- Home

- »

- Clothing, Footwear & Accessories

- »

-

Workwear Market Size, Share, Growth, Industry Report 2033GVR Report cover

![Workwear Market Size, Share & Trends Report]()

Workwear Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Workwear Apparel, Workwear Footwear), By Demography (Men, Women), By Application (Construction, Chemical, Power, Food and Beverage, Biological), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-186-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Workwear Market Summary

The global workwear market size was estimated at USD 19.20 billion in 2025 and is projected to reach USD 28.08 billion by 2033, growing at a CAGR of 4.9% from 2026 to 2033. The market growth is primarily driven by growing awareness of workplace safety standards, increased enforcement of occupational health and safety regulations, and the rising need for durable, functional apparel across various industries.

Key Market Trends & Insights

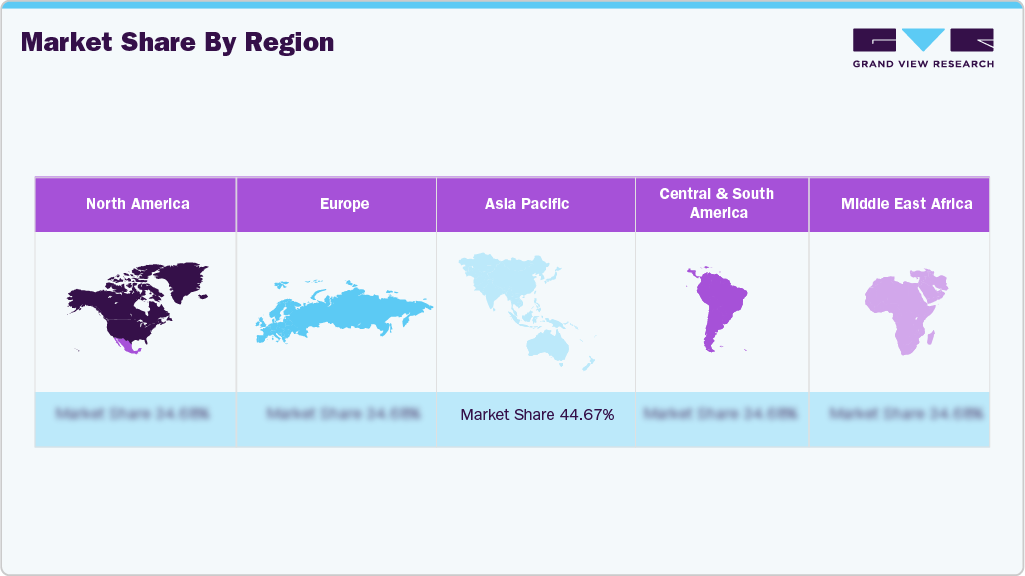

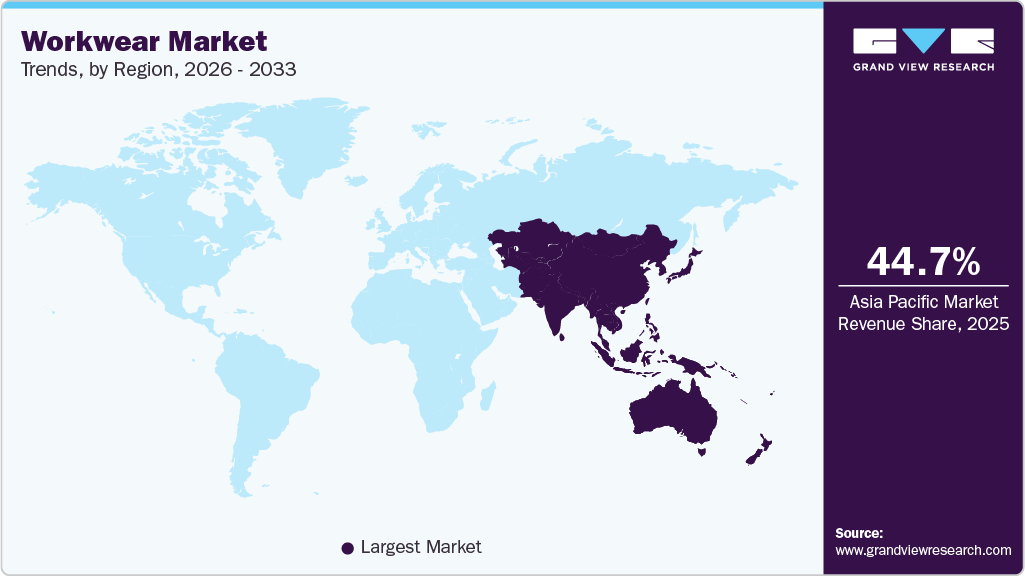

- Asia Pacific held the largest share of the global workwear market in 2025, accounting for 44.67%.

- The U.S. led the North American workwear market in 2025, holding the largest market share with 79.49% of the region’s total revenue.

- By application, the workwear market for construction accounted for a revenue share of 23.75% in 2025.

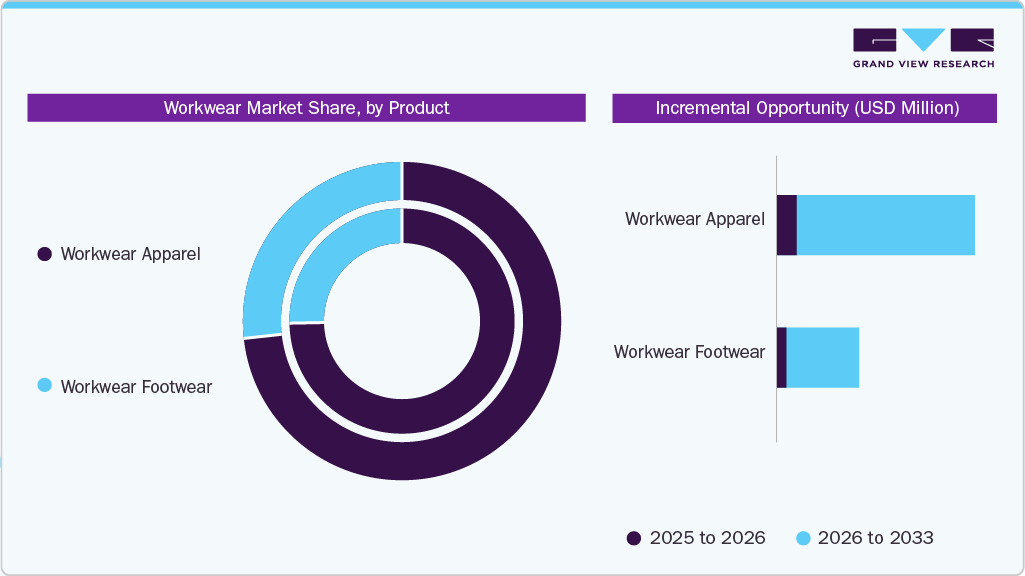

- By product, the workwear apparel segment led the workwear market, accounting for a revenue share of 74.67% in 2025.

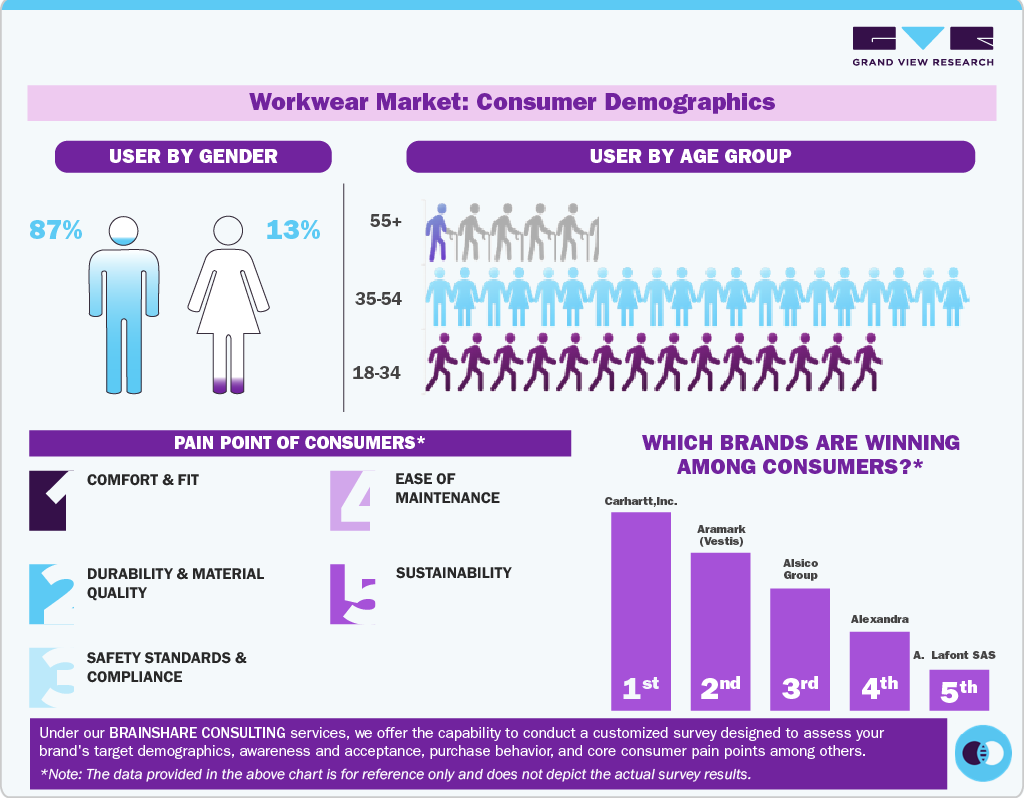

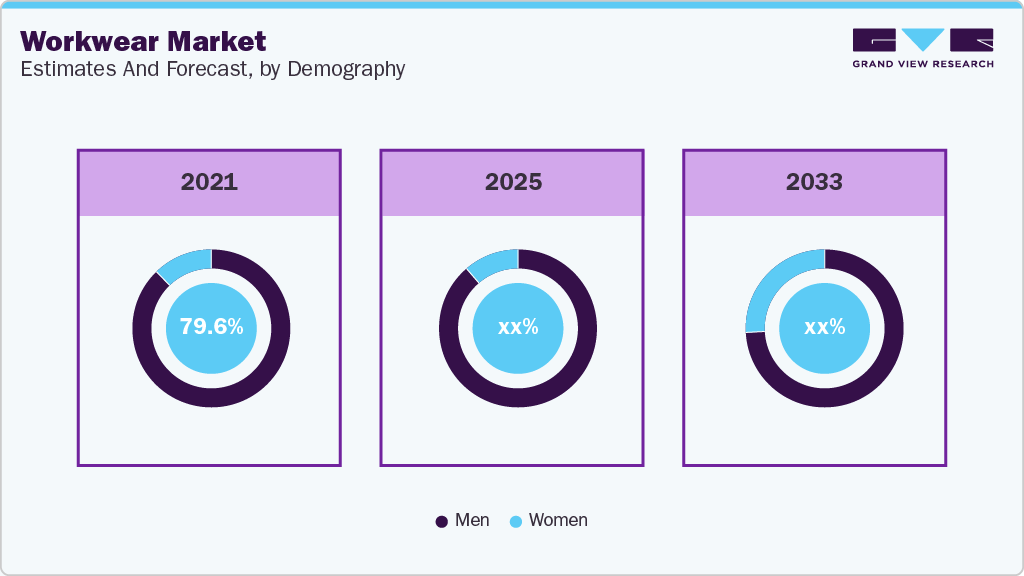

- By demography, the men’s workwear segment led the workwear industry, accounting for a revenue share of 87.24% in 2025.

Market Size & Forecast

- 2024 Market Size: USD 19.20 Billion

- 2033 Projected Market Size: USD 28.08 Billion

- CAGR (2025-2033): 4.9%

- Asia Pacific: Largest market in 2025

Additionally, the expansion of industrialization, urban infrastructure development, and the growing demand for customized and branded workwear solutions are accelerating market growth. As workplace safety regulations tighten and awareness of occupational health increases across industries, the global demand for durable and compliant workwear continues to rise. Additionally, the growing focus on employee comfort, brand identity, and professional appearance encourages companies to invest in high-quality, functional, and customized uniforms. Technological advances in fabric innovation, such as moisture-wicking, flame-resistant, and antimicrobial features, along with the rising popularity of sustainable and eco-friendly materials, are further transforming the market. Furthermore, the growth of e-commerce and digital platforms is making procurement processes more efficient and broadening access to a wider variety of workwear solutions worldwide.

The growth of the global workwear market is fueled by rising employment in the manufacturing, construction, and healthcare sectors. As reported in January 2024, the construction industry added approximately 17,000 jobs in December 2023, based on an analysis by the Associated Builders and Contractors (ABC) using data from the U.S. Bureau of Labor Statistics. Increasing demand for gender-specific and plus-size workwear is also boosting sales. Rapid urbanization and infrastructure projects in emerging economies contribute to market expansion. Furthermore, growing corporate focus on employee well-being and productivity supports continued investment in quality work apparel.

The rising demand for specialized protective clothing in high-risk environments, such as the oil & gas and chemical industries, is driving the global workwear market. The most essential pieces of protective workwear include flame-resistant clothing, safety goggles and gloves, hard hats, and steel-toed boots in the oil, gas & chemical industries. The increasing focus on uniformity and corporate branding across organizations also supports market expansion. Growing awareness around environmental sustainability is pushing manufacturers toward eco-friendly materials and production methods. Additionally, advancements in smart textiles and wearable technology are introducing new functionalities to modern workwear.

Consumer Insights

The global workwear industry is undergoing a significant transformation as industries incorporate automation, stricter occupational safety frameworks, and more sustainable procurement policies. Organisations across various sectors, including heavy engineering, transportation, energy, warehousing, pharmaceuticals, and food processing, are shifting toward clothing systems designed to support consistent performance under variable temperatures, chemical exposure, and mechanical strain. The rise of younger employees in industrial and service environments has accelerated demand for workwear that feels less restrictive, incorporates modern textile engineering, and aligns with brands that demonstrate clear environmental responsibility. Digital channels have become central to product discovery, with buyers increasingly relying on detailed fabric performance walkthroughs, certification explanations, and peer-led demonstrations that assess durability, stain resistance, and comfort in real-life situations.

Globally, companies are placing strong emphasis on workwear that offers anatomical shaping, multi-directional stretch, and climate-adaptive features. Lightweight insulation, anti-odor treatments, liquid-repellent coatings, and ergonomic seam placements are now standard expectations in higher-use categories such as utilities and industrial maintenance. Consumers and procurement teams tend to favour garments that balance longevity with ease of care, especially in sectors with frequent laundering cycles or exposure to oils and particulates.

Across regions, purchasing decisions are guided by compliance with international benchmarks, including EN ISO 13688 for general protective clothing, EN 343 for rainwear, and arc-flash standards such as ASTM F1506. Global brands such as Helly Hansen Workwear, Dickies, Portwest, 3M, and DuPont maintain strong credibility due to transparent reporting on fabric testing, abrasion performance, and product traceability. Newer manufacturers often differentiate themselves through the use of recycled-material blends, modular garment systems, or aggressive value positioning. User communities on digital forums and video platforms have become influential, as real-world testimonials increasingly shape expectations around garment lifespan and comfort.

Price dynamics vary widely, with cost-sensitive buyers prioritising functional basics. At the same time, large industrial operators and technical service providers invest in premium lines that reduce replacement frequency and enhance employee safety outcomes. Seasonal shifts, infrastructure programs, and climate-related disruptions are increasingly influencing demand, reinforcing the global shift toward durable, adaptive workwear designed for continuous use.

Product Insights

The workwear apparel segment led the workwear market, accounting for a revenue share of 74.67% in 2025. The market is witnessing substantial growth driven by a heightened emphasis on safety and functionality in the workplace. Employees frequently face environments that pose heat-related health risks, including dehydration, heatstroke, and fainting. These challenging conditions have prompted workwear manufacturers to continually innovate with advanced fabrics and apparel technologies. The goal is to enhance protection and ensure a safer, more comfortable environment for workers. For instance, in April 2025, the Arco Limited brand Trojan launched an advanced workwear range, including performance trousers engineered for high flexibility and long-lasting wear, jackets and gilets built with weather-resistant insulation, and fleeces that are lightweight, warm, and designed to allow unrestricted movement.

The workwear footwear segment is projected to grow at a CAGR of 5.6% over the forecast period. The workwear footwear market is expanding due to the rising demand for protective shoes across various industries, including construction, mining, and logistics. Increasing government regulations mandating the use of safety footwear in hazardous workplaces are a key growth driver. The growing awareness of foot health and injury prevention among workers is also influencing purchasing decisions. Additionally, the shift toward lightweight, ergonomic, and stylish safety footwear is attracting a broader consumer base. Technological advancements, such as anti-slip soles, steel toes, waterproof materials, and shock absorption, are further enhancing product appeal and performance. For instance, in April 2025, the Arco Limited brand Trojan launched an advanced workwear range, including footwear focused on comfort, featuring advanced grip, shock absorption, and GORE-TEX options.

Demography Insights

The men’s workwear segment led the workwear industry, accounting for a revenue share of 87.24% in 2025. The steady growth of male-dominated industries, such as construction, manufacturing, and transportation, propels the growth. According to the Organization for Economic Co-operation and Development (OECD) data published in April 2024, male employment in 2023 across all age groups increased to 76.9%. Increasing demand for durable and versatile apparel that withstands tough working conditions is a significant factor. The rising preference for functional designs that offer comfort and mobility drives market growth. Additionally, the trend toward branded and stylish workwear for a professional appearance is gaining traction. Innovations in fabric technology, which enhance breathability and wear resistance, are further driving demand in this segment. For instance, in September 2023, Cat Footwear introduced its latest addition to the Invader collection, the Invader Mid Vent, a high-traction safety shoe that boasts unparalleled traction and exceptional style.

The women’s workwear segment is projected to grow at a CAGR of 5.2% over the forecast period. The women’s workwear market is growing rapidly as more women enter traditionally male-dominated sectors, such as construction, manufacturing, and engineering. According to the Organization for Economic Co-operation and Development (OECD) data published in April 2024, female employment in 2023 across all age groups increased to 63.2%. There is an increasing demand for workwear tailored to fit women’s body shapes, providing both comfort and functionality. The growing emphasis on gender diversity and inclusion in the workplace is encouraging companies to invest in uniforms tailored to women. Additionally, the rise of professional women seeking stylish yet practical workwear contributes to market expansion. Moreover, firms are increasingly collaborating to develop better workwear solutions and empower women in the workforce. For instance, in April 2025, Deere & Company announced a collaboration with Dovetail Workwear to develop apparel & gear for women designed to suit he needs of women working in the agriculture industry.

Application Insights

The workwear used for construction accounted for a revenue share of 23.75% in 2025, driven by the sector’s stringent safety requirements and the need for durable, protective clothing that can withstand harsh environments. Increasing infrastructure development and urbanization globally are boosting demand for specialized construction apparel. The rising adoption of high-visibility and flame-resistant materials enhances worker safety and compliance with regulations. Additionally, the focus on ergonomic designs to improve comfort during long working hours supports market growth. Growing investment in smart construction technologies is also encouraging the integration of advanced features in workwear for better performance and protection.

Workwear used in biological is projected to grow at a CAGR of 5.7% over the forecast period, driven by the increasing need for infection control and patient safety in clinical environments. Rising hospital admissions and the expansion of healthcare infrastructure globally are increasing the demand for specialized medical apparel. There's a growing emphasis on comfortable, breathable, and long-wear garments that support extended shifts for medical staff. The shift toward reusable and sustainable medical textiles is also influencing purchasing trends in the sector. Furthermore, the rise in personalized and department-specific uniforms is promoting brand identity and operational efficiency in healthcare institutions.

Regional Insights

The North America workwear market accounted for the global revenue share of 23.61% in 2025. The market growth is driven by a strong industrial base, increasing investment in infrastructure projects, and a growing emphasis on occupational safety across various sectors. The rise of automation and advanced manufacturing is also pushing demand for technologically enhanced, task-specific apparel. Additionally, the region’s focus on sustainability encourages the adoption of eco-friendly workwear materials.

U.S. Workwear Market Trends

The U.S. workwear industry led North America in 2025, holding the largest revenue share of 79.49%. In the U.S., stringent federal and state-level labor safety regulations, particularly those enforced by OSHA, are a significant factor driving workwear demand. In January 2024, the U.S. Department of Labor launched a multi-year initiative to reduce worker fatalities and injuries in the tree and landscape services sectors across New Jersey, New York, Puerto Rico, and the U.S. Virgin Islands. The growth of sectors such as energy, logistics, and emergency services has created a steady demand for specialized uniforms. The trend toward local manufacturing and “Made in USA” branding is also influencing consumer preferences in work apparel.

Europe Workwear Market Trends

The workwear industry in Europe is projected to grow at a CAGR of 3.9% from 2026 to 2033. Strong labor unions shape Europe’s workwear landscape, strict EU workplace safety standards, and a focus on ethical sourcing and production. The increasing adoption of circular economy principles is promoting the use of recyclable and long-lasting materials. Moreover, rising demand for gender-specific and fashion-forward workwear is redefining product development strategies.

The Germany workwear market led Europe in 2025, holding the largest revenue share og 23.15%. Germany’s industrial strength in automotive, engineering, and manufacturing drives consistent demand for high-quality protective clothing. The country’s strong vocational training culture supports the uniform adoption of skills across various trade professions. Additionally, innovation in technical textiles and the integration of wearable tech are key trends shaping the market.

Asia Pacific Workwear Market Trends

The Asia Pacific accounted for the largest market share of 44.67% in 2025. Asia Pacific is witnessing rapid growth, driven by large-scale industrialization, urban development, and expanding manufacturing hubs. The increasing presence of global companies in the region is encouraging the adoption of standardized safety practices and uniform usage. Moreover, increasing disposable incomes and awareness of worker rights are fueling demand for higher-quality work apparel. Recognizing the rising demand, key players are collaborating to cater to it. For instance, in April 2024, BASF collaborated with KPR King Power to introduce safety footwear in China made with Elastopan Loop, a recycled polyurethane solution that reclaims PU waste using advanced liquefaction techniques, thereby preserving both durability and comfort.

Central & South America Workwear Market Trends

The workwear industry in Central & South America is projected to grow significantly at a CAGR of 5.3% from 2026 to 2033, driven by a growing emphasis on formalizing the workforce and improving labor conditions across key industries. Expansion of the healthcare and public service sectors is creating demand for professional and hygienic uniforms. Additionally, the rise of local manufacturing capabilities is making workwear more accessible and affordable within the region. Increasing awareness of climate-specific apparel needs, such as lightweight and breathable fabrics for hot environments, is also influencing product development and adoption.

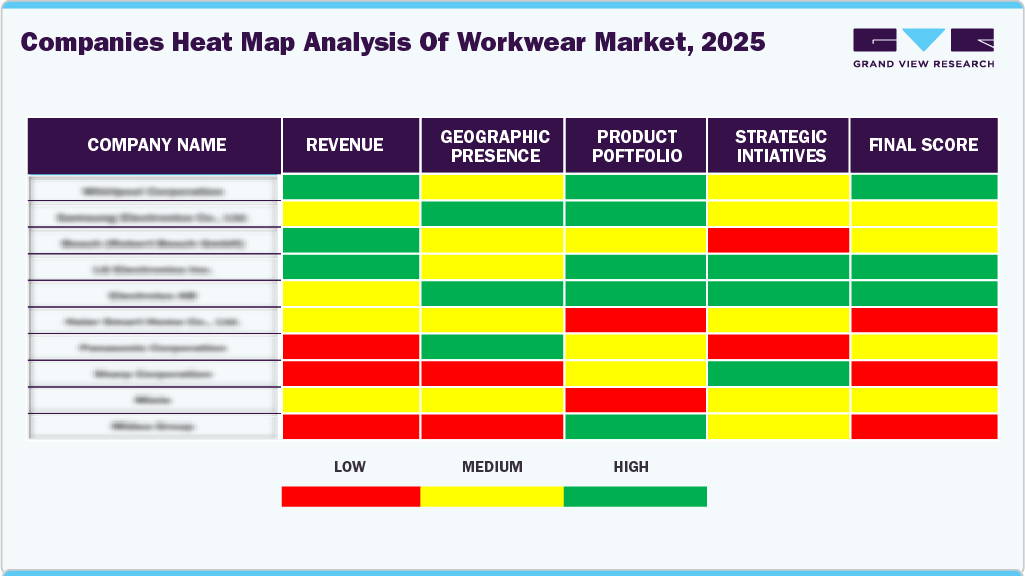

Key Workwear Company Insights

Many brands in the global workwear market have identified untapped potential within specialized industry segments and are strategically innovating to capture these opportunities. This involves introducing advanced fabric technologies, expanding size and fit inclusivity, and offering customizable solutions tailored to specific job functions and environments. Companies are also refining their branding and distribution strategies to better align with regional regulations, workforce demographics, and shifting consumer expectations. By targeting emerging sectors and evolving workplace needs, these brands aim to enhance their market share and reinforce their global competitiveness.

Key Workwear Companies:

The following are the leading companies in the workwear market. These companies collectively hold the largest market share and dictate industry trends.

- Carhartt, Inc.

- Aramark (Vestis)

- Alsico Group

- Alexandra

- A. Lafont SAS

- Hard Yakka

- 3M

- Ansell Ltd.

- Honeywell International, Inc.

- Snickers Workwear

Recent Developments

-

In September 2025, the Chile Army Contracting Command announced it had awarded a contract for protective personnel equipment to Galvion, valued at USD 9.2 million over approximately two years. The newly awarded contract tasks Galvion with supplying protective personnel equipment for foreign military sales to Chile. The work will be carried out at the company’s Portsmouth, New Hampshire, facility, with an estimated completion date of August 24, 2026.

-

In July 2024, Ansell completed the acquisition of Kimberly‑Clark’s Personal Protective Equipment (KCPPE) business, bringing the Kimtech (scientific/cleanroom PPE) and KleenGuard (industrial safety PPE) brands into its portfolio. This strategic move broadens Ansell’s product offering with new capabilities, including the RightCycle sustainable disposal program and APEX cleanroom services, reinforcing its global leadership in personal protection solutions.

Workwear Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 20.04 billion

Revenue forecast in 2033

USD 28.08 billion

Growth rate

CAGR of 4.9% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, demography, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Carhartt, Inc.; Aramark (Vestis); Alsico Group; Alexandra; A. Lafont SAS; Hard Yakka; 3M; Ansell Ltd.; Honeywell International, Inc.; Snickers Workwear

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Workwear Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the workwear market report based on product, demography, application, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Workwear Apparel

-

General Workwear

-

Protective Workwear

-

-

Workwear Footwear

-

General Footwear

-

Protective Footwear

-

-

-

Demography Outlook (Revenue, USD Billion, 2021 - 2033)

-

Men

-

Women

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Construction

-

Chemical

-

Power

-

Food and Beverage

-

Biological

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors driving growth in the workwear market include increasing awareness of workplace safety, stringent government regulations, and rising demand for protective and functional clothing. The expansion of industries such as construction, manufacturing, and oil & gas further fuels this demand. Additionally, the adoption of stylish and comfortable workwear is influencing purchasing decisions, blending utility with modern design.

b. The workwear market size was estimated at USD 19.20 billion in 2025 and is expected to reach USD 20.04 billion in 2026.

b. The workwear market is expected to grow at a compound annual growth rate (CAGR) of 4.9 % from 2026 to 2033 to reach USD 28.08 billion by 2033.

b. The workwear apparel market accounted for a revenue share of 74.67% in 2025, driven by rising demand for durable, functional clothing and increased workplace safety regulations. The workwear apparel market is also fueled by growth in the industrial and construction sectors.

b. Some key players operating in workwear market include Carhartt, Inc.; Aramark (Vestis); Alsico Group; Alexandra; A. Lafont SAS; Hard Yakka; 3M; Ansell Ltd.; Honeywell International, Inc.; and Kimberly-Clark Corporation

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.