- Home

- »

- Medical Devices

- »

-

Chemotherapy At Home Services Market Size Report, 2030GVR Report cover

![Chemotherapy At Home Services Market Size, Share & Trends Report]()

Chemotherapy At Home Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Oral, Infusion), By Cancer Type (Leukemia, Lung Cancer, Breast Cancer, Colon Cancer, Rectum Cancer), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-111-2

- Number of Report Pages: 168

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global chemotherapy at home services market size was valued at USD 1.39 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.28% from 2023 to 2030. The factors attributing to the market’s growth are the rising incidence of various types of cancer and the unwillingness of the patient to take chemotherapies at hospitals owing to long stays and the high cost of treatment. For instance, in 2022, according to the American Cancer Society, it was estimated that around 1,958,310 new cancer cases were diagnosed, and 609,360 deaths occurred in the U.S.

The lower cost of chemotherapy at home compared to hospital-based services is expected to boost the demand for services in developing countries over the forecast period. Home-based chemotherapy services are less expensive than on-site administration owing to the high fixed costs associated with clinic operations. According to the article published in the National Library of Medicine in February 2021, colon cancer patients reported cost savings of around USD 1,513.37 per patient for the entire course of chemotherapy at home in Thailand.

Some pharmacy providers are encouraging patients and service providers to offer home-based chemotherapy services. For instance, in January 2021, CVS Health entered into collaboration with the Cancer Treatment Centers of America (CTCA) to increase the chemotherapy at home accessibility for insured and eligible patients. This collaboration allowed CTCA to improve access to chemotherapy during the pandemic. The range of patients began treatment in the hospital or outpatient centres and gradually shifted to home-based treatment methods.

The COVID-19 pandemic positively impacted the market owing to the reduction in hospital-based treatment and the shift of patients towards home-based chemotherapy to reduce the spread of the virus. The cancer patients were at higher risk of mortality and morbidity from COVID-19. Hence patients’ preference shifted towards at-home services from hospital-based care. For instance, from March 2020 to April 2020, the number of patients participating in the Cancer Care at Home program at Penn Medicine increased by around 700% to reach 310 patients from 39 patients. The market is expected to witness similar penetration post-pandemic owing to the increased preference of patients and lower cost of home therapies compared to hospital-based treatment methods.

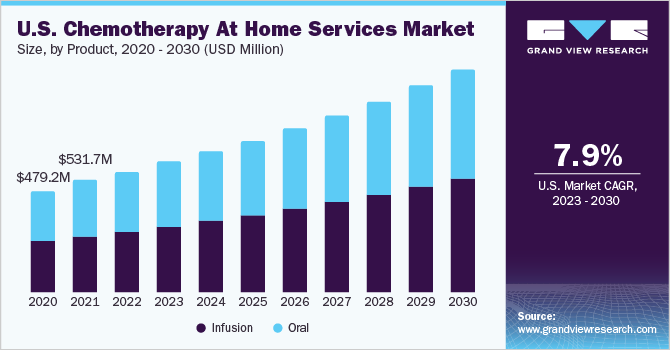

Product Insights

Based on the product, the market is bifurcated into oral and infusion. The oral segment dominated the market, with the largest market of 50.74% in 2022. This can be attributed to the easy administration and lower cost of the products. Many hospital settings offering home-based care services offer oral chemotherapy services. For instance, in February 2020, Penn Medicine launched a Cancer Care at Home program. It was a joint initiative of PCI3, the Division of Hematology and Oncology, and the Centre for Healthcare Innovation at Penn Medicine. This program offers access to several chemotherapeutics, including rituximab, bortezomib, leuprolide, and dose adjusted EPOCH for treating lymphoma, myeloma, prostate, and breast cancer.

On the other hand, it is projected that the infusion segment is expected to witness the fastest growth over the forecast period. With the growing incidences of cancer, the demand for infusion therapies is expected to increase in the coming years. In addition, many drugs are receiving approval to be administered through infusions which are expected to contribute to the growth of the market. For instance, in June 2020, FDA approved the drug PHESGO by Genentech, Inc. in combination with chemotherapy for the treatment of HER2-positive breast cancer. The drug could be administered intravenously with healthcare professionals' help of infusion pumps at home.

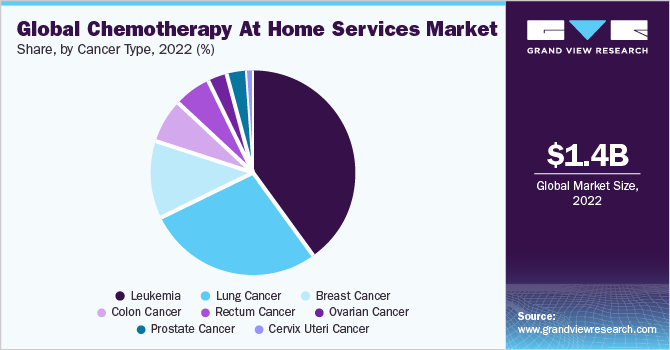

Cancer Type Insights

Based on the cancer type, the market is segmented into leukemia, lung, breast, colon, rectum, cervix uteri, prostate, and ovarian cancer. The leukemia segment dominated the market, with the largest market of 39.75% in 2022. This can be attributed to the increasing incidence of leukemia; chemotherapy is considered the standard treatment for such cancer. In addition, the growing emphasis on the safety of home-based treatment for leukemia is expected to drive the growth of the market over the forecast period. For instance, the European Hematology Association 2021 Virtual Congress study stated that home-based chemotherapy is a patient-centered and good alternative for outpatient care and hospitals. It was proved that home-based chemotherapies are safe for patients suffering from leukemia.

However, cervix uteri cancer is expected to witness the fastest growth over the forecast period. In the early stages of cancer, chemotherapy is often administered in combination with radiation therapy for cervix uteri. Moreover, the rising incidence of cervix uteri cancer is expected to drive the growth of the market over the forecast period. According to the World Cancer Research Fund International, cervical cancer is the 4th most common cancer among adult females globally and 7th most common cancer overall.

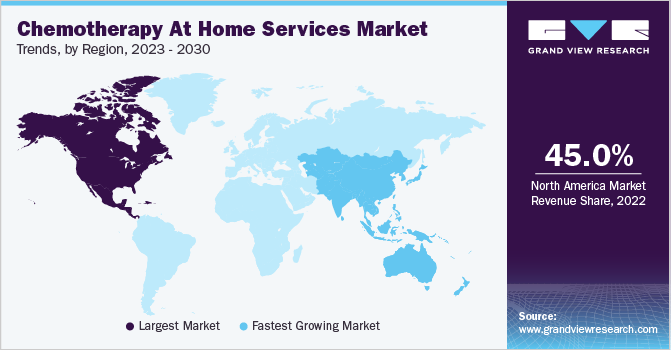

Regional Insights

North America region dominated the market with the largest market share of 45.01% in 2022. The rising incidence of cancer and the increasing number of service providers in the region are expected to drive the market's growth. For instance, in July 2021, Cancer Treatment Centers of America (CTCA) launched a pilot program, Oncology Clinic at Home, to provide chemotherapy treatment services for cancer patients.

Asia Pacific region is expected to witness the fastest growth over the forecast period. The growth of the region can be attributed to the rising number of service providers amid the pandemic. For instance, in April 2020, Portea Medical launched chemotherapy at home services in major countries of India, including Bengaluru, Chennai, Mumbai, Kolkata, Hyderabad, and Delhi.

Moreover, Europe held a significant market share in 2022 owing to the growing demand for home infusion services for cancer treatment. In addition, the COVID-19 pandemic boosted the demand for chemotherapy at home services in the region to reduce the mortality rate associated with the hospitalization of patients on chemotherapy due to the COVID-19 virus. According to NHS England, in August 2020, around 10,000 home deliveries for chemotherapy were made from June 2020 to August 2020 in the UK to avoid the risk of COVID-19 infection.

Key Companies & Market Share Insights

The market is highly fragmented as many small and medium-sized players in each country are offering at-home chemotherapy services. The major players in the market are focusing on growth strategies such as advancements in the existing service offering, licensing agreements, and mergers & acquisitions to gain market share. For instance, in July 2023, DispatchHealth and Reimagine Care entered into a strategic partnership to support cancer treatment at home. The partnership reduces emergency department visits and unplanned hospitalizations. Some prominent players in the chemotherapy at home services market include:

-

Sciensus Pharma Services Limited

-

Portea Medical

-

Ubiqare

-

Penn Medicine (The Trustees of the University of Pennsylvania)

-

Advocate Health Care

-

View Health Pty Ltd group (chemo@home Pty Ltd)

-

Vitalis Health and Home Care Pty Ltd

-

Medibank Private Limited

-

TCP Homecare

-

LloydsPharmacy Clinical Homecare

Chemotherapy At Home Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.51 billion

Revenue forecast in 2030

USD 2.63 billion

Growth Rate

CAGR of 8.28% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, cancer type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sciensus Pharma Services Limited; Portea Medical; Ubiqare; Penn Medicine (The Trustees of the University of Pennsylvania); Advocate Health Care; View Health Pty Ltd group (chemo@home Pty Ltd); Vitalis Health and Home Care Pty Ltd; Medibank Private Limited; TCP Homecare; LloydsPharmacy Clinical Homecare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemotherapy At Home Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chemotherapy at home services market report based on product, and cancer type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Infusion

-

-

Cancer Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Breast Cancer

-

Colon Cancer

-

Rectum Cancer

-

Cervix Uteri Cancer

-

Lung Cancer

-

Prostate Cancer

-

Ovarian Cancer

-

Leukemia

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global chemotherapy at home services market size was estimated at USD 1.39 billion in 2022 and is expected to reach USD 1.51 billion in 2023.

b. The global chemotherapy at home services market is expected to grow at a compound annual growth rate of 8.28% from 2023 to 2030 to reach USD 2.63 billion by 2030.

b. Oral segment dominated the chemotherapy at home services market with a share of 50.74% in 2022 owing to the easy administration and lower cost of the products.

b. Some key players operating in the chemotherapy at home services market include Sciensus Pharma Services Limited; Portea Medical; Ubiqare; Penn Medicine (The Trustees of the University of Pennsylvania); Advocate Health Care; View Health Pty Ltd group (chemo@home Pty Ltd); Vitalis Health and Home Care Pty Ltd; Medibank Private Limited; TCP Homecare; LloydsPharmacy Clinical Homecare.

b. Key factors that are driving the chemotherapy at home services market growth include increasing incidence of cancer globally, lower cost of home-based chemotherapy services compared to hospital based services, and rising supportive government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.