- Home

- »

- Clothing, Footwear & Accessories

- »

-

Chile Workwear Market Size & Share, Industry Report, 2033GVR Report cover

![Chile Workwear Market Size, Share & Trends Report]()

Chile Workwear Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Workwear Apparel, Workwear Footwear), By Demography (Men, Women), By Application (Construction, Manufacturing, Oil & Gas, Chemical, Power), And Segment Forecasts

- Report ID: GVR-4-68040-837-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chile Workwear Market Summary

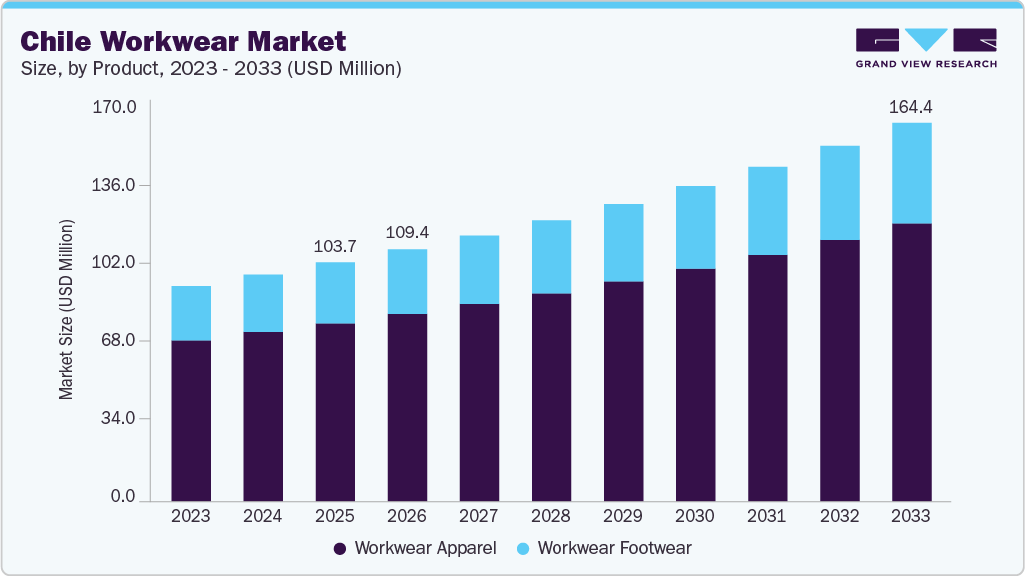

The Chile workwear market size was estimated at USD 103.7 million in 2025 and is projected to reach USD 164.4 million by 2033, growing at a CAGR of 6.0% from 2026 to 2033. The market has expanded rapidly as industrial activity intensifies and employers move beyond basic uniforms toward performance-driven, safety-oriented apparel.

Key Market Trends & Insights

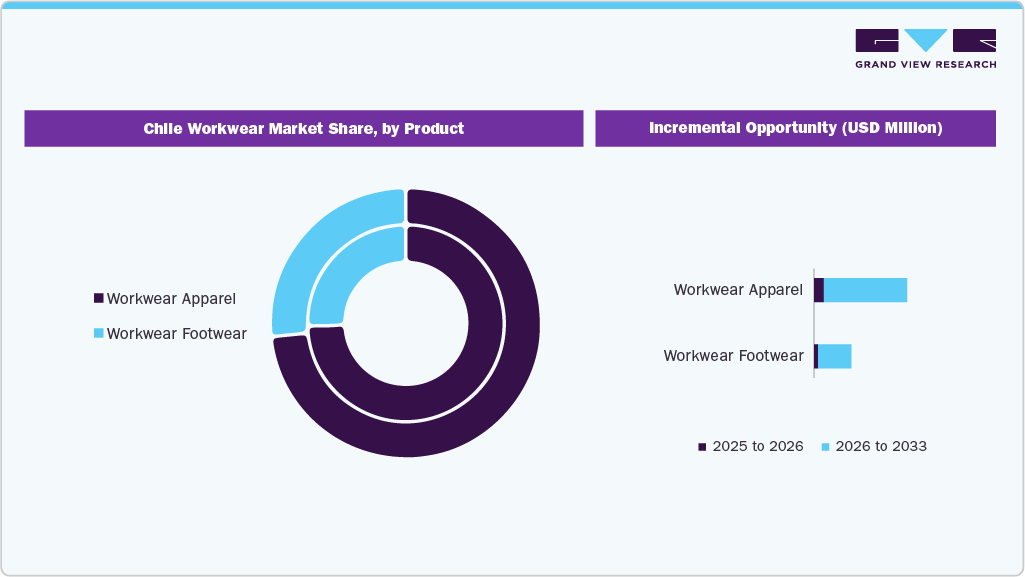

- By product, workwear apparel accounted for a revenue share of 74.55% 2025 in the overall Chile workwear industry.

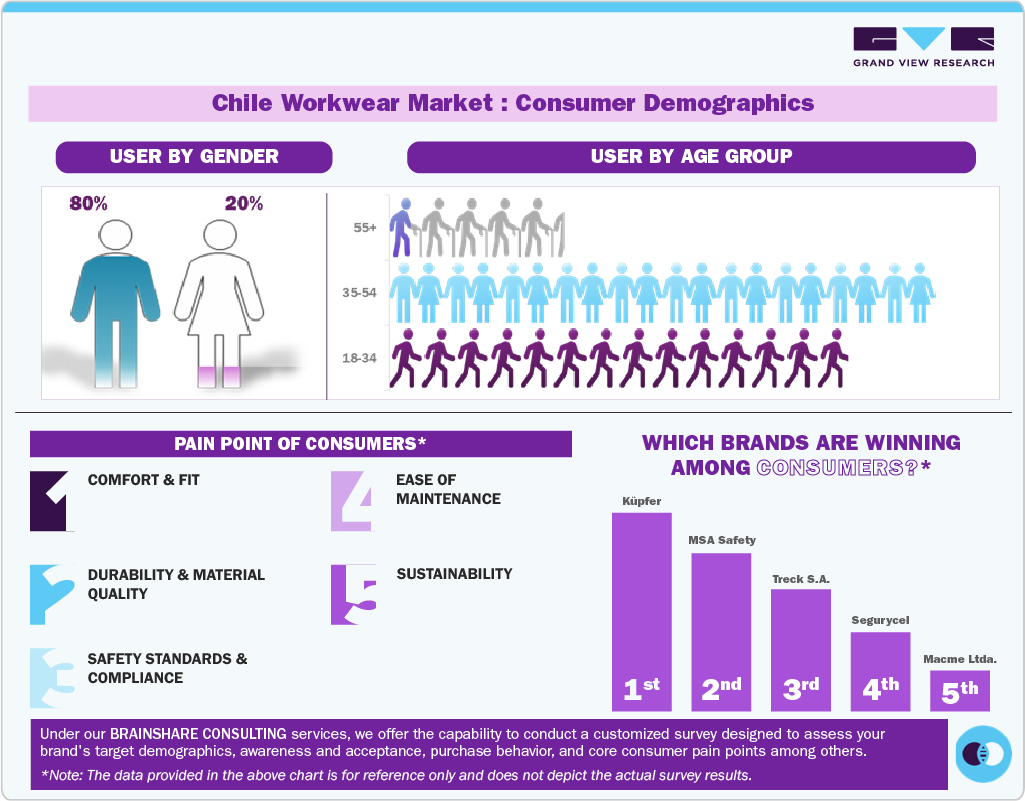

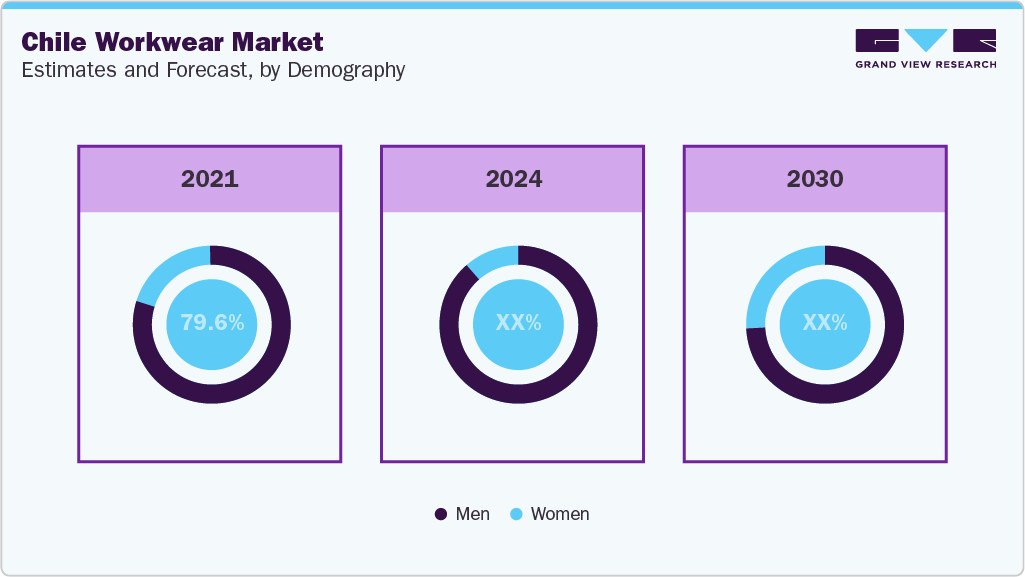

- By demography, men’s workwear accounted for a revenue share of 80.25% in 2025 in the overall Chile workwear industry.

- By application, the workwear used for construction accounted for a revenue share of 25.52% in 2025 of the Chile workwear industry.

Market Size & Forecast

- 2025 Market Size: USD 103.7 Million

- 2033 Projected Market Size: USD 164.4 Million

- CAGR (2026-2033): 6.0%

The dominance of mining, energy, and large-scale construction continues to generate sustained demand for durable, specialized garments capable of withstanding extreme operating environments. As highlighted in the 2024 Investment Climate Statement, foreign capital in Chile continues to flow primarily into mining, energy, utilities, and other heavy industries. This concentration of investment has boosted Chile’s position as a resource driven economy, with expanding project activity across extraction, power generation, and infrastructure development. Hence, demand for high-performance workwear is rising, driven by the need for protective, climate-resistant, and safety-compliant clothing in hazardous and high-intensity working environments.Regulatory momentum has further reinforced demand by tying workplace safety directly to corporate accountability, operational risk, and brand reputation. Employers are under growing pressure to comply with occupational safety standards, triggering a steady rise in procurement of certified protective apparel such as high-visibility garments, flame-resistant fabrics, and chemical-resistant coatings.

At the same time, workforce expectations are changing, with employees demonstrating greater awareness of personal safety rights and higher standards for workplace conditions. As a result, businesses are sourcing higher-quality workwear not only to remain compliant but also to strengthen employee trust, minimize accident-related downtime, and reduce long-term liability exposure. Safety performance has become inseparable from operational performance in procurement decision-making.

In parallel, broader labor and procurement trends are increasing the transition toward premium and standardized workwear solutions. As Chile’s industrial sector modernizes and integrates further with global supply chains, companies increasingly adopt centralized sourcing strategies and international safety benchmarks. This has led to greater emphasis on consistency, quality assurance, and lifecycle value rather than low-cost, short-term garment solutions. At the workforce level, employees increasingly prioritize comfort, thermal control, and mobility, especially in physically demanding roles and harsh environments. Together, these shifts position workwear as a strategic investment rather than an operating expense, supporting long-term demand growth across Chile’s core industrial sectors.

Consumer Insights

Growing industrial modernization and heightened attention to worker safety standards are reshaping consumer and employer behaviour in Chile’s workwear market. Companies across mining, construction, logistics, and agriculture are increasingly prioritising apparel that supports uninterrupted performance in demanding environments, especially as younger workers expect gear that blends safety compliance with comfort and durability. Protective certifications, sustainability credentials, and clear evidence of performance testing from brands strongly influence purchasers. Digital-first buyers within the 18-34 cohort rely heavily on demonstration videos, field-testing footage, and influencer reviews that show real-world resilience, making online education a crucial conversion tool across B2B and B2C workwear channels.

Employers increasingly expect brands to offer adjustable fits, extended size runs, and high-stretch technical fabrics that maintain mobility throughout long shifts. Products addressing common pain points, such as heat stress, chafing, or limited flexibility, consistently outperform basic uniforms. The presence of built-in reinforcements without added weight, breathable linings, and quick-dry or moisture-management textiles strengthens consumer preference, particularly among repeat purchasers who prioritise reliability and task-specific performance over purely aesthetic considerations.

Buyers closely evaluate certifications such as ISO 20471 for high-visibility gear, flame-resistant standards such as NFPA 2112, and the use of recycled polyester or organic cotton blends. Established suppliers, including Dulon, Redbanc Workwear, and international players such as 3M and DuPont, strengthen trust through published test results and sector-specific case studies. Newer entrants often depend on aggressive pricing strategies and broad discounting to build credibility. Peer reviews, YouTube durability tests, and worker-community forums meaningfully impact purchasing, as decision-makers seek validation before committing to bulk orders.

Younger self-employed workers remain highly price-sensitive and gravitate toward entry-level garments during seasonal promotions, while mid-income industrial employees and larger contractors demonstrate a stronger willingness to invest in premium pieces that promise long-term durability and compliance savings. Free shipping thresholds, multi-unit bundles, and simplified returns support higher conversion rates. Seasonal factors such as mining project cycles, summer construction peaks, and agricultural harvest periods generate pronounced purchasing surges, reinforcing the value of high-performance workwear that balances protection with comfort.

Product Insights

Workwear apparel accounted for a revenue share of 74.55% 2025 in the overall Chile workwear industry. People purchase workwear first because it protects them on the job, especially in industries such as mining, construction, manufacturing, utilities, and logistics, where exposure to heat, chemicals, heavy machinery, or low visibility is common. Certified garments such as flame-resistant clothing, high-visibility vests, and reinforced trousers are seen less as optional items and more as essential equipment. Many workers also prefer standardized uniforms because they signal professionalism and belonging, while employers require them to meet safety regulations and maintain a consistent corporate image.

Workwear footwear segment is projected to grow at a CAGR of 6.6% from 2026 to 2033, growth is supported by rising awareness of health, compliance, and quality differentiation. Workers are more informed about the long-term impact of poor-quality footwear on posture, joint health, and productivity, which drives preference for certified and well-engineered products. Meanwhile, wider product availability through distributors, retail chains, and online platforms makes it easier for consumers to access branded and specialized footwear models. With style now also merging into performance, consumers increasingly choose work footwear that blends safety with modern design, reinforcing the shift from generic boots to high-performance, purpose-built safety shoes in Chile’s evolving workwear market.

Demography Insights

Men’s workwear accounted for a revenue share of 80.25% in 2025 in the overall Chile workwear industry. Male workers often operate in high-risk environments involving heavy machinery, extreme temperatures, and long working hours, leading to faster wear and tear of clothing. As a result, consumers actively seek garments that last longer, resist damage, and provide practical benefits such as reinforced stitching, multiple utility pockets, weather resistance, and enhanced visibility.

Women’s workwear are projected to grow at a CAGR of 6.5% over the forecast period. Women prefer workwear that reflects professionalism and confidence rather than compromise. Branded uniforms, modern designs, and customization are becoming more popular as women view workwear as part of their professional image. At the same time, organizations are adopting gender-inclusive uniform policies and investing in diverse workwear ranges, further encouraging adoption. As a result, women in Chile are increasingly purchasing specialized workwear that combines safety, performance, and appearance, driving sustained growth in this segment.

Application Insights

The workwear used for construction accounted for a revenue share of 25.52% in 2025 of the Chile workwear industry. Construction work is physically demanding, with long hours in varying outdoor environments, so workers actively seek clothing that is durable, breathable, and flexible. Reinforced stitching, water-resistant fabrics, stretchable materials, and multiple utility pockets are highly valued features. In footwear, slip-resistant soles, steel or composite toe caps, and shock absorption are important for reducing fatigue and preventing injuries. Consumers are increasingly willing to invest in higher-quality garments that ensure comfort, longevity, and safety on the job.

Workwear used for biological/healthcare is projected to grow at a CAGR of 8.0% from 2026 to 2033. The growth can be attributed to the growing need for protective clothing in Chile’s hospitals, clinics, laboratories, and pharmaceutical facilities, where healthcare professionals and laboratory staff are routinely exposed to biological hazards and infectious agents. Workers purchase this specialized workwear to safeguard both themselves and patients, relying on garments such as scrubs, lab coats, disposable gowns, surgical caps, gloves, masks, and protective footwear that provide essential barriers against contamination while ensuring compliance with strict hygiene and safety standards.

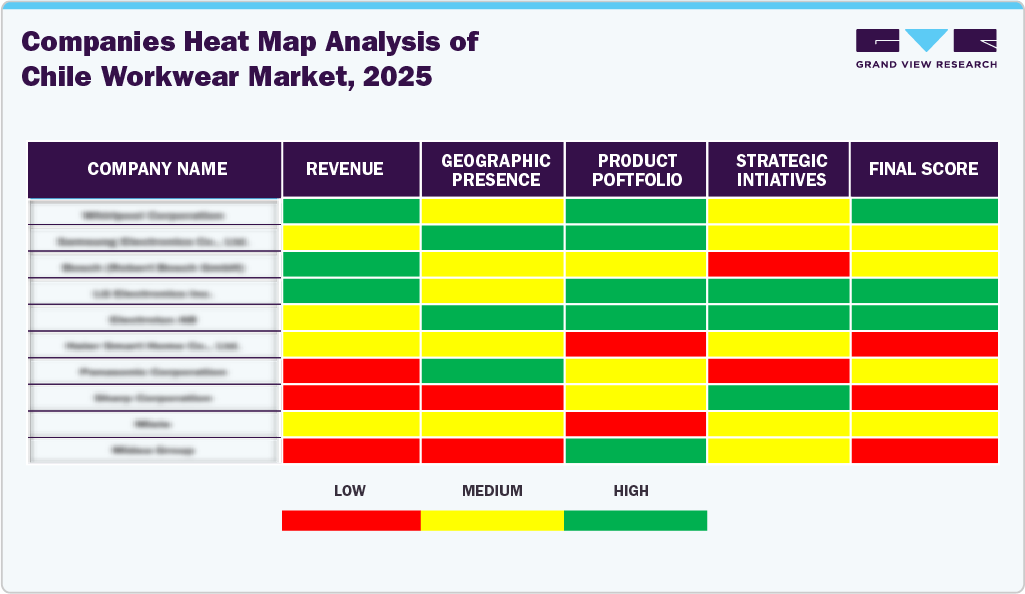

Key Chile Workwear Company Insights

The Chile workwear industry is being shaped by a mix of established safety-apparel suppliers and emerging performance-focused brands that are raising standards for durability, protection, comfort, and sustainability across industrial sectors such as mining, construction, logistics, agriculture, and energy. Companies are prioritising advanced technical fabrics, reinforced seams, ergonomic cuts, and lighter flame-resistant or high-visibility materials that improve mobility and withstand harsh working conditions, while also integrating recycled fibres, organic cotton blends, and compliance with certifications such as ISO 20471, EN ISO 11612, and NFPA 2112 to meet rising expectations for environmental responsibility and regulatory alignment. As workwear distributors expand through industrial retailers, hardware chains, online procurement platforms, and direct-to-business channels, brands such as Dulon, Redbanc Workwear, 3M, and DuPont are strengthening credibility through transparent testing data and material disclosures, while newer local manufacturers rely on value pricing to build trust in competitive segments. This combined focus on performance, safety, sustainability, and omnichannel access is accelerating the adoption of high-quality workwear across Chile’s workforce and supporting long-term demand growth.

Key Chile Workwear Companies:

- Küpfer

- MSA Safety

- Treck S.A.

- Segurycel

- Macme Ltda.

- Covecorp

- Vitatex

- AOTEC SPA

- Teamgraff

- Jayson

Recent Developments

-

In September 2025, the Chile Army Contracting Command announced it had awarded a contract for protective personnel equipment to Galvion, valued at USD 9.2 million over approximately two years. The newly awarded contract tasks Galvion with supplying protective personnel equipment for foreign military sales to Chile. The work is expected to be carried out at the company’s Portsmouth, New Hampshire, facility, with an estimated completion date of August 24, 2026.

-

In March 2025, ICB Food Service, a distributor specializing in food supplies for hotels, cafes, chains, and restaurants, has expanded its portfolio in Chile by adding Chef Works, a professional clothing brand for chefs and culinary students.

Chile Workwear Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 109.4 million

Revenue forecast in 2033

USD 164.4 million

Growth rate

CAGR of 6.0% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, demography, application

Country scope

Chile

Key companies profiled

Küpfer; MSA Safety; Treck S.A.; Segurycel; Macme Ltda.; Covecorp; Vitatex; AOTEC SPA; Teamgraff; Jayson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Chile Workwear Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Chile workwear market report based product, demography, and application:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Workwear Apparel

-

General Workwear

-

Protective Workwear

-

-

Workwear Footwear

-

General Footwear

-

Protective Footwear

-

-

-

Demography Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemical

-

Power

-

Public Safety & Emergency Services

-

Food & Beverages

-

Biological/Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The Chile workwear market size was estimated at USD 103.7 million in 2025 and is expected to reach USD 109.4 million in 2026.

b. The Chile workwear market is expected to grow at a compound annual growth rate of 6.0% from 2026 to 2033 to reach USD 164.4 million by 2033.

b. Workwear apparel accounted for a revenue share of 74.55% in the year 2025 in the overall Chile workwear industry, as employers prioritized regulation-compliant protective garments with high wear-and-tear exposure, standardized uniforms across large workforces, and recurring procurement driven by harsh operating conditions and strict occupational safety enforcement.

b. Some key players operating in the Chile workwear market include Küpfer; MSA Safety; Treck S.A.; Segurycel; Macme Ltda.; Covecorp; Vitatex; AOTEC SPA; Teamgraff; Jayson

b. Key factors that are driving the Chile workwear market growth include the enforcement of occupational safety regulations, the rising employer focus on worker protection and compliance, and consistent replacement demand for durable, climate-appropriate protective clothing across industrial sectors

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.