- Home

- »

- Advanced Interior Materials

- »

-

Chemical Vapor Deposition Market Size, Share Report, 2030GVR Report cover

![Chemical Vapor Deposition Market Size, Share & Trends Report]()

Chemical Vapor Deposition Market Size, Share & Trends Analysis Report By Category (CVD Equipment, CVD Materials, CVD Services), By Application (Semiconductor & Microelectronics, Data Storage, Solar Products), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-997-5

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Chemical Vapor Deposition Market Trends

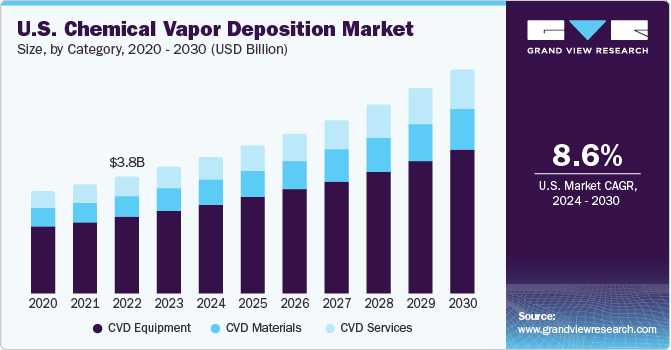

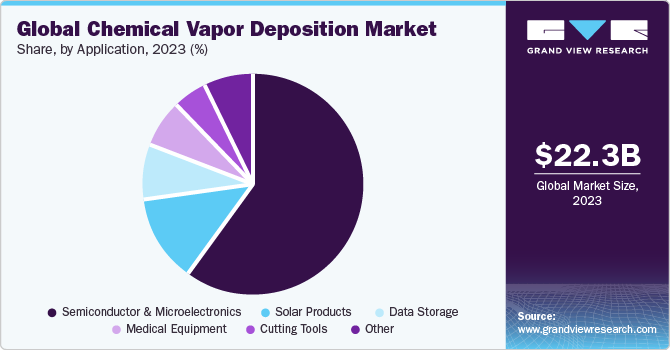

The global chemical vapor deposition market size was estimated at USD 22.35 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.0% from 2024 to 2030. Increasing consumer disposable income and expenditure on electrical and electronic devices is expected to boost semiconductor production and create a high demand for chemical vapor deposition (CVD) technology for semiconductor fabrication. The demand for semiconductors is increasing significantly worldwide, resulting in the large consumption of semiconductors.

Moreover, rising global demand for consumer electronics can be attributed to the increasing per capita disposable income and high demand for advanced electronics. The surging adoption of electronic products for workplaces, daily use, and entertainment is expected to increase the global demand for semiconductors and drive the demand for CVD equipment and services for the semiconductor fabrication process.

In the U.S., the increasing demand for high-quality and high-performance materials in the aerospace and defense sectors has been a significant driver for using CVD technology. The aerospace industry in the U.S. constantly pushes the boundaries of innovation to enhance aircraft performance, reduce fuel consumption, and improve overall efficiency. CVD has become a crucial manufacturing process in the aerospace and defense sectors due to its ability to deposit precise and uniform thin films and coatings on various substrates.

Furthermore, in the U.S., rising demand for miniaturized and high-performance electronic devices has propelled the adoption of CVD for thin-film deposition of semiconductors and insulating materials. In 2021, the U.S. witnessed a substantial export of semiconductors, reaching a remarkable sum of USD 62 billion. This figure positioned semiconductors as the fourth most significant export category in the U.S., trailing behind airplanes, refined oil, and crude oil by export value. One of the key factors contributing to this consistently high level of semiconductor exports is that more than 80% of these cutting-edge electronic components are sold to customers outside the U.S. market. The rising production & export of semiconductors is anticipated to propel the CVD market in the U.S. over the forecast period.

At global level, the trend of green energy, such as solar photovoltaic cells, is expected to rise over the forecast period owing to its advantages, environmental benefits, and positive perceptions of consumers. The rising manufacturing of solar photovoltaic cells is likely to create demand for chemical vapor deposition over the forecast period. Chemical vapor deposition technology is used for the fabrication of solar cells. The processes involved in the fabrication of solar cells using CVD include diffusion, deposition of antireflective layers, silicon epitaxial deposition, oxidation, and sulfurization of the photovoltaic cells. Asia Pacific is at the cusp of a renewable energy revolution; this is indicated by increasing investments in the renewable energy sector in recent years. The green energy trend in emerging economies is expected to drive the CVD market over the forecast period.

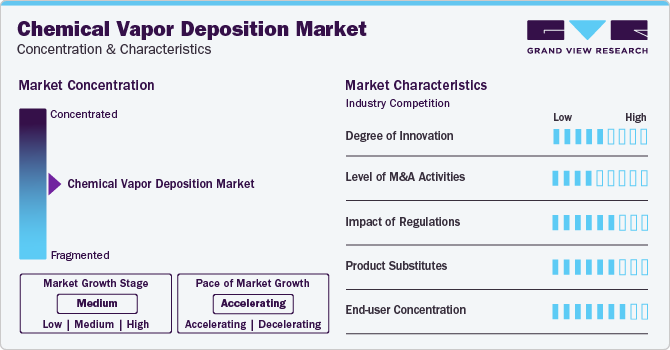

Market Concentration & Characteristics

The market growth stage is medium, and pace of the market growth is accelerating. Rapid technological advancements characterize the market with a high degree of innovation. Further, the market players have been undertaking strategic initiatives to cater to rising demand for chemical vapor depositions through acquisition & merger, joint venture, category innovation, and research & development activities. For instance, in June 2023, Taiyo Nippon Sanso Corporation introduced UR26K-CCD, a state-of-the-art mass production GaN (gallium nitride) MOCVD System. This cutting-edge system boasts fully automated wafer handling and parts cleaning capabilities for a remarkable enhancement in production efficiency, with an approximately 2-fold increase compared to conventional systems.

The chemical vapor deposition industry is also characterized by moderate merger and acquisition (M&A) activity by the leading players. Mergers and acquisitions are undertaken to improve reach of their products in the market by making these products & services available to end users over diverse geographical areas. Key market players adopting this inorganic growth strategy include CVD Equipment Corporation, Tokyo Electron Limited, Oerlikon Group, IHI Corporation, and ASM International NV.

Regulations play a crucial role in shaping the landscape of this sector. It influences product development, safety standards, and market access. Market players are increasingly prioritizing sustainability by opting for carbon-efficient processes to manufacture the equipment used in carbon deposition. By embracing sustainable operations, manufacturers can contribute to environmental conservation and improve their brand positioning and market penetration rate.

Category Insights

The CVD equipment segment led the market, accounting for 65.4% of the global market revenue in 2023. The rising demand for advanced and high-performance materials across various industries, including semiconductors, optical coatings, and protective layers, drives the demand for CVD equipment. These materials are essential for developing innovative electronics, improved energy-efficient devices, and advanced coatings for enhanced product durability. Hence, with the growing manufacturing of high-performance materials, the demand for CVD equipment segment is expected to rise over the forecast period.

The CVD services segment is likely to grow at a significant CAGR over the forecast period. The CVD services are an integral part of the chemical vapor deposition market, catering to industries requiring thin film deposition services. These services involve the deposition of thin films on substrates through chemical reactions in a gaseous environment, enabling the production of customized materials with specific properties. As the semiconductor industry moves toward micro-size components and more sophisticated designs, CVD plays a pivotal role in depositing ultra-thin and precise films on advanced microchips, sensors, and integrated circuits. The rising complexity and miniaturization of electronic devices and components have created a substantial demand for CVD services.

Application Insights

The semiconductor & microelectronics segment accounted for largest market revenue share in 2023. CVD is widely used in material science, particularly for manufacturing thin films, coatings, and advanced materials. CVD processes have played a vital role in producing semiconductor devices, nanomaterials, and diverse protective coatings, contributing significantly to technological advancements and product development in various industries. Furthermore, expansion of the Internet of Things (IoT) and the rapid development of 5G technology are further propelling the segment’s growth. With the proliferation of IoT devices, there is a rising demand for microelectronics that can provide efficient processing, low power consumption, and small form factors.

The medical equipment segment is likely to grow at a significant CAGR over the forecast period. CVD technology offers a versatile and reliable solution for applying biocompatible coatings on medical implants, such as orthopedic implants, stents, and dental implants, enhancing their functionality and bio integration. In addition, advancements in medical technologies, such as diagnostic imaging systems, rely on precision optics and sensors that often require thin films deposited through CVD processes. The increasing global healthcare expenditure and the growing aging population have led to rising demand for medical equipment and devices, ultimately propelling the demand for CVD market in medical equipment segment.

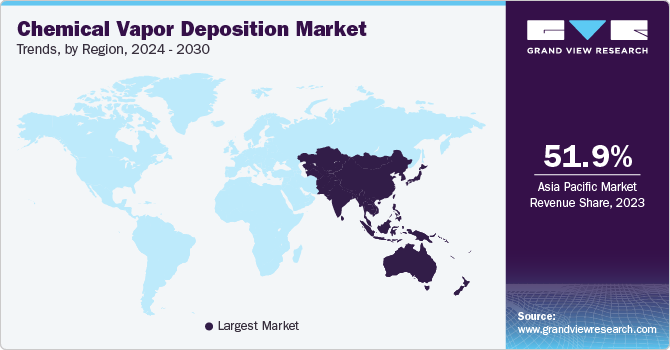

Regional Insights

Asia Pacific dominated the market and accounted for 51.9% of the market share in 2023 and is expected to grow at the fastest CAGR over the forecast period. The increased demand for high-performance LEDs (Light Emitting Diodes) in Asia Pacific has significantly driven the growth of the CVD market. LEDs have become increasingly popular and widely adopted in various applications due to their energy efficiency, long lifespan, and versatility. They are extensively used in general lighting, automotive lighting, display backlighting, consumer electronics, and other applications. CVD provides a sophisticated and controllable method for depositing thin films of semiconducting materials, such as gallium nitride (GaN) and indium gallium nitride (InGaN), essential for producing high-quality LEDs. As the demand for LEDs continues to rise in the Asia Pacific, CVD's scalability will likely become necessary to efficiently meet the increasing production requirements.

The North American CVD market accounted for second-largest market share in 2023. North America is home to some of the world's largest consumer electronics manufacturers, and the demand for high-quality and technologically advanced devices continues to grow. CVD technology enables the production of sophisticated microelectronics, including integrated circuits, sensors, and displays, meeting the market's evolving needs for miniaturization and performance improvement. Additionally, the CVD market is witnessing a shift toward developing 2D materials through techniques like graphene CVD. With its exceptional mechanical, electrical, and thermal properties, graphene has attracted significant attention for applications in flexible electronics, sensors, and energy storage devices. The increase in production of consumer electronics & sophisticated microelectronics has been contributing to increased demand for CVD technology in North America.

Key Companies & Market Share Insights

Some of the key players operating in the market include CVD Equipment Corporation, Tokyo Electron Limited, and IHI Corporation.

-

CVD Equipment Corporation specializes in designing, developing, and manufacturing process equipment solutions for research & development, pilot, and production applications. Its product range comprises a comprehensive selection of turnkey solutions, associated gas abatement systems, gas panels, gas and liquid delivery cabinets, and chemical vapor deposition systems. The company offers both standard and custom chemical vapor deposition systems. With a heavy emphasis on research & development activities and ability to develop new systems to cater unique market trends, the company is considered a mature player in the market.

-

Tokyo Electron Limited (TEL) is a crucial global semiconductor and flat panel display (FPD) production equipment manufacturer. It offers semiconductor production equipment such as coater, deposition, cleaning, test, wafer bonder and debonder, wafer edge trimming, and gas cluster ion beam systems. Its deposition equipment portfolio comprises atomic layer deposition (ALD) systems, thermal processing systems, and plasma-enhanced batch thermal atomic layer deposition (ALD) systems. Due to the complex product mix the company can offer it is considered a mature player in the market.

NuFlare Technology Inc., Denton Vaccum, and OC Oerlikon Management AG are some of the emerging market participants in the chemical vapor deposition market.

-

NuFlare Technology Inc. provides advanced equipment and solutions for the semiconductor manufacturing industry, specifically focusing on electron beam (EB) mask writers. These mask writers play a crucial role in producing photomasks, which are critical components used in the fabrication of integrated circuits (ICs) and other microelectronic devices. The company's cutting-edge technology enables the creation of precise and intricate photomasks.

-

Denton Vacuum manufactures and supplies advanced vacuum deposition systems and thin film technology solutions. The company specializes in designing and producing high-quality equipment used in various industries to deposit thin films onto substrates. Their product portfolio includes multiple vacuum deposition systems, such as sputtering systems, electron beam evaporation systems, thermal evaporation systems, and plasma-enhanced chemical vapor deposition (PECVD) systems.

Key Chemical Vapor Deposition Companies:

- CVD Equipment Corporation

- Tokyo Electron Limited.

- IHI Corporation

- Veeco Instruments Inc.

- ASM International N.V.

- Plasma-Therm LLC

- Applied Materials, Inc.

- OC Oerlikon Management AG

- voestalpine AG

- ULVAC Inc.

- Aixtron SE

- TAIYO NIPPON SANSO CORPORATION

- LPE

- Nuflare Technology Inc.

- RIBER

Recent Developments

-

In May 2023, AIXTRON invested an estimated 100 million euros (USD 109.7 million) at its Herzogenrath site. With this investment, the company planned to construct an innovation center to enhance its research and development capabilities significantly. This center is likely to cater to deposition equipment manufacturing in the semiconductor industry, providing semiconductor market players with expanded capacities for innovation and development.

-

In July 2023, OC Oerlikon Management AG announced the introduction of its latest PVD coating, BALIQ TISINOS PRO. This state-of-the-art coating is developed for hardened steels, stainless steels, and high-temperature alloys. The load on the tool is effectively reduced with the application of BALIQ TISINOS PRO, leading to a remarkable improvement in wear resistance on steels with a hardness of up to 70 HRC during hard machining processes.

Chemical Vapor Deposition Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.23 billion

Revenue forecast in 2030

USD 40.73 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Category, application, region

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

CVD Equipment Corporation; Tokyo Electron Limited.; IHI Corporation; Veeco Instruments Inc.; ASM International N.V.; Plasma-Therm LLC; Applied Materials, Inc.; OC Oerlikon Management AG; voestalpine AG; ULVAC, Inc.; Aixtron SE; TAIYO NIPPON SANSO CORPORATION; LPE; Nuflare Technology Inc.; RIBER

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemical Vapor Deposition Market Report Segmentation

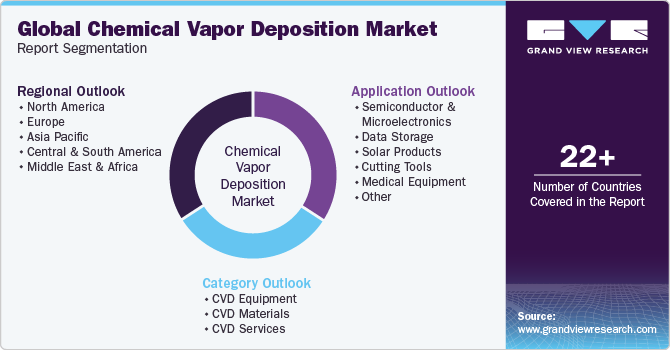

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chemical vapor deposition market report based on category, application, and region.

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

CVD Equipment

-

CVD Materials

-

CVD Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Semiconductor & Microelectronics

-

Data Storage

-

Solar Products

-

Cutting Tools

-

Medical Equipment

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. the global chemical vapor deposition market size was estimated at USD 22.35 billion in 2023 and is expected to be USD 24.23 billion in 2024.

b. The global chemical vapor deposition market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to reach USD 40.73 billion by 2030.

b. Asia Pacific region dominated the market in 2023 by accounting for a share of 51.9% of the market. The demand for the chemical vapor deposition technique in the region is driven by the growing semiconductor & microelectronics industry and solar product industries.

b. Some of the key players operating in the chemical vapor deposition market include, CVD Equipment Corporation, Tokyo Electron Limited, IHI Corporation, Veeco Instruments Inc., ASM International NV, Plasma Therm LLC, Applied Materials Inc., Oerlikon Group, Voestalpine AG, ULVAC Inc., Aixtron SE, Taiyo Nippon Sanso Corporation, LPE, Nuflare Technology Inc., RIBER

b. Key factors driving the chemical vapor deposition market is rising consumer electronics usage, increasing developments in medical equipment, and growing demand for solar renewable energy source.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."