- Home

- »

- Organic Chemicals

- »

-

Ceric Ammonium Nitrate Market Size & Share Report, 2030GVR Report cover

![Ceric Ammonium Nitrate Market Size, Share & Trends Report]()

Ceric Ammonium Nitrate Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Laboratories, Photomasks, Liquid Crystal Display), By Region, And Segment Forecasts

- Report ID: 978-1-68038-742-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceric Ammonium Nitrate Market Summary

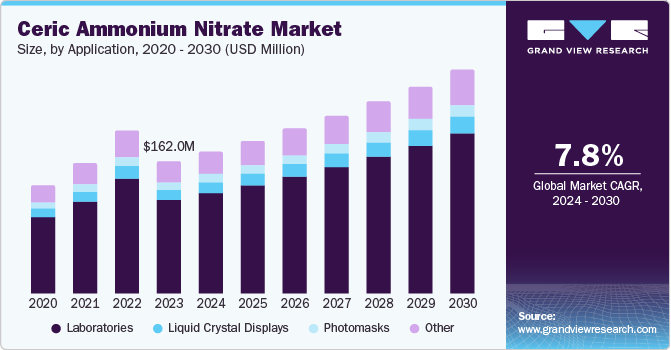

The global ceric ammonium nitrate market size was valued at USD 162.0 million in 2023 and is projected to reach USD 274.0 million by 2030, growing at a CAGR of 7.8% from 2024 to 2030. The market growth can be attributed to the rising demand in the pharmaceutical industry for various drug fusions and formulations.

Key Market Trends & Insights

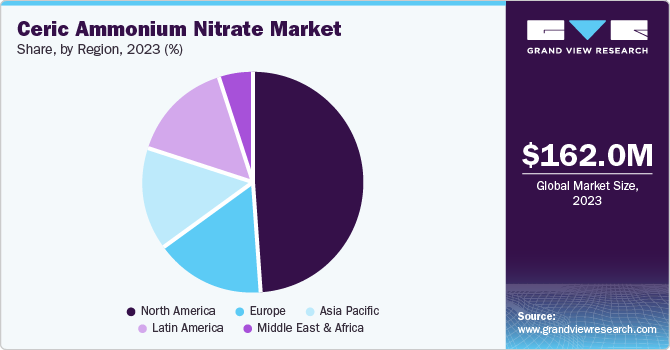

- The North America ceric ammonium nitrate market dominated the global market and accounted for the largest revenue share of 49.4% in 2023.

- The Europe ceric ammonium nitrate market is expected to grow significantly over the forecast years.

- Based on application, the laboratories segment dominated the market and accounted for the largest revenue share of 70.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 162.0 Million

- 2030 Projected Market Size: USD 274.0 Million

- CAGR (2024-2030): 7.8%

- North America: Largest market in 2023

The increasing chemical industries across the world, the continuous research and development activities run by sectors, the stringent regulations of government imposing more efficient and eco-friendly catalysts, the rising demand for smaller and more complex electronic components and parts, and the increasing pharmaceutical sector are some of the key factors driving the market growth.

Ceric ammonium nitrate is used as a catalyst in many chemical reactions, and there is a growing demand for this compound in sectors such as pharmaceuticals, electronics, and automotive. In addition, the growing electronics and chemical industry also contributes to market growth as ceric ammonium nitrate is used for the building and creating of various electronic components, and chrome etchants are used in the precise assembly of electronic components and circuits of devices, preparation of adhesives, coatings, and paints. Furthermore, the market is significantly fueled worldwide by the demand for ceric ammonium nitrate as a catalyst property in various chemical reactions. In terms of polymerization, the compound is essential in making plastics and synthetic materials, thereby raising innovation in materials science and manufacturing.

In addition, the growth of the electronics industry has led the market upward, as ceric ammonium nitrate is essential and is used widely in production and manufacturing. With the evolution in digitalization, advancements, and innovations of consumer electronics, semiconductor devices, and the Internet of Things (IoT), the demand subsequently increased, further boosting the market for ceric ammonium nitrate. Moreover, its broad applications across various industries, including pharmaceuticals, laboratory research, and aerospace, result in market growth.

Application Insights

Laboratories dominated the market and accounted for the largest revenue share of 70.6% in 2023 driven by its increasing application as a catalyst in chemical reactions, particularly in organic synthesis and oxidation processes. The expanding research initiatives in educational institutions and laboratories enhance the demand for CAN, as it is crucial for various analytical and synthetic applications. In addition, the rising focus on innovation in materials science and the pharmaceutical sector also contributes to the market's growth trajectory. Furthermore, the growing emphasis on sustainable practices and green chemistry prompts researchers to explore CAN's potential in environmentally friendly processes, further boosting its adoption across diverse laboratory settings.

Liquid crystal display application use is expected to grow at a CAGR of 7.2% over the forecast period. Ceric ammonium nitrate is significant in manufacturing LCD displays, which are widely used in televisions, computer monitors, clocks, and airplane cockpit displays. The high demand from consumer electronics, which manufactures high-quality displays and enhances performance and stability in various electronic devices, is boosting the market for ceric ammonium nitrate.

Regional Insights

The North America ceric ammonium nitrate market dominated the global market and accounted for the largest revenue share of 49.4% in 2023 owing to the increasing demand from the electronics and automotive industries for high-quality materials anticipated to fuel the market. Furthermore, the investments from the government and significant companies executing R&D activities for manufacturing enhanced goods and products with additional features widen the market opportunities, diversify its applications of the ceric ammonium nitrate market, and sustain its development and advancement.

U.S. Ceric Ammonium Nitrate Market Trends

The ceric ammonium nitrate market in the U.S. dominated the North American market, with the largest revenue share of 83.9% in the year 2023. The country leads the ceric ammonium nitrate market owing to the increasing requirement in the automobile industry, which is anticipated to surge positive market growth. In addition, the region's stringent quality principles and government regulations ascertain the need for high-performance laboratory chemicals, propelling the market growth further. Hence, the region's emphasis on sustainability and aim to protect the environment leads to ceric ammonium nitrate's applications.

Europe Ceric Ammonium Nitrate Market Trends

The Europe ceric ammonium nitrate market is expected to grow significantly over the forecast years.This growth is attributed to the region's broad applications of ceric ammonium nitrate. However, the electronics and automotive industries market and research and development expenditures are increasing. Furthermore, the market is anticipated to grow due to the increasing demand for high-performance materials in various sectors, encompassing the chemical and pharmaceutical industries.

UK Ceric Ammonium Nitrate Market Trends

The ceric ammonium nitrate market in the UK is expected to experience significant growth over the forecast years owing to its broad use in the chemical industry. In addition, stringent regulatory standards, a focus on innovation in pharmaceuticals and electronics, and investments in research and development are key factors supporting market growth. The expanding chemical manufacturing sector and demand for precise, reliable chemical reagents such as CAN further contribute to the market's expansion in the UK.

Asia Pacific Ceric Ammonium Nitrate Market Trends

The Asia Pacific ceric ammonium nitrate market is expected to grow at a CAGR of 8.5% over the forecast period. This growth is attributed to the presence of major electronics manufacturers, increased industrialization, and expanding chemical and pharmaceutical sectors. Countries such as China, India, and Japan are major contributors, driven by their burgeoning electronics and manufacturing industries. Significant investments in research and development, coupled with rising demand for advanced chemical products, fuel market expansion in Asia Pacific.

China Ceric Ammonium Nitrate Market Trends

The ceric ammonium nitrate market in China is expected to grow substantially over the forecast years owing to rapid industrialization and a booming pharmaceutical sector. The increasing demand for specialty chemicals in drug synthesis and organic chemistry applications significantly boosts market prospects. Furthermore, advancements in manufacturing technologies enhance production efficiency, while the expanding electronics industry further propels the need for ceric ammonium nitrate.

Ceric Ammonium Nitrate Company Share & Insights

Some key companies in the ceric ammonium nitrate market include URANUS CHEMICALS CO., LTD, GFS Chemical, Inc., Dow, Ganzhou Wanfeng Advanced, and Materials Tech. Co., Ltd., Chuanyan Technology Co., Ltd., Merck KGaA.;in the market focusing on development & to gain a competitive edge in the industry.

-

Merck KGaA is a science-technology-based company that produces many chemical and pharmaceutical products. It is actively engaged in several sectors, such as healthcare, life science, performance materials, corporate, etc. They also offer lab water systems, cell lines, antibodies, gene editing tools, biomonitoring and microbiology products, test assays, analytical reagents, flow cytometry kits and instruments, and end-to-end systems.

-

Uranus Chemicals CO., LTD is a prominent manufacturer and marketer with a strong presence in imports and exports of inorganic acid. The company produces electronic grade, battery materials, specialty chemicals, and oxalic acids.

Key Ceric Ammonium Nitrate Companies:

The following are the leading companies in the ceric ammonium nitrate market. These companies collectively hold the largest market share and dictate industry trends.

- URANUS CHEMICALS CO., LTD

- GFS Chemical, Inc.

- Dow

- Ganzhou Wanfeng Advanced Materials Tech. Co., Ltd.

- Chuanyan Technology Co., Ltd.

- Merck KGaA

- Treibacher Industrie AG

- American Elements.

- ProChem Inc.

- Blue Line Corporation.

Recent Developments

-

In June 2024, Dow announced its agreement to acquire Circulus, a polyethylene recycler in North America, to enhance its mechanical recycling capabilities. The acquisition comprised two facilities in Alabama and Oklahoma, with a combined capacity of 50,000 metric tons per year. This move aimed to support Dow's 2030 sustainability goals by producing higher-performing circular products and advancing the circular economy in plastic packaging, leveraging both companies' expertise in materials science and recycling technology.

Ceric Ammonium Nitrate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 174.1 million

Revenue forecast in 2030

USD 274.0 million

Growth rate

CAGR of 7.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in tons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Brazil, Argentina

Key companies profiled

URANUS CHEMICALS CO., LTD; GFS Chemical, Inc.; Dow; Ganzhou Wanfeng Advanced Materials Tech. Co., Ltd.; Chuanyan Technology Co., Ltd.; Merck KGaA; Treibacher Industrie AG; American Elements.; ProChem Inc.; Blue Line Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ceric ammonium nitrate market report based on application and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Laboratories

-

Photomasks

-

Liquid crystal displays

-

Other

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.