- Home

- »

- Medical Devices

- »

-

Chronic Wound Care Market Size, Industry Report, 2033GVR Report cover

![Chronic Wound Care Market Size, Share & Trends Report]()

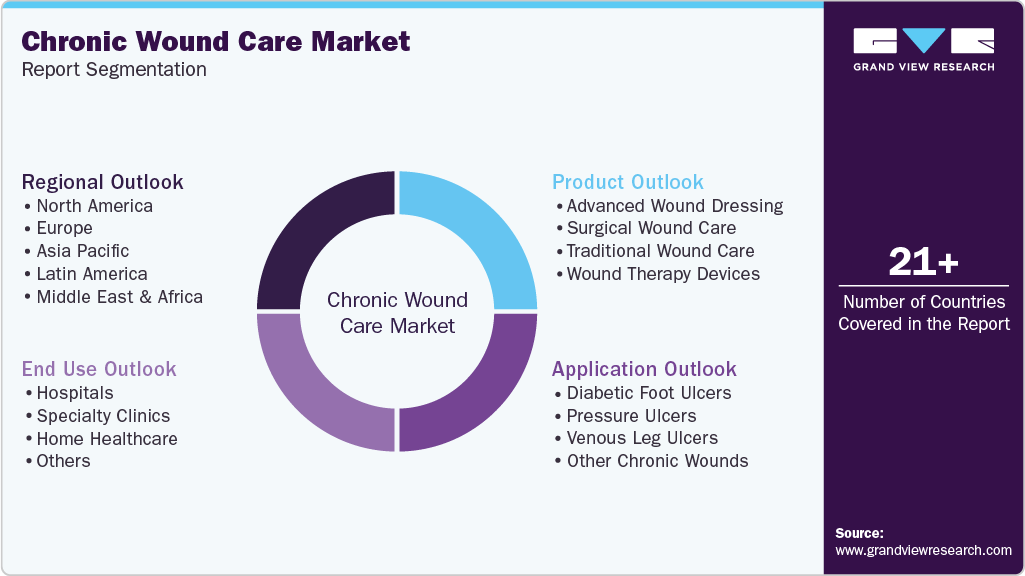

Chronic Wound Care Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Advanced Wound Dressing, Surgical Wound Care, Traditional Wound Care, Wound Therapy Devices), By Application (Diabetic Foot Ulcers, Pressure Ulcers), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-004-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chronic Wound Care Market Summary

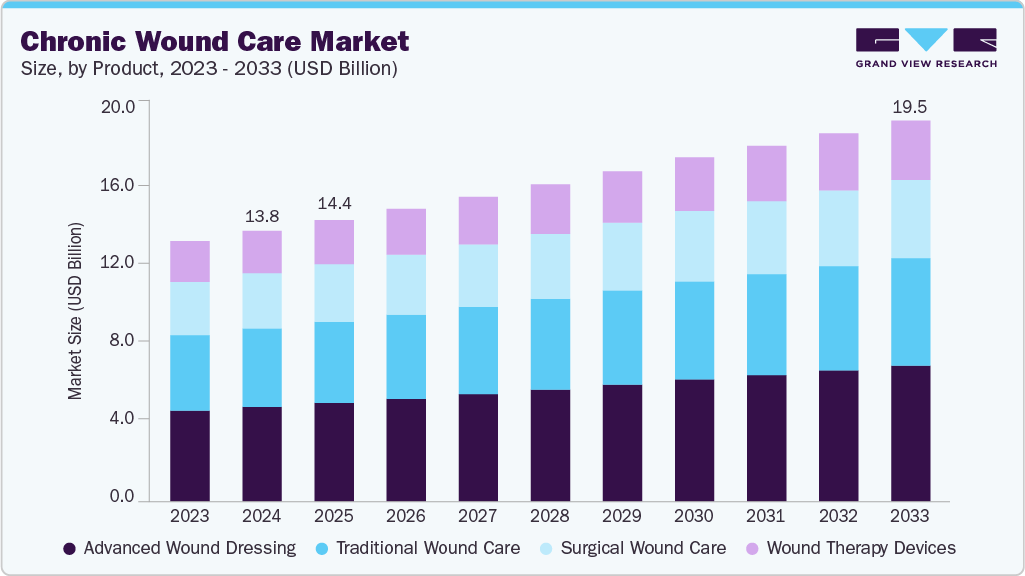

The global chronic wound care market size was estimated at USD 13.8 billion in 2024 and is projected to reach USD 19.5 billion by 2033, growing at a CAGR of 4.11% from 2025 to 2033. The chronic wound care market continues to expand due to rising diabetes-related ulcers, a growing geriatric population, and increasing prevalence of pressure and venous leg ulcers.

Key Market Trends & Insights

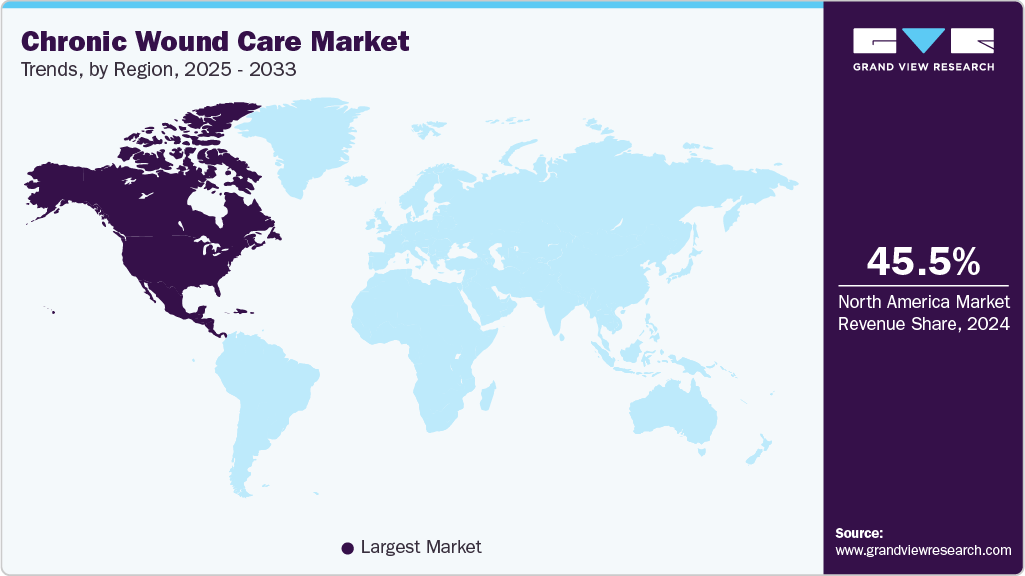

- North America dominated the chronic wound care market with the largest share of 45.47% in 2024.

- The chronic wound care market in the U.S. accounted for the largest market revenue share of 85.24% in North America in 2024.

- By product, the advanced wound dressing segment led the market with the largest revenue share of 34.95 %in 2024.

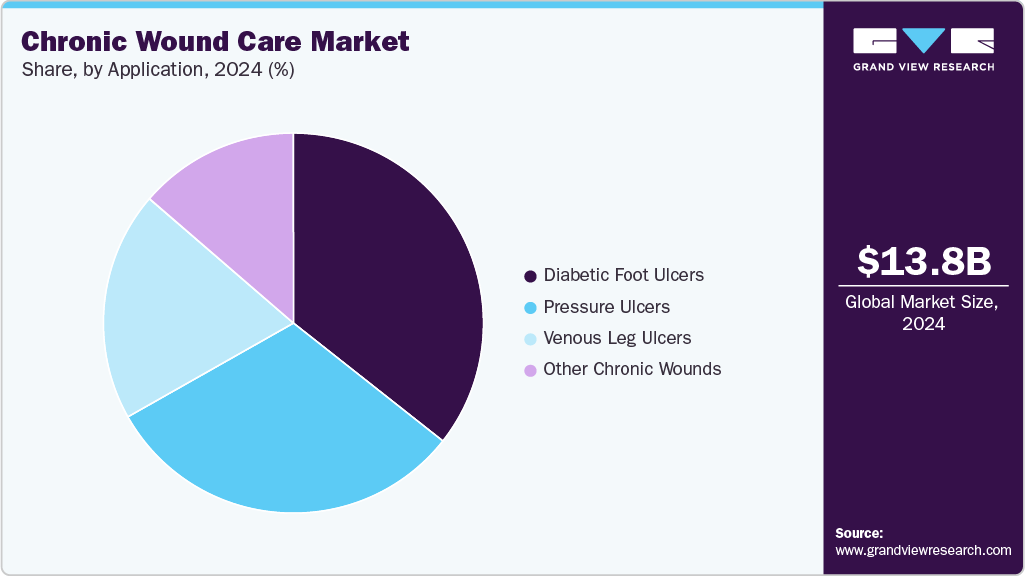

- By application, the diabetic foot ulcers segment led the market with the largest revenue share of 35.63% in 2024.

- Based on end use, the hospital segment led the market with the largest revenue share of 45.41% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.8 Billion

- 2033 Projected Market Size: USD 19.5 Billion

- CAGR (2025-2033): 4.11%

- North America: Largest market in 2024

Adoption of advanced dressings, NPWT systems, and infection-control technologies-combined with greater investment in specialty wound centers and home-care services-is further accelerating market growth. According to the article published by the National Rural Health Association in November 2025, diabetic foot ulcers (DFU) significantly strain Critical Access Hospitals (CAH). With 38.4 million Americans living with diabetes and higher prevalence in rural regions, DFUs drive more hospitalizations, emergency visits, and wound-care needs. This increases clinical workload, resource pressure, and operating costs for CAHs. The article emphasizes that structured wound-care programs and regular podiatry screenings can reduce complications and improve patient retention

The chronic wound care market is driven by the growing number of patients living with long-lasting ulcers and the associated treatment costs. The rising clinical and economic burden of chronic wounds continues to be a significant driver for growth in the chronic wound care market. According to an article published in the journal Advances in Wound Care in 2025, chronic wounds affect an estimated 10.5 million Medicare beneficiaries in the U.S., creating substantial demand for ongoing treatment. The journal reports that Medicare spends tens of billions of dollars annually due to slow-healing ulcers, complications, and recurrent hospitalizations. As populations age and diabetes, obesity, and vascular disease increase, payers and providers are forced to invest more in advanced wound care solutions, sustaining long-term market growth.

Technological innovation is a core driver of the chronic wound care market, as providers seek products that accelerate healing, control infection, and reduce clinic time. According to the article published in the journal Gels in 2025, recent advancements in wound dressing materials-particularly hydrogels, foams, and antimicrobial dressings-are significantly improving chronic wound management. The paper reports that stimuli-responsive hydrogels combined with antimicrobial agents and nanomaterials are showing enhanced wound-healing outcomes, reducing infection risk and shortening healing time. These innovations support the growing demand for advanced wound-care solutions, thereby reinforcing market growth potential.

The market is also driven by the expansion of dedicated wound care centers and integrated care models that channel more patients into structured chronic wound pathways. In January 2024, Amrita Hospital in Kochi launched advanced wound care services specifically to manage chronic, non-healing wounds using multidisciplinary approaches. In April 2025, Gruppo San Donato in Italy established a Wound Care Network linking its hospitals into a coordinated chronic wound treatment system. Such initiatives increase diagnosis, referral, and use of advanced products, reinforcing recurring demand in the chronic wound care market.

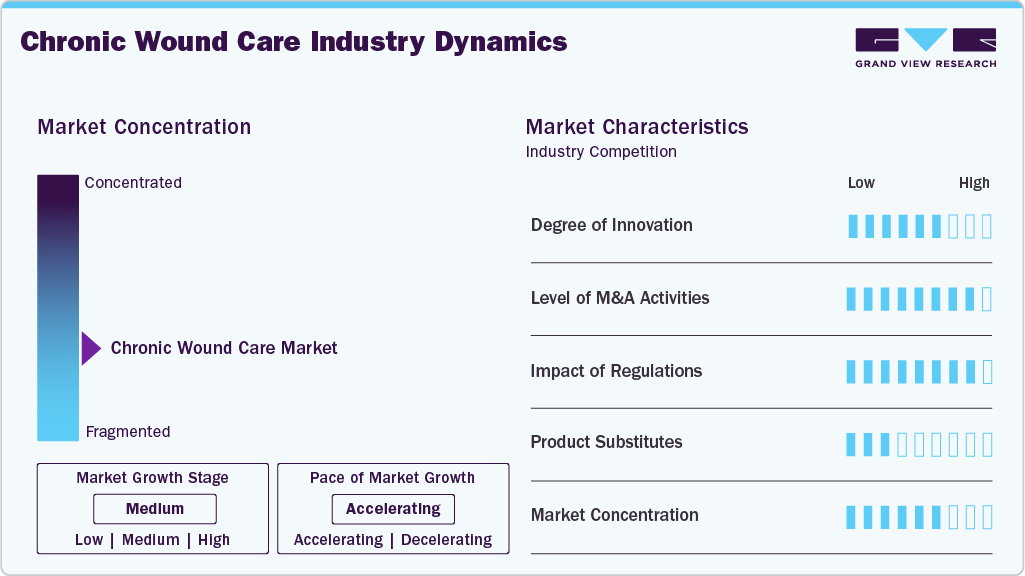

Market Concentration & Characteristics

The chronic wound care market is driven by the rising burden of long-duration wounds-including diabetic foot ulcers, pressure ulcers, and venous leg ulcers-and the growing need for advanced solutions that support faster healing and reduce complications. Increasing adoption of evidence-based wound-care protocols, along with expanding use of advanced dressings and device-based therapies, is strengthening market growth. Healthcare systems are investing in modern wound-care infrastructure and digital monitoring tools, reflecting a broader focus on infection prevention, patient safety, and improved long-term outcomes across outpatient clinics, hospitals, and home-care settings.

The chronic wound care market demonstrates a strong level of innovation driven by continuous advancements in dressing materials, biologically active therapies, and device-based wound-healing systems. New formulations in foams, hydrogels, alginates, and collagen dressings are improving moisture control, exudate handling, and infection prevention. Innovation is also advancing in areas such as negative pressure wound therapy, oxygen-based healing systems, and electrical stimulation, which enhance tissue regeneration. The market is increasingly adopting digital monitoring tools, automated therapy systems, and smart wound-care platforms, reflecting a broader shift toward technology-enabled chronic wound management.

The chronic wound care market has witnessed a moderate level of mergers and acquisitions, primarily aimed at expanding product portfolios and enhancing neonatal care technologies. Strategic acquisitions, like larger medical device companies acquiring innovative startups, have focused on integrating advanced catheter protection and infection prevention solutions. For instance, in November 2025, Solventum entered into a definitive agreement to acquire Acera Surgical for USD 725 million in cash plus up to USD 125 million in contingent payments. Acera, a privately-held bioscience firm focused on synthetic treatment materials for complex wounds, is expected to generate approximately USD 90 million in sales in 2025. The acquisition expands Solventum’s advanced wound care portfolio and accelerates its entry into the synthetic tissue matrices space. These collaborations are strengthening market presence and accelerating innovation in wound care market.

Regulatory policies significantly influence the chronic wound care market by defining product safety, clinical performance, and quality standards. Agencies such as the U.S. FDA, EMA, and MHRA require rigorous testing for advanced dressings, NPWT devices, oxygen-based systems, and biologic wound products, affecting approval timelines and development costs. Recent initiatives-such as the FDA’s strengthened oversight on antimicrobial dressings, real-world evidence guidance, and updated device classification rules-ensure safer wound technologies but also increase compliance demands, shaping market entry and innovation strategies.

The chronic wound care market faces competition from lower-cost substitutes such as traditional gauze, cotton dressings, and topical ointments, which are often used in place of advanced dressings in budget-constrained settings. Offloading devices, compression garments, and therapeutic footwear can substitute for pressure-relief systems, while conservative care-such as regular debridement and antimicrobial cleansing-may delay the use of NPWT, oxygen therapy, or electrical stimulation devices. Although substitutes exist, advanced dressings and device-based therapies remain preferred for complex chronic wounds.

The chronic wound care market reflects a moderately concentrated structure, with a mix of global leaders and mid-sized manufacturers competing across advanced dressings, surgical wound products, and device-based therapies. A small group of established companies holds significant share due to broad product portfolios, strong distribution networks, and continual investment in R&D. However, emerging innovators in biomaterials, regenerative therapies, and smart wound technologies are steadily increasing competition. Consolidation through partnerships and acquisitions continues to shape market positioning and expand technological capabilities.

Product Insights

The advanced wound dressings segment dominated the chronic wound care market in 2024. Advanced wound dressings are specialized medical coverings designed for complex and non-healing wounds, providing moisture management, infection control, and enhanced healing environments. A 2025 review in the journal Gels highlights significant progress in hydrogels, foams, and antimicrobial dressings aimed at chronic wound care. For instance, in August 2025 researchers at the Shenzhen Institute of Advanced Technology developed a bacterial cellulose-based dressing for burn and chronic wounds, offering rapid bleeding control and scaffold support. These innovations reinforce market adoption of advanced dressings over traditional materials

The surgical wound care segment is expected to grow significantly during the forecast period. The increasing volume of surgical procedures worldwide, combined with heightened focus on preventing surgical site infections (SSIs), is boosting demand for advanced post-operative care products such as antimicrobial dressings and device-based closure systems. These growth dynamics highlight the segment’s increasing significance within the chronic wound care portfolio.

Application Insights

The diabetic foot ulcers segment is dominated chronic wound care market in 2024, due to their high prevalence, severe complications, and rising diabetes burden. According to the CDC (2024), over 38 million Americans are living with diabetes, placing them at elevated risk for foot ulceration and lower-limb complications. A 2024 article in Scientific Reports highlights that 15-25% of diabetic patients are likely to develop a foot ulcer during their lifetime, underscoring the need for advanced dressings and device-based therapies. Increasing hospitalizations, amputation risk, and higher care costs continue to strengthen DFU-driven demand in the market.

The pressure ulcers segment is expected to grow at the fastest pace in the chronic wound care market from 2025 to 2033. Growth is supported by increasing rates of prolonged immobility among older adults and patients in long-term or post-acute care settings. Pressure-related skin breakdown continues to place a significant clinical and economic burden on care facilities, driving the need for advanced dressings, negative pressure systems, and pressure-relief technologies. As early-intervention protocols become more routine, the use of advanced pressure-ulcer management products is projected to increase steadily.

End Use Insights

The hospitals segment dominated the chronic wound care market in 2024, Hospitals remain the largest and most influential end-use setting in the chronic wound care market because they manage the highest volume of complex diabetic foot ulcers, pressure injuries, venous ulcers, and post-surgical wounds. Their clinical infrastructure, access to multidisciplinary teams, and ability to deliver advanced therapies drive substantial demand for premium wound-care products. Recent expansions reinforce this trend. In October 2025, University Hospitals Samaritan Medical Center opened a dedicated wound-care center to support advanced treatment needs. Moreover, in November 2025, Griffin Hospital reported 92-97% recovery rates supported by comprehensive wound programs. These developments highlight growing hospital investment in advanced dressings, negative-pressure systems, and hyperbaric care.

The home healthcare segment is emerging as the fastest-growing end-use category in the chronic wound care market, supported by the shift toward decentralized care and increased adoption of remote wound-management models. Growth is reinforced by the rising prevalence of diabetic foot ulcers and pressure injuries among aging populations, along with payer preference for lower-cost, home-based treatment pathways. Recent expansions in home-wound-care programs and the wider availability of advanced dressings and portable negative-pressure systems are accelerating product utilization in residential settings, strengthening the segment’s upward trajectory.

Regional Insights

North America held the largest revenue share of 45.47% in 2024 in chronic wound care market, due to the high clinical and economic burden documented by U.S. federal agencies. CMS identifies chronic wounds-including diabetic foot ulcers, venous leg ulcers, and pressure injuries-as major drivers of Medicare spending, with “skin substitute” expenditures rising from USD 256 million in 2019 to more than USD 10 billion in 2024. This substantial cost burden, combined with CMS-recognized prevalence of diabetes, vascular disease, and mobility-related ulcers, reinforces sustained demand for advanced wound dressings, debridement tools, pressure-relief systems, and device-based therapies across U.S. hospitals and wound-care programs.

U.S. Chronic Wound Care Market Trends

The U.S. chronic wound care market continues to expand due to the rising burden of diabetes, obesity, and an aging population-conditions strongly associated with higher rates of diabetic foot ulcers, venous leg ulcers, and pressure injuries. Growing hospital investments in dedicated wound care centers and advanced therapies further support market growth. Increasing CMS guidelines, reimbursement policies, and quality-of-care programs also encourage adoption of evidence-based wound management practices nationwide.

Europe Chronic Wound Care Market Trends

Europe Chronic wound care demand in is supported by strong clinical burden data from national systems, particularly the UK. Gov.uk reports that 2.2 million people in the UK live with chronic wounds, costing the NHS approximately GBP 5.3 billion annually. Additional NHS data shows pressure-ulcer treatment alone costs more than GBP 3.8 million per day, with tens of thousands of new pressure injuries recorded each year. These documented pressures on healthcare budgets and patient outcomes drive adoption of advanced dressings, negative-pressure wound therapy, and pressure-relief devices throughout European hospital and community-care settings.

The UK chronic wound care market is driven by increasing prevalence of diabetes, vascular disease, and age-related chronic wounds. According to Diabetes UK’s 2023-24 figures, more than 5.8 million people in the UK are living with diabetes, with diabetic foot ulcers affecting 5-7% of this population annually. The UK also faces rising pressure ulcer incidence, particularly among older adults and long-term care residents, according to the National Wound Care Strategy Programme (NWCSP). Government efforts to standardize wound care pathways and reduce avoidable amputations are strengthening demand for advanced dressings, compression therapy, and wound-care services.

Asia Pacific Chronic Wound Care Market Trends

Asia Pacific demonstrates high structural demand for chronic wound care supported by WHO evidence on diabetes prevalence-the region’s primary source of diabetic foot ulcers. WHO Western Pacific reports 131 million adults living with diabetes and 262,000 diabetes-related deaths, with diabetes-related foot complications explicitly identified as major causes of ulcers and amputations. Countries with rising diabetic populations, such as China, India, and Sri Lanka, face increasing incidence of neuropathy and poor circulation, fueling chronic wound formation. These epidemiological pressures are expanding the need for advanced dressings, off-loading products, and community-based wound-care programs across APAC.

Chronic wound care market in China is closely tied to the national diabetes burden highlighted by the National Health Commission and WHO. China represents one of the largest diabetic populations globally, with rising prevalence and ageing demographics increasing the risk of neuropathy and circulation-related foot complications. WHO notes that diabetic foot ulcers and amputations are common outcomes when diabetes management and vascular health decline. As hospitals modernize and chronic disease programs expand, demand grows for advanced wound dressings, pressure-relief solutions, infection-control products, and device-assisted wound therapy to manage DFUs, VLUs, and pressure injuries.

Latin America Chronic Wound Care Market Trends

The Latin America chronic wound care market is supported by a growing burden of diabetes-related complications. Countries such as Brazil and Argentina face rising neuropathy and poor-circulation-related wounds, increasing demand for effective treatment solutions. Improving access to hospital and community-based wound services, combined with government initiatives targeting chronic-disease management, continues to strengthen adoption of advanced dressings, off-loading devices, and supportive wound-care technologies.

Middle East and Africa Chronic Wound Care Market Trends

Chronic wound care demand in MEA is strongly supported by WHO evidence from the Eastern Mediterranean Region, which records the highest diabetes prevalence globally-over 14% of adults, representing about 70 million people today and projected to reach 135 million by 2045. WHO emphasizes that diabetic foot ulcers and amputations are major consequences of poor glycemic control and limited vascular health, making DFU a significant regional concern. In Africa, WHO-linked analyses place DFU prevalence around 7.2% among individuals with diabetes, above global averages. These epidemiological pressures drive increased adoption of dressings, off-loading products, and advanced wound-care interventions.

Key Chronic Wound Care Company Insights

The chronic wound care market spans advanced wound dressings, surgical wound care, traditional wound care, and wound therapy devices. Advanced dressings-such as foam, hydrocolloid, film, alginate, hydrogel, and collagen-support moisture control and healing in diabetic foot ulcers, venous leg ulcers, and pressure injuries. Surgical products, including sutures, staples, adhesives, and sealants, remain essential in post-operative care. Traditional wound care and device-based therapies like NPWT, oxygen systems, and pressure-relief devices continue to see strong adoption across hospitals and home-care settings.

Key Chronic Wound Care Companies:

The following are the leading companies in the chronic wound care market. These companies collectively hold the largest market share and dictate industry trends.

- JOHNSON & JOHNSON

- BAXTER INTERNATIONAL

- Coloplast Corp.

- 3M

- Medline Industries, Inc.

- ConvaTec Group PLC

- Derma Sciences (Integra LifeSciences)

- Cardinal Health

- Mölnlycke Health Care AB

- Paul Hartmann AG

- Smith & Nephew PLC

Recent Developments

-

In March 2025, ConvaTec Group PLC revealed its “strongest wound-care innovation pipeline ever” at the EWMA 2025 conference, highlighting next-generation foam dressings and antimicrobial trials. Link

-

InMay 2025, Mölnlycke announced a USD15 million investment in MediWound Ltd., a company specialising in next-generation enzymatic therapeutics for non-surgical wound debridement, supporting Mölnlycke’s wound-care strategy.

-

In April 2024, Smith+Nephew introduced the RENASYS EDGE Negative Pressure Wound Therapy System in the U.S., specifically designed for home-based chronic wound management.

-

In December 2024, Johnson & Johnson MedTech joined global surgical experts to define a standardized classification system for surgical site outcomes (SSOs) including wound complications such as infections and dehiscence

Chronic Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.4 billion

Revenue forecast in 2033

USD 19.5 billion

Growth rate

CAGR of 4.11% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025- 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

JOHNSON & JOHNSON; BAXTER INTERNATIONAL; Coloplast Corp.; 3M; Medline Industries, Inc.; ConvaTec Group PLC; Derma Sciences (Integra LifeSciences); Cardinal Health; Mölnlycke Health Care AB; Paul Hartmann AG; Smith & Nephew PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Chronic Wound Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global chronic wound care market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Advanced Wound Dressing

-

Foam Dressing

-

Hydrocolloid Dressing

-

Film Dressing

-

Alginate Dressing

-

Hydrogel Dressing

-

Collagen Dressing

-

Other Dressing

-

-

Surgical Wound Care

-

Suture & Staples

-

Tissue Adhesive & Sealants

-

Anti-infective Dressing

-

-

Traditional Wound Care

-

Medical Tapes

-

Cleansing Agents

-

Others

-

-

Wound Therapy Devices

-

Negative Pressure Wound Therapy

-

Oxygen and Hyperbaric Oxygen Equipment

-

Electric Stimulation Devices

-

Pressure Relief Devices

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global chronic wound care market size was estimated at USD 13.8 billion in 2024 and is expected to reach USD 14.4 billion in 2025.

b. The global chronic wound care market is expected to grow at a compound annual growth rate of 4.11% from 2025 to 2033 to reach USD 19.5 billion by 2033.

b. Advanced wound dressing dominated the product segment of the chronic wound care market in 2024. This is attributable to an increase in technological advancement, rising cases of chronic diseases, and an increase in the number of sports-related injuries.

b. The key players operating in the chronic wound care market include Johnson & Johnson, Baxter International, Coloplast Corp., 3M, Medline Industries, Inc., ConvaTec Group PLC, Derma Sciences (Integra LifeSciences), Mölnlycke Health Care AB, Paul Hartmann AG, Smith & Nephew PLC.

b. Increasing incidence of chronic diseases such as diabetes, cancer, and other autoimmune diseases is anticipated to boost the chronic wounds care market across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.