- Home

- »

- Homecare & Decor

- »

-

Chandeliers Market Size, Share And Trends Report, 2030GVR Report cover

![Chandeliers Market Size, Share & Trends Report]()

Chandeliers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Traditional, Transitional, Modern), By Application (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-964-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chandelier Market Summary

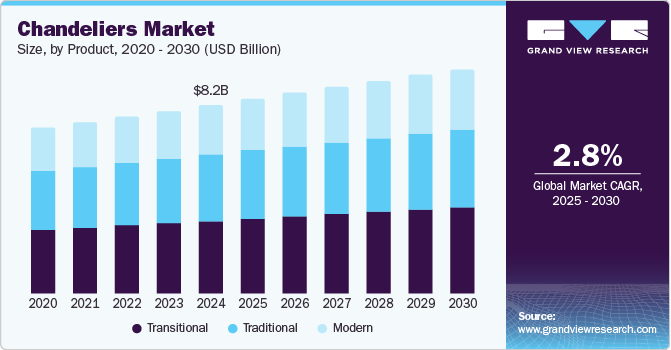

The global chandeliers market size was valued at USD 8.20 billion in 2024 and is expected to reach USD 9.72 billion by 2030, growing at a CAGR of 2.8% from 2025 to 2030. This growth market is driven by the increasing demand for luxurious and aesthetically pleasing home decor products.

Key Market Trends & Insights

- North America dominated the global market with a revenue share of 31.0% in 2024.

- The U.S. contributed the largest revenue share in the North American chandeliers market in 2024.

- By product, the transitional segment accounted for 65.7% of the total market revenue in 2024.

- By distribution channel, the offline segment dominated the global chandeliers market in 2024.

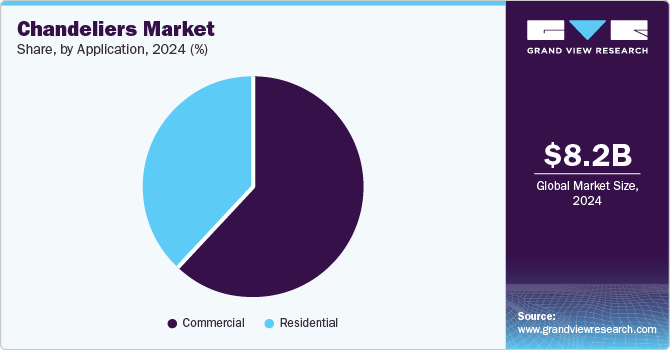

- By application, the commercial segment emerged as the largest revenue contributor in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.20 Billion

- 2030 Projected Market Size: USD 9.72 Billion

- CAGR (2025-2030): 2.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With the increase in consumers' disposable incomes, there is a surge in home renovation and interior design, resulting in greater demand for chandeliers. Additionally, the integration of LED technology in chandeliers has enhanced their energy efficiency and durability, making them more appealing to environmentally conscious consumers.

The trend towards smart home integration also plays a crucial role, as modern chandeliers can now be controlled via smartphone applications or virtual assistants, offering unparalleled convenience. Furthermore, the expansion of the hospitality sector, with more luxury hotels and resorts incorporating chandeliers to create a grand ambiance, contributes to market growth.

Product Insights

The transitional segment accounted for 65.7% of the total revenue generated in the global chandeliers market in 2024. This segment's popularity can be attributed to its versatile design, which blends traditional and contemporary elements, making it suitable for various interior styles. Transitional chandeliers appeal to consumers who seek a balanced aesthetic that is neither too ornate nor overly minimalist. This adaptability allows them to complement various decor themes, from classic to modern, enhancing their appeal in residential and commercial settings.

The modern chandeliers segment is expected to grow at a CAGR of 3.2% over the forecast period, driven by the increasing inclination towards contemporary and minimalist interior designs, particularly among younger consumers and urban dwellers. The rising awareness and adoption of smart home technologies further boost the demand for modern chandeliers, which can be easily integrated into automated home systems. Moreover, the expanding hospitality and commercial sectors, prioritizing modern and stylish lighting solutions to create sophisticated environments, contribute to the segment's growth.

Distribution Channel Insights

The offline segment dominated the global chandeliers market in 2024, primarily due to the traditional preference for in-person shopping for high-value and aesthetic products such as chandeliers. Showrooms and specialty lighting stores provide a tangible shopping experience, allowing customers to assess the quality, design, and size of chandeliers in person. Additionally, offline channels offer personalized customer service, expert advice, and immediate product availability, which are significant advantages over online shopping. The presence of established retail networks and the ability to build trust through face-to-face interactions further bolster the dominance of the offline segment. Moreover, many consumers still value the convenience of local stores for after-sales services, such as installation and maintenance, which are more readily accessible through offline channels.

The online segment is projected to grow at the fastest rate over the forecast period, driven by the increasing penetration of e-commerce and the growing consumer comfort with online shopping. The convenience of browsing a wide variety of products from the comfort of one's home and the ability to compare prices and read customer reviews make online shopping an attractive option. E-commerce platforms often offer competitive pricing, discounts, and a broader selection of products than physical stores, which appeals to cost-conscious and tech-savvy consumers. The integration of augmented reality (AR) and virtual reality (VR) technologies in online platforms also enhances the shopping experience by allowing customers to visualize how chandeliers will look in their spaces.

Application Insights

The commercial segment emerged as the largest contributor to revenue in the global chandeliers market in 2024, largely driven by the extensive use of chandeliers in various commercial spaces such as hotels, restaurants, corporate offices, and retail stores. In the hospitality industry, chandeliers are often used to create a luxurious and inviting ambiance, enhancing the overall guest experience. High-end restaurants and event venues also utilize chandeliers to add a touch of elegance and sophistication to their interiors. Corporate offices and retail stores, particularly those targeting premium clientele, invest in chandeliers to project a high-end image and improve the aesthetic appeal of their spaces. The commercial segment benefits from large-scale projects and renovations, where the installation of multiple chandeliers can significantly boost revenue.

The residential segment is projected to grow at the fastest rate from 2025 to 2030. Several factors, including the rising disposable incomes and the increasing trend of home renovation and interior decoration, fuel this anticipated growth. Homeowners are increasingly investing in high-quality, stylish lighting fixtures to enhance the aesthetic appeal and functionality of their living spaces. The growing popularity of open floor plans and high ceilings in modern homes creates a suitable environment for installing chandeliers, which serve as functional lighting and decorative centerpieces. The residential segment also benefits from the expanding real estate market, with new housing developments and luxury apartments incorporating chandeliers as part of their standard offerings.

Regional Insights

North America dominated the global chandeliers market with a revenue share of 31.0% in 2024, driven by a strong demand for luxury home decor and high disposable incomes. The region’s affluent consumer base significantly prefers premium and aesthetically pleasing lighting solutions, which has bolstered the chandelier market. The presence of numerous high-end residential and commercial projects further supports this demand.

U.S. Chandeliers Market Trends

The U.S. contributed the largest revenue share in the North American chandeliers market in 2024 attributed to the country’s robust economic conditions and the high spending power of its consumers. The increasing adoption of smart home technologies has driven the demand for innovative lighting solutions.

Asia Pacific Chandeliers Market Trends

The Asia Pacific chandeliers market is expected to grow at the fastest rate from 2025 to 2030, driven by rising disposable incomes and urbanization in countries such as China, India, and Japan. The increasing number of residential and commercial construction projects in these countries creates a substantial demand for chandeliers. Additionally, the growing middle class in the region is showing a heightened interest in luxury home decor, further propelling market growth.

China accounted for a substantial revenue share of the Asia Pacific chandeliers market in 2024. The country’s booming real estate sector and the increasing number of high-end residential and commercial projects are key drivers of this growth. Chinese consumers increasingly invest in luxury home decor items, including chandeliers, to enhance their living spaces. The government’s focus on urbanization and infrastructure development also supports the market.

Europe Chandeliers Market Insights & Trends

Europe’s chandeliers market is expected to grow at a CAGR of 2.9% over the forecast period. The region’s rich cultural heritage and appreciation for ornate, classical designs drive the demand for traditional chandeliers. Countries such as Germany, France, and the UK are leading markets within the region, with a strong preference for high-quality and aesthetically pleasing lighting solutions. The trend towards sustainable and energy-efficient lighting is also gaining momentum in Europe, with consumers increasingly opting for LED chandeliers.

Key Chandeliers Company Insights

Some of the key companies in the Chandeliers market include Abbott, Cardinal Health, Medtronic, Merit Medical, Teleflex Incorporated, and others.

-

Elegant Lighting is a prominent player in the global chandeliers market, known for its extensive range of luxurious and intricately designed lighting fixtures. The company specializes in creating high-quality chandeliers catering to traditional and contemporary tastes.

-

Koninklijke Philips N.V., commonly known as Philips, is a significant player in the global lighting industry, including the chandeliers market. Philips is known for its innovative lighting solutions incorporating advanced technologies such as LED and smart lighting systems. Their chandeliers often feature energy-efficient designs and can be integrated into smart home ecosystems, appealing to tech-savvy consumers.

Key Chandeliers Companies:

The following are the leading companies in the chandeliers market. These companies collectively hold the largest market share and dictate industry trends.

- Elegant Lighting

- Generation Brands LLC

- Koninklijke Philips N.V.

- Maxim Lighting International

- HSL Worldwide Lighting Corporation

- Acuity Brands Lighting Inc.

- Hubbell Incorporated

- Vanguard Lighting Co. Ltd.

- King's Chandelier Company

- James R. Moder Crystal Chandelier Inc.

Recent Developments

-

In September 2024, Kingswood Capital Management announced the acquisition of Kichler Lighting. Kichler will be merged with Progress Lighting, another Kingswood Capital portfolio company. This strategic combination aims to leverage expanded distribution networks, enhanced service capabilities, and a comprehensive product portfolio to better serve customers in the homebuilder, trade, showroom, retail, and e-commerce markets.

-

In August 2024, Capitol Lighting, operating under the name 1800lighting, completed the acquisition of the Bellacor brand and its digital assets. Both the Bellacor brand and 1800lighting.com will maintain their separate retail presence. Capitol Lighting's service teams will oversee all operational and fulfillment activities.

Chandeliers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.47 billion

Revenue forecast in 2030

USD 9.72 billion

Growth rate

CAGR of 2.8% from 2025 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, China, India, Japan, Australia, South Korea, Brazil, South Africa

Key companies profiled

Elegant Lighting, Generation Brands LLC, Koninklijke Philips N.V., Maxim Lighting International, HSL Worldwide Lighting Corporation, Acuity Brands Lighting Inc, Hubbell Incorporated, Vanguard Lighting Co. Ltd., King's Chandelier Company, James R. Moder Crystal Chandelier Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chandeliers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Chandeliers market report based on product, distribution channel, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional

-

Transitional

-

Modern

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.