- Home

- »

- Organic Chemicals

- »

-

Chemical As A Service Market Size & Share Report, 2030GVR Report cover

![Chemical As A Service Market Size, Share & Trends Report]()

Chemical As A Service Market Size, Share & Trends Analysis Report By Application (Water Treatment & Purification, Metal Parts Cleaning, Industrial Cleaning, Industrial Gases), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-911-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Chemical As A Service Market Size & Trends

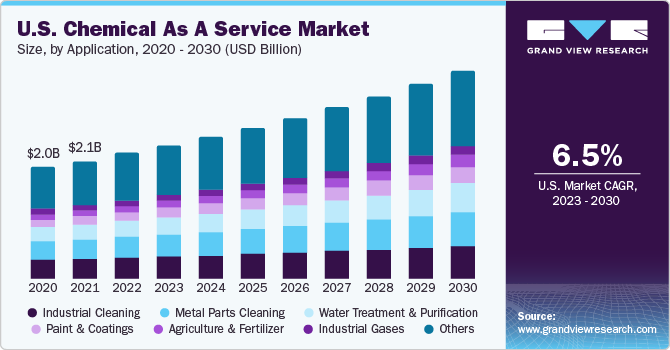

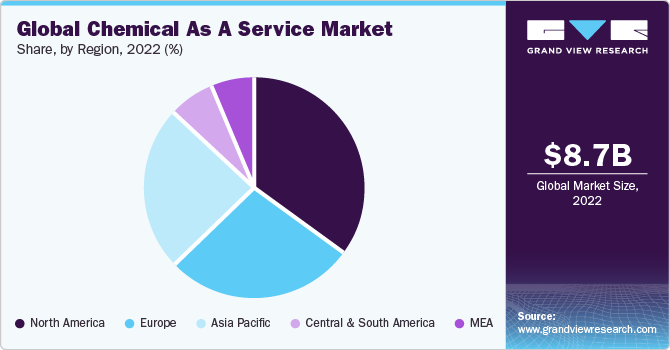

The global chemical as a service market size was valued at USD 8.7 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.9% over the forecast period. The market growth is anticipated to be triggered by the growing awareness regarding chemical sustainability, increasing demand for chemical leasing services, and government support. Moreover, the rise in the demand for chemical management in the end-user industries is further accelerating market growth. The market experienced a decline in growth in 2020 compared to the previous year owing to the outbreak of the COVID-19 pandemic.

However, the market has not experienced a negative impact due to the remarkable demand for surface disinfectants, cleaning chemicals, and surfactants in 2020. Major challenges for the players operating in the CaaS market include price fluctuations, raw material sourcing, government regulations regarding disposal, cost of chemical production, and revival period for end-use industries. Chemical as a service is a business model in which a customer can get the benefit from chemicals and their functions and applications without purchasing the chemicals. In this service model, the supplier does not sell them in quantities, instead, he sells the function and performance of the chemicals. The supplier provides services of chemicals for various applications in the end-user industries.

The model includes Chemical Management Services (CMS), chemical leasing, and closed-loop systems. The growing chemical industry in developing countries such as India, China, and Brazil is one of the driving factors for the growth of the market. Companies operating in this market provide end-to-end services including logistics, development of specific chemicals, processes, and applications. The companies also provide services such as chemical and waste management. The chemical service providing companies are offering these services for various applications in different industries such as industrial gases, agricultural and fertilizer, metal parts cleaning, water treatment and purification, paint and coatings, industrial cleaning, and more.

The chemical as a service is a new business model. Thus, limited companies are offering these services at the global level. According to United Nations Industrial Development Organization (UNIDO), around 100 companies have integrated chemical leasing into their business strategies worldwide. The majority of the players in this market operate at the local and regional levels only. However, few players are operating at the global level. For instance, Diversey Holdings LTD. a U.S.-based company is offering chemical leasing services worldwide. There is a huge opportunity for these services from the untapped markets. In the developed market such as the U.S., factors such as the presence of large chemical, automotive, fertilizer, among other industries are expected to drive the market.

Regional Insights

North America dominated the global chemical as a service market and accounted for the largest revenue share of 35.3% in 2022, on account of several factors, such as the presence of a huge chemical industry in the U.S. Also, the region has the presence of various major industries such as automotive, aerospace, healthcare, among others. This business model is expected to be adopted by the aforementioned industries in the upcoming years for applications such as cleaning, washing, and degreasing metal parts.

Asia Pacific is expected to grow at the fastest CAGR of 9.7% during the forecast period. This is due to the presence of various several small, medium, and large companies operating in the agrochemical and fertilizers, water treatment, paints and coatings, among others. Moreover, increasing industrialization in the region mainly in countries such as India, China, Japan, and South Korea is expected to drive the market. Middle East and Africa is anticipated to be the second-fastest-growing market with a CAGR of 9.2% over the forecast period due to the presence of a huge oil and gas industry. In addition, increasing demand for mobile water treatment in the region is further expected to drive the market in the near future.

End-user Industry Insights

The industrial cleaning segment accounted for the largest revenue share of 17.7% in 2022. This model is majorly utilized in the industries for cleaning vessels, pipes, reactors, and metal parts. Industrialists instead of purchasing chemicals to clean the machinery and conveyor sort for chemical services as they are cost-effective and convenient. End-users do not have to pay separate amounts for labor and chemicals.

The agriculture & fertilizer segment is expected to grow at the fastest CAGR of 9.7% during the forecast period. The growing agricultural industry across the globe is expected to drive the market. The increasing focus on precision farming and newer technologies is influencing agriculturists to utilize new business models and services such as chemical as a service model. Agriculturists get the benefit from various chemicals and applications without purchasing them. For instance, farmers can get the benefit of fertilizers by this service without purchasing. By subscribing to these services, farmers do not have to apply fertilizers to the crop on their own.

Key Companies & Market Share Insights

The global chemical as a service is a novel business model that includes chemical leasing, development of chemical processes, logistics, and chemical management. The chemical leasing model was launched by the United Nations Industrial Development Organization (UNIDO) in 2004 with the support of the government of Austria. The market is in the initial phase of its growth with limited players operating in the segment. The competition among players is based on numerous parameters including service offerings, corporate reputation, and price. Distribution network expansion, joint ventures, mergers, and acquisitions are some of the key strategies being adopted by the players to strengthen their position in the market and gain a higher market share.

Key Chemical As A Service Companies:

- Diversey Holdings Ltd.

- Henkel AG & Co. KGaA

- Safechem Europe Gmbh

- CSC JÄKLECHEMIE GmbH & Co. KG

- Polikem

- Ecolab Inc.

- Hidrotecnik

- BASF SE

- Haas TCM

- PPG Industries

- Sphera

- Quaker Chemical

Recent Development

-

In December 2020, Quaker Chemical Corporation, a prominent chemical company based in the U.S., completed the acquisition of Coral Chemical Company for a total amount of USD 53 million. This strategic acquisition has resulted in a significant increase in Quaker Chemical's net sales, providing the company with added growth opportunities and enhanced market presence.

-

In May 2022, Sphera, a renowned global provider of software, data, and consulting services formed a strategic partnership with BASF. This collaboration aims to offer a comprehensive and automated solution to chemical and manufacturing companies, enabling them to calculate the carbon footprints of their entire product portfolio with speed, accuracy, and efficiency.

Chemical As A Service Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.4 billion

Revenue forecast in 2030

USD 16.04 billion

Growth rate

CAGR of 7.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Russia; China; Japan; India; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Diversey Holdings Ltd.; Henkel AG & Co. KGaA; Safechem Europe Gmbh; CSC JÄKLECHEMIE GmbH & Co. KG; Polikem; Ecolab Inc.; Hidrotecnik; BASF SE; Haas TCM; PPG Industries; Sphera; Quaker Chemical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemical As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global chemical as a service market on the basis of application and region:

-

Application Industry Outlook (Revenue in USD Million, 2018 - 2030)

-

Agriculture & Fertilizer

-

Water Treatment & Purification

-

Metal Parts Cleaning

-

Paint & Coatings

-

Industrial Cleaning

-

Industrial Gases

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chemical as a service market size was valued at USD 8.70 billion in 2022 and is expected to reach USD 9.36 billion in 2023.

b. The global chemical as a service market is anticipated to grow at a compounded annual growth rate (CAGR) of 7.9% from 2023 to 2030 and reach USD 16.04 billion by 2030.

b. North America dominated the chemical as a service market and accounted for a 35.3% share of global revenue in 2022, on account of several factors, such as the presence of a huge chemical industry in the U.S.

b. Some prominent players in the chemical as a service market include Diversey Holdings Ltd., Henkel AG & Co. KGaA, Safechem Europe Gmbh, CSC JÄKLECHEMIE GmbH & Co. KG, Polikem, Ecolab Inc., Hidrotecnik, BASF SE, Haas TCM, PPG Industries, Sphera, and Quaker Chemical

b. The chemical as a service market growth is expected to be driven by the increasing demand for chemical leasing services, growing awareness regarding chemical sustainability, and government support. Moreover, the rise in the demand for chemical management in the end-user industries is further accelerating market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."