- Home

- »

- Petrochemicals

- »

-

Chemical Distribution Market Size, Industry Report, 2030GVR Report cover

![Chemical Distribution Market Size & Trends Report]()

Chemical Distribution Market (2025 - 2030) Size & Trends Analysis Report By Type (Specialty Chemicals, Commodity Chemicals), By End-use (Industrial Manufacturing, Pharmaceuticals, Textile, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-753-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Chemical Distribution Market Summary

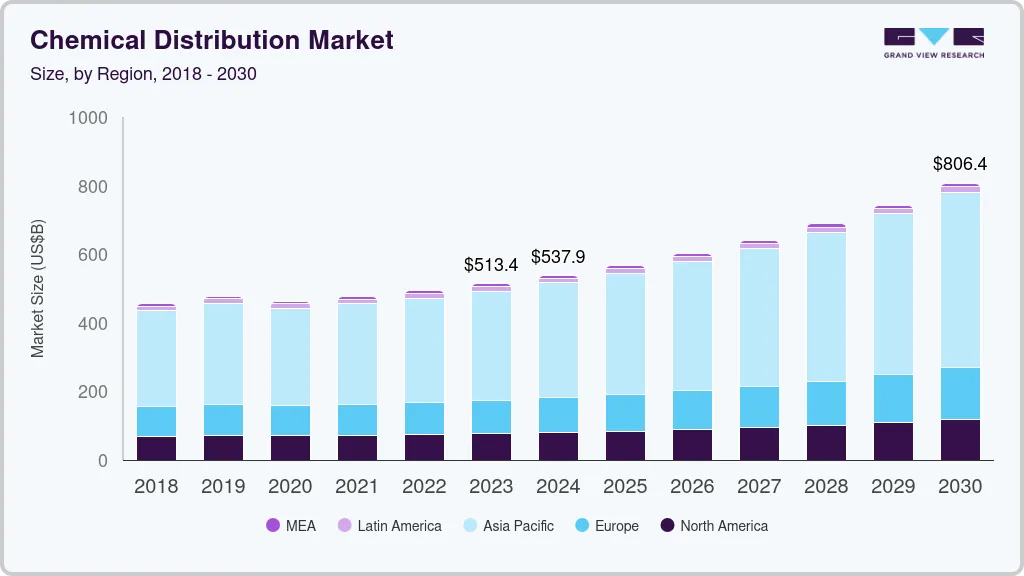

The global chemical distribution market size was estimated at USD 268.9 billion in 2024 and is projected to reach USD 403.22 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The demand for products is projected to be driven by rising chemical consumption in various end-use industries, including construction, pharmaceuticals, polymers & resins, and plastics.

Key Market Trends & Insights

- The Asia Pacific chemical distribution market accounted for the largest revenue share of 62.2% in 2024.

- The chemical distribution market in the U.S. held the largest share in North America.

- By type, commodity chemicals segment accounted for the largest revenue share of 63.7% in 2024.

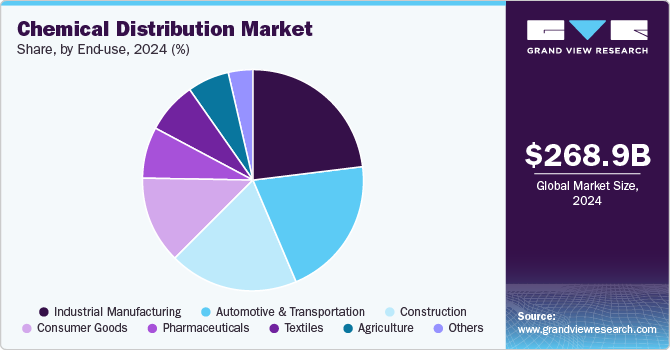

- By end-use, the industrial manufacturing segment accounted for the largest revenue share of 23.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 268.9 Billion

- 2030 Projected Market Size: USD 403.22 Billion

- CAGR (2025-2030): 7.3%

- Asia Pacific: Largest market in 2024

Essential raw materials are produced and supplied by the chemical industry to businesses in the manufacturing and industrial sectors. These raw materials are sold directly by producers or distributed to end users by outside distributors. Due to outsourcing value-added services like logistics, packaging, blending, waste removal, inventory management, and technical training, the distribution of commodity and specialty chemicals by third parties is predicted to grow significantly more than selling products directly to end users.

Transporting and storing products in bulk and packaged form is known as chemical distribution. Sacks, barrels, containers, and pipelines are frequently used to disperse them. The chemical business creates a variety of chemicals such as raw materials for oil and petroleum, cosmetics, food, textile, paint, building construction, and agricultural industries. Distributors worldwide offer a range of specialty and common chemicals.

The market services provide a crucial link for producers to connect with smaller clients in less developed areas. The chemical distributors' assistance aids the growth of the global chemical industry in assisting chemical producers in entering new markets. Today, emerging markets like those in the Asia Pacific, the Middle East, Latin America, and Africa are crucial because the chemical industry may grow tremendously in these areas. This sector also makes significant contributions to both developed and developing markets.

Type Insights

Commodity chemicals accounted for the largest revenue share of 63.7% in 2024. As economies expand, there is an increased demand for products that rely on commodity chemicals, such as plastics, fertilizers, and solvents. Industries such as automotive, construction, and agriculture heavily depend on these chemicals for manufacturing. For instance, the rise in construction activities leads to higher demand for polymers and resins used in building materials. This correlation between economic activity and product consumption underscores the importance of macroeconomic indicators in forecasting demand within this segment.

The specialty chemicals segment is anticipated to register the fastest growth with a CAGR of 7.9% worldwide during the forecast period. Specialty chemicals are high-value, low-volume products that serve various industries, from automotive to agriculture to pharmaceuticals. Unlike commodity chemicals, specialty chemicals are often tailored to meet specific needs and provide enhanced functionality. As industries continue to emphasize product quality, sustainability, and innovation, the demand for these specialized chemicals is surging, thus contributing significantly to the segment's growth.

End-use Insights

The industrial manufacturing accounted for the largest revenue share of 23.2% in 2024. As industries such as automotive, aerospace, electronics, and machinery continue to expand, the demand for specialized chemicals used in the production of advanced materials, coatings, lubricants, adhesives, and composites has risen significantly. This growth is underpinned by increasing industrialization in emerging economies, where rapid urbanization and infrastructure development are boosting the need for industrial goods.

Downstream chemicals are expected to grow at a CAGR of 7.3% over the forecast period. The increasing demand for materials such as resins, plastics, and coatings, essential for manufacturing a wide range of consumer goods and industrial products, plays a pivotal role in expanding the market for downstream chemicals. As global urbanization continues to rise, particularly in developing regions, the demand for infrastructure and consumer products drives the need for commodity chemicals.

In addition, the pharmaceuticals segment is anticipated to register the fastest CAGR over the forecast period. Specialty chemicals are pivotal in producing active pharmaceutical ingredients (APIs), excipients, and formulations that meet strict regulatory standards. As healthcare systems worldwide continue to modernize and expand, pharmaceutical companies are under pressure to develop more sophisticated, effective, and safer drugs, fueling the demand for specialty chemicals tailored to these needs.

The industrial manufacturing is anticipated to grow significantly over the forecast period. Industrial manufacturing relies heavily on commodity chemicals such as solvents, lubricants, adhesives, and coatings for various applications, making it an essential sector in the overall chemicals distribution market. As industries worldwide ramp up production to meet consumer and business demands, the need for consistent and affordable supplies of chemicals has led to sustained growth in the sector.

Regional Insights

North America chemical distribution market held a substantial market revenue share in 2024. As North American industries continue to innovate and modernize, the demand for high-quality chemicals is increasing. The market is critical in ensuring a seamless supply chain and providing industries with suitable materials at the right time. As manufacturing processes become more complex and customized, distributors are essential in meeting the tailored needs of their customers by offering specialized products and technical expertise.

U.S. Chemical Distribution Market Trends

The chemical distribution market in the U.S. held the largest share in North America. The U.S. is a global leader in manufacturing, and these sectors require a wide array of chemicals, from basic industrial chemicals to advanced specialty chemicals. For example, the automotive industry demands coatings, adhesives, and polymers, while agriculture relies on agrochemicals like fertilizers, pesticides, and herbicides. Chemical distributors in the U.S. are crucial in supplying these materials to ensure efficient production processes.

Asia Pacific Chemical Distribution Market Trends

The Asia Pacific chemical distribution market accounted for the largest revenue share of 62.2% in 2024. Asia Pacific has experienced significant economic growth over the past few decades, with countries such as China, India, and Southeast Asian nations being major contributors. The expansion of industries such as automotive, construction, electronics, pharmaceuticals, and agriculture in these economies has created a robust demand for various chemicals. Chemical distributors, acting as intermediaries between manufacturers and end-users, are crucial in meeting this demand by ensuring the efficient delivery of raw materials and chemicals to diverse sectors.

The chemical distribution market in China is experiencing substantial growth. As the world’s largest manufacturing hub, China’s demand for chemicals across various sectors, such as automotive, electronics, construction, textiles, and consumer goods, is immense. The rapid expansion of infrastructure and the growth of urban centers have significantly increased the demand for construction chemicals, specialty coatings, adhesives, and polymers. Chemical distributors are crucial in ensuring these industries have access to high-quality, cost-effective raw materials to meet their production needs, making them indispensable partners in China’s industrial growth.

Europe Chemical Distribution Market Trends

Europe chemical distribution market is anticipated to grow significantly over the forecast period As European industries expand and modernize, the demand for specialized chemicals ranging from basic to high-performance materials has surged. This creates an opportunity for chemical distributors to cater to a broad range of applications, offering everything from solvents and additives to specialty chemicals for advanced manufacturing processes.

Key Chemical Distribution Company Insights

Some key players operating in the market include Univar Solution Inc., Helm AG, Brenntag AG, and others:

-

Univar Solutions Inc. is a global chemical and ingredient distributor, providing various products and services to multiple industries, including agriculture, food and beverage, personal care, pharmaceuticals, and industrial applications. The company operates a vast distribution network that delivers over 10,000 products from more than 1,000 suppliers to customers across North America, Europe, Asia Pacific, and Latin America.

-

Helm AG operates through an extensive network of over 30 countries, facilitating the supply of chemicals to various industries, including agriculture, pharmaceuticals, and manufacturing. The company offers a diverse portfolio that includes basic chemicals, specialty chemicals, and agrochemicals, ensuring compliance with stringent safety and environmental regulations.

Key Chemical Distribution Companies:

The following are the leading companies in the chemical distribution market. These companies collectively hold the largest market share and dictate industry trends.

- Univar Solutions Inc.

- Helm AG

- Brenntag AG

- Ter Group

- Barentz

- Azelis

- Safic Alan

- ICC Industries, Inc.

- Jebsen & Jessen Pte. Ltd.

- Quimidroga

- Solvadis Deutschland GmbH

- Ashland

- Caldic B.V.

- Wilbur Ellis Holdings, Inc.

- Omya AG

- IMCC

- Biesterfeld AG

- Stockmeier Group

- REDA Chemicals

- Manuchar

Chemical Distribution Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 283.45 billion

Revenue forecast in 2030

USD 403.22 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; Belgium; China; India; Japan; South Korea; Taiwan; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Qatar; Kuwait; Bahrain; Oman

Segments covered

Type, end-use, region

Key companies profiled

Univar Solutions Inc.; Helm AG; Brenntag AG; Ter Group; Barentz; Azelis; Safic Alan; ICC Industries, Inc.; Jebsen & Jessen Pte. Ltd.; Quimidroga; Solvadis Deutschland GmbH; Ashland; Caldic B.V.; Wilbur Ellis Holdings, Inc.; Omya AG; IMCD; Biesterfeld AG; Stockmeier Group; REDA Chemicals; Manuchar

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemical Distribution Market Report Segmentation

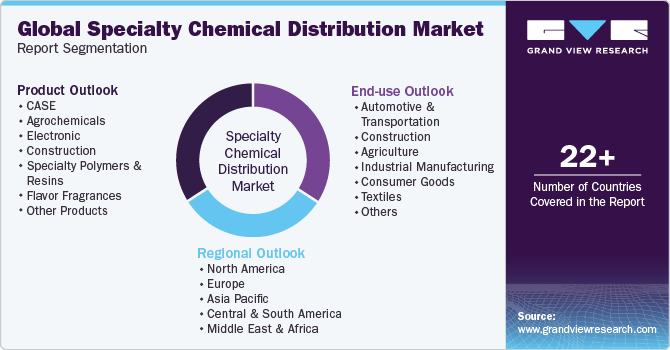

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chemical distribution market based on the type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Specialty Chemicals

-

CASE

-

Agrochemicals

-

Electronic

-

Construction

-

Specialty Polymers & Resins

-

Personal Care & Pharmaceuticals

-

Other Specialty Chemicals

-

-

Commodity Chemicals

-

Plastic & Polymers

-

Synthetic Rubber

-

Explosives

-

Petrochemicals

-

Other Commodity Chemicals

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Specialty Chemicals

-

Automotive & Transportation

-

Construction

-

Agriculture

-

Industrial Manufacturing

-

Consumer Goods

-

Textiles

-

Pharmaceuticals

-

Other Specialty Chemical End-uses

-

-

Commodity Chemicals

-

Downstream chemicals

-

Textile

-

Electrical & Electronics

-

Automotive & Transportation

-

Industrial Manufacturing

-

Other Commodity Chemicals End-uses

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Qatar

-

Kuwait

-

Oman

-

Bahrain

-

-

Frequently Asked Questions About This Report

b. The global chemical distribution market size was estimated at USD 268.93 billion in 2024 and is expected to reach USD 283.45 billion in 2025.

b. The global chemical distribution market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 403.22 billion by 2030.

b. Commodity chemicals dominated the chemical distribution market with a share of 63.7% in 2024 owing to an increased demand for products that rely on commodity chemicals.

b. Some key players operating in the chemical distribution market include Univar AG, Helm AG, Brenntag AG, Azelis Holdings SA, IMCD Group, BASF SE and Biesterfeld AG.

b. Key factors that are driving the market growth include increasing consumption of chemicals across end-use industries such as construction, pharmaceutical, polymers and resins coupled with high complexity in reaching the customers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.