- Home

- »

- Consumer F&B

- »

-

Snack Bars Market Size And Share, Industry Report, 2030GVR Report cover

![Snack Bars Market Size, Share & Trends Report]()

Snack Bars Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Breakfast Bars, Granola/Muesli Bars, Fruit Bars, Energy & Nutrition Bars), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-084-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Snack Bars Market Summary

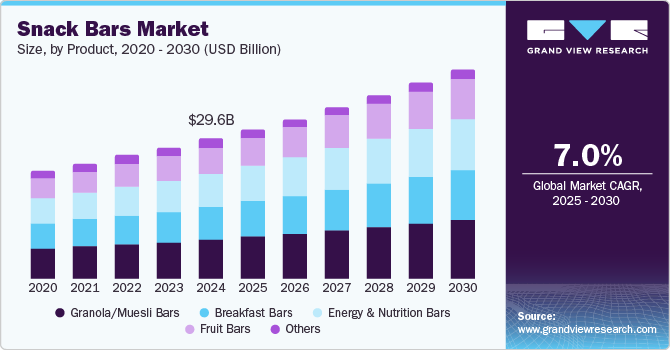

The global snack bars market size was estimated at USD 29.59 billion in 2024 and is projected to reach USD 44.25 billion by 2030, growing at a CAGR of 7.0% from 2025 to 2030. Rapidly increasing awareness regarding health and fitness among consumers has resulted in an increased preference for healthy snacking items.

Key Market Trends & Insights

- North America snack bars market accounted for the largest revenue share of 42.3% in 2024.

- The U.S. accounted for a dominant revenue share in the regional market in 2024.

- By product, the granola/muesli bars segment accounted for the largest revenue share of 28.0% in the global snack bars industry in 2024.

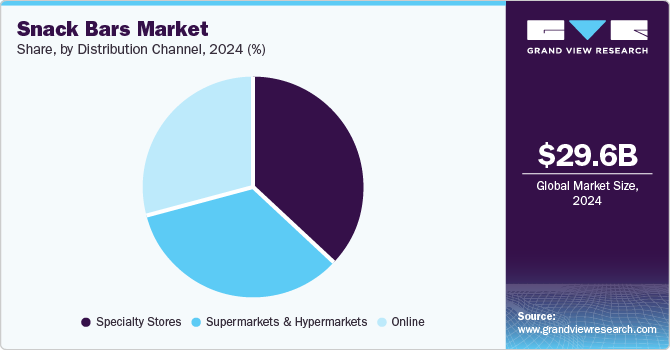

- By distribution channel, the specialty stores segment accounted for the largest revenue share in the global snack bars industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 29.59 Billion

- 2030 Projected Market Size: USD 44.25 Billion

- CAGR (2025-2030): 7.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Manufacturers of snack bars focus on incorporating nutritional ingredients in their offerings, which is expected to maintain substantial product demand in the coming years. Snack bars have become popular as a go-to snack, steadily replacing high-calorie content products such as chocolates and cookies.

With the rising pace of globalization and industrialization, there is a growing preference for quick, portable, and easy-to-eat snacks among working professionals. Snack bars address this need perfectly, providing a convenient option for breakfast, lunch, or a mid-day energy boost. Constantly evolving dietary preferences have compelled manufacturers to introduce low-sugar, high-protein, and vegan offerings in the snack bars industry. For instance, in January 2024, Fazer announced the limited edition launch of the ‘Fazer Taste the Future’ chocolate snack bar in Singapore. This product makes use of ‘Solein’ as a core ingredient, which is a protein originating from a natural single-cell organism and has been made by the Finland-based food technology company Solar Foods. Similar innovations by major market players and start-ups are expected to create potential growth opportunities for this market.

The growing demographic of gym-goers and fitness enthusiasts has resulted in the expanded use of functional ingredients such as probiotics and superfoods in these products. As more consumers become aware of the importance of gut health, they are actively seeking products, including snack bars with the required probiotic content, to help maintain a healthy gut flora balance. Furthermore, there has been a noticeable rise in the demand for snack bars with sustainable and recyclable packaging in recent years. Brands are making use of eco-friendly packaging materials such as compostable wrappers or minimal packaging to boost their appeal among environmentally conscious consumers. Social media platforms such as YouTube, Instagram, and TikTok are also considered major avenues to drive product demand due to their large audience base. Companies are collaborating with fitness influencers and athletes to promote the benefits of their products and increase sales in the snack bars industry.

Product Insights

The granola/muesli bars segment accounted for the largest revenue share of 28.0% in the global snack bars industry in 2024, owing to increasing sales due to widespread awareness regarding their nutritional benefits. Granola and muesli bars are convenient because they are pre-packaged and portable, making them a useful on-the-go snacking option for working professionals, travelers, and fitness enthusiasts. They are generally prepared using whole grains such as oats, which are high in fiber. Additionally, the combination of complex carbohydrates (from oats and whole grains), healthy fats, and protein in granola and muesli bars provides a balanced energy source, making them a great option for an energy boost that lasts longer than sugary snacks.

The energy & nutrition bars segment is anticipated to grow at the highest CAGR during the forecast period. Increasing participation in physical and sporting activities across the globe has highlighted the need for on-the-go food items that can provide a quick and sustained energy source. Energy bars that contain proteins such as whey, soy, or plant-based proteins help with muscle recovery and repair after workouts. These proteins facilitate the rebuilding of muscle tissue and support faster recovery. Energy bars made with complex carbohydrates release energy more slowly, helping to maintain consistent energy levels throughout the day. Companies are launching products that cater to wider demographics, such as the elderly population and kids, which is expected to boost their market penetration during the forecast period.

Distribution Channel Insights

The specialty stores segment accounted for the largest revenue share in the global snack bars industry in 2024. Specialty stores, including health food shops, upscale grocery outlets, and natural product retailers, serve a distinct customer base that is often willing to pay a premium price for high-quality or niche snack products. There has been a growing presence of such stores in major cities globally that further offer benefits such as product discounts, vouchers, and home delivery. Snack bars sold in physical outlets emphasize quality ingredients, sustainable sourcing, and superior nutritional profiles to appeal to consumers. An increasing number of establishments are collaborating with fitness clubs, yoga studios, and wellness-focused businesses to promote snack bars to health-conscious consumers.

The supermarkets & hypermarkets segment is expected to grow at a substantial CAGR from 2025 to 2030. These channels target a broad consumer base and offer convenience, variety, and competitive pricing, marking their importance for mass-market snack brands. Unlike specialty stores, supermarkets and hypermarkets cater to a more diverse group of customers, which helps in attracting newer customer demographics that can drive additional revenue. Many supermarkets and hypermarkets have their own private-label snack bar brands, often priced lower than branded products. These store brands can be particularly appealing to price-conscious consumers, particularly in emerging economies. Snack bars are generally positioned in high-traffic areas such as checkout aisles, snack aisles, or health food sections, making them easy for customers to grab while shopping for other essentials.

Regional Insights

North America snack bars market accounted for the largest revenue share of 42.3% in 2024. The consistently growing health-conscious population in the region and preference for snacking products that can provide nutritional value has helped drive regional market growth. Snack bars are increasingly marketed as functional foods in the U.S. and Canada. This includes bars with added benefits such as probiotics (for gut health), collagen (for skin and joints), superfoods (chia seeds, acai, or spirulina), and adaptogens (for stress management). Moreover, the busy lifestyles of working professionals in the region have highlighted the need for frequent smaller and healthy meals, which snack bars easily address, aiding their demand.

U.S. Snack Bars Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024. An increasing preference for a wellness-based lifestyle among consumers has driven sales of nutritional products in the economy, including snack bars. Intensifying competition in the market due to the presence of several brands has led to constant innovations in terms of flavors and combinations that can meet diverse consumer tastes. Reports suggest that snack bars are a very popular product in the snack-related category in the U.S., with younger consumers showing the highest consumption frequency. Additionally, snack bars that can serve as meal replacements are growing in popularity. Bars that are high in protein, fiber, and other essential nutrients address the needs of consumers looking for a quick and balanced meal replacement option.

Europe Snack Bars Market Trends

Europe accounted for a substantial revenue share in the global market in 2024. European consumers are becoming more health-conscious, and there is a growing trend toward clean eating, where natural and minimally processed foods are being prioritized. Consequently, snack bars that are free from artificial additives, preservatives, and refined sugars are becoming more popular. Consumers are opting for bars that offer added health benefits, such as high protein content, fiber, and essential vitamins. Local and regional ingredients are also a significant factor in the regional market. Products that feature local fruits, nuts, or traditional ingredients, such as hazelnuts, which are popular in Mediterranean regions, and oats, which are widely consumed in the UK and Ireland, find significant appeal among local tastes and preferences.

Asia Pacific Snack Bars Market Trends

The Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The continued urbanization in regional economies such as India and China and sharp growth in the working population have created an expansive market for snack bars. Moreover, with rising disposable income levels, the trend of premium snack bars is anticipated to positively shape market developments in the coming years. Companies are collaborating with athletes, influencers, and celebrities to increase their market penetration. For instance, SuperYou, a brand launched in November 2024 in India, develops protein wafers in various flavors, including chocolate and strawberry. The company aims to address the rapidly growing health-focused population in the country. Such initiatives are expected to boost market awareness and product sales.

China accounted for a leading revenue share in the Asia Pacific market for snack bars in 2024. With the economy's growing popularity of fitness and wellness culture, many consumers are seeking convenient, high-protein, and nutrient-dense snacks to maintain their active lifestyles. A strong preference for diverse flavors has prompted brands to innovate with local ingredients, such as matcha, red bean, and black sesame, while maintaining the incorporation of notable Western ingredients, such as chocolate and nuts. China's Millennial and Gen Z demographics are particularly focused on their health, fitness, and convenience. They are more willing to try new products, with their preferences being driven by trends on social media, making them an important consumer segment for snack bars.

Key Snack Bars Company Insights

Some major companies involved in the global snack bars industry include General Mills, Kellanova, and Mars, among others.

-

General Mills produces a wide range of consumer food products and is known for its brands across various categories, such as cereal, snacks, frozen foods, and baking products. The company has several notable snack brands, including Annie’s, Chex Cereal, EPIC, Fiber One, Larabar, Nature Valley, and Pillsbury. Nature Valley has become one of the leading brands in the granola bar and snack category, particularly in North America. Good Measure is another well-known company brand that specializes in blood sugar-friendly snacks.

-

Mars, Incorporated is a major confectionery, pet care, food, and drink product manufacturer. The company is recognized for its chocolate and confectionery offerings under brands such as Mars, Snickers, Twix, Milky Way, and Skittles. Under the KIND brand, the company offers Kind Bars that combine whole nuts, seeds, dried fruit, and natural sweeteners in a chewy texture. Leading products in this brand include Nut Bars, ZEROg Added Sugar Bars, Soft Baked Squares Bars, Breakfast Bars, and Kids Allergy Friendly Bars, among others.

Key Snack Bars Companies:

The following are the leading companies in the snack bars market. These companies collectively hold the largest market share and dictate industry trends.

- General Mills

- Kellanova

- WEETABIX

- The Quaker Oats Company

- Mondelez International group

- Earnest Eats

- Mars

- Nestlé

- The Hain Celestial Group, Inc.

- Hero Group

Recent Developments

-

In August 2024, Mars, Incorporated announced that it had signed an agreement to acquire Kellanova, which manufactures snacking and cereal products. The acquisition is expected to strengthen Mars’ snacking portfolio and increase its global footprint. Kellanova is known for its snacking brands, including Pringles, Pop-Tarts, Cheez-It, Rice Krispies Treats, and RXBAR, along with popular food brands such as Kellogg’s (international) and MorningStar Farms.

-

In May 2023, Nature Valley, a General Mills brand, announced the launch of the Nature Valley Savory Nut Crunch Bar, available in three different flavors such as White Cheddar, Smoky BBQ, and Everything Bagel. These products have been made using the company’s proprietary binding technique, which eliminates the requirement for sugar binders to keep the contents intact.

Snack Bars Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31.60 billion

Revenue forecast in 2030

USD 44.25 billion

Growth Rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, UAE

Key companies profiled

General Mills; Kellanova; WEETABIX; The Quaker Oats Company; Mondelez International group; Earnest Eats; Mars; Nestlé; The Hain Celestial Group, Inc.; Hero Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Snack Bars Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global snack bars market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Breakfast Bars

-

Granola/Muesli Bars

-

Fruit Bars

-

Energy & Nutrition Bars

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.