- Home

- »

- Advanced Interior Materials

- »

-

China Flame Retardant Apparel Market Report, 2020-2027GVR Report cover

![China Flame Retardant Apparel Market Size, Share & Trends Report]()

China Flame Retardant Apparel Market Size, Share & Trends Analysis Report By Fabric (Inherent, Treated), By Product (Disposable, Durable), By End-use (Defense & Law Enforcement, Firefighting), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-133-5

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

Report Overview

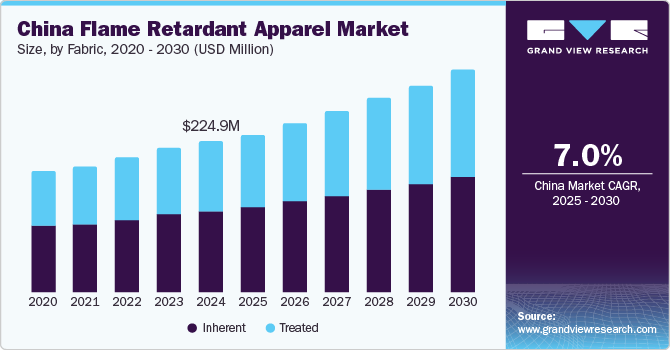

The China flame retardant apparel market size was valued at USD 192.0 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2020 to 2027. Rising demand for flame retardant apparel across the end-use industries, such as oil and gas and petrochemical and chemical, for worker safety is expected to drive the market. Firefighters work in risky environments to conduct rescue operations in an event of a fire. Firefighters are exposed to situations that could result in exposure to fire and heat. Therefore, they need to have proper protective gear in such hazardous situations. Therefore, China is significantly investing in protective apparel for firefighters. The value chain of the market is characterized by the presence of raw material manufacturers/suppliers, intermediate manufacturers, flame retardant apparel manufacturers, distributors, and end-users. Applications of treated fiber types include industrial protective clothing, utilities, and firefighter work uniforms and as inherent fabrics used in the petrochemical, electrical, and utility industries.

Online e-commerce websites such as Alibaba, Made-in-China, and Global Sources remained a preferred choice for small and medium enterprises for expanding their reach to the international markets. However, large players focus on supplying their products directly to cut down distribution costs.

In order to reduce costs, thermally stable fibers are combined with nylon, rayon, or cotton, along with flame retardant chemicals, to create reliable protective clothing fabrics. Thermally stable fibers can withstand temperatures up to 400°C without decomposing or melting. The most common examples of these fibers are aramids used in Kermel, Kevlar, and Nomex.

The average cost of primary flame-resistant clothing can increase by up to 15-20% every year as dirty and damaged clothes need to be replaced when exposed to high levels of inflammable materials, such as oil, grease, and fuel. In addition, wear and tear from normal duties that include tight spaces or heavy machinery may lead to frequent replacement of flame retardant clothing.

Fabric Insights

The inherent fabric segment led the market and accounted for 54.3% share of the total revenue in 2019 owing to the increasing adoption of these fabrics in FR apparel in minimizing the extent of burn injuries. Inherent FR apparel is used by personnel working in the electrical and utility, fire services, and petrochemical industries. However, they are not preferred for use in work environments involving molten substances and welding operations.

Inherent FR fabrics are highly durable and do not lose their flame-resistant properties on washing or extensive usage. Modacrylic fibers, a combination of para-aramid, lyocell, or polyamide-imide fibers, are durable, resistant to chemicals and solvents, non-allergic, and flame resistant. On account of the aforementioned characteristics, the modacrylic fibers are widely used in manufacturing high-performance protective clothing.

Treated FR fabrics comprise natural fibers, such as cotton, cotton-blend, nylon, and rayon, which are chemically treated to make them flame resistant. These fibers obtain flame-resistant properties after treatment with flame retardant chemicals. These fabrics have the ability to self-extinguish when exposed to flame or fire events.

Cotton fibers provide low resistance to abrasion, whereas nylon fibers offer enhanced abrasion resistance. Compared to inherent FR apparel, the cost of treated FR apparel is less. However, the ability of treated FR fabrics to retain flame-resistant properties reduces after multiple washes as well as in the case of soiling or tearing. Hence, to ensure the longevity of the treated FR apparel, proper laundering and maintenance are required.

Product Insights

Disposable flame retardant apparel led the market and accounted for 59.4% share of the overall revenue in 2019. They are used as an outer layer by the personnel working in an environment prone to fire or flame hazards. These apparel aid in providing protection to the personnel as well as to the base layer flame retardant clothing from grime, dirt, chemicals, paint, and dust. They are used in various industries including fire services, oil and gas, mining, petrochemical, military, and law enforcement.

Disposable flame retardant clothing complies with global disposable norms. They are designed for particular purposes, which last for a shorter time period. Therefore, such clothing is less durable but easy to dispose of. The emerging trend of using disposable clothing, along with durable clothing, is expected to drive the FR apparel demand in China.

The durable flame retardant apparel segment is expected to expand at the fastest CAGR of 7.1% from 2020 to 2027 owing to the high-tensile flame-repellent characteristic of the apparel under high pressure and heat. Durability is one of the major features that a customer expects from flame retardant clothing. FR clothing for industries including chemical, mechanical, oil and gas, and nuclear should offer exceptional durability with high performance under adverse environmental conditions.

Durability is linked with prices as clothing offering high durability, i.e., the ability to be useful for more extended periods in extreme heat-pressure conditions is priced higher. Reinforced carbon fibers, thermoplastics, and other engineered fibers are some of the materials employed for manufacturing durable clothing. Hence, the finished products have premier prices when compared to general FR protective clothing.

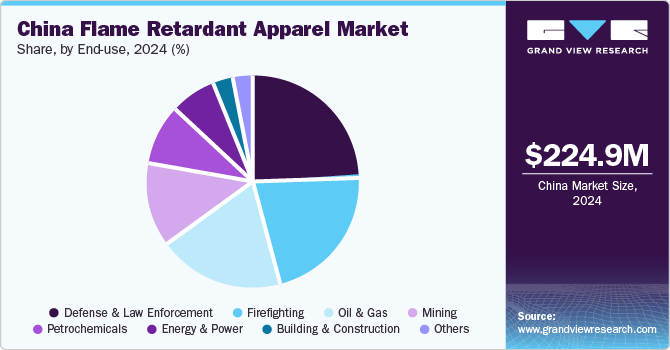

End-use Insights

The defense and law enforcement segment held the largest share of 23.4% in 2019 and is expected to expand at a significant CAGR over the forecast period. Military and law enforcement personnel are exposed to several thermal hazards owing to which they require high-quality flame retardant apparel. FR clothing exhibits self-extinguishing characteristics, which provide valuable escape time to the wearer in a flash fire situation.

FR apparel used by firefighters is made from fabrics and components that are non-conductive and do not melt on the skin of the wearer, thereby preventing any burn injury. FR clothing provides thermal insulation to protect the wearer from heat and fire that could expose the skin to various hazards. The growing importance of FR station wear among firefighters is projected to drive the segment over the forecast period.

According to S&P Global Platts, China’s oil exports grew at a significant rate in 2019 as the country reduced the restrictions in light of strong promotions by the public sector oil companies. The substantial growth of the oil and gas industry in the country, coupled with increasing exploration and extraction activities, is expected to augment the penetration of FR apparel in the oil and gas end-use segment over the forecast period.

Rising awareness about the benefits of renewable energy over conventional sources has augmented its utilization, thereby driving the energy and power generation industry in China. Surging energy demand in various industrial and commercial sectors, including supermarkets, manufacturing facilities, and airports, is expected to drive the power generation industry in the country over the forecast period.

Key Companies & Market Share Insights

Key players are adopting partnership strategies with companies to gain dominance in the market. Players are entering into agreements with regional and local distributors for providing FR apparel to end-users. E-commerce is a key factor driving the sales of flame retardant apparel. Therefore, manufacturers are shifting their focus and concentrating on developing other efficient and effective distribution channels. The market is highly competitive due to the presence of a number of major companies striving to gain market leadership. Key players have integrated along the value chain to further strengthen their market positions. The market has been witnessing M&As and strategic alliances aimed at gaining a competitive advantage. Some of the prominent players in the China flame retardant apparel market include:

-

3M

-

DuPont

-

Cintas Corporation

-

Kimberly-Clark Corporation

-

Williamson-Dickie Mfg. Co.

-

Ansell Ltd.

-

Helly Hansen

-

Xinxiang Shinco Protective Garments Co., Ltd.

-

Karmor Co., Ltd.

-

Xinke Protective

China Flame Retardant Apparel Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 203.9 million

Revenue forecast in 2027

USD 316.1 million

Growth Rate

CAGR of 6.4% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fabric, product, end-use

Key companies profiled

3M; DuPont; Cintas Corporation; Kimberly-Clark Corporation; Williamson-Dickie Mfg. Co.; Ansell Ltd.; Helly Hansen; Xinxiang Shinco Protective Garments Co., Ltd.; Karmor Co., Ltd.; Xinke Protective

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the China flame retardant apparel market report on the basis of the fabric, product, and end use:

-

Fabric Outlook (Revenue, USD Million, 2016 - 2027)

-

Inherent

-

Treated

-

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Disposable

-

Durable

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Defense & Law Enforcement

-

Firefighting

-

Oil & Gas

-

Petrochemicals

-

Mining

-

Energy & Power

-

Building & Construction

-

Others

-

Frequently Asked Questions About This Report

b. The China flame retardant apparel market size was estimated at USD 192.0 million in 2019 and is expected to reach USD 203.9 million in 2020.

b. The China flame retardant apparel market is expected to grow at a compound annual growth rate of 6.4% from 2020 to 2027 to reach USD 316.1 million by 2027.

b. Defense & Law Enforcement dominated the China flame retardant apparel market with a share of 23.4% in 2019 on account of the increasing use of FR clothing in police and military uniforms as it offers protection against electric arcs, flash fires, and firebombs.

b. Some of the key players operating in the China flame retardant apparel market include 3M, DuPont, Cintas Corporation, Kimberly-Clark Corporation, Williamson-Dickie Mfg. Co., Ansell Ltd., Helly Hansen, Xinxiang Shinco Protective Garments Co., Ltd., Karmor Co., Ltd., and Xinke Protective.

b. Key factors that are driving the China flame retardant apparel market include increasing employment in the firefighting sector, rise in the number of forest fires, and growing demand for flame retardant apparel in end-use industries such as law enforcement & defense, oil & gas, and petrochemical.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."