- Home

- »

- Advanced Interior Materials

- »

-

Circular Construction Materials Market, Industry Report 2033GVR Report cover

![Circular Construction Materials Market Size, Share & Trends Report]()

Circular Construction Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Recycled Aggregates, Recycled Metals, Reclaimed Wood, Recycled Plastics), By End-use (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-801-7

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Circular Construction Materials Market Summary

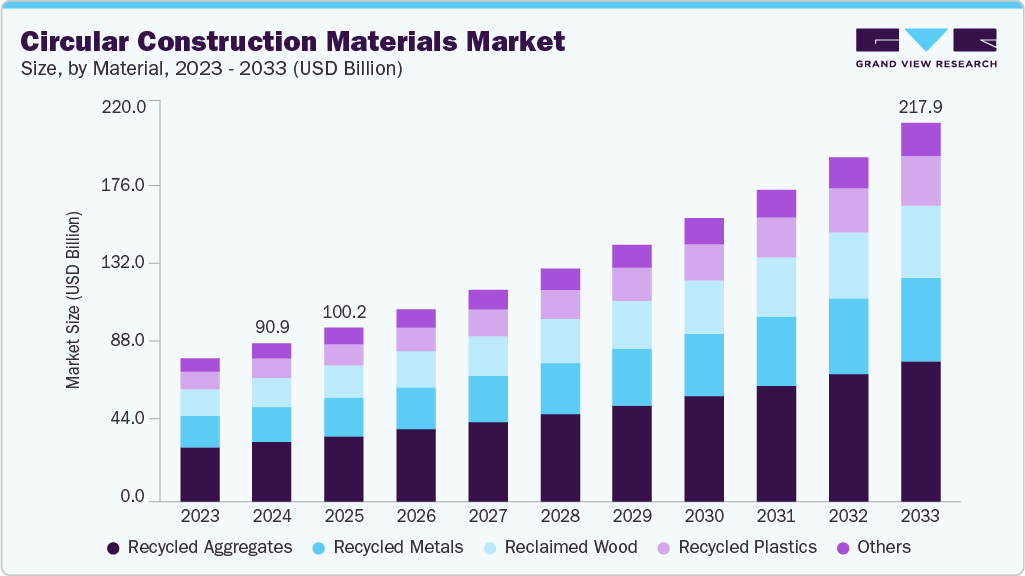

The global circular construction materials market size was estimated at USD 90.92 billion in 2024 and is projected to reach USD 217.91 billion by 2033, growing at a CAGR of 10.2% from 2025 to 2033. The demand for circular construction materials is rising as the construction industry shifts towards sustainability and waste reduction.

Key Market Trends & Insights

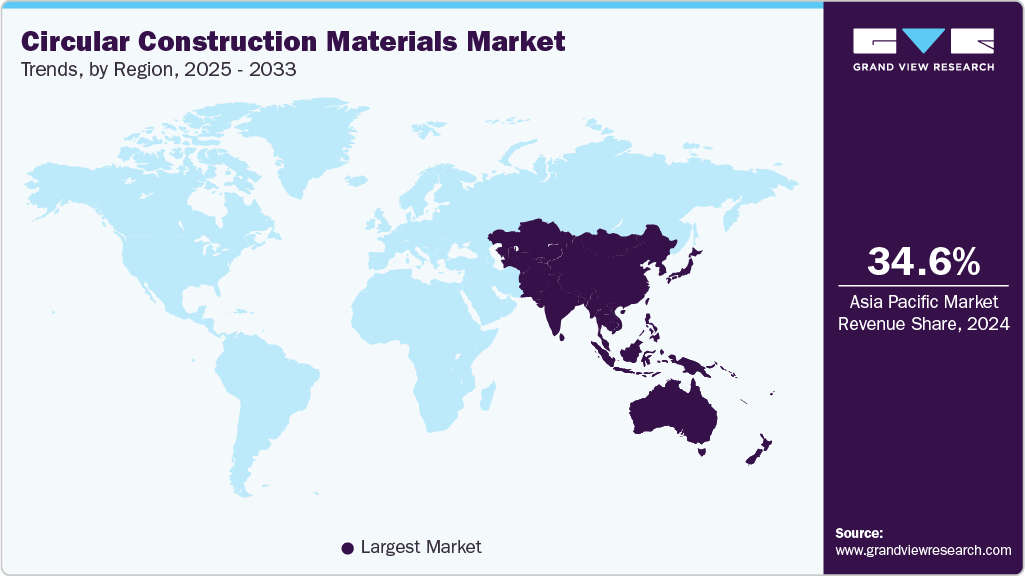

- The Asia Pacific dominated the circular construction materials market, accounting for the largest revenue share of 34.6% in 2024.

- By material, the recycled plastics segment is expected to grow at the fastest CAGR of 11.0% over the forecast period.

- By end use, the non-residential segment is expected to grow at the fastest CAGR of 10.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 90.92 Billion

- 2033 Projected Market Size: USD 217.91 Billion

- CAGR (2025-2033): 10.2%

- Asia Pacific: Largest market in 2024

Increasing urbanization and infrastructure expansion have led to significant amounts of construction waste, prompting stakeholders to adopt recyclable and reusable materials. Green building certifications and heightened environmental awareness among developers and end-users are fueling this transition. Moreover, circular materials support long-term cost savings by minimizing raw material dependency and waste management costs. The growing focus on lifecycle assessments and carbon footprint reduction further strengthens the market’s appeal.

Key drivers of the circular construction materials include the global push for net-zero emissions and stringent environmental regulations. Rapid innovation in material recycling technologies such as reclaimed concrete, recycled steel, and bio-based composites is enhancing performance and market viability. The integration of circular economy principles in urban planning and construction procurement is encouraging closed-loop systems. In addition, the rising costs of raw materials have made recycled alternatives more financially attractive. Increased collaboration between construction companies and waste management firms is optimizing supply chains.

Governments worldwide are implementing circular economy frameworks to minimize resource depletion and promote sustainable construction. The European Union’s Circular Economy Action Plan and Construction Materials Regulation emphasize recyclability and durability in material standards. In India, initiatives such as the Green Building Code and the Swachh Bharat Mission promote the utilization of recycled aggregates and waste. The U.S. Green Building Council encourages sustainable procurement practices through LEED certifications.

Market Concentration & Characteristics

The market remains moderately fragmented, featuring both established construction material manufacturers and emerging green technology firms. Global players such as LafargeHolcim, Heidelberg Materials, and CEMEX dominate with advanced recycling divisions, while local firms contribute through waste valorization projects. The level of consolidation varies regionally, with Europe showing higher integration due to strict regulatory enforcement. Startups specializing in recycled aggregates, eco-cement, and secondary raw materials are expanding rapidly, intensifying competition. Strategic partnerships between contractors, recyclers, and developers are increasingly common.

The threat of substitutes in the circular construction materials market is moderate, as conventional materials, such as Portland cement, virgin steel, and natural aggregates, still dominate global construction. However, rising costs, emission concerns, and resource scarcity are gradually limiting their competitiveness. Alternative green materials such as bamboo composites, bio-bricks, and carbon-neutral cement are gaining traction. The transition pace depends on cost parity and structural performance. While traditional materials will coexist, circular products are increasingly preferred for green-certified projects. The growing regulatory and consumer preference for sustainable infrastructure reduces the long-term threat of conventional substitutes.

Material Insights

The recycled aggregates segment held the largest revenue market share of 37.6% in 2024, primarily due to their wide-scale use in road construction, foundations, and structural concrete. The availability of large volumes of construction and demolition waste has made recycled aggregates a cost-effective and sustainable alternative to natural stone. Their mechanical strength, comparable performance to virgin aggregates, and compatibility with cement-based applications have further supported this dominance. Governments promoting green building certifications and circular economy models have also boosted adoption across both public and private infrastructure projects.

The recycled plastics segment is expected to grow at the fastest CAGR of 11.0% over the forecast period, owing to increasing innovations in polymer processing and rising demand for lightweight, durable, and weather-resistant materials. These plastics are being utilized in roofing, insulation, piping, and facade panels, reducing dependence on virgin plastic resins. Global initiatives to tackle plastic waste, coupled with new technologies in chemical recycling and polymer blending, have accelerated the trend. Furthermore, rising investments from major players to incorporate recycled plastics in construction composites are expected to sustain this segment’s expansion.

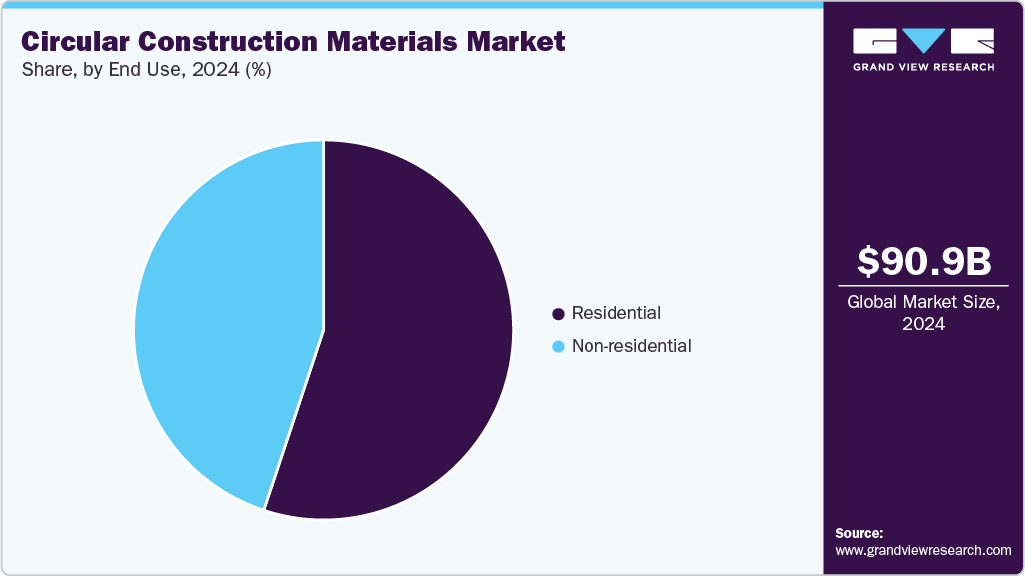

End Use Insights

The residential segment held the largest revenue market share of 55.1% in 2024, supported by the growing demand for affordable, sustainable housing solutions and eco-friendly urban infrastructure. Homebuilders are increasingly integrating recycled aggregates, reclaimed wood, and low-carbon concrete to meet sustainability targets and consumer demand for green living spaces. Governments offering tax incentives and subsidies for sustainable housing construction have also encouraged circular material usage. Furthermore, the retrofit and renovation of older housing units using recycled products have further strengthened the residential sector’s dominance.

The non-residential segment is expected to grow at the fastest CAGR of 10.5% over the forecast period, as commercial and industrial developers adopt circular materials for cost savings and compliance with sustainability requirements. Construction of green offices, public infrastructure, and industrial facilities is increasingly leveraging recycled steel, concrete, and composite materials. Corporate sustainability goals and green procurement policies have led to greater adoption of circular construction practices across global supply chains. Moreover, public-private partnerships focusing on sustainable infrastructure are driving large-scale use of circular materials in institutional and commercial projects.

Regional Insights

The Asia Pacific circular construction materials industry dominated the global market, accounting for the largest revenue share of 34.6% in 2024, due to rapid urbanization, rising environmental regulations, and significant infrastructure investments. China, India, and Japan are adopting green construction norms to curb waste generation. The growing emphasis on sustainable housing and eco-cities further drives adoption. Local recycling networks and government-backed material reuse programs are expanding. In addition, the integration of smart city initiatives and green financing mechanisms supports market growth. High construction output and cost-efficient recycling technologies make the region the global leader in circular construction adoption.

China Circular Construction Materials Market Trends

The circular construction materials industry in China focuses on low-carbon development and industrial waste reuse has propelled its circular construction material market. The government’s Five-Year Plans emphasize green construction standards and demolition waste recycling. Companies are increasingly using recycled aggregates and fly ash-based concrete in infrastructure projects. Major construction players are partnering with recyclers to achieve zero-waste building targets. The rising number of eco-industrial parks also supports material circularity. Domestic innovation in recycled steel and prefabricated construction boosts market competitiveness and sustainability.

North America Circular Construction Materials Market Trends

The circular construction materials industry in North America is driven by climate goals, green building standards, and corporate sustainability mandates. The U.S. and Canada are promoting circular infrastructure through initiatives like the EPA’s Sustainable Materials Management program. The presence of leading recyclers and technology innovators enhances implementation. Market growth is supported by tax incentives for sustainable construction and growing demand for LEED-certified buildings. Urban redevelopment projects using reclaimed materials are gaining popularity.

The U.S. circular construction materials industry is witnessing strong demand for circular construction materials in both commercial and residential projects. Federal and state-level mandates on construction waste recycling are driving adoption. Major cities like New York and Los Angeles are implementing zero-waste construction policies. Increasing investments in sustainable cement alternatives and modular construction methods are reshaping industry practices. Collaboration between developers and material recovery facilities is growing rapidly. The U.S. market is poised to lead technological innovation in this domain.

Europe Circular Construction Materials Market Trends

The circular construction materials industry in Europe is a frontrunner, driven by stringent EU waste management and carbon neutrality targets. The region’s focus on lifecycle assessment and extended producer responsibility encourages recycling and reuse of materials. Countries like Germany, the Netherlands, and the U.K. are pioneers in circular building initiatives. High innovation in bio-based and low-carbon materials underpins regional growth. Public procurement policies favor sustainable construction practices. Europe’s advanced recycling infrastructure provides a competitive edge globally.

The Germany circular construction materials industry is thriving under strong government support and industrial collaboration. The country’s Circular Economy Act and construction waste regulations have accelerated recycling efficiency. Major infrastructure projects now integrate reclaimed aggregates and low-carbon cement. German companies are leading in technological innovations, such as carbon capture-based cement. The emphasis on durability and modularity aligns well with the circular economy model. Collaboration between academic institutions and manufacturers fosters continuous R&D growth.

Central & South America Circular Construction Materials Market Trends

The circular construction materials industry in Central & South America is gradually adopting circular construction concepts, supported by urban renewal and sustainability-focused investments. Brazil, Mexico, and Chile are key markets experimenting with recycled aggregates and eco-concrete. Government initiatives promoting waste minimization and sustainable urban planning are emerging. However, limited recycling infrastructure remains a challenge. The region’s increasing awareness of green certification and international partnerships is enhancing the adoption of circular materials. Market growth is expected to accelerate as regulatory clarity improves.

Middle East & Africa Circular Construction Materials Market Trends

The circular construction materials industry in Middle East & Africa is witnessing growing awareness of circular construction due to large-scale infrastructure projects and sustainability goals. Countries like the UAE and Saudi Arabia are integrating recycled materials in giga projects such as NEOM. Local policies are beginning to emphasize waste reuse and construction material recycling. Africa’s market is still nascent but holds potential through urbanization and foreign investments in sustainable infrastructure. Expanding cement recycling and green building initiatives will boost adoption in the coming years.

Key Circular Construction Materials Company Insights

Some of the key players operating in the market include LafargeHolcim, CEMEX

-

LafargeHolcim is a global leader in sustainable building solutions, driving circular construction through its ECOCycle technology, which reuses construction and demolition waste in new materials. The company aims to recycle 10 million tons of materials annually, supporting carbon-neutral and resource-efficient construction globally.

-

CEMEX integrates circular economy principles by converting construction and industrial waste into alternative raw materials and fuels through its Regenera business. It actively promotes low-carbon cement, recycled aggregates, and energy-efficient production to reduce landfill waste and emissions in the global construction sector.

Heidelberg Materials and Commercial Metals Company are some of the emerging market participants in the circular construction materials industry.

-

Heidelberg Materials is pioneering urban mining initiatives, recovering raw materials from demolished structures and reintroducing them into the building material cycle. Its commitment to circularity includes the use of recycled aggregates and the development of carbon-neutral concrete solutions for sustainable urban infrastructure.

-

Commercial Metals Company (CMC) focuses on closed-loop steel recycling for construction and infrastructure. With operations spanning scrap collection to steel production, CMC converts waste metal into new rebar and structural products, significantly reducing environmental impact and enhancing material circularity in the construction sector.

Key Circular Construction Materials Companies:

The following are the leading companies in the circular construction materials market. These companies collectively hold the largest market share and dictate industry trends.

- LafargeHolcim

- CRH plc

- Heidelberg Materials

- CEMEX

- Boral Limited

- Vulcan Materials Company

- Commercial Metals Company

- Putman Groep

- Miniwiz

- FRONT

Recent Developments

-

In September 2025, Holcim expanded its ECOCycle® range in the UK, offering aggregates, cement, and concrete products with up to 100% recycled construction and demolition materials (CDM). The company launched a national circularity survey to promote waste reuse and achieve its 2030 recycled content targets.

-

In February 2024, CRH introduced “ReConn”, a new line of low-carbon, recycled aggregate-based materials in Europe. The launch aligns with CRH’s goal to reduce construction waste and achieve circular material sourcing across its infrastructure projects by 2035.

-

In March 2025, Heidelberg Materials North America announced that it acquired certain assets of Concrete Crushers Inc. (CCI), the largest concrete recycler in Calgary, Alberta.

Circular Construction Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 100.19 billion

Revenue forecast in 2033

USD 217.91 Billion

Growth rate

CAGR of 10.2% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

LafargeHolcim; CRH plc; Heidelberg Materials; CEMEX; Boral Limited; Vulcan Materials Company; Commercial Metals Company; Putman Groep; Miniwiz; FRONT

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Circular Construction Materials Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global circular construction materials market report on the basis of material, end use, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Recycled Aggregates

-

Recycled Metals

-

Reclaimed Wood

-

Recycled Plastics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global circular construction materials market size was estimated at USD 90.92 billion in 2024 and is expected to reach USD 100.19 billion in 2025.

b. The global circular construction materials market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2033 to reach USD 217.91 billion by 2033.

b. The recycled aggregates segment held the highest revenue market share of 37.6% in 2024, primarily due to their wide-scale use in road construction, foundations, and structural concrete.

b. Some of the key players operating in the circular construction materials market include LafargeHolcim, CRH plc, Heidelberg Materials, CEMEX, Boral Limited, Vulcan Materials Company, Commercial Metals Company, Putman Groep, Miniwiz, and FRONT.

b. Key factors driving the circular construction materials market include rising sustainability goals, stricter waste management regulations, cost advantages of recycled materials, and growing adoption of green building practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.