- Home

- »

- Renewable Chemicals

- »

-

Chondroitin Sulfate Market Size, Share, Industry Report 2033GVR Report cover

![Chondroitin Sulfate Market Size, Share & Trends Report]()

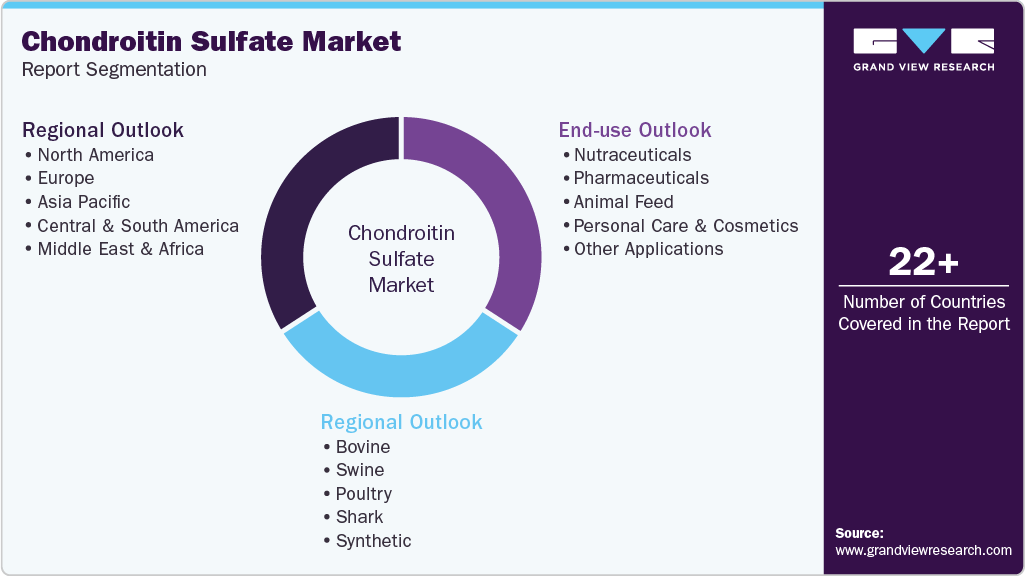

Chondroitin Sulfate Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Bovine, Shark, Swine, Poultry, Synthetic), By Application (Nutraceuticals, Pharmaceuticals, Animal Feed, Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-501-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Chondroitin Sulfate Market Summary

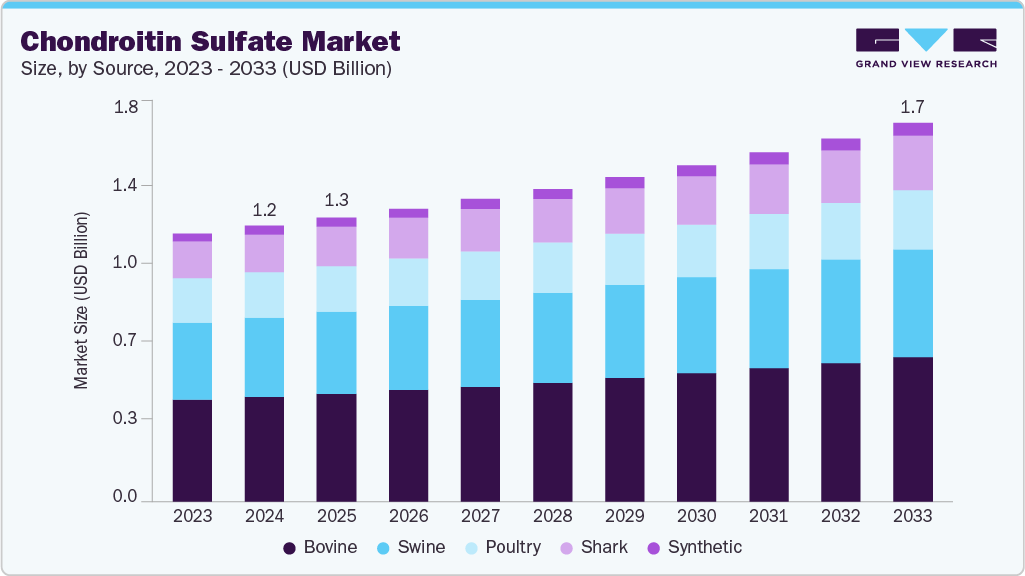

The global chondroitin sulfate market size was estimated at USD 1,221.59 million in 2024 and is projected to reach USD 1,679.17 million by 2033, growing at a CAGR of 3.7% from 2025 to 2033. The demand for chondroitin sulfate is expected to grow significantly, supported by the increasing popularity of nutraceutical products and the rising prevalence of osteoarthritis.

Key Market Trends & Insights

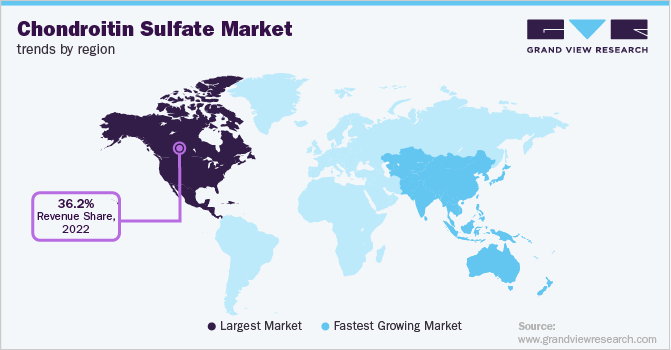

- The North America regional segment dominated the market with a revenue share of over 36.2% in 2024.

- The chondroitin sulfate market in the U.S. is expected to grow at a substantial CAGR of 3.7% from 2025 to 2033.

- By source, the synthetic segment is expected to grow at a considerable CAGR of 4.9% from 2025 to 2033 in terms of revenue.

- By application, the pharmaceuticals segment is expected to grow at a considerable CAGR of 4.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,221.59 Million

- 2033 Projected Market Size: USD 1,679.17 Million

- CAGR (2025-2033): 3.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Pharmaceutical-grade chondroitin sulfate is primarily used in the management of osteoarthritis, cataracts, and urinary tract infections (UTIs), which contributes to its market growth. In addition, it is used in certain medications aimed at regulating blood sugar, supporting liver health, and inhibiting the spread of tumors. Overall, the market is likely to benefit from expanding applications in osteoarthritis care and other health conditions.Chondroitin sulfate is composed of a long chain of sugars, including glucuronic acid and N-acetylgalactosamine. It naturally occurs in human connective tissues, cartilage, and joints, and its regular intake is known to help maintain healthy joint function. Beyond human use, chondroitin sulfate also finds applications in veterinary treatments and is an ingredient in eye drops for alleviating dry eyes. The meat industry plays a crucial role in meeting the demand for chondroitin sulfate, as increased meat consumption and the high need for animal-based ingredients in the pet sector help fuel market growth. Animal parts such as kidneys, spleens, livers, brains, and lungs are highly nutritious and serve various industrial purposes. For example, countries like Japan, China, and India utilize animal glands and organs for medicinal uses.

Animal intestines are processed to produce tallow, fertilizers, meat meal, and pet food, while pig and cattle liver extracts supply vitamin B12 as a supplement for treating certain forms of anemia. Fish by-products with excess bones or oil are repurposed for industrial feed. Cartilage itself is a key source for extracting collagen and chondroitin sulfate, which are then incorporated into pharmaceutical, nutraceutical, cosmetic, and food applications.

The growing consumption of meat and meat-based ingredients has resulted in an increase in animal slaughter, which in turn supports the production of chondroitin sulfate since it is derived from cartilage obtained post-slaughter. Osteoarthritis, one of the most common musculoskeletal conditions among older adults, affects joint function, limits mobility, and causes chronic pain. Chondroitin sulfate is commonly used to manage osteoarthritis by easing pain, slowing disease progression, and reducing symptoms. As osteoarthritis becomes more widespread, especially in developed countries like the U.S. and the UK, the demand for chondroitin sulfate is expected to rise further.

Osteoarthritis remains one of the most widespread musculoskeletal disorders among the elderly, leading to joint pain, restricted mobility, and discomfort. Chondroitin sulfate is widely used to manage osteoarthritis by easing pain, slowing disease progression, and improving joint function. Rising cases of osteoarthritis in developed regions like the U.S. and the UK are expected to boost the demand for chondroitin sulfate in therapeutic applications.

According to the CDC, around 67 million people in the U.S. are projected to have arthritis by 2025, while Arthritis Research UK estimates over 8.3 million individuals may suffer from knee osteoarthritis by 2035. This growing prevalence is fueling the need for chondroitin sulfate in pharmaceuticals, nutraceuticals, and dietary supplements. The aging population, higher healthcare spending, and greater awareness of preventive care are driving manufacturers to increase production for joint health products.

Beyond human health, chondroitin sulfate plays a key role in pet nutrition and veterinary supplements, helping manage conditions like arthritis and hip dysplasia in animals. Sourced from bovine, shark, poultry, and swine cartilage, the extraction process is complex and costly due to strict purity standards and price fluctuations in raw materials. These challenges can raise production costs, but the proven benefits for both humans and animals continue to support steady demand in food, feed, and healthcare markets.

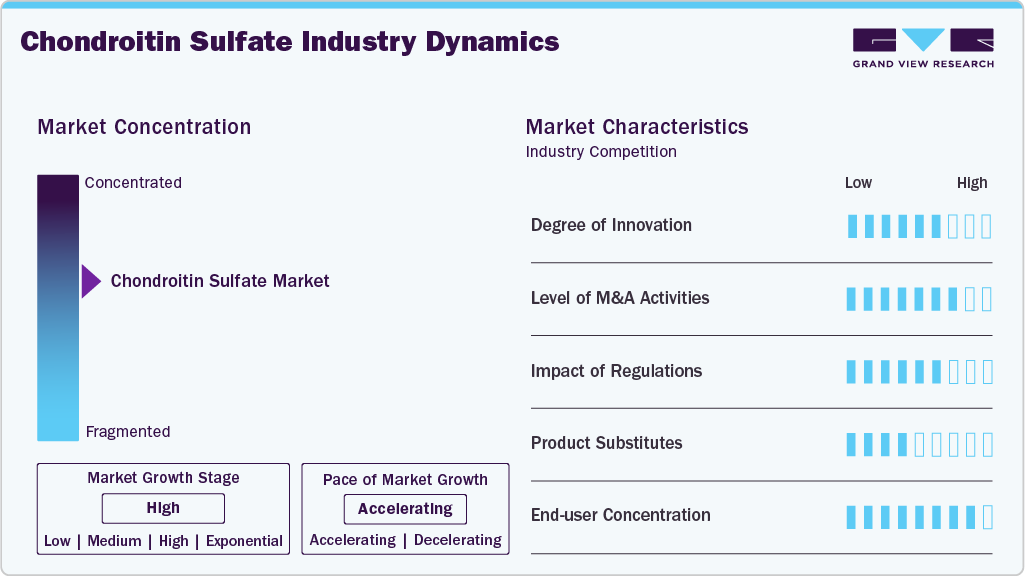

Market Concentration & Characteristics

The global market for chondroitin sulfate is relatively concentrated, with a number of companies primarily serving specific regional markets. Key players operating in this space include TSI Group Ltd., Hebei SanXin Industrial Group, Sino Siam Biotechnique Company Ltd., and Bio-gen Extracts Pvt. Ltd. Many of these companies have secured exclusive partnerships with distributors to effectively reach end users and expand their market presence.

Major producers based in developed countries such as the U.S., France, Germany, and the UK supply a significant portion of chondroitin sulfate to leading firms in the nutraceutical and pharmaceutical sectors. Market expansion is supported by the increasing incidence of osteoarthritis and a higher uptake of dietary supplements. However, the industry remains highly competitive due to the substantial capital needed for operations and the heavy investment in research and development to enhance product quality and efficiency. For example, Foodchem International Corporation is known for producing high-grade chondroitin sulfate, which is widely used in nutraceutical and pharmaceutical applications. The company focuses on delivering products with high purity and effectiveness, addressing the rising demand for supplements that support joint health and overall wellness.

Source Insights

The bovine source segment dominated the global industry in 2024 and accounted for a maximum share of more than 37.9% of the overall revenue. This is attributed to the increased usage of the source in a variety of application industries, including pharmaceutical, personal care & cosmetics, and nutraceuticals globally. Pharmaceutical, nutraceutical, and animal feed industries are among the few sectors that use chondroitin sulfate made from sharks. Shark is currently regarded as an endangered species, which may impede the expansion of the sector.

The capacity to treat persons with HIV, arthritis and gut inflammation makes the shark-derived product the preferred form, and this preference is anticipated to further fuel demand during the projection period. Synthetic sodium chondroitin sulfate is produced utilizing a two-stage fermentation-based technique. Because animal cartilage is not used in the process, there is a low risk of contamination and adulteration. Low sourcing costs are also a result of the extraction process' simplicity. In addition, it can be used as an alternative by vegetarians and other people with dietary and religious limitations, and thus, its demand is anticipated to increase in Asian and Middle Eastern nations.

Specialty enzymes segment is expected to grow at the fastest CAGR of 4.9% during the forecast period from 2025 to 2033. This segment is propelled due to increasing demand for premium-grade, highly purified formulations used in advanced nutraceuticals and pharmaceuticals. Rising consumer preference for clinically validated joint health products, growing awareness of preventive healthcare, and technological advancements in extraction and purification processes are boosting this segment. In addition, expanding applications in veterinary medicine and personalized nutrition are further driving its global market growth.

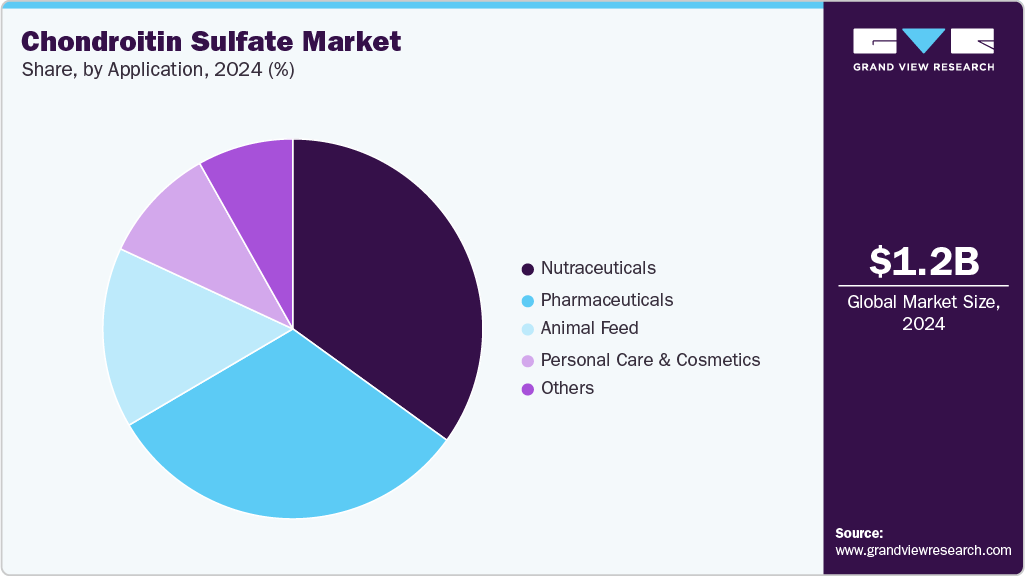

Application Insights

The nutraceutical segment dominated the industry in 2024 and accounted for the largest share of 35.0% of the overall revenue. Its high share is attributed to the rising investments in the sector on account of the need to develop new and more effective dietary supplements. In the nutraceutical sector, it is frequently used as a dietary supplement to treat osteoarthritis and joint discomfort. They are ingested to soothe arthritis pain and to fortify bones, cartilage, and joints. The source is classed considering the national laws of each nation.

It is prescribed as a dietary supplement and combined with glucosamine to relieve arthritic pain in the United States. In nations like the U.S., rising dietary supplement consumption is predicted to fuel market expansion. Furthermore, animal feed additives often contain glucosamine hydrochloride and chondroitin sulfate. To improve joint health and mobility, pet diets, particularly those for dogs and cats, contain chondroitin sulfate from bovine sources. The medicine is also used to treat hip dysplasia, osteoarthritis, intervertebral disc disease, and chronic discomfort from patellar luxation and intervertebral disc disease.

The pharmaceuticals segment is predicted to grow at a CAGR of 4.0% from 2025 to 2033 during the forecast period. This segment is increasing due to the rising prevalence of osteoarthritis and other joint-related conditions among aging populations worldwide. Increasing adoption of chondroitin sulfate in prescription medications for pain relief and cartilage repair, combined with supportive clinical studies validating its therapeutic benefits, is driving demand. In addition, expanding healthcare expenditure, better patient access to treatment, and growing awareness of non-surgical management of joint disorders are boosting this segment’s growth.

Regional Insights

North America chondroitin sulfate industry dominated globally with a revenue share of 36.2% in 2024. This is attributed to the rising pharmaceutical sector in the United States, along with the FDA’s approval for the use of goods containing sodium chondroitin sulfate. In addition, the demand is expected to be fueled by factors such as the increasing prevalence of osteoarthritis, rising usage of cholesterol treatment, cataract surgery, and formulations for eye drops. The pharmaceutical, cosmetics, culinary, pet food, and veterinary industries are among the few industries in Europe that use chondroitin sulfate. In dietary supplements, chondroitin sulfate is used as an alternative therapy to treat osteoarthritis.

U.S. Chondroitin Sulfate Market Trends

The chondroitin sulfate industry in the U.S. derives chondroitin sulfate from bovine sources, which remains widely preferred for managing osteoarthritis, HIV, heart conditions, and high cholesterol. The country’s expanding elderly population, combined with a strong consumer shift toward dietary supplements for joint and heart health, continues to fuel demand. This growing focus on preventive care and wellness is expected to further drive market growth.

Asia Pacific Chondroitin Sulfate Market Trends

The Asia Pacific chondroitin sulfate industryis expected to witness the fastest CAGR of 4.1% from 2025 to 2033. This is attributed to the expansion of end use industries including nutraceutical, pharmaceutical, personal care, and cosmetics. Increasing production of chondroitin sulfate in the region and increasing exports from key countries such as China and Japan are anticipated to contribute to the market growth.

The chondroitin sulfate industry in China is fragmented in nature with the presence of over 200 manufacturers. Raw material is a prominent cost driving factor, accounting for a major share of the final product price. However, high product export from China to developed countries such as the U.S. and some European countries is expected to further drive the market. The U.S. Food and Drug Administration (FDA) recognized "oversulfated chondroitin sulfate" as a pollutant in heparin originating from the country, which is anticipated to hamper the market growth in China.

Chondroitin sulfate industry in Japan widely uses the product in pharmaceutical and cosmetic sectors. Burgeoning aging population has led to a surge in the prevalence of osteoarthritis in the country. Chondroitin sulfate reduces the swelling and pain associated with osteoarthritis and helps recover knee function. It is also used in eye drops, energy foods, and metabolic drugs, which is projected to drive the product demand in the country.

Europe Chondroitin Sulfate Market Trends

The Europe chondroitin sulfate industry is growing significantly on account of the increased use of sodium chondroitin sulfate-infused pharmaceuticals and nutraceuticals, which are expected to boost the market in Europe. Chondroitin sulfate is generally used to treat osteoarthritis, relieve joint pain, treat heart problems & excessive cholesterol, and prepare eye drops. The growing aging population in emerging nations like China and India has led to a high frequency of osteoarthritis and other joint health-related problems. The pharmaceutical industry in the Asia Pacific is expected to see increased demand for sources due to an increase in the prevalence of osteoarthritis and its growing inclusion in the treatment of various medical disorders.

The chondroitin sulfate industry in Germany indicates major uses of chondroitin sulfate in the treatment of osteoarthritis, on account of the high disease occurrence rate in the country. The product is also used in several food products and dietary supplements. Rising number of patients suffering from osteoarthritis coupled with increasing product demand from nutraceutical sector is anticipated to drive the market in the country over the coming years.

The Spain chondroitin sulfate industry explicitly uses the product in nutraceutical products and dietary supplements. Spain has emerged as a key market for R&D activities in new nutraceutical products. Manufacturers in the country are focusing on product innovation and thus, are spending a high amount on R&D activities. The development of nutraceutical products infused with chondroitin sulfate is anticipated to further drive the market over the forecast period.

Latin America Chondroitin Sulfate Market Trends

Latin America chondroitin sulfate industry growth can be attributed to the surging demand for medicines and dietary supplements in key countries such as Brazil and Argentina. Bovine-derived chondroitin sulfate is mainly preferred in the region as key countries are involved in beef farming as well as in domestic consumption of chondroitin sulfate products. Furthermore, high prevalence of osteoarthritis coupled with rising consumer awareness regarding healthy diet is anticipated to drive the product demand. Carbosynth is a prominent manufacturer and supplier of chondroitin sulfate in the region.

The Brazil chondroitin sulfate industry majorly uses the product in the production of pharmaceutical and nutraceutical products. The development of pharmaceutical industry in the country can be attributed to innovation, impressive local pharmaceutical products production, and undertaking public policies, which provide access to medicines. The well-educated youth in the country is inclined toward the consumption of dietary supplements in order to boost immunity and protein intake. These factors are anticipated to drive product demand in the country.

Middle East & Africa Chondroitin Sulfate Market Trends

The Middle East chondroitin sulfate industry uses the product in pharmaceutical sector to treat patients suffering from osteoarthritis. Most of the aging population in the region has experienced a few symptoms of osteoarthritis. These individuals face difficulties in performing daily activities. Rising awareness of pharmaceutical manufacturers regarding the effectiveness of chondroitin sulfate in the treatment of osteoarthritis is contributing to the market growth in the region.

South Africa chondroitin sulfate industry is anticipated to grow significantly over the forecast period. Knee osteoarthritis has been a major concern in the urban part of South Africa over the past decade, as over 50% of the aging population was prone to osteoarthritis. Chondroitin sulfate is primarily used in pharmaceutical, nutraceutical, and animal feed applications. Increased consumption of dietary supplements in order to boost immune system along with the growth of pharmaceutical sector in the country is anticipated to drive the product demand.

Key Chondroitin Sulfate Company Insights

Due to the presence of numerous manufacturers, particularly in China, the industry is highly fragmented. Due to the rising R&D expenditures for source innovation and improving source efficiency, there is intense competition in the industry. High competitive rivalry is indicated by high competitiveness in the source’s final prices and producers’ shifting priorities toward greater use of natural extracts. Sustainable raw material sourcing and effective sourcing techniques are the main areas of concern for manufacturers. To make the sources, companies are turning to cartilage with a high-purity concentration. For example, ZPD provides multiple grades that contain 20%, 40%, and 80% sodium chondroitin sulfate as well as other forms of sodium chondroitin sulfate components that are consistent with regulations for pet food makers.

Some of the key players operating in the market include

-

TSI Group Ltd. manufactures and distributes innovative and functional health products. It develops ingredients and finished dosage forms for human consumption, including tablets, stick packs, powders, and two-piece hard capsules. The ingredients are backed by an inclusive technical dossier of clinical studies, safety information, and technical specifications. It has custom manufacturing solutions and expertise in formulation development. The company follows vertically integration, which turns raw materials, both proprietary and conventional, into profitable solutions. It offers chondroitin sulfate-based supplements, pharmaceutical products, and food-grade products under the PUREFLEX brand.

-

Qingdao Wan Toulmin Biological Products Co., Ltd specializes in the development, manufacturing, and distribution of high-quality chondroitin sulfate and collagen peptides-based products worldwide. The company has adopted a quality management system that complies with ISO and CGMP 9001. It is fully integrated and involved in purchasing, production, warehousing, documentation, quality control, and other functional departments, and resources quality assurance of products.

Key Chondroitin Sulfate Companies:

The following are the leading companies in the chondroitin sulfate market. These companies collectively hold the largest market share and dictate industry trends.

- TSI Group Ltd.

- Qingdao Wan Toulmin Biological Sources Co., Ltd.

- Hebei SanXin Industrial Group

- Bioiberica SAU

- Sigma Aldrich, Inc.

- ZPD

- Sino Siam Biotechnique Company Ltd.

- BRF

- Bio-gen Extracts Pvt. Ltd.

- Comp10

Recent Development

-

In April 2024, Borsch Med Pte Ltd, a company specializing in health and nutrition, revealed its collaboration with Zeria Pharmaceutical Co. Ltd. Under this partnership, Zeria will act as the official distributor of Borsch Med’s chondroitin-based products within the Singapore market.

-

In May 2024, BRF SA, a leading player in the biopharmaceuticals and nutraceuticals sector known for its production of chondroitin sulfate, entered into a strategic supply agreement with SALIC (Saudi Agricultural and Livestock Investment Company). Under this deal, SALIC will have the option to procure up to 200,000 pounds of products annually to support food security measures in Saudi Arabia during emergencies.

Chondroitin Sulfate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,257.88 million

Revenue forecast in 2033

USD 1,679.17 million

Growth rate

CAGR of 3.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, Volume in Tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Taiwan; Brazil; Argentina; Chile; Colombia; South Africa

Key companies profiled

TSI Group Ltd.; Qingdao Wan Toulmin Biological Sources Co., Ltd.; Hebei SanXin Industrial Group; Bioiberica SAU; Sigma Aldrich, Inc.; ZPD; Sino Siam Biotechnique Company Ltd; BRF; Bio-gen Extracts Pvt. Ltd.; Seikagaku Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chondroitin Sulfate Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global chondroitin sulfate market report based on source, application, and region.

-

Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2033)

-

Bovine

-

Swine

-

Poultry

-

Shark

-

Synthetic

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2033)

-

Nutraceuticals

-

Pharmaceuticals

-

Animal Feed

-

Personal Care & Cosmetics

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chondroitin sulfate market size was estimated at USD 1,221.59 million in 2024 and is expected to reach USD 1,257.88 million in 2025.

b. The global chondroitin sulfate market is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2033, reaching USD 1,679.17 million by 2033.

b. North America dominated the chondroitin sulfate market with a share of 36.2% in 2024. This is attributable to the booming pharmaceutical industry in the U.S. coupled with the FDA approval for using sodium chondroitin sulfate-infused products.

b. Some key players operating in the enzymes market include TSI Group Ltd.; Qingdao Wan Toulmin Biological Sources Co., Ltd.; Hebei SanXin Industrial Group; Bioiberica SAU; Sigma Aldrich, Inc.; ZPD; Sino Siam Biotechnique Company Ltd; BRF; Bio-gen Extracts Pvt. Ltd.; Seikagaku Corp.

b. Key factors that are driving the market growth include increasing demand for joint health supplements along with prevalence of osteoarthritis among geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.