- Home

- »

- Communication Services

- »

-

China Business Process Outsourcing Market, Report, 2030GVR Report cover

![China Business Process Outsourcing Market Size, Share & Trends Report]()

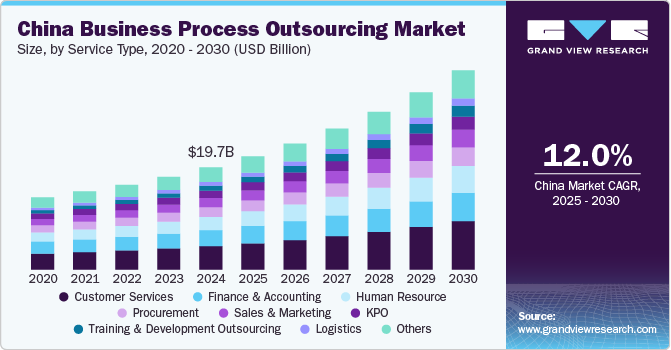

China Business Process Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (KPO, Human Resource, Finance & Accounting), By Outsourcing Type, By Deployment, By Application, And Segment Forecasts

- Report ID: GVR-4-68039-922-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China BPO Market Size & Trends

The China business process outsourcing market size was valued at USD 19.68 billion in 2024 and is anticipated to grow at a CAGR of 12.0% from 2025 to 2030. The increasing adoption of digital transformation initiatives by companies, both domestic and international, operating in China is driving the demand for business process outsourcing (BPO). As organizations strive to improve operational efficiency, reduce costs, and enhance customer experiences, they are increasingly outsourcing non-core business functions, such as customer support, IT services, human resources, and finance & accounting. The country’s large, skilled workforce and relatively lower labor costs compared to Western markets make it an attractive destination for outsourcing.

Unique political and geographic factors have powered the market growth. The Chinese government has been involved actively in the development of the industry to an atypical level, by offering a myriad of benefits and incentives to the local as well as foreign companies to invest in the country. In addition, China’s ability to provide specialized support to the diverse markets in the Asia Pacific region is also expected to spur market growth. Thus, China will continue to play a vital role in the Asia Pacific region as a strategic location as well as an offshoring center for the regional Multi-national Corporations (MNCs). Companies who are willing to enter the China BPO sector will need to adopt a structured approach for selecting a suitable city or industry park to fulfill business objectives.

China’s strong domestic economy and the increasing demand for outsourcing from local companies have also been instrumental in the market's expansion. As Chinese businesses grow and seek to optimize their operations, many have turned to BPO services to handle back-office functions, allowing them to focus on core competencies. The rise of the e-commerce industry in China, which requires extensive customer support, logistics management, and IT services, has further fueled the demand for BPO services.

Moreover, China’s strategic location in Asia Pacific provides easy access to other emerging markets, making it an attractive hub for multinational corporations (MNCs) seeking to outsource their operations while expanding in the region. The Chinese government’s supportive policies, including tax incentives and investment in technology parks, have also contributed to the growth of the business process outsourcing (BPO) sector, creating a favorable business environment for outsourcing firms.

The increasing use of AI and Robotic Process Automation (RPA) in China’s BPO sector is transforming how services are delivered. Automation tools are being deployed to handle repetitive tasks such as data processing, freeing up human workers to focus on more complex problem-solving and customer interaction. This use of advanced technologies enables BPO providers to offer higher-quality, more efficient services at a lower cost, making outsourcing more attractive to businesses. Moreover, the Chinese government's heavy investment in AI and technology innovation has further strengthened the country's capabilities in delivering tech-enabled BPO services.

Service Type Insights

The customer services segment accounted for the largest market share of over 23.0% in 2024 due to the rapid expansion of China’s e-commerce and retail sectors. As the largest e-commerce market in the world, China’s businesses, particularly online retailers, require extensive customer support to handle the increasing volume of customer inquiries, order management, and after-sales services. BPO providers are stepping in to manage these operations, allowing companies to focus on core business activities while ensuring efficient, round-the-clock customer service. The rising expectations of Chinese consumers for fast, high-quality customer support have intensified the need for professional BPO services in this area.

The human resource segment is anticipated to grow at a significant CAGR over the forecast period. The rising demand for workforce management solutions in China is a major contributor to the growth of the HR BPO segment. Companies are increasingly turning to specialized HR outsourcing providers to manage tasks such as recruitment, employee training, performance evaluations, and retention strategies. This is especially prevalent in sectors experiencing rapid growth, such as technology, manufacturing, and e-commerce, where companies must efficiently scale their workforce.

Outsourcing Type Insights

The onshore segment accounted for the largest market share of over 69.0% in 2024. The increasing complexity of regulatory requirements in China, particularly in sectors such as healthcare, finance, and telecommunications, has driven demand for onshore BPO services. As companies face more stringent regulations and compliance obligations, outsourcing specialized functions like legal processing, regulatory reporting, and compliance management to domestic BPO providers has become a practical solution.

The nearshore segment is anticipated to grow at a significant CAGR over the forecast period owing to the increasing demand from neighboring countries such as Japan and South Korea, which are looking to streamline operations by outsourcing services to China. These countries have long-standing business ties with China, and nearshoring enables them to take advantage of China’s large, skilled workforce, particularly in technical fields like IT, software development, and customer support. Japanese and South Korean companies, in particular, are looking to leverage China's expertise in tech-enabled BPO services, benefiting from the cultural affinity and shorter distances for business interactions.

Deployment Insights

The cloud segment accounted for the largest market share of over 52.0% in 2024 due to the need for improved data accessibility and real-time collaboration. Cloud infrastructure allows BPO providers to offer seamless, 24/7 services, regardless of location, which is crucial for multinational companies operating across different time zones. Cloud solutions also enable BPO providers to streamline operations by facilitating real-time data sharing, improving communication, and reducing downtime, leading to faster response times and higher client satisfaction. The ability to integrate multiple services such as customer relationship management (CRM) systems, data analytics, and enterprise resource planning (ERP) solutions on a single cloud platform further enhances operational efficiency.

The on premise segment is anticipated to grow at a significant CAGR over the forecast period owing to the stringent regulatory landscape in China, particularly with the implementation of laws like the Cybersecurity Law and the Data Security Law. These regulations impose strict data localization requirements, mandating that companies store sensitive data, especially related to Chinese citizens, on servers within the country.

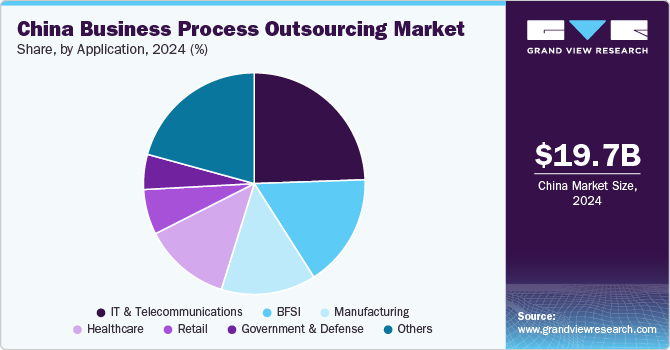

Application Insights

The IT & telecommunications segment accounted for the largest market share of over 24.0% in 2024 as cloud computing and big data analytics are significantly shaping the IT outsourcing landscape in China’s BPO market. As telecom companies collect vast amounts of data from their users, they require advanced analytics and data management solutions to derive insights, improve service delivery, and enhance customer experiences. BPO providers in China have responded by offering cloud-based IT solutions and data analytics services that help telecom companies store, process, and manage this data more efficiently.

The retail segment is anticipated to grow at a significant CAGR over the forecast period. As the retail landscape evolves rapidly, driven by technological advancements and changing consumer behaviors, companies are increasingly outsourcing various business processes to enhance efficiency and customer engagement. With the rise of e-commerce and digital shopping, retailers are seeking specialized BPO services to manage customer service, order fulfillment, inventory management, and marketing activities.

Key China Business Process Outsourcing Company Insights

Key players operating in the China BPO market include Accenture, Amdocs Ltd., Capgemini SE, Wipro Ltd., and China Customer Relations Centers, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2024, Accenture and S&P Global announced a strategic partnership to advance generative AI innovation within the financial services sector. This collaboration empowers customers and S&P Global’s workforce to adopt and effectively utilize generative AI at scale. To facilitate this, S&P Global plans to implement a comprehensive generative AI learning program for its employees, equipping them with the necessary skills to harness this transformative technology. The two companies are also working together to enhance AI development and benchmarking solutions tailored to the financial services industry.

-

In January 2024, Amdocs unveiled its new End-to-End Service Orchestration (E2ESO) solution to improve operational efficiency and streamline business intent delivery. The E2ESO solution bridges desired business outcomes and the required network resources and configurations. The solution enhances interactions between service providers and their customers by simplifying network complexity and intelligently orchestrating various actions, ensuring successful outcomes throughout the complete lifecycle in various network conditions.

Key China Business Process Outsourcing Companies:

- Accenture

- Amdocs

- Capgemini SE

- China Customer Relations Centers, Inc.

- China Data Group Co., Ltd.

- Chinasoft International Co., Ltd.

- Infosys Ltd.

- M&Y Global Services

- Northking Information Technology Co., Ltd.

- Wipro Ltd.

China Business Process Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.78 billion

Revenue forecast in 2030

USD 38.38 billion

Growth rate

CAGR of 12.0% from 2025 to 2030

Actual data

2018 - 2023

Base Year for Estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report service

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, outsourcing type, deployment, application

Key companies profiled

Accenture; Amdocs; Capgemini SE; China Customer Relations Centers, Inc.; China Data Group Co., Ltd.; Chinasoft International Co., Ltd.; Infosys Ltd.; M&Y Global Services; Northking Information Technology Co., Ltd.; Wipro Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Business Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the China business process outsourcing market report based on service type, outsourcing type, deployment, and application:

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance & Accounting

-

Human Resource

-

KPO

-

Procurement

-

Customer Services

-

Sales & Marketing

-

Logistics

-

Training and Development Outsourcing

-

Others

-

-

Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Onshore

-

Offshore

-

Nearshore

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On premise

-

Cloud

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

IT & Telecommunications

-

Retail

-

Government & Defense

-

Others

-

Frequently Asked Questions About This Report

b. The China business process outsourcing market size was estimated at USD 19.68 billion in 2024 and is expected to reach USD 21.78 billion in 2025.

b. The China business process outsourcing market is expected to grow at a compound annual growth rate of 12.0% from 2025 to 2030 to reach USD 38.38 billion by 2030.

b. The IT and telecommunications segment accounted for the largest market share, over 24.0%, in 2024, as cloud computing and big data analytics are significantly shaping the IT outsourcing landscape in China’s BPO market.

b. Some key players operating in the China business process outsourcing market include Accenture, Amdocs, Capgemini SE, China Customer Relations Centers, Inc., China Data Group Co., Ltd., Chinasoft International Co., Ltd., Infosys Ltd., M&Y Global Services, Northking Information Technology Co., Ltd., Wipro Ltd. among others

b. Key factors driving the China business process outsourcing market growth include the increasing adoption of digital transformation initiatives by companies, both domestic and international. As organizations strive to improve operational efficiency, reduce costs, and enhance customer experiences, they increasingly outsource non-core business functions, such as customer support, IT services, human resources, and finance & accounting.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.