- Home

- »

- Medical Devices

- »

-

China Small Molecule CDMO Market Size, Share Report 2033GVR Report cover

![China Small Molecule CDMO Market Size, Share & Trends Report]()

China Small Molecule CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Active Pharmaceutical Ingredients (API), Finished Drug Products), By Drug (Innovators, Generics), By Application (Oncology, Cardiovascular Disease), And Segment Forecasts

- Report ID: GVR-4-68040-031-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Small Molecule CDMO Market Summary

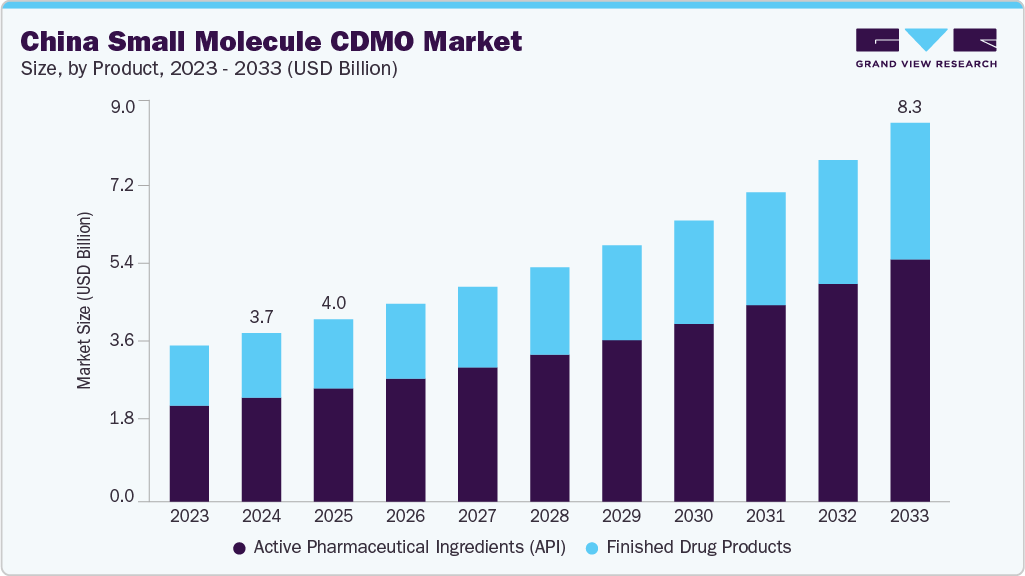

The China small molecule CDMO market size was estimated at USD 3.71 billion in 2024 and is projected to reach USD 8.34 billion by 2033, growing at a CAGR of 9.58% from 2025 to 2033. The market is driven by rising drug discovery efforts in fields such as oncology, cardiovascular, and central nervous system, leading many pharmaceutical companies to outsource.

Key Market Trends & Insights

- The China small molecule CDMO market in the Asia Pacific is expected to grow significantly over the forecast period.

- Based on product, the active pharmaceutical ingredients (API) segment held the highest market share in 2024

- By drug, the innovators segment held the highest market share of 58.03% in 2024.

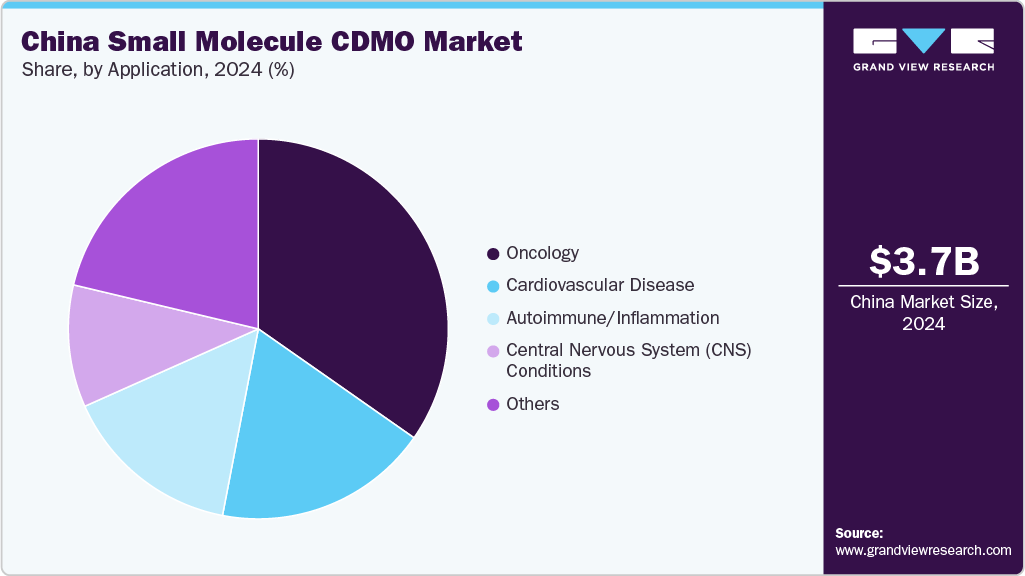

- Based on application, the oncology segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.71 Billion

- 2033 Projected Market Size: USD 8.34 Billion

- CAGR (2025-2033): 9.58%

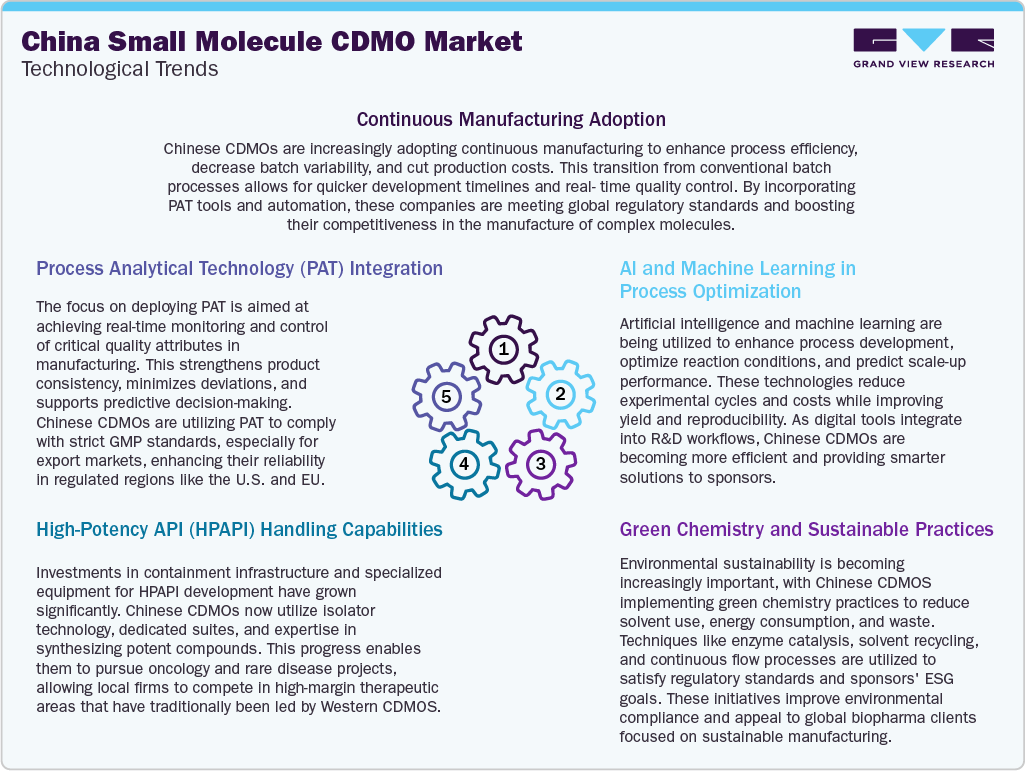

Besides, the small molecule CDMOs in China are characterized by favorable cost structures, a skilled workforce, and a growing range of domestic projects, further becoming appealing partners for both local and international companies. In addition, the market's expansion is fueled by the rising demand for generics and innovative small molecule therapies, further propelling the trend toward integrated, end-to-end development and manufacturing solutions. In addition, growing technological advancements in the market have played a crucial role in enhancing the capabilities of China's CDMO sector, which further supports market growth.Besides, innovations such as process optimization, real-time monitoring via Process Analytical Technology (PAT), and machine learning applications for predictive analytics are increasingly prioritized to improve efficiency and product quality. Moreover, the integration of continuous manufacturing technologies and advanced synthetic chemistry further supports the development of high-potency and complex molecules. This technological advancement has further supported the Chinese CDMOs to compete more effectively in the global arena, particularly for early-phase and high-value niche projects.

Furthermore, increased investments being made to drive small molecule CDMO capabilities, supported by government initiatives like "Made in China 2025," have fueled the Chinese small molecule CDMO facilities in key locations such as Shanghai, Suzhou, and Hangzhou. These investments are enhanced by venture capital and international collaborations. Numerous partnerships and licensing agreements between multinational pharmaceutical companies and local biotechs are reinforcing the domestic CDMO pipeline. Moreover, upgrading facilities compliance with Good Manufacturing Practices (GMP), and strategic acquisitions are also taking place to improve global competitiveness.

Moreover, the China's regulatory environment is evolving to meet international standards with the National Medical Products Administration (NMPA) streamlining the approval processes for innovative drugs and implementing policies designed to protect intellectual property and ensure data exclusivity. However, increased regulatory scrutiny, including routine inspections and quality audits, especially for facilities exporting to the U.S. and Europe, highlights ongoing challenges in the market. Besides, external geopolitical factors, such as potential foreign policy restrictions have led to increased caution regarding engagement with Chinese CDMOs from global stakeholders. Such factors are expected to drive the market growth during the forecast period.

Opportunity Analysis

China's small molecule CDMO industry is experiencing new growth opportunities driven by rising demand for cost-effective API manufacturing, coupled with the expansion of the country’s innovative drug pipeline. This has established local CDMOs as vital partners for both global and domestic companies. Besides, opportunities are especially in areas such as high-potency APIs (HPAPIs), complex generics, and continuous manufacturing platforms. The alignment of local regulations with ICH guidelines and enhanced intellectual property protection facilitates access to regulated markets. In addition, government initiatives like “Made in China 2025” and the development of biotech clusters in cities like Suzhou, Shanghai, and Guangzhou are attracting new foreign investment and encouraging joint ventures. Moreover, the multinational companies are increasingly adopting dual-sourcing strategies, viewing China as a cost-effective site for early-phase or volume-driven production. Furthermore, advancements in automation, digitalization, and green chemistry are opening up new value-added services. As global supply chains evolve, China’s CDMO providers are strategically positioned to broaden their involvement across projects from preclinical stages to commercial production.

The small molecule CDMO market in China is undergoing a transformation driven by key technological advancements that are enhancing competitiveness and regulatory alignment. Continuous manufacturing is being adopted to streamline production, reduce cycle times, and ensure consistent product quality. This transition from batch to continuous processing enables faster scale-up and improved cost-efficiency. Moreover, along with this, the integration of Process Analytical Technology (PAT) allows real-time monitoring of critical process parameters, ensuring greater process control and regulatory compliance. Besides, significant investments have been made in high-potency API (HPAPI) handling capabilities, including specialized containment facilities and expertise in potent compound synthesis, positioning Chinese CDMOs to support oncology and niche therapeutics. Furthermore, artificial intelligence and machine learning are leveraged for process optimization, predictive analytics, and formulation modeling, enabling faster and more reliable development cycles. Besides, complementing these advancements, a growing emphasis on green chemistry and sustainable practices is driving the adoption of environmentally responsible techniques, including solvent recycling and biocatalysis. Thus, these innovations are expected to drive the small molecule CDMO market in China.

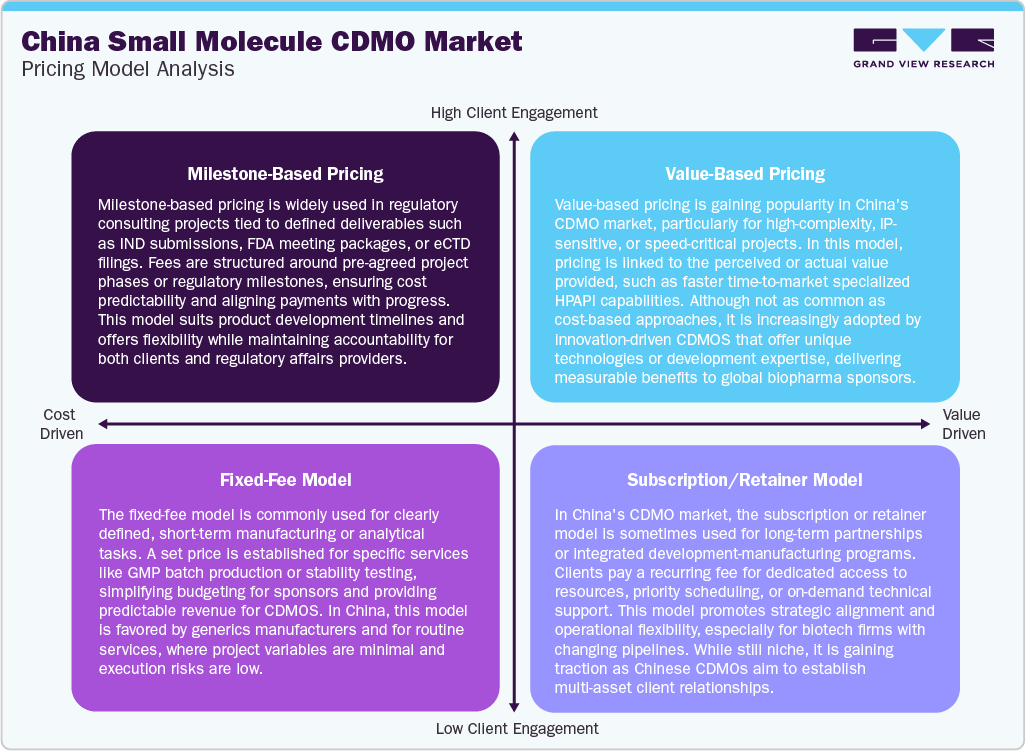

The small molecule CDMO market in China is driven by various pricing models employed to meet diverse sponsor needs. Milestone-based pricing is widely used for development projects, where payments are tied to key deliverables such as process development, clinical batch completion, or regulatory submissions. This model supports risk-sharing and offers financial flexibility. Fixed-fee models are commonly applied to routine or well-scoped projects like GMP manufacturing or analytical testing, ensuring cost predictability and operational efficiency. Value-based pricing is gradually emerging, particularly for complex or high-value services such as HPAPI development, where fees are linked to outcomes like accelerated timelines or technical differentiation. It reflects a shift toward performance-aligned compensation. Moreover, the subscription or retainer model is used in strategic, long-term partnerships where clients pay recurring fees for dedicated capacity, priority access, or continuous support. Also, this model is gaining traction among biotech sponsors seeking integrated, multi-project engagements with Chinese CDMOs.

Market Concentration & Characteristics

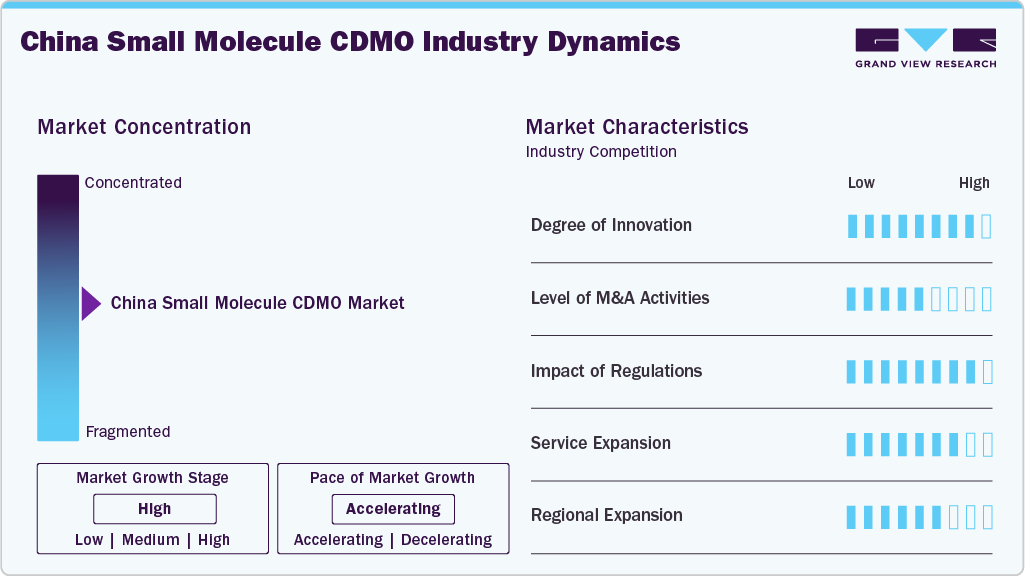

The China small molecule CDMO industry growth stage is moderate, with an accelerating pace. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

The market is experiencing significant innovation due to advancements in continuous manufacturing, high-potency capabilities, and digitalization. Increased R&D investment and technology transfer from multinational partners are boosting innovation in process development and formulation services.

M&A activity in the Chinese small molecule CDMO sector is rising, as local companies acquire niche technology firms and international players enter through joint ventures. These transactions are focused on expanding capacity, diversifying services, and accessing regulated market capabilities.

China's regulatory reforms have positively impacted the CDMO market by aligning more closely with ICH standards, speeding up approvals, and strengthening GMP enforcement. However, geopolitical scrutiny and export restrictions have introduced uncertainty for CDMOs catering to U.S. and European pharmaceutical clients.

These CDMOs are broadening their service offerings to include end-to-end solutions like API synthesis, formulation development, analytical services, and clinical supply. The growing demand for HPAPI, controlled substances, and complex generics is driving innovation and specialization throughout the development stages.

The CDMOs are expanding regionally by developing facilities in ASEAN, the EU, and the U.S. markets. This approach enhances global compliance, mitigates geopolitical risk, and improves their capacity to serve multinational clients looking for localized or dual-sourced manufacturing options.

Product Insights

Based on product, the active pharmaceutical ingredients (API) segment dominated the market in 2024. The segment is driven by low production costs, robust infrastructure, and a skilled chemical workforce. Besides, rising demand for generics, complex APIs, and high-potency compounds. Regulatory alignment with ICH-GMP standards and increasing investments in quality systems have enhanced China’s position as a reliable supplier. Despite geopolitical scenarios and compliance scrutiny, Chinese CDMOs continue to expand capabilities in continuous manufacturing, green chemistry, and HPAPI handling, positioning themselves as strategic partners for global pharmaceutical and biotech companies.

On the other hand, the finished drug products segment is expected to witness growth at a CAGR of 8.86% over the forecast period. The finished drug products are fueled by rising demand for both generic and innovative medications. Improved manufacturing capabilities, compliance with international quality standards, and investments in advanced formulation technologies have fueled the country’s competitiveness in the market. Also, regulatory reforms have enabled quicker approvals and enhanced compliance, further supporting market growth. Moreover, the country is broadening its offerings in finished dosage forms, including solid and liquid formulations, making it a preferred partner for domestic and international pharmaceutical companies focusing on reliable, cost-effective contract manufacturing solutions.

Drug Insights

In terms of drug, the innovators segment accounted for the largest share in 2024. China’s small molecule CDMO innovators segment is driven by a rise in domestic R&D and increased collaborations with global pharmaceutical companies. Innovations in process chemistry, high-potency APIs, and advanced manufacturing technologies are expected to enhance market competitiveness, further contributing to market growth. Besides, favorable government policies and regulatory reforms have supported the adoption of innovation and sped up product development timelines. Moreover, with the rising challenges such as intellectual property protection and international scrutiny persisting, the country’s innovators are playing a more significant role in developing complex molecules and offering specialized services. This positions them as crucial partners for global biopharmaceutical sponsors seeking efficient, innovative, and scalable small molecule solutions.

On the other hand, the generics segment is expected to grow significantly over the forecast period. The market is expanding rapidly, propelled by strong domestic demand and government initiatives promoting affordable healthcare. Competitive manufacturing costs, increasing capacity, and streamlined regulatory pathways have enabled local CDMOs to scale generic API and finished product production efficiently. Despite intense competition and pricing pressures, innovation in complex generics and enhanced quality standards has improved market positioning. These factors are expected to drive market growth over the estimated time period.

Application Insights

Based on application, in 2024, the oncology segment dominated the market, accounting for a revenue share of 34.71%. The oncology segment is driven by the rising prevalence of cancer, greater investment in R&D, and an expanding array of targeted therapies. CDMOs are stepping up their capabilities in high-potency API manufacturing, complex formulation development, and continuous processing to support the innovation of oncology drugs. Besides, supportive government policies, better regulatory alignment, and increased collaborations with multinational pharmaceutical companies are further fueling the market growth. With advancements in process optimization and a focus on oncology therapeutics, Chinese CDMOs are becoming key strategic partners for global and domestic companies working on next-generation small molecule cancer treatments. Such factors are expected to drive the market over the estimated time period.

On the other hand, the cardiovascular disease segment is expected to grow significantly during the forecast period. The market is expanding, supported by a high disease burden and growing demand for effective therapies. Besides, increased focus on chronic disease management and rising healthcare spending fuel the formulation and API outsourcing. In addition, the CDMOs in the country are enhancing capabilities in complex synthesis, sustained-release formulations, and large-scale production to meet evolving sponsor needs. With strong domestic expertise and alignment with global quality standards, CDMOs are well-positioned to support both branded and generic cardiovascular drugs, serving as valuable partners in accelerating development and manufacturing for global pharmaceutical companies. Such factors are expected to drive the market over the estimated time period.

Key China Small Molecule CDMO Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in April 2023, Crystal Pharmatech received a “Drug Manufacturing License” from the Jiangsu Medical Products Administration, a division of the Chinese National Medical Products Administration (NMPA). This accreditation establishes Crystal Formulation Services as a prominent formulation CDMO by verifying compliance with the stringent quality standards of the Chinese NMPA for drug production, including Good Manufacturing Practice (GMP) facilities, software systems, and overall quality systems. Such innovations are expected to drive market growth.

Key China Small Molecule CDMO Companies:

- Lonza

- Catalent, Inc

- Thermo Fisher Scientific Inc.

- Bellen Chemistry

- Siegfried Holding AG

- Recipharm AB

- Eurofins Scientific

- WuXi AppTec

- Asymchem Laboratories

- Langhua Pharmaceutical (Viva Biotech subsidiary)

- Apeloa Pharmaceutical

- JiuZhou Pharmaceutical

Recent Developments

- In July 2025, Flamma, a CDMO, mentioned its new cGMP-compliant facility in China. This strategic expansion is set to strengthen the company’s ability to manufacture and supply small-molecule active pharmaceutical ingredients (APIs), supporting the development and commercialization efforts of innovator pharmaceutical partners across global markets.

China Small Molecule CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.01 billion

Revenue forecast in 2033

USD 8.34 billion

Growth Rate

CAGR of 9.58% from 2025 to 2033

Actual Data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, drug, application

Country scope

China

Key companies profiled

Lonza; Catalent, Inc.; Thermo Fisher Scientific Inc.; Bellen Chemistry; Siegfried Holding AG; Recipharm AB; Eurofins Scientific; WuXi AppTec; Asymchem Laboratories; Langhua Pharmaceutical (a Viva Biotech subsidiary); Apeloa Pharmaceutical; JiuZhou Pharmaceutical.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Small Molecule CDMO Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the China small molecule CDMO market report based on product, drug, and application.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Active Pharmaceutical Ingredients (API)

-

Finished Drug Products

-

-

Drug Outlook (Revenue, USD Million, 2021 - 2033)

-

Innovators

-

Generics

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Cardiovascular Disease

-

Central Nervous System (CNS) Conditions

-

Autoimmune/Inflammation

-

Others

-

Frequently Asked Questions About This Report

b. The China small molecule CDMO market size was estimated at USD 3.71 billion in 2024 and is expected to reach USD 4.01 billion in 2025.

b. The China small molecule CDMO market is expected to grow at a compound annual growth rate of 9.58% from 2025 to 2033 to reach USD 8.34 billion by 2033.

b. The Active Pharmaceutical Ingredients (API) segment dominated the China small molecule CDMO market with a share of 61.80% in 2024. The segment growth is driven by low production costs, robust infrastructure, and a skilled chemical workforce. Besides, rising demand for generics, complex APIs, and high-potency compounds is expected to fuel the market over the estimated period.

b. Some key players operating in the China small molecule CDMO market include Lonza, Catalent, Inc., Thermo Fisher Scientific Inc., Bellen Chemistry, Siegfried Holding AG, Recipharm AB, Eurofins Scientific, WuXi AppTec, Asymchem Laboratories, Langhua Pharmaceutical (a Viva Biotech subsidiary), Apeloa Pharmaceutical, and JiuZhou Pharmaceutical among others.

b. Key factors driving the China small molecule CDMO market growth include rising drug discovery efforts in fields like oncology, cardiovascular, and central nervous system, leading many pharmaceutical companies to outsource. Besides, the small molecule CDMOs in China are characterized by favorable cost structures, a skilled workforce, and a growing range of domestic projects, further becoming appealing partners for both local and international companies, which is expected to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.