China Draught Beer Market Summary

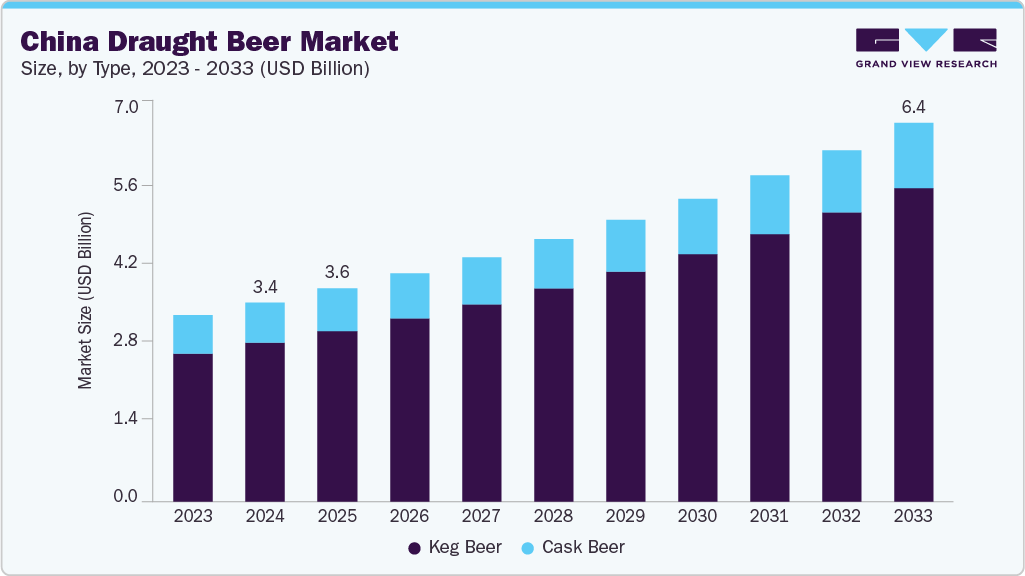

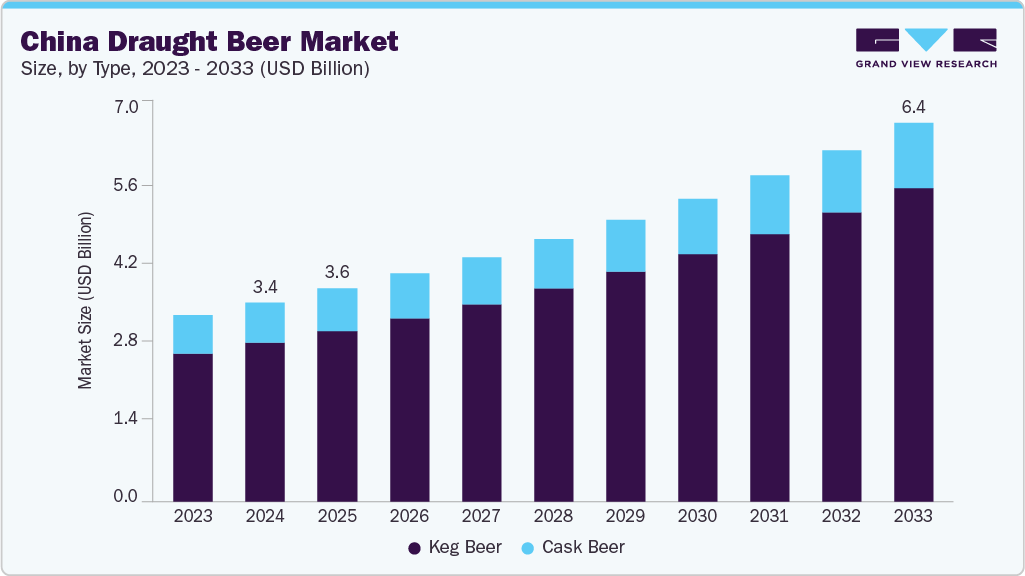

The China draught beer market size was estimated at USD 3.36 billion in 2024 and is projected to reach USD 6.38 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The market is driven by consumer preference for fresh, premium-tasting beverages and the growing popularity of Western-style pubs and craft beer bars.

Key Market Trends & Insights

- By type, the keg beer segment held the highest market share of 79.8% in 2024.

- The cask beer is expected to grow at a significant CAGR of 5.5% from 2025 to 2033.

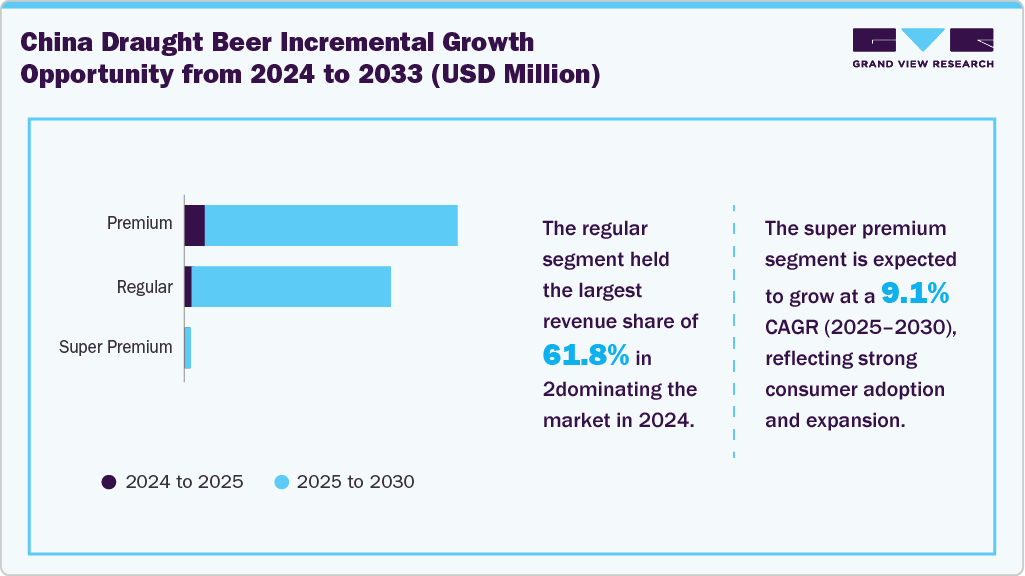

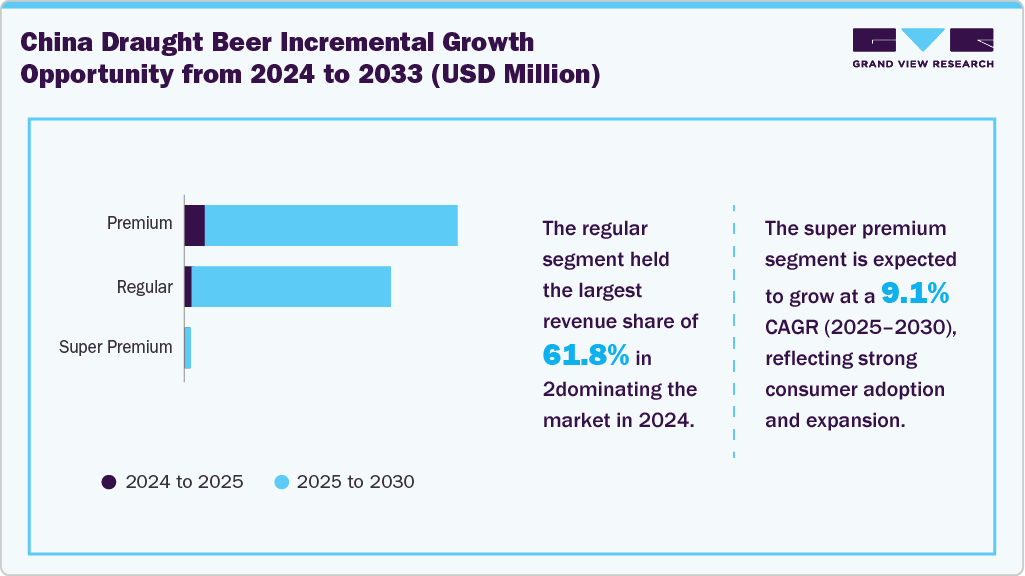

- By category, the regular segment held the highest market share of 61.9% in 2024.

- Based on production type, the macro brewery segment held the highest market share of 73.6% in 2024.

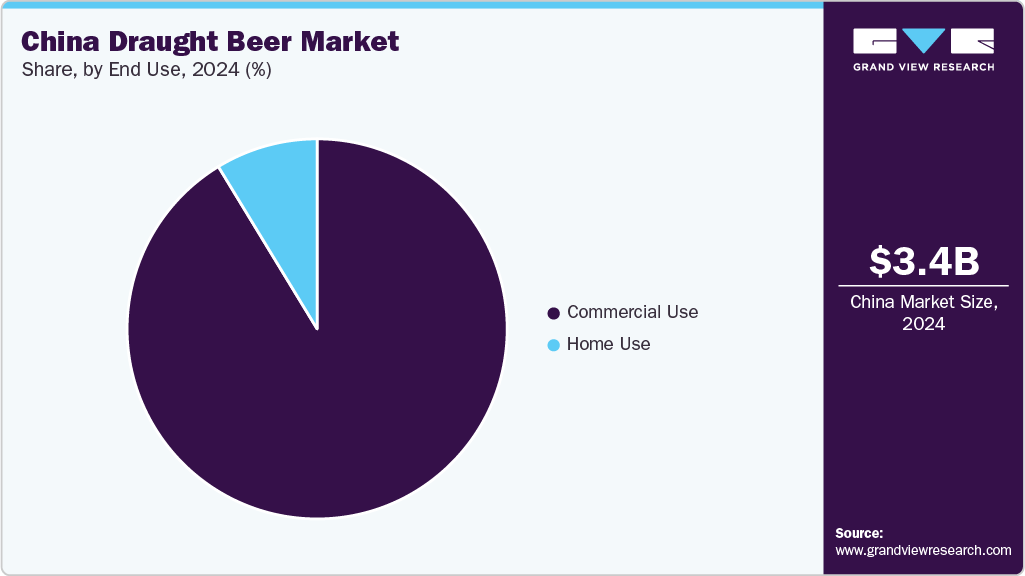

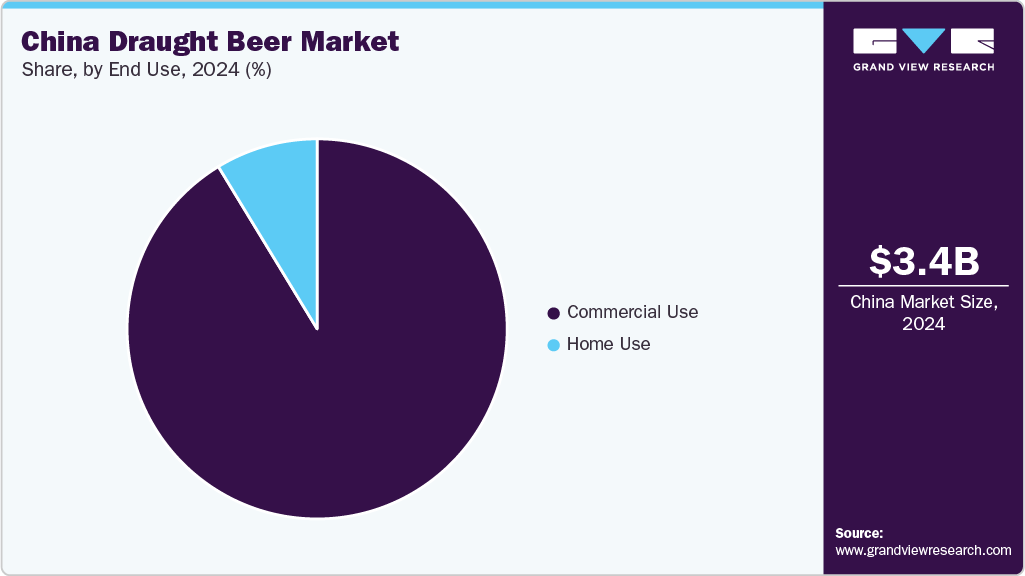

- Based on end use, the commercial use segment held the highest market share of 91.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.36 Billion

- 2033 Projected Market Size: USD 6.38 Billion

- CAGR (2025-2033): 7.5%

Urbanization and a growing middle class drive demand for unique, high-quality drinking experiences. Chinese consumers increasingly favor premium alcoholic beverages, with draught beer gaining popularity for its freshness and superior taste. Unlike packaged beer, draught beer is often perceived as a more refined and social option, especially in urban settings. This shift aligns with the broader premiumization trend in China's beverage market.

Rapid urbanization and the expansion of nightlife culture fuel draught beer consumption across major Chinese cities. Young professionals and middle-class consumers seek social and recreational experiences, often centered around food and beverage establishments. Draught beer is a central component in these settings, driving on-premise sales. The rise of craft beer bars and Western-style pubs also supports this trend.

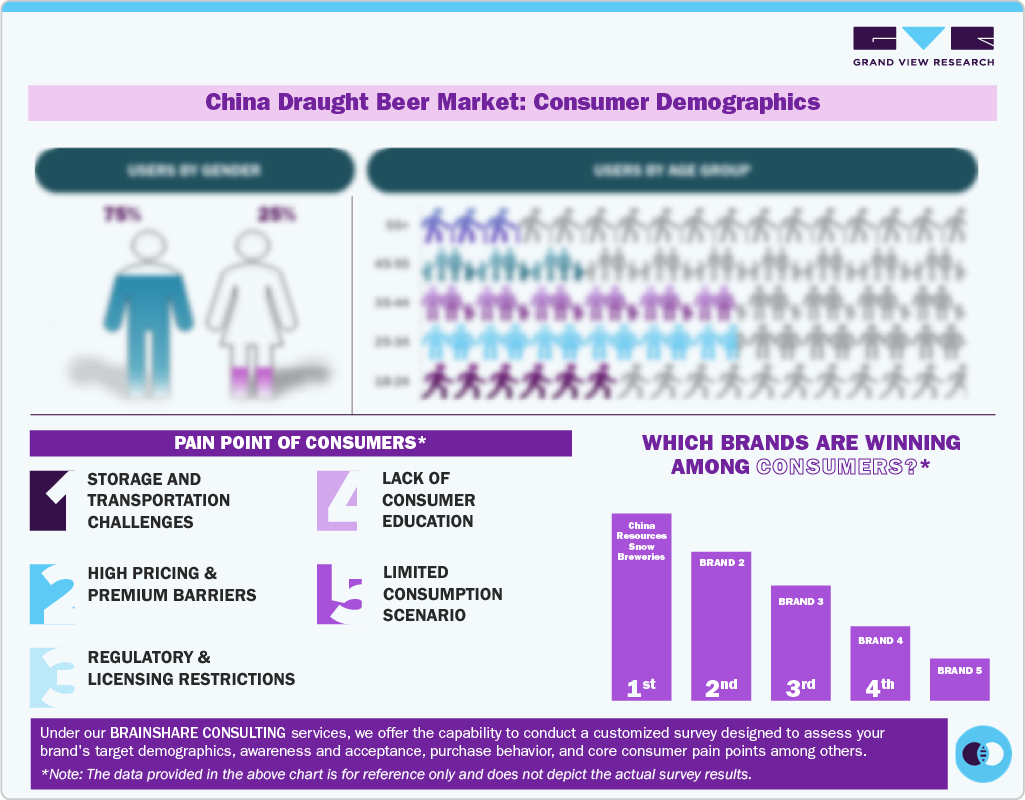

Consumer Insights

In China, consumer preference for draught beer is increasingly influenced by shifting lifestyle trends, urbanization, and rising disposable incomes. In major metropolitan areas such as Shanghai, Beijing, and Guangzhou, draught beer is gaining popularity among younger, educated consumers who seek fresh, premium, and authentic drinking experiences. The preference is driven by a growing appreciation for craft and artisanal beers served on tap, which aligns with a desire for quality and uniqueness.

Consumer Demographic

Chinese draught beer consumers demonstrate a growing inclination toward authenticity, provenance, and premium quality. Many view draught beer as more than a beverage and a lifestyle choice connected to craftsmanship, tradition, and innovation. There is increasing awareness and appreciation for brewing techniques such as cask conditioning and using local or unique ingredients, contributing to exclusivity and artisanal value.

Sustainability and environmental responsibility are emerging considerations among certain consumer segments, particularly younger generations in urban areas who seek products that reflect ethical and quality standards. This evolving demographic landscape includes a rising number of urban professionals and millennials who prioritize freshness, flavor complexity, and variety in their beer selections.

Type Insights

The keg beer segment dominated the China draught beer market with the largest revenue share of 79.8% and is expected to grow at the fastest CAGR over the forecast period. Consumers favor fresh-tasting, on-tap beer experiences that keg systems provide, enhancing beer's perceived quality and freshness. This trend encourages breweries to invest in innovative keg technologies, including stainless steel and recyclable plastic kegs, which support quality and sustainability demands.

The cask beer segment is projected to experience a significant CAGR of 5.5% from 2025 to 2033. Cask beer, a traditional style of unfiltered and unpasteurized beer, is increasingly attracting niche interest within China’s draught beer market as consumers seek more artisanal and authentic drinking experiences. As awareness of brewing techniques and product origin grows, demand for cask beer is anticipated to increase gradually. This trend aligns with China's broader movement toward quality-oriented draught beer consumption.

Category Insights

The regular segment dominated the China draught beer market with the highest revenue share in 2024. A growing preference for fresher, better-tasting beer largely fuels the segment's growth. Consumers are increasingly choosing on-tap options, which provide a superior flavor to bottled beer. This trend is particularly prominent in urban areas where the social drinking culture is expanding. The widespread availability of regular draught beer in mid-tier bars, restaurants, and casual dining venues is also boosting its popularity. In addition, breweries are investing in enhanced cold-chain logistics to maintain quality. Together, these factors improve accessibility and increase consumer appeal.

The super premium segment is projected to grow at the highest CAGR from 2025 to 2033. With rising disposable income, particularly in urban areas, consumers are increasingly willing to spend on high-quality and distinctive beer experiences that extend beyond conventional selections. This trend signifies a growing consumer preference for authenticity, characterized by a demand for carefully crafted brews produced using premium, often unfiltered brewing techniques. In response, breweries are introducing a range of specialty draught beers that highlight natural ingredients and unique flavor profiles, fostering an image of luxury and refined taste.

Production Type Insights

The macro breweries segment held the largest market share in 2024. Large-scale macro breweries dominate China’s draught beer market by focusing on industrial production designed for consistency and wide distribution. Leading companies such as China Resources, Tsingtao, and AB InBev utilize advanced technologies and cold-chain logistics to maintain quality and freshness, especially for on-trade consumption channels. These breweries often run specialized draught beer lines featuring optimized carbonation levels and packaging options such as steel or PET kegs. Their production processes enable quick scaling across urban areas. To keep up with changing consumer tastes, many companies are also expanding their portfolios to include premium and craft-style draught beers. Moreover, they tailor flavor profiles to suit regional preferences while ensuring efficient operations.

The microbrewery segment is anticipated to experience the fastest CAGR over the forecast period, driven primarily by increasing consumer demand for unique, locally crafted beers with distinctive flavors. Younger urban consumers, influenced by global craft beer trends and rising disposable incomes, are shifting away from mass-produced lagers toward artisanal brews.

End Use Insights

The commercial use segment dominated the Chinese draught beer market in 2024. The market is witnessing strong growth, driven by expanding on-premise consumption venues such as bars, restaurants, and sports arenas. Rising urbanization and increasing disposable incomes encourage consumers to seek social and experiential drinking settings, particularly in bars, restaurants, and entertainment venues. As a result, the demand for fresh draught beer served on tap is growing steadily.

The home use segment is anticipated to experience the fastest CAGR from 2025 to 2033. The market is gaining momentum, driven by the increasing popularity of at-home entertainment and social gatherings. As consumers seek bar-like experiences in the comfort of their homes, mini kegs are becoming more accessible and affordable. This shift is particularly evident among younger consumers who value convenience and premium quality.

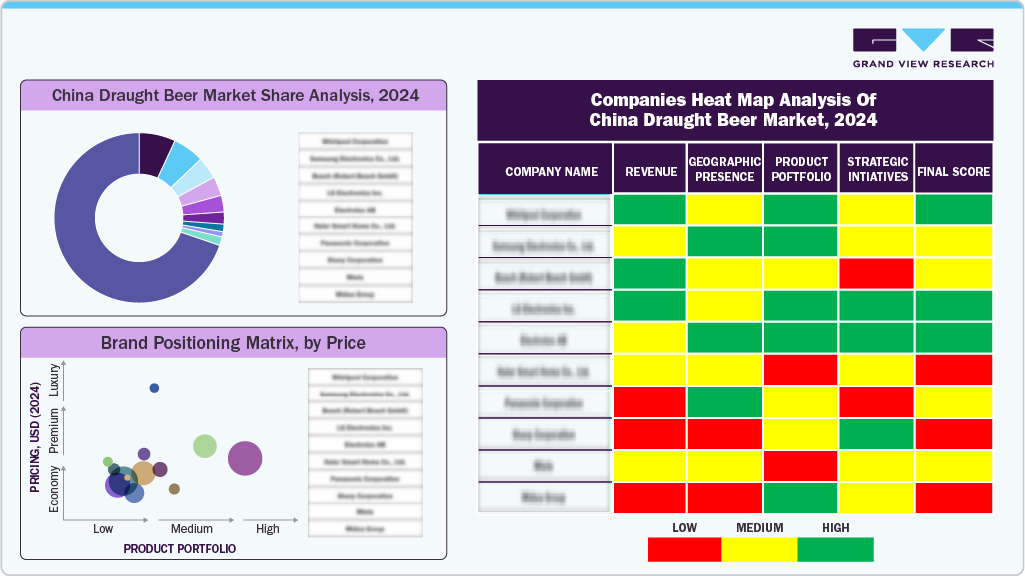

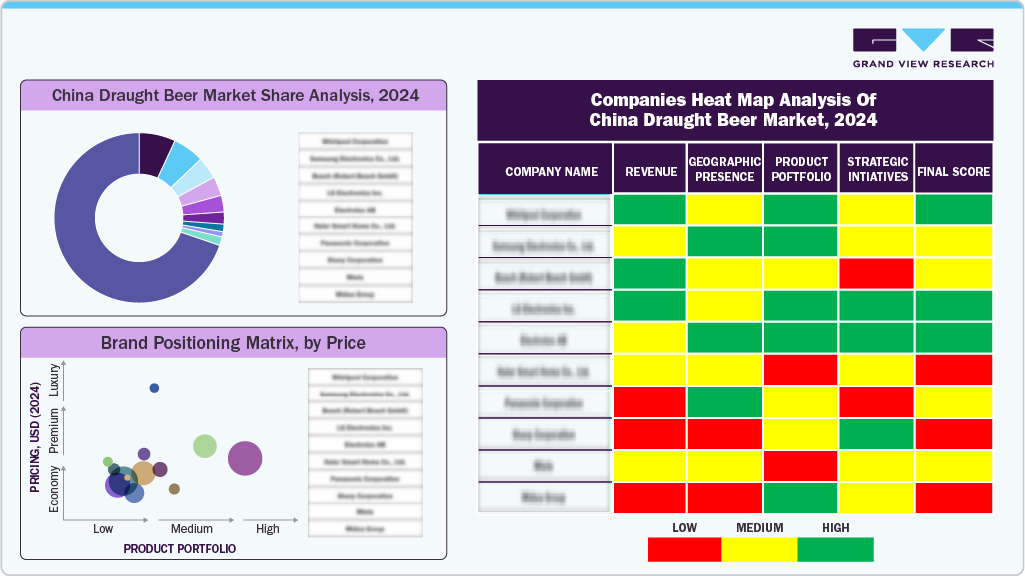

Key China Draught Beer Company Insights

Some of the key players in the China draught beer market include Guangzhou Zhujiang Brewery Co., Ltd., CR Beer Snow, Twin Tails Brewing Co, and others.

- China Resources Beer (Holdings) Company Limited is a leading Chinese beer company headquartered in Beijing, operating as a subsidiary of China Resources Beverage Group. It is best known for its flagship brand Snow Beer, which has held the title of the world’s best-selling beer by volume.

Key China Draught Beer Companies:

- China Resources Beer (Holdings) Company Limited

- Tsingtao Brewery Co., Ltd.

- Guangzhou Zhujiang Brewery Co., Ltd.

- Carlsberg Group

Recent Developments

- In August 2024, Carlsberg Group opened its 27th brewery in Foshan Sanshui, China, with a 5 million hectoliter annual capacity. The facility produces brands such as Wusu, 1664 Blanc, Carlsberg, and Tuborg, expanding Carlsberg’s premium draught beer portfolio.

China Draught Beer Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 3.59 billion

|

|

Revenue forecast in 2033

|

USD 6.38 billion

|

|

Growth rate

|

CAGR of 7.5% from 2025 to 2033

|

|

Actual data

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Type, category, end use, production type

|

|

Key companies profiled

|

China Resources Beer (Holdings) Company Limited; Tsingtao Brewery Co., Ltd.; Guangzhou Zhujiang Brewery Co., Ltd.; Twin Tails Brewing Co.; Carlsberg Group

Carlsberg Group

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

China Draught Beer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the China draught beer market report based on type, category, end use and production type outlook:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Premium

-

Premium

-

Regular

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Production Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Macro Breweries

-

Microbreweries