- Home

- »

- Consumer F&B

- »

-

Chia Seeds Market Size And Share, Industry Report, 2030GVR Report cover

![Chia Seeds Market Size, Share & Trends Report]()

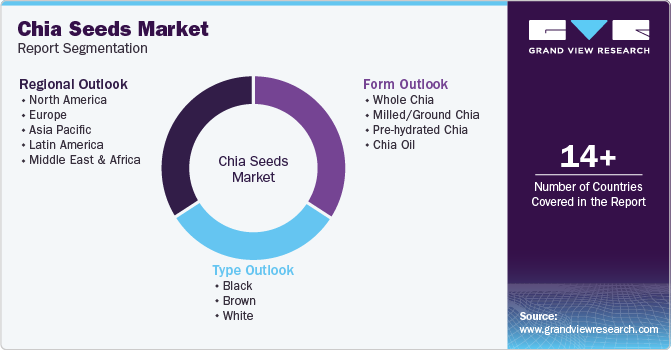

Chia Seeds Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Whole Chia, Milled/Ground Chia, Pre-hydrated Chia, Chia Oil), By Type (White, Black, Brown), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-631-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chia Seeds Market Summary

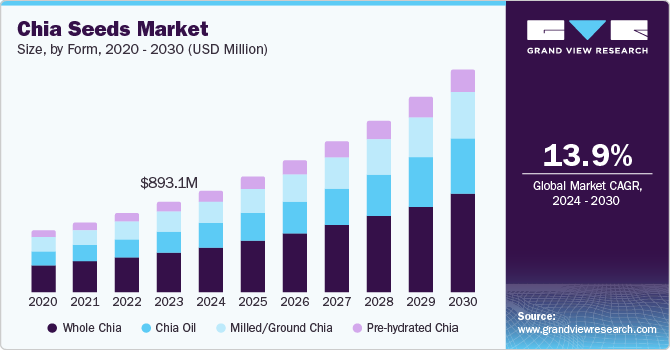

The global chia seeds market size was valued at USD 893.1 million in 2023 and is projected to reach USD 2.22 billion by 2030, growing at a CAGR of 13.9% from 2024 to 2030, owing to the increasing consumer awareness about the health benefits of chia seeds. Rich in omega-3 fatty acids, antioxidants, fiber, and essential minerals, chia seeds are recognized for their potential to improve heart health, aid digestion, and support weight management.

Key Market Trends & Insights

- The Europe chia seeds market held the highest CAGR of 49.8% of the global revenue in 2023.

- The chia seeds market in Germany held the largest revenue share in the Europe chia seeds market in 2023.

- Based on form, whole chia seeds dominated the market with 44.1% of the share in 2023.

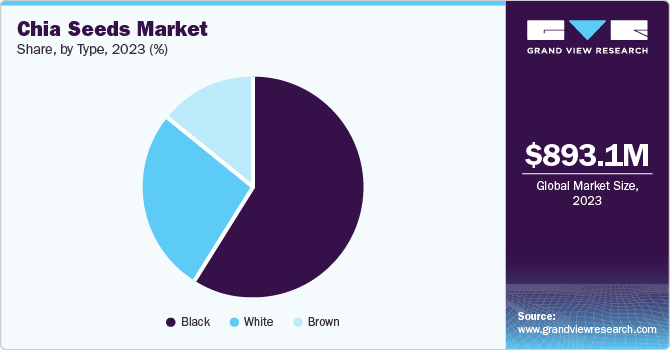

- Based on type, black chia seeds accounted for the dominant market share in 2023 with the growing consumer awareness of the health benefits.

Market Size & Forecast

- 2023 Market Size: USD 893.1 Billion

- 2030 Projected Market Size: USD 2.22 Billion

- CAGR (2024-2030): 13.9%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

This growing awareness is largely fueled by the rising trend of health and wellness, where consumers are more inclined towards incorporating nutrient-dense superfoods into their diets. Another significant factor is the surge in demand for gluten-free products. With the prevalence of gluten intolerance and celiac disease coupled with a general shift towards gluten-free diets for perceived health benefits, chia seeds have emerged as a popular alternative. Their versatility allows them to be used in various gluten-free recipes, including baked goods and smoothies, making them a staple in many health-conscious households. For instance, applying 3% chia seeds in frankfurters enhances the nutritional composition without affecting their inherent properties.

In addition, the cosmetic and personal care industry propelled the chia seeds market. Chia seeds have been increasingly used in skincare products due to their high antioxidant content, which helps reduce inflammation and promote healthy skin. The trend towards natural and organic ingredients in cosmetics has further driven the demand for chia seeds in this sector.

Moreover, the animal feed industry has recognized the benefits of chia seeds, particularly as a source of omega-3 fatty acids. Including chia seeds in animal feed helps improve the nutritional profile of the feed, which in turn enhances the health and productivity of livestock. A recent study suggests that chia seeds contain up to 20% protein.

Form Insights

Whole chia seeds dominated the market with 44.1% of the share in 2023 due to the growing consumer awareness of the health benefits associated with whole chia seeds. These seeds are packed with essential nutrients, including omega-3 fatty acids, fiber, protein, and antioxidants, which contribute to improved heart health, digestive health, and overall well-being. Such nutritional profile makes whole chia seeds a favored choice among health-conscious consumers seeking natural and wholesome food options. In addition, the ability of chia seeds to be easily incorporated into various recipes, such as smoothies, salads, and baked goods, has further enhanced their appeal.

Chia oil is expected to grow at the fastest CAGR during the forecast period. The market surge can be credited to the increasing consumer awareness of the health benefits associated with chia oil. Rich in omega-3 fatty acids, antioxidants, and essential nutrients, chia oil is recognized for its potential to improve heart health, reduce inflammation, and support skin health. This nutritional profile makes chia oil a sought-after ingredient in both dietary supplements and functional foods, catering to health-conscious consumers seeking natural and effective health solutions. Furthermore, the rising demand for natural and organic personal care products has driven the market with its high antioxidant content and moisturizing properties. The trend towards clean beauty that is devoid of synthetic chemicals and the preference for plant-based ingredients derived from sustainable sources has further propelled the demand for chia oil in this sector.

Type Insights

Black chia seeds accounted for the dominant market share in 2023 with the growing consumer awareness of the health benefits. These seeds are rich in omega-3 fatty acids, antioxidants, fiber, and essential minerals, which contribute to improved heart health, digestive health, and overall well-being. Additionally, these seeds have been increasingly used in skincare products due to their high antioxidant content, which helps in reducing inflammation and promoting healthy skin.

White chia seeds are expected to emerge at a significant CAGR over the forecast period. White chia seeds are naturally gluten-free, which makes them an ideal ingredient for individuals with gluten intolerance or those following a gluten-free diet. Additionally, the growing trend towards plant-based and vegan diets has boosted the demand for white chia seeds as a versatile and nutrient-dense plant-based protein source.

Regional Insights

The Europe chia seeds market held the highest CAGR of 49.8% of the global revenue in 2023 owing to the rise in plant-based diets. European consumers have increasingly adopted vegetarian and vegan lifestyles, driven by health concerns, environmental considerations, and ethical reasons. Chia seeds are an excellent source of plant-based protein, omega-3 fatty acids, and dietary fiber, making them a valuable addition to these diets. Their versatility allows them to be easily incorporated into a variety of dishes, including baked goods, and puddings. According to Mintel’s Global New Products Database (GNPD), chai seeds were among the top ingredients in newly launched health food products in Europe.

The chia seeds market in Germany held the largest revenue share in the Europe chia seeds market in 2023 owing to the increasing consumer awareness of the health benefits associated with chia seeds, such as their high content of omega-3 fatty acids, antioxidants, and dietary fiber. This superfood status has made chia seeds a popular choice among health-conscious consumers seeking natural and organic food products. Moreover, incorporating chia seeds into various food and beverage products, including smoothies, yogurts, and bakery items, has expanded its market reach.

Asia Pacific Chia Seeds Market Trends

The Asia Pacific (APAC) chia seeds market is expected to register the fastest CAGR over the forecast period. They can be used in a variety of forms, including whole seeds, ground seeds, and chia oil, catering to diverse consumer preferences. This versatility allows manufacturers to innovate and introduce new chia seed-based products, expanding their presence in the food and beverage industry.

The Australia accounted for a significant market share of the regional chia seeds market in 2023. The rising demand for gluten-free products has significantly boosted the market, as chia seeds are naturally gluten-free and cater to the needs of individuals with celiac disease or gluten sensitivity. Furthermore, the robust distribution networks and the presence of major health food retailers in the country have facilitated easy access to chia seeds, thereby supporting market growth.

The China is expected to grow at a significant CAGR during the forecast period owing to the rising trend towards plant-based diets and veganism. In addition, the increasing use of chia seeds in personal care and cosmetic products, owing to their skin-nourishing properties, is further fueling the market growth in the country.

North America Chia Seeds Market

The North America chia seeds market accounted for a significant market revenue share in 2023 owing to the increasing consumer awareness of the health benefits associated with chia seeds. Rich in omega-3 fatty acids, antioxidants, fiber, and essential minerals, chia seeds are recognized for their potential to support overall well-being. Chia seeds have become a key ingredient in functional foods and beverages. In 2022, over 25.0% of new product launches in the health food sector in the region included chia seeds in snacks, smoothies, and energy bars.

U.S. Chia Seeds Market Trends

The U.S. dominated the regional market in 2023 owing to the rising demand for gluten-free and plant-based products over the forecast period. This trend is fueled by a growing awareness of gluten intolerance and celiac disease, prompting many consumers to seek out gluten-free alternatives. Chia seeds, being naturally gluten-free, have become a popular choice for those looking to avoid gluten while still enjoying nutrient-dense foods. A survey conducted by IFIC in 2023 reported that around 43.0% of U.S. consumers actively sought out foods with added health benefits.

Key Chia Seeds Company Insights

Some of the key companies in the chia seeds market include Benexia, Nutiva Inc., Garden of Life, and others. Since the production is mainly concentrated in Central & South America, most of the companies have depended on imports. Increasing demand for organic products has increasingly fueled industry competition. New product development and innovations have been the key strategies undertaken by companies to retain their market share.

-

Benexia is a leading company specializing in producing, processing, and marketing chia seeds and chia-based ingredients. The company sources its chia seeds through regenerative agricultural practices, ensuring clean and certified gluten-free ingredients. They offer a wide range of chia products, including whole seeds, chia oil, and chia flour, catering to various industries such as food and beverages, dietary supplements, and cosmetics.

-

Nutiva Inc. is a pioneer in the organic and plant-based food industry. It is dedicated to revolutionizing the way people eat by offering nutrient-dense, organic products. The company expanded its product line to include a variety of organic culinary oils, snacks, spreads, and superfoods such as chia seeds. Additionally, Nutiva’s products are USDA Certified Organic and Non-GMO Project Verified.

Key Chia Seeds Companies:

The following are the leading companies in the chia seeds market. These companies collectively hold the largest market share and dictate industry trends.

- BENEXIA

- Nutiva Inc.

- Garden of Life

- Mamma Chia

- Glanbia plc

- Salba Smart Natural Products

- Spectrum Organic Products, LLC

- NAVITAS ORGANICS

- Sesajal SA De CV

- Bioglan

Recent Development

-

In January 2022, Mamma Chia unveiled a fresh look for 2022. Gestalt Brand Lab completed an extensive re-branding of the chia seeds category innovator, revitalizing the iconic ‘Goddess’ symbol, updating the company’s color code, and creating latest packaging for their entire product line, including Chia Beverages, Chia Squeeze, and Chia Beverages pouches.

Chia Seeds Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.01 billion

Revenue forecast in 2030

USD 2.22 billion

Growth rate

CAGR of 13.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Mexico, Canada, UK, France, Germany, Italy, Spain, Russia, China, India, Japan, Australia & New Zealand, South Korea, Brazil, Argentina, South Africa, UAE, Saudi Arabia

Key companies profiled

BENEXIA; Nutiva Inc.; Garden of Life; Mamma Chia; Glanbia plc; Salba Smart Natural Products; Spectrum Organic Products, LLC; NAVITAS ORGANICS; Sesajal SA De CV; Bioglan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chia Seeds Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the chia seeds market report based on form, type, and region.

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Whole Chia

-

Milled/Ground Chia

-

Pre-hydrated Chia

-

Chia Oil

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Black

-

Brown

-

White

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.