest revenue share in 2024. The wide variety of products available in these large retail stores allows consumers to compare and select from numerous brands and flavors. The convenience of one-stop shopping for groceries and other essentials also attracts a significant customer base. Supermarkets and hypermarkets often offer competitive pricing due to their ability to leverage economies of scale and negotiate bulk discounts with suppliers. This makes cereal bars more affordable for consumers than purchasing them from smaller retail stores or specialty shops. Promotional activities, discounts, and the ability to physically inspect products before purchase enhance the shopping experience.

Sales of cereal bars through online channels are expected to grow at the fastest CAGR over the forecast period. Consumers purchase cereal bars from online stores and e-commerce channels for various reasons. The convenience factor stands out prominently, as individuals can browse and buy cereal bars from the comfort of their homes or while on the go. Online platforms typically offer a wider range of options than physical stores, catering to diverse dietary preferences and needs. In addition, online shopping allows for easy price comparison, access to customer reviews, and the opportunity to find discounts or special promotions. The doorstep delivery feature saves time and effort, particularly for busy individuals.

Regional Insights

The North American cereal bars market dominated the global industry with the largest revenue share of 42.4% in 2024. The market in North America is expected to grow in the coming years, fueled by a rising demand for vegan snack bars and a preference for smaller portions of nutritionally dense food. This trend reflects evolving consumer lifestyles and dietary preferences, along with the increasing prevalence of nuclear families in developed nations. Americans are increasingly drawn to cereal bars due to their convenience, portability, and perceived health benefits. These bars offer a quick and easy snack option for busy lifestyles as they require no preparation and are suitable for on-the-go consumption. Marketed as healthy alternatives, cereal bars often contain whole grains, nuts, seeds, and dried fruits, appealing to health-conscious consumers seeking nutritious snacks.

U.S. Cereal Bars Market Trends

The cereal bars market in U.S. is expected to grow significantly over the forecast period. The growing inclination toward healthier snacking alternatives is expected to drive market expansion in the U.S. Regional growth is likely to be boosted by innovative flavor offerings, discounted pricing, and appealing packaging. Healthy cereal bars are expected to experience significant growth, driven by a high demand for breakfast grains and cereals, particularly among consumers of all age groups in the U.S.

Europe Cereal Bars Market Trends

Europe's cereal bars market was identified as a lucrative region in 2024. Busy lifestyles and the need for convenient, on-the-go snacks make cereal bars a popular choice. Increasing health consciousness leads consumers to seek nutritious options, and cereal bars often contain wholesome ingredients such as whole grains, nuts, and fruits. The market's variety and innovation, offering flavors and benefits such as high protein, low sugar, and organic options, cater to diverse preferences. Effective marketing strategies and attractive packaging further boost their popularity and sales in Europe.

Asia Pacific Cereal Bars Market Trends

Asia Pacific cereal bars market is expected to grow at the fastest CAGR of 10.9% from 2025 to 2030. The demand for cereal bars in Asia Pacific is experiencing substantial growth as consumers seek nutritionally balanced snacks suitable for on-the-go consumption. They increasingly value snacks that offer convenience and align with their preferences for healthy and clean-label products. The surge in the popularity of functional foods further propels this market. Market dynamics are also shaped by the growing consumer emphasis on health and wellness, which drives the demand for organic snack bars and cereal bars.

The cereal bar market in China is expected to grow from 2024 to 2030. The trend toward natural and healthy food products is influencing the market. Consumers are increasingly opting for products made with natural ingredients, whole grains, and added nutritional value, contributing to its growth.

The India cereal bar market is expected to grow rapidly from 2024 to 2030. Cereal bars, known for their convenience and nutritional advantages, are gaining traction among consumers seeking convenient snack choices that strike a balance between taste and health. The inclination toward natural and wholesome food items is exerting an influence on the cereal bar market in India.

Central & South America Cereal Bar Market Trends

In the Central and South America cereal bar market, consumers are showing a growing preference for fiber-rich snacks, with increasing awareness of the advantages associated with cereal bars, thus driving market expansion. Moreover, shifting consumption habits and dietary preferences among consumers in the region amplify the demand for cereal bars. The rising purchasing power and higher expenditure on dining out are also contributing positively to the sales of granola bars in the region.

Middle East & Africa Cereal Bar Market Trends

An increasing number of local brands are diversifying their offerings to include fruit-based snacks in the Middle East and Africa cereal bar market, thereby expanding consumer options. Regional and international food exhibitions are especially noteworthy and are pivotal in promoting local cereal bar offerings in the Middle East and African markets. These exhibitions serve as platforms where numerous local brands present a wide array of sweet and savory fruit snack options to a discerning audience.

Key Cereal Bars Company Insights

Some key companies in the cereal bars market include General Mills, Inc.; Naturell India Pvt. Ltd.; Mars Incorporated and its Affilitates; BELLRING BRANDS, INC.; Nestlé; and others. The market players face intense competition from each other as some of them are among the top cereal manufacturers with diverse product portfolios for cereal bars. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both regional and international consumers.

-

Naturell India Pvt. Ltd. is a prominent cereal bar market player, known for its wide range of healthy and nutritious products. Its offerings include Protein Bars, Snacking Bars, and Nutritious Bars.

Key Cereal Bars Companies:

The following are the leading companies in the cereal bars market. These companies collectively hold the largest market share and dictate industry trends.

- General Mills, Inc.

- Naturell India Pvt. Ltd.

- Mars Incorporated and its Affilitates

- BELLRING BRANDS, INC.

- Nestlé S.A.

- Think!

- WK Kellogg Co

- McKee Foods

- PepsiCo

Recent Developments

-

In August 2024, Nature Valley launched its new Soft-Baked Muffin Bars, available in four packs in lemon poppy seed and chocolate chip flavors. The bars are designed for convenient snacking and will be sold in Sainsbury’s and Morrisons.

-

In August 2024, Think! partnered with Jessie James Decker to launch the new Think! MINIS Protein Snack Bars, aimed at celebrating summer’s delightful moments. These snack bars come in seven flavors and are crafted for convenient on-the-go consumption, offering an optimal balance of macros and taste.

-

In April 2024, KIND Snacks announced a range of new product launches that emphasize the brand's commitment to delivering both taste and nourishment to consumers. The company expanded its core nut bar line with new flavors in the Seeds, Nuts, and Fruits line, described as "trail mix in a bar," including Strawberry Sunflower Seed, Dark Chocolate Raspberry Pumpkin, and Orange Cranberry Pumpkin Seed.

-

In March 2024, Think!, a protein snack brand under Glanbia Performance Nutrition, announced its newest addition: think! MINIS Protein Snack Bars. These bars pack a satisfying punch with 100 calories and 6 grams of protein per serving.

-

In February 2024, Fordham Athletic Director Ed Kull announced a partnership between the Rams (a basketball team) and JUNKLESS, a rapidly growing granola bar brand in the U.S. These chewy granola bars are crafted from simple, wholesome ingredients such as 100% whole grain oats and real fruit, offering 34% less sugar than the leading granola bar.

-

In December 2023, Mars China unveiled a new SNICKERS bar featuring dark chocolate cereal, marking a significant advancement in sustainable packaging. This innovative product offers consumers a low-sugar, low-glycemic index option.

-

In March 2023, Bagrrys India, a prominent breakfast cereals and health food brand based in New Delhi, unveiled its latest product, “The Mighty Muesli Bars.” The bars designed to be energy-infused, comprise a blend of nuts, fruits, multi-grains, and honey, boasting a high fiber content. Available in three distinct varieties-Signature Crunch, Choco Nut Delight, and Fruits, Nuts & Seeds-Bagrry’s re-enters the cereal bar market, maintaining its commitment to quality through meticulous ingredient selection and rigorous testing before consumer launch.

Cereal Bars Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.22 billion

Revenue forecast in 2030

USD 28.12 billion

Growth rate

CAGR of 7.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

General Mills, Inc.; Naturell India Pvt. Ltd.; Mars Incorporated and its Affilitates; BELLRING BRANDS, INC.; Nestlé S.A.; Think!; WK Kellogg Co; McKee Foods; PepsiCo; Mondelez International group.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cereal Bars Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cereal bars market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Snack Bars

-

Energy & Nutrition Bars

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Traditional Grocery Stores

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.