- Home

- »

- Electronic Devices

- »

-

Circuit Protection Market Size & Share Analysis Report, 2030GVR Report cover

![Circuit Protection Market Size, Share & Trends Report]()

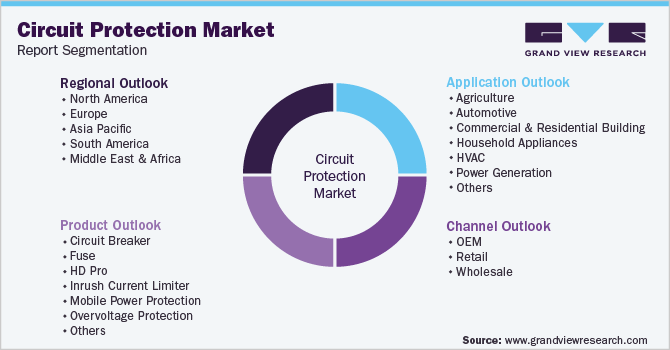

Circuit Protection Market Size, Share & Trends Analysis Report By Product (Circuit Breaker, Fuse, Inrush Current Limiter, Mobile Power Protection), By Channel, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-329-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

The global circuit protection market size was valued at USD 46,844.9 million in 2022 and is expected to advance at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The growing demand for wireless and connected devices is experiencing growth worldwide, along with proliferating electronic components sales in developing countries, resulting in high demand for circuit protection products for equipment safety, which is a major factor expected to drive the growth of the global market. In addition, stringent government regulations pertaining to the quality of electronic products, along with high demand for fuses, overvoltage protection, and PTC Devices from the automotive and telecommunication sector are factors expected to positively impact the market growth. The automotive sector across the globe is witnessing rapid growth, manufacturers are investing heavily in R&D activities with a focus to introduce new electric vehicles with more efficiency and better quality. Also, automotive ethernet is gaining popularity globally aimed at faster communication within the automotive infrastructure. This increasing electric vehicle sales and approach towards providing a better quality product with enhanced electric safety is expected to support the global market growth.

The fluctuation in raw material prices is a major factor expected to hamper the market growth. Materials such as glass, solenoids, diodes, and metal wirings are used in manufacturing circuit breakers and fuses. Fluctuating in the prices of these materials impacts the overall prices of the end product. Also, the high cost of SF6 circuit breaker technology products poses a major challenge in its adoption. The SF6 circuit breaker products are added with minimal content of silver and gold to increase the efficiency of the product this increases the assembly cost making the overall product expensive.

COVID-19 negatively impacted the market growth. The government had imposed strict regulations to control the pandemic outbreak. Production facilities operations were at a halt due to the complete lockdown imposed by the governments globally. This temporary halt at production facilities lowers the demand for products from automotive and electronics manufacturers. However, the market is witnessing growth in 2022 as the production facilities are at full operation and demand for electric vehicles and consumer appliances is increasing which will ultimately increase demand for circuit breaker products.

Moreover, circuit protection devices are widely used in the telecommunication industry. With the advent of 5G technology players are focused on upgrading the telecom infrastructure by deploying various types of equipment that are capable to handle the heavy load of communication. This equipment is costly and gets damaged due to voltage fluctuation or overheating resulting in players opting for advanced current protection solutions to lower the product damage and save additional cost. This high demand for overvoltage protection and inrush current limiters from the telecom sector is expected to boost the target market growth. Also, circuit protection manufacturers are focused on the introduction of new products focused on a particular application is expected to boost the circuit protection market growth.

Product Insights

The circuit breaker segment dominated the global market in 2022 and accounted for a revenue share of 21.27% Increasing residential and commercial construction activities globally, along with increasing demand for better electrical connectivity is ultimately increasing demand for more efficient circuit breaker products that are highly reliable and accurate. Moreover, high investment by the government and private players in renewable energy projects aimed at the rising demand for power is expected to drive the demand for circuit breakers.

The HD Pro segment is expected to witness faster growth over the forecast period with a CAGR of 7.2%. This growth can be attributed to increasing residential and commercial construction activities globally. Their ability to protect equipment suitable to high voltage shocks have made them an essential part of commercial and residential construction settings.

Application Insights

The power generation segment dominated in 2022 and accounted for a revenue share of 20.30%. Rising demand for energy from the commercial and industrial sectors, along with the inclination towards adoption of green energy is resulting in demand for circuit breakers, fuses, and overvoltage protection devices which is anticipated to augment the market growth. Also, increasing investment by the government in green power generation, and the establishment of smart grids and power distribution centers are expected to increase demand for circuit protection products.

The HVAC segment is expected to witness account for faster CAGR growth of 7.9% over the forecast period. The growth in HVAC systems can be attributed to changing climatic conditions. HVAC system manufacturers are introducing new products that are energy efficient with improved design, which is attracting consumers. This increasing installation of new HVAC systems is expected to support the segment growth.

Channel Insights

The original equipment manufacturers segment is anticipated to dominate the global market by acquiring a share of over 58.15% in 2022. Stringent government regulations related to quality standards, result in OEMs focused on manufacturing products that operate safely and reliably as per industry standards.

The wholesale segment is expected to witness significant growth of 7.2% over the forecast period. Wholesales have a robust network of product distributors that cater the consumer needs globally. Due to COVID-19, commercial operations were at a halt resulting in huge losses, now companies are focused on rearranging their distribution operations to recover from the losses which are expected to support the target segment growth.

Regional Insight

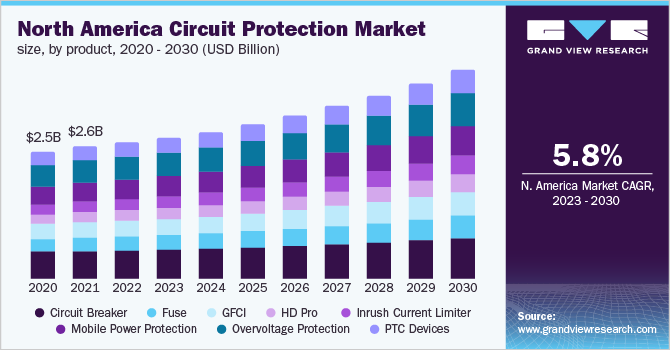

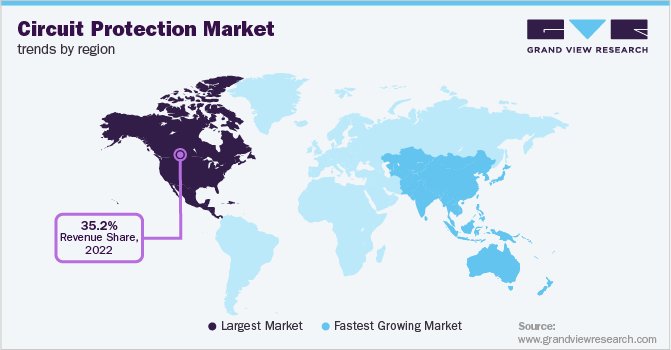

North America accounted for 35.2% of revenue share in 2022 and is expected to grow steadily over the forecast period. The demand for IoT devices to improve the operation and monitoring of traffic signals power grids etc. is growing, which can be ascribed to rising investments in green power generation and the focus on smart city initiatives. Additionally, the market expansion is anticipated to be supported by the increased demand for circuit protection solutions from electronic and telecommunications firms due to rising worries regarding equipment.

The Asia Pacific is expected to witness significant growth over the forecast period. Rapid urbanization and increasing construction activities resulted in high demand for energy which is expected to increase the demand for circuit protection products. Additionally, increasing electric vehicle sales in the region are expected to contribute to market growth.

Key Companies & Market Share Insights

Manufacturers in the market are focused on product development activities and the introduction of new products in order to attract new customers and stay ahead of the competition.

Moreover, players are strengthening their presence through strategic acquisition and partnership which is expected to help them acquire a significant share of the market. For instance, in July 2022, Eaton Corporation, an Irish-American power management company announced the acquisition of a 50% stake in Jiangsu Huineng Electric Co. Ltd. Low voltage circuit breaker business. Some prominent players in the global circuit protection market include:

-

ABB Ltd.

-

Bel Fuse Inc

-

Schneider Electric SE

-

Mitsubishi Electric Corporation

-

Eaton Corporation plc

-

General Electric Company

-

Siemens AG

-

Rockwell Automation, Inc.

-

Larsen & Toubro Limited

-

NXP Semiconductors N.V.

-

SCHURTER Holding AG

-

Sensata Technologies Holding plc

-

Texas Instruments Incorporated

Circuit Protection Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 48,470.8 million

Revenue forecast in 2030

USD 72,677.3 million

Growth rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, channel, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Rest of Europe; China; India; Japan; Rest of APAC

Key companies profiled

ABB Ltd.; Bel Fuse Inc.; Schneider Electric SE; Mitsubishi Electric Corporation; Eaton Corporation plc; General Electric Company; Siemens AG; Rockwell Automation, Inc.; Larsen & Toubro Limited; NXP Semiconductors N.V.; SCHURTER Holding AG; Sensata Technologies Holding plc; Texas Instruments Incorporated.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Circuit Protection Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global circuit protection market report based on product, application, channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Circuit Breaker

-

Low Current

- High Current

-

-

Fuse

-

Fast Acting

-

Slow Blow

-

-

HD Pro

-

High Power Inline/Bulkhead GFCI

-

High Power Inline/Bulkhead ELCI

-

High Power Inline/Bulkhead EGFPD

-

-

Inrush Current Limiter

-

Mobile Power Protection

-

Automatic Transfer Switch

-

Battery Control Center

-

Inverter

-

Load Center

-

Others

-

-

Overvoltage Protection

-

Crowbar Devices

-

ESD Protector

-

Gas Discharge Tubes (GDT)

-

Metal Oxide Varistors (MOV)

-

Surge Protection Device (SPD)

-

Others

-

-

PTC Devices

-

Ceramic

-

Polymeric

-

-

GFCI

-

Adapters

-

In-line Cord Sets

-

Quad Boxes

-

Panel Mount

-

Right Angle Cord Sets

-

User Attachable

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Automotive

-

Commercial & Residential Building

-

Household Appliances

-

HVAC

-

Power Generation

-

Recreational Vehicle (RV)

-

Telecom

-

Others

-

-

Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Retail

-

Wholesale

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global circuit protection market size was estimated at USD 46,844.9 million in 2022 and is expected to reach USD 48,470.8 million in 2023.

b. The global circuit protection market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 72,677.3 million by 2030.

b. North America dominated the circuit protection market with the highest share of 35.26% in 2022. The need for circuit protection is anticipated to increase owing to the rising concern about the safety of electronic and telecommunication equipment in the region.

b. Some key players operating in the circuit protection market include ABB Ltd.; Bel Fuse Inc; Schneider Electric SE; Mitsubishi Electric Corporation; Eaton Corporation plc; General Electric Company; Siemens AG; Rockwell Automation, Inc.; Larsen & Toubro Limited; NXP Semiconductors N.V.; SCHURTER Holding AG; Sensata Technologies Holding plc; Texas Instruments Incorporated.

b. The increasing demand for circuit protection products across areas such as automotive, commercial & residential buildings, household appliances, agriculture, and non-traditional end-use sectors of healthcare, defense, and transportation is driving the market worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."