- Home

- »

- Medical Devices

- »

-

Chile Minimally Invasive Surgical Instruments Market Report, 2028GVR Report cover

![Chile Minimally Invasive Surgical Instruments Market Size, Share & Trends Report]()

Chile Minimally Invasive Surgical Instruments Market (2021 - 2028) Size, Share & Trends Analysis Report By Device (Handheld Instruments, Electrosurgical Devices), By Application (Orthopedic, Cosmetic), And Segment Forecasts

- Report ID: GVR-4-68039-531-1

- Number of Report Pages: 50

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

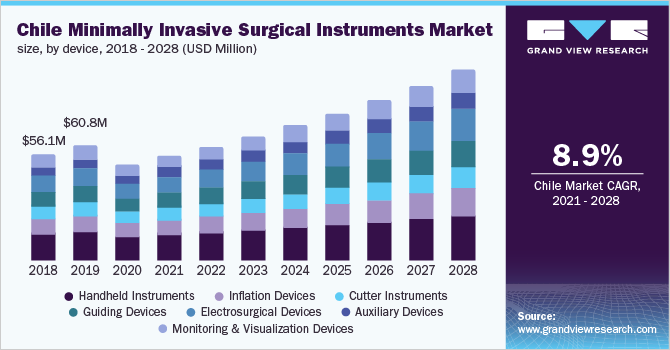

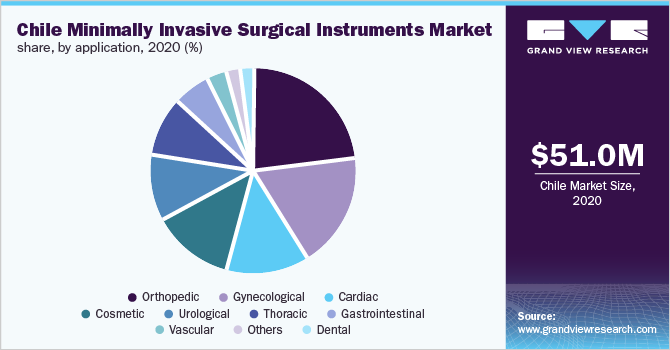

The Chile minimally invasive surgical instruments market size was valued at USD 51.0 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.9% from 2021 to 2028. The market growth can be attributed to the improving healthcare infrastructure in the country, coupled with the easy access to the market. In addition, the rise in the geriatric population and technological advancements are some of the key factors driving the market. For instance, as per the Ministry of Foreign Affairs, by 2050, Chileans aged 60 and up will account for 32.9 percent of the population, an increase from 15.7 percent today, while those aged 80 and up will account for 10.3 percent.

In recent years, minimally invasive surgery (MIS) has grown in popularity, offering significant advantages over standard surgical approaches for a variety of procedures. Key advantages of minimally invasive surgery include reduced pain, increased accuracy, decreased risk of complications, quicker recovery, shorter length of hospital stays, decreased risk of infection, lower incidence of post-surgery complications, decreased psychological impact, and overall improved quality of life. This rapid expansion has also been made possible by considerable advancements in medical technology.

Chile's government is engaged in investing in health infrastructure and in 2018, it revealed a USD 10 billion hospital infrastructure plan for the period 2018 - 2022. 75 new hospitals will be built in the near future, according to a Chilean government program. With the Chilean government investing a large sum of money in hospital construction in the future years, there will be a greater need for innovative medical technologies and supplies. For medical devices and supplies, Chile is 95% reliant on imports. The medical device market in Chile is competitive, with numerous companies from around the world simply finding their way in. Therefore, improving health infrastructure and easy access to the market are expected to boost market growth. However, in October 2019, Chileans were outraged by the country's inequities between affluent and poor. Thus, inequality of healthcare access and longer waiting time for surgeries are likely to hamper the market growth in Chile.

The healthcare system has faced extraordinary challenges as a result of the COVID-19 pandemic. Despite the fact that the number of elective surgeries performed increased by one-fifth as a result of the lockdown, COVID-19-related health-care reorganizations increased elective surgery waiting times by up to one-third. Although returning to baseline, the extended wait times may increase mortality and necessitate more complex surgery in the near future.

Device Insights

The handheld instruments segment dominated the market and held a revenue share of 24.3% in 2020. This is attributed to an increase in the number of surgical procedures performed, its higher precision and versatility, safe performance, high accuracy, and affordability. Furthermore, surgeons are progressively adopting technological developments in handheld surgical devices as the ease of use of these instruments improves. The market for handheld tools is being driven by technical advancements and their increasing use in minimally invasive surgeries. For instance, in July 2021, Smith & Nephew launched CORI, a surgeon-controlled handheld robotic platform for both total and unicompartmental knee arthroplasty.

The electrosurgical devices segment is anticipated to expand at the fastest CAGR of 9.6% over the forecast period. The use of electrosurgical devices has grown significantly to include a wide range of surgical specialties owing to benefits such as less operating time, minimal blood loss, and less damage to the surrounding tissues as these devices are highly precise, where the low voltage is chosen for cut modes and high voltage is preferred for coagulation modes. Furthermore, the minimal cost and reduced post-operative recovery period are expected to boost the segment growth.

Application Insights

The orthopedic segment held the largest revenue share of 23.1% in 2020. The adoption of minimally invasive surgery (MIS) is high in orthopedics due to advantages such as minimum blood loss, minimal soft tissue damage, shorter turnaround time, and faster rehabilitation with smaller scars. In orthopedics, minimally invasive surgery is becoming the desired standard, principally due to technological advancements. The approach is proving to be particularly effective in joint replacement, fracture and bone reconstruction, and limb realignment.

The cosmetic segment is expected to expand at the highest CAGR during the forecast period. Owing to the rise in cosmetic surgery procedures, the decision to get cosmetic surgery has recently received a lot of attention. For instance, according to the American Society of Plastic Surgeons, in 2018, over 17.7 million surgical and minimally invasive cosmetic treatments were performed in the United States, a number that has continuously increased over the previous five years, with no signs of slowing down. Furthermore, the introduction of technologically improved minimally invasive equipment, such as lasers and injectables, has paved the path for smoother market expansion.

Key Companies & Market Share Insights

With a significant number of manufacturers, the market is highly competitive. In order to acquire a significant share in the market, major companies are implementing various growth methods, such as new product development, product differentiation approaches, and financing and international strategy. For instance, in November 2020, Abbott launched its clip delivery system. The device is intended for use in the treatment of mitral regurgitation as a minimally invasive heart valve repair device. This device gives surgeons access to cutting-edge technology by providing a life-saving therapy option for those suffering from mitral regurgitation as a result of a heart defect or heart failure. Some prominent players in Chile minimally invasive surgical instruments market include:

-

Medtronic

-

Stryker

-

Smith & Nephew

-

Abbott

-

CONMED

-

Zimmer Biomet

-

Intuitive Surgical, Inc.

Chile Minimally Invasive Surgical Instruments Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 55.8 million

Revenue forecast in 2028

USD 101.4 million

Growth Rate

CAGR of 8.9% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, application

Country scope

Chile

Key companies profiled

Medtronic; Stryker; Smith & Nephew; Abbott; CONMED; Zimmer Biomet; Intuitive Surgical, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the Chile minimally invasive surgical instruments market report on the basis of device and application:

-

Device Outlook (Revenue, USD Million, 2016 - 2028)

-

Handheld Instruments

-

Inflation Devices

-

Cutter Instruments

-

Guiding Devices

-

Electrosurgical Devices

-

Auxiliary Devices

-

Monitoring & Visualization Devices

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Cardiac

-

Gastrointestinal

-

Orthopedic

-

Vascular

-

Gynecological

-

Urological

-

Thoracic

-

Cosmetic

-

Dental

-

Others

-

Frequently Asked Questions About This Report

b. The Chile MIS instruments market size was estimated at USD 51.0 million in 2020 and is expected to reach USD 55.8 million in 2021.

b. Chile MIS instruments market is expected to grow at a compound annual growth rate of 8.9% from 2021 to 2028 to reach USD 101.4 million by 2028.

b. The handheld instruments segment dominated Chile MIS instruments market with a share of 24% in 2020. This is attributable to rising the increase in the number of surgical procedures performed, its higher precision and versatility, safe performance, high accuracy, and affordability.

b. Some key players operating in Chile MIS instruments market include Medtronic; Stryker; Smith & Nephew; Abbott; CONMED; Zimmer Biomet; Intuitive Surgical, Inc.

b. The Chile MIS instruments market growth can be attributed to the improving healthcare infrastructure in the country coupled with the easy access to the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.