- Home

- »

- Advanced Interior Materials

- »

-

Chemical Mechanical Planarization Market Size Report, 2030GVR Report cover

![Chemical Mechanical Planarization Market Size, Share & Trends Report]()

Chemical Mechanical Planarization Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment (CMP Equipment, CMP Consumable), By Application (Integrated Circuits, Automotive), By Region And Segment Forecasts

- Report ID: GVR-4-68040-476-8

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chemical Mechanical Planarization Market Summary

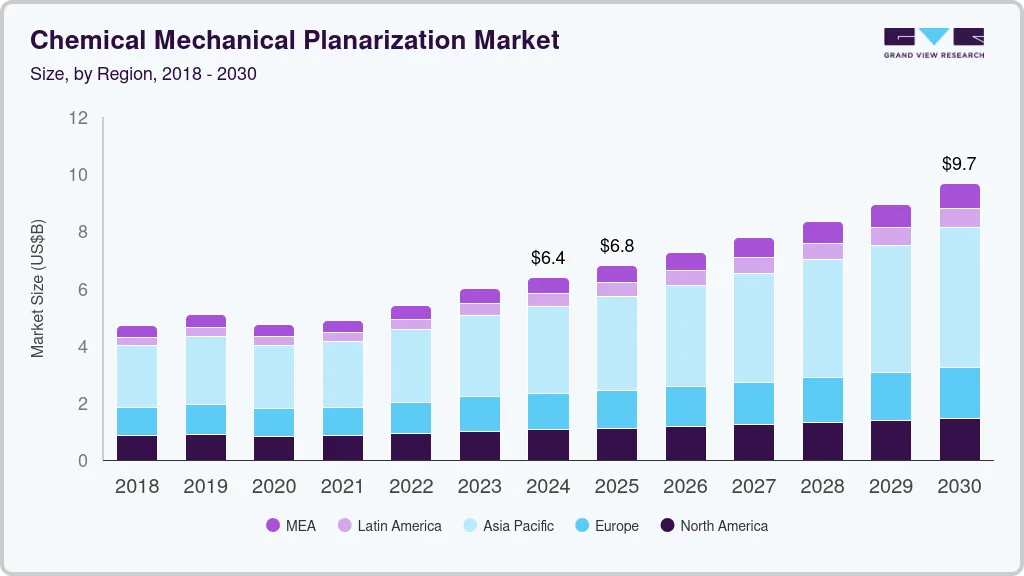

The global chemical mechanical planarization market size was estimated at USD 6,393.3 million in 2024 and is projected to reach USD 9,681.6 million by 2030, growing at a CAGR of 7.2% from 2025 to 2030. The rapid advancements in semiconductor manufacturing technology are a significant catalyst, as the push for smaller, more efficient chips necessitates advanced surface finishing techniques like CMP to achieve the required flatness and smoothness.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, India is expected to register a CAGR of 8.8% from 2024 to 2030.

- In terms of equipment, the CMP Equipment segment dominated the market and accounted for a 57.1% revenue share in 2023.

- The CMP Consumable segment is expected to grow at a notable CAGR of 7.6% from 2024 to 2030 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 6,393.3 Million

- 2030 Projected Market Size: USD 9,681.6 Million

- CAGR (2025-2030): 7.2%

- Asia Pacific: Largest market in 2023

The increasing demand for high-performance electronic devices, particularly in sectors such as consumer electronics, automotive, and telecommunications, fuels the need for CMP processes to enhance the performance and reliability of these products.

Drivers, Opportunities & Restraints

The proliferation of cutting-edge technologies, such as 5G, artificial intelligence, and the Internet of Things (IoT), has intensified the demand for innovative semiconductor solutions, further propelling the market. The trend towards miniaturization in electronics also requires highly precise and uniform polishing processes, making chemical mechanical planarization (CMP) indispensable in modern manufacturing.

The complexity of the CMP process requires skilled personnel and a shortage of trained workers may limit adoption in some regions. Environmental regulations concerning waste disposal and chemical usage can also pose challenges, requiring companies to invest in compliance measures.

The expansion of industries such as automotive and consumer electronics, which rely on high-performance chips, further drives market demand. Innovations in chemical mechanical planarization (CMP) materials and techniques, such as the development of eco-friendly slurries and processes, also present opportunities for differentiation and market expansion

Equipment Insights

“The CMP Consumable segment is expected to grow at a notable CAGR of 7.6% from 2024 to 2030 in terms of revenue”

In the CMP consumable segment, growth is fueled by the rising need for specialized slurries and pads that enhance the polishing process. As manufacturers seek to optimize performance and yield, the demand for high-quality consumables that improve efficiency and reduce defects is on the rise.

The CMP Equipment segment dominated the market and accounted for a 57.1% revenue share in 2023. This segment is driven by the increasing demand for precision and efficiency in semiconductor manufacturing processes. As technology advances and devices become smaller and more complex, manufacturers require advanced CMP systems to achieve the necessary surface finishes for high-performance chips.

Application Insights

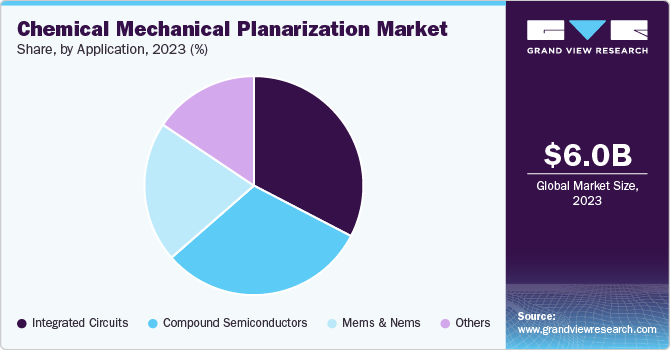

The demand for the compound semiconductors segment is expected to grow at a considerable CAGR of 7.4% from 2024 to 2030 in terms of revenue”

The compound semiconductors segment is experiencing growth due to the expanding applications of compound semiconductors in telecommunications, LED lighting, and power electronics. These materials require precise polishing techniques, driving the demand for chemical mechanical planarization (CMP) solutions tailored to their unique properties.

The integrated circuits segment led the market and accounted or a 32.6% revenue share in 2023, largely driven by the proliferation of electronic devices and the increasing complexity of chip designs. As industries such as automotive, consumer electronics, and telecommunications continue to expand, the need for high-performance integrated circuits necessitates effective CMP processes to ensure reliability and performance.

Regional Insights

“India to witness fastest market growth at 8.8% CAGR”

In the Asia Pacific region, rapid industrialization and urbanization are key growth drivers for the chemical mechanical planarization (CMP) market. Countries such as China, South Korea, and Japan are leading in semiconductor production, creating substantial demand for CMP technologies to enhance manufacturing efficiency. The growing adoption of consumer electronics and advancements in telecommunications, particularly with the rollout of 5G, further contribute to the increased need for high-performance semiconductors, driving the growth of CMP applications. Additionally, government initiatives to boost local manufacturing capabilities support market expansion across the region.

The chemical mechanical planarization market in India, is estimated to grow at 8.8% over the forecast period. The rapid expansion of the semiconductor industry in India, fueled by government initiatives such as the "Make in India" program, is creating significant demand for advanced manufacturing technologies, including CMP. Moreover, the increasing adoption of electronics in various sectors-ranging from consumer devices to automotive and industrial applications-is driving the need for high-performance integrated circuits and components, which require effective polishing techniques.

North America Chemical Mechanical Planarization Market Trends

In North America, market growth is primarily driven by significant advancements in semiconductor technology and an increase in demand for high-performance electronic devices. The region is home to leading semiconductor manufacturers and research institutions, fostering innovation and technological development. Additionally, the rising focus on data centers and cloud computing enhances the need for efficient and reliable integrated circuits, further propelling CMP adoption.

The Chemical Mechanical Polishing/Planarization (CMP) market in the U.S. is on the rise, fueled by the country's strong semiconductor industry and growing demand for advanced electronics. With a focus on producing smaller, more efficient chips, the U.S. leverages CMP technologies to meet the high precision required in manufacturing. This growth is supported by significant advancements in technology and the presence of major semiconductor manufacturers, positioning the U.S. as a key player in the global CMP market.

Europe Chemical Mechanical Planarization Market Trends

The Chemical Mechanical Planarization (CMP) market in Europe is supported by stringent regulations aimed at improving energy efficiency and sustainability. The increasing focus on renewable energy sources, particularly solar power, drives demand for compound semiconductors that require precision polishing. Moreover, the strong automotive sector in Europe is integrating advanced electronics, creating a need for high-quality polishing processes in the manufacturing of semiconductors used in electric vehicles and smart systems.

Key Chemical Mechanical Planarization Company Insights

Some key players operating in the market include Apex Broaching Systems and WSP among others.

-

Entegris Inc. is a global manufacturer engaged in the production of filtration products, wafer carriers, gas delivery systems, CMP slurries, and others. The company’s CMP slurries are catered for applications pertaining to rigid dusk substrates, wafer substrates, and foundry. The company has its headquarters in Massachusetts, U.S., and is heavily involved in R&D activities.

-

Applied Materials Inc. is a prominent American corporation that specializes in materials engineering solutions, primarily for the semiconductor and display industries. Established in 1967 and headquartered in Santa Clara, California, the company has grown to become a key player in the global electronics manufacturing sector.

Key Chemical Mechanical Planarization Companies:

The following are the leading companies in the chemical mechanical planarization market. These companies collectively hold the largest market share and dictate industry trends.

- Applied Materials Inc.

- Entegris Inc.

- Ebara Corporation

- Lapmaster Wolters Gmbh

- Dupont De Nemours Inc.

- Fujimi Incorporated

- Revasum Inc.

- Resonac Holdings Corporation (Showa Denko Materials)

- Okamoto Corporation

- Fujifilm Corporation (Fujifilm Holdings Corporation)

- Tokyo Seimitsu Co. Ltd (Accretech Create Corp.)

Recent Developments

-

In June 2022, Entegris Inc., finalized its acquisition of CMC Materials. This strategic move enhances Entegris Inc.’s product offerings and operational capabilities, particularly in semiconductor applications. The acquisition is expected to increase the company's revenue derived from unit-driven sales from 70% to around 80%, thereby improving customer productivity and cost efficiency.

-

Fujifilm Electronic Materials, U.S.A., Inc., a subsidiary of Fujimi Incorporated completed an $88 million expansion of its Mesa, Arizona facility, enhancing its capacity to supply the semiconductor industry. The expansion adds 80,000 square feet, including five new buildings dedicated to manufacturing Chemical Mechanical Polishing (CMP) slurries, high-purity solvents, and process chemicals. This development increases the company's manufacturing capacity by 30% and is expected to create 120 new jobs in various fields by the end of 2024.

Chemical Mechanical Planarization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,812.2 million

Revenue forecast in 2030

USD 9,681.6 million

Growth rate

CAGR of 7.2% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan, South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Applied Materials Inc.; Entegris Inc.; Ebara Corporation; Lapmaster Wolters Gmbh; Dupont De Nemours Inc.; Fujimi Incorporated; Revasum Inc.; Resonac Holdings Corporation (Showa Denko Materials); Okamoto Corporation; Fujifilm Corporation (Fujifilm Holdings Corporation); Tokyo Seimitsu Co. Ltd (Accretech Create Corp.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemical Mechanical Planarization Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chemical mechanical planarization market on the equipment, application, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

CMP Equipment

-

CMP Consumable

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Compound Semiconductors

-

Integrated Circuits

-

Mems and Nems

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global chemical mechanical planarization market size was estimated at USD 6,010.5 million in 2023 and is expected to reach USD 9,681.6 million in 2024.

b. The global chemical mechanical planarization market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 9,681.6 million by 2030.

b. The automotive segment dominated the market in 2023 accounting for 39.9% of the market share in 2023. As sectors like automotive, healthcare, and consumer electronics expand, the complexity of chip designs increases, necessitating high-performance integrated circuits. This growing complexity drives the need for effective CMP processes, ensuring optimal surface finish and reliability in the production of these crucial components.

b. Some of the key players operating in the chemical mechanical planarization market are MITSUBISHI HEAVY INDUSTRIES, LTD., Accu-Cut, Apex Broaching Systems, Chemical Mechanical Polishing/Planarization (CMP) Specialties, Colonial tool group inc., The Ohio Broach & Machine Co., Pioneer Broach, The Ohio Broach & Machine Co., AXISCO PRECISION MACHINERY CO., LTD., YAO SHENG MACHINERY CO., LTD., Power Broach, YEOSHE HYDRAULICS TECHNOLOGY CO.,LTD, and Taizhou Chengchun Automation Co., Ltd.

b. The chemical mechanical planarization market is driven by advancements in semiconductor technology and rising demand for high-performance electronics in sectors such as automotive and telecommunications. Innovations such as 5G and IoT further increase the need for precise polishing processes, while ongoing research and a focus on sustainability create additional growth opportunities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.