- Home

- »

- Water & Sludge Treatment

- »

-

Waste Management Market Size, Industry Report, 2033GVR Report cover

![Waste Management Market Size, Share & Trends Report]()

Waste Management Market (2026 - 2033) Size, Share & Trends Analysis Report By Service Type (Collection, Transportation, Disposal), By Waste Type (Municipal Waste, Medical Waste, Industrial Waste, E-waste), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-917-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Waste Management Market Summary

The global waste management market size was estimated at USD 1,497.17 billion in 2025 and is projected to reach USD 2,365.14 billion by 2033, growing at a CAGR of 6.0% from 2026 to 2033. Rapid urbanization, population growth, and changing consumption patterns are the primary growth drivers.

Key Market Trends & Insights

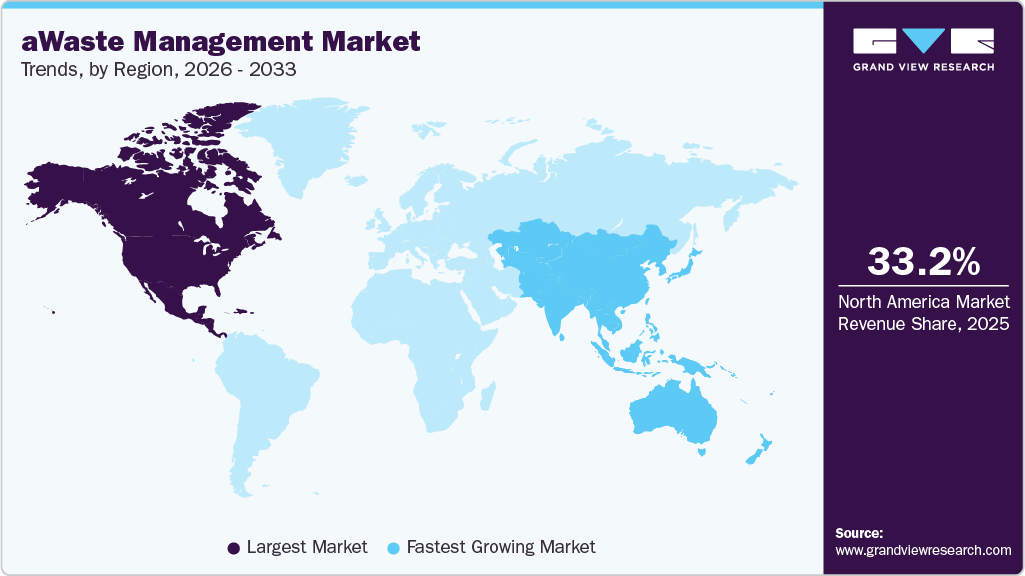

- North America dominated the waste management market with the largest revenue share of 33.2% in 2025.

- The U.S. waste management industry dominates North America, driven by high waste generation and a well-developed service infrastructure.

- By service type, the disposal service segment is expected to grow at a considerable CAGR of 6.5% from 2026 to 2033 in terms of revenue.

- By waste type, the E-waste segment is expected to grow at a fastest CAGR of 8.0% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 1,497.17 Billion

- 2033 Projected Market Size: USD 2,365.14 Billion

- CAGR (2026-2033): 6.0%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Rising municipal solid waste volumes, higher use of packaged goods, and shorter product life cycles are pushing governments and private players to expand collection and processing capacity. Another key growth driver for the waste management industry is the expansion of the healthcare, industrial, and electronics sectors, which generate complex waste streams that require specialized treatment. Growth in medical facilities has increased demand for compliant medical waste handling, while industrialization is boosting volumes of hazardous and non-hazardous industrial waste. The rapid rise in electronic consumption is accelerating e-waste generation, creating opportunities for recycling and material recovery.

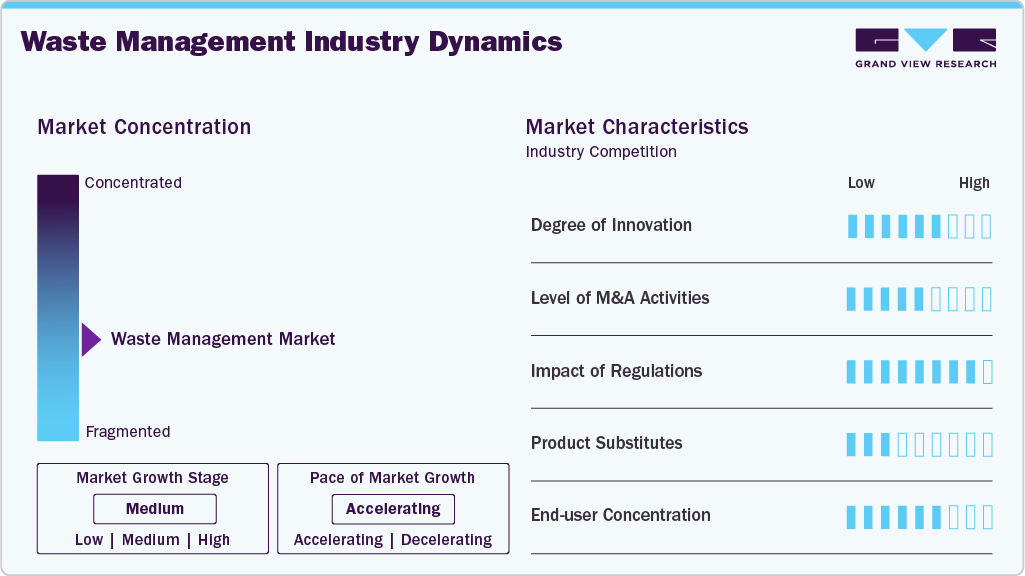

Market Concentration & Characteristics

The waste management market is moderately fragmented, with a mix of large multinational operators and a broad base of regional and local service providers. Major players tend to dominate long-term municipal contracts, hazardous waste treatment, and capital-intensive facilities such as landfills and waste-to-energy plants. However, collection and transportation services remain highly decentralized, especially in emerging economies, where small and mid-sized operators play a critical role.

The waste management industry is moving beyond basic collection and disposal toward technology-led and data-driven operations. Digital monitoring, automation, and advanced sorting systems are improving efficiency across the value chain. Large operators are investing heavily in innovation, as seen in initiatives by SUEZ, which focuses on digital solutions, circular economy models, and advanced recycling to manage complex waste streams. These developments are gradually reshaping the industry, although adoption remains uneven among smaller players.

Regulation has a strong and direct influence on industry operations, shaping how waste is collected, treated, and disposed of. Governments are enforcing stricter landfill norms, emissions limits, and recycling targets, which raise compliance costs but also create demand for organized services. Extended producer responsibility and medical waste rules are pushing more waste into formal channels. Regulatory stability often determines long-term investment in treatment infrastructure.

End user concentration is moderate, with demand spread across municipalities, healthcare facilities, industrial producers, and commercial establishments. Municipal bodies account for a large share of service contracts, typically through long-term agreements that provide revenue stability. Industrial and healthcare users add complexity through specialized waste streams and compliance needs. This diversified customer base helps balance demand but increases the need for customized services.

Drivers, Opportunities & Restraints

Rising urban populations and higher waste generation rates are the core drivers of the waste management market. Governments are increasing spending on organized collection, treatment, and disposal to meet environmental and public health goals. Stricter regulations on landfill usage and emissions are accelerating the shift toward recycling and waste-to-energy solutions. Growth in healthcare, industrial activity, and consumer electronics further adds to complex waste volumes.

Opportunities are expanding in advanced recycling, waste-to-energy projects, and formal e-waste processing. Digitalization of collection and transportation creates scope for cost reduction and service optimization. Public-private partnerships are opening long-term revenue streams, especially in municipal and industrial waste segments. Material recovery from plastics, metals, and electronics is improving profitability and circular economy adoption.

High capital investment for treatment facilities and waste-to-energy plants remains a key restraint. Regulatory compliance and permitting delays can slow project execution and raise operating costs. Informal waste handling in developing regions limits the growth of organized players. Volatility in recycled material prices also affects margins and investment decisions.

Service Type Insights

The collection segment leads the global waste management market, accounting for a 61.8% share in 2025, driven by the essential need for regular waste removal across residential, commercial, and industrial sectors. Urbanization and rising waste volumes have increased demand for efficient collection systems. Municipal contracts and private service providers play a key role in maintaining sanitation. Technological upgrades in routing and scheduling are further improving service efficiency.

The disposal segment is experiencing rapid growth due to increasing volumes of hazardous, electronic, and biomedical waste. Stricter environmental regulations are driving demand for safe and compliant disposal methods. Growth in waste-to-energy plants and engineered landfills is enhancing the segment’s value. Additionally, emerging economies are investing in proper disposal infrastructure to curb environmental pollution.

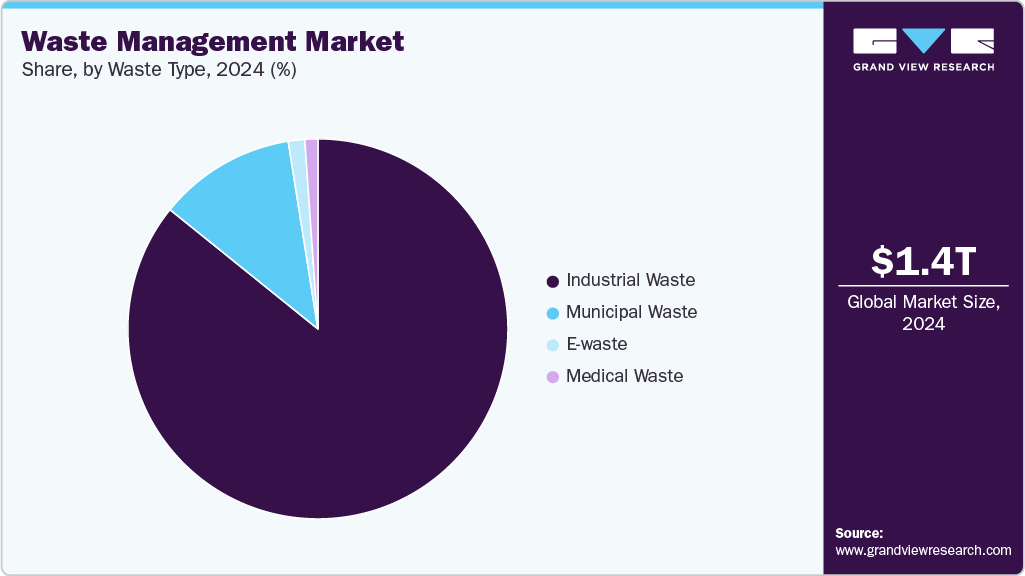

Waste Type Insights

The industrial waste segment led the waste management market, accounting for 85.7% in 2025, driven by the large volumes generated by the manufacturing, mining, construction, and chemical sectors. These industries generate both hazardous and non-hazardous waste, which requires specialized handling and treatment. Strict compliance norms further necessitate professional waste management services. The scale and frequency of industrial operations make this segment the largest contributor.

E-waste is the fastest-growing waste type segment, driven by rapid technological advancement and short product lifecycles. The increasing consumption of electronics and digital devices is driving significant disposal volumes. Rising awareness and regulations regarding toxic components in e-waste are pushing for proper recycling. This trend is especially prominent in both developed and rapidly digitizing economies.

Regional Insights

North America dominated the waste management market, accounting for a 33.2% share in 2025, due to well-established collection systems and strong regulatory enforcement. High municipal waste generation and widespread outsourcing to private operators support steady demand. The region also leads in landfill management, recycling infrastructure, and waste-to-energy adoption. Long-term municipal contracts provide revenue stability for major players.

U.S. Waste Management Market Trends

The U.S. waste management industry dominates North America, driven by high waste generation and a well-developed service infrastructure. Strong environmental regulations and widespread outsourcing of municipal services support consistent demand. The presence of large private operators and long-term municipal contracts strengthens market leadership. Advanced recycling and waste-to-energy projects further reinforce growth.

The Canada waste management market is witnessing steady growth, supported by rising urbanization and increasing focus on sustainable waste practices. Provincial regulations promoting recycling and landfill diversion are driving investments in modern treatment facilities. Public-private partnerships are expanding organized waste collection and processing. Growing emphasis on circular economy initiatives is shaping long-term market development.

Europe Waste Management Market Trends

Europe shows consistent growth, supported by strict environmental regulations and high recycling targets. The region emphasizes circular economy practices, waste reduction, and energy recovery. Advanced segregation and treatment technologies are widely adopted across municipalities. Policy-driven demand continues to support innovation and investment.

The waste management market in Germany dominates Europe, due to its advanced recycling systems and strong policy framework. High landfill diversion rates and well-established extended producer responsibility programs support market leadership. The country has significant capacity in recycling and waste-to-energy infrastructure. Continuous investment in circular economy solutions sustains long-term growth.

The UK waste management market is showing steady growth, driven by tighter landfill restrictions and rising recycling targets. Local authorities increasingly rely on private operators for collection and treatment services. Investment in energy recovery facilities is expanding as landfill capacity declines. Policy alignment with sustainability goals continues to support market expansion.

Asia Pacific Waste Management Market Trends

The Asia Pacific waste management industry is expected to grow at the fastest CAGR of 6.6% over the forecast period, driven by rapid urbanization, population growth, and rising consumption. Expanding cities are under pressure to formalize waste collection and disposal systems. Government initiatives focused on cleanliness, recycling, and infrastructure development are accelerating market expansion. Further increasing private sector participation supports growth.

China's waste management market dominates Asia Pacific, driven by massive urban populations and high waste generation volumes. Strong government involvement in waste segregation, recycling, and waste-to-energy projects supports market leadership. Large-scale infrastructure investments have expanded treatment and disposal capacity across major cities. Policy-driven enforcement continues to formalize waste handling practices.

The waste management market in India is one of the fastest-growing markets in the region, driven by rapid urbanization and rising consumption. National and municipal programs are pushing improvements in collection coverage and scientific disposal. Private sector participation is increasing through public-private partnerships. Growing focus on recycling and energy recovery is shaping long-term growth.

Middle East & Africa Waste Management Market Trends

The Middle East and Africa region is experiencing gradual growth, supported by infrastructure development and urban expansion. Governments are investing in modern landfills, waste-to-energy plants, and centralized collection systems. Rising environmental awareness is strengthening regulatory frameworks. Market growth remains uneven but shows strong long-term potential.

The UAE’s waste management market is growing swiftly, driven by rapid urban development and high consumption rates. Dubai and Abu Dhabi are actively investing in waste-to-energy projects and modern landfill sites to reduce reliance on landfills. Government-led initiatives such as mandatory recycling programs and sustainable development targets are reinforcing infrastructure expansion. Private investments and public-private partnerships are accelerating the adoption of advanced collection, segregation, and treatment technologies.

Latin America Waste Management Market Trends

Latin America is growing steadily as countries improve urban waste collection coverage and landfill standards. Investments are increasing in controlled disposal sites and recycling facilities. Public-private partnerships are helping modernize waste services in major cities. However, informal waste handling still limits faster market expansion.

Brazil's waste management market is growing due to increasing urbanization and rising volumes of municipal solid waste. Government programs like the National Solid Waste Plan are supporting improvements in recycling, treatment, and disposal infrastructure. Investments in waste-to-energy and composting facilities are gaining traction. Additionally, smart waste technologies and collaboration with private firms are helping modernize services and enhance regulatory compliance.

Key Waste Management Company Insights

Some of the key players operating in the market include WM Intellectual Property Holdings, L.L.C., Suez, and Valicor.

-

WM Intellectual Property Holdings, L.L.C. is a wholly owned subsidiary of Waste Management, Inc., focused on managing and protecting the company’s portfolio of patents, trademarks, and proprietary technologies. It plays a key role in supporting WM’s innovation in waste processing, recycling systems, and sustainability solutions. The subsidiary handles licensing agreements, enforces IP rights, and safeguards technological advancements tied to environmental services. It supports the development of automated material recovery systems and digital route optimization platforms. Strategic IP management enables WM to maintain a competitive edge in smart waste management technologies.

-

SUEZ is a global utility company specializing in sustainable water and waste management solutions across municipal, industrial, and commercial sectors. The company develops advanced technologies for wastewater treatment, desalination, biogas recovery, and smart water infrastructure. It is known for circular economy innovations, including resource recovery from sludge and plastics. SUEZ also partners with scientific institutions, such as the CNRS, to pioneer environmental R&D in areas including PFAS reduction and hydrothermal gasification. Its operations span over 40 countries, delivering integrated environmental services with a focus on climate resilience and digital transformation.

Key Waste Management Companies:

The following key companies have been profiled for this study on the waste management market.

- WM Intellectual Property Holdings, L.L.C.

- Suez

- Valicor

- Veolia

- Waste Connections.

- Republic Services

- Biffa

- CLEAN HARBORS, INC.

- Reworld.

- DAISEKI CO.,Ltd.

- Stericycle, Inc.

- Casella Waste Systems, Inc.

- CECO ENVIRONMENTAL.

- Cleanaway

- GFL Environmental Inc.

Recent Developments

-

In July 2025, SUEZ and SIAAP inaugurated France’s largest biogas production unit at the Seine Aval wastewater treatment plant near Paris. The facility processes 130,000 tonnes of sludge annually, generating 350 GWh of renewable energy. This covers over half the plant’s energy needs. The €401 million project supports sustainable and energy-efficient wastewater management.

-

In April 2025, SUEZ and CNRS entered a five-year strategic partnership to advance sustainable water and waste management solutions. The collaboration focuses on areas like sludge recovery, pollutant reduction, and hydrothermal gasification. A pilot project in Bordeaux aims to turn sludge into renewable gas by 2026. The partnership strengthens innovation through joint research, patents, and technological development.

-

In November 2024, Waste Management finalized its USD 7.2 billion acquisition of Stericycle on November 4, 2025. Stericycle will now operate under WM’s Healthcare Solutions division. The merger is expected to deliver over USD 125 million in cost synergies. This move strengthens WM’s presence in the medical waste and information destruction sectors.

Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,576.2 billion

Revenue forecast in 2033

USD 2,365.14 billion

Growth rate

CAGR of 6.0% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, waste type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; UAE; South Africa.

Key companies profiled

WM Intellectual Property Holdings, L.L.C.; Suez; Valicor; Veolia; Waste Connections; Republic Services; Biffa; CLEAN HARBORS, INC.; Reworld; DAISEKI CO., Ltd.; Stericycle, Inc.; Casella Waste Systems, Inc.; CECO ENVIRONMENTAL; Cleanaway; GFL Environmental, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waste Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global waste management market report based on service type, waste type, and region:

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Collection

-

Transportation

-

Disposal

-

-

Waste Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Municipal Waste

-

Medical Waste

-

Industrial Waste

-

E-waste

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the global waste management market include WM Intellectual Property Holdings, L.L.C., Suez, Valicor, Veolia., Waste Connections, Republic Services, Biffa, CLEAN HARBORS, INC., Reworld., DAISEKI CO.,Ltd., Stericycle, Inc., Casella Waste Systems, Inc., CECO ENVIRONMENTAL., Cleanaway, GFL Environmental Inc.

b. Key factors driving the global waste management market include rapid urbanization, industrial growth, and increasing waste generation worldwide. Rising environmental concerns and strict regulations are pushing for improved recycling, treatment, and disposal solutions. Technological advancements and circular economy initiatives are further accelerating market expansion.

b. The global waste management market size was estimated at USD 1,497.17 billion in 2025 and is expected to be USD 1,576.15 billion in 2026.

b. The global waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.0% from 2026 to 2033 to reach USD 2,365.14 billion by 2033.

b. North America leads the waste management market and accounted for 33.2% share, due to well-established collection systems and strong regulatory enforcement. High municipal waste generation and widespread outsourcing to private operators support steady demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.